I took lots of time to hone the list of "Diamonds in the Rough" today. There were plenty of selections so there are a number of "Stocks to Review" today. I'm ready to dip my toes in the water so today's symbols are three that I am considering for my portfolio. However, there are other candidates that I didn't present that are worth a look.

Please remember, my portfolio is far from perfect and before you run out and buy the stocks I'm "considering", make sure they fit your analysis process or indicators that you might use. I won't be able to sleep at night if I know subscribers are 'blindly' buying because I might be buying.

Remember that ALL "Diamonds in the Rough" and "Stocks to Review" are good enough for my portfolio, but my analysis process is keeping my exposure fairly low. I'm currently at 15%, but looking to expand to 25% or possibly 30% if this bear market rally gets some legs.

You'll notice a few "reversal" trades on the lists. I'm not in favor of buying reversals in a bear market, but if your investment horizon is such that you can monitor these trades on a daily basis, I believe the market environment for the next week or two could mean a relief rally for beat down names. They must have good technicals to even consider them; hence my extensive list for your review.

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": LFG, MODN and SILK.

Stocks to Review: ARMK, DLTR, GIII, IRM, LHX, PSTL, SLCA, HII, IMXI, PAYX, TGLS and WH.

RECORDING LINK (5/27/2022):

Topic: DecisionPoint Diamond Mine 5/27/2022) LIVE Trading Room

Start Time: May 27, 2022 09:00 AM

Meeting Recording Link.

Access Passcode: MayDP#27

REGISTRATION FOR Friday 6/3 Diamond Mine:

When: Jun 3, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (6/3/2022) LIVE Trading Room

Register in advance for this webinar HERE.

** Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.**

Free DP Trading Room (5/31) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: May 31, 2022 08:59 AM

Meeting Recording Link.

Access Passcode: May#31st

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Archaea Energy Inc. (LFG)

EARNINGS: 8/9/2022 (BMO)

Archaea Energy, Inc. is a renewable energy company, which develops renewable natural gas. It engages in recovery and processing of biogas from landfills, other non-fossil and low-carbon fuel. The company was founded by McCarthy Brian and is headquartered in Houston, TX.

Predefined Scans Triggered: New 52-week Highs, Filled Black Candles, P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

LFG is unchanged in after hours trading. Based on the description of the company, this is actually a Renewable Energy stock. Be careful with these. This one seems less volatile and it does straddle the Solar and Energy space. I like the "V" bottom on the chart. It has retraced halfway back to April highs after a beautiful positive divergence. Nearly every stock I looked at today is up against overhead resistance. This one is too with one difference: it has already overcome resistance at the 50-day EMA. It closed right on it today. The RSI is positive and the PMO triggered a crossover BUY signal today. Volume is coming in on the rally based on the OBV. Stochastics are rising strongly and it has been a great relative performer. The stop is set just under the 200-day EMA.

This is a new issue so we don't have much data on the weekly chart. The weekly RSI is in positive territory, but the weekly PMO is falling fast which I don't like. Overall it is in a rising trend channel. The SCTR is at a healthy 83.9, meaning it has very good internal and relative strength among its small-cap peers. The upside target is at the all-time high, giving us upside potential of 19.4%.

Model N, Inc. (MODN)

EARNINGS: 8/9/2022 (AMC)

Model N, Inc. engages in the provision of revenue management cloud solutions for the life science and technology industries. Its industry solutions include: revenue cloud for pharma, revenue cloud for medtech, revenue cloud for high tech and business services for life sciences. The firm's products include: channel data management, channel management, deal Intelligence, deal management for high tech, deal management for life sciences, global pricing management, global tender management, government pricing, intelligence cloud, market development fund management, medicaid, payer management, price intelligence, provider management, rebate management and validata. Its services include: business services, customer support, education services, express services, global customer success, managed services & support and strategic services. The company was founded by Yarden Malka, Zack Rinat and Ali Tore on December 14, 1999 and is headquartered in San Mateo, CA.

Predefined Scans Triggered: None.

MODN is down -1.39% in after hours trading. I've dabbled in this stock over the years but forgot all about it until it showed up in my scans today. This one is also up against overhead resistance, but it closed strongly above the 50-day EMA. This is a Technology sector reversal play = higher risk. Definitely keep your hand on the wheel with this one. Today saw a positive 5/20-day EMA crossover which is a ST Trend Model BUY signal. The RSI is positive now and the PMO triggered a crossover BUY signal today. Volume is coming in heavy on the rally with today being a 4th follow-through day suggesting more upside to follow. Stochastics are strong and relative strength is picking up. The stop is set below the 20-day EMA, but it could be tightened up a bit more.

There is a large bullish falling wedge on the weekly chart. My one concern is that the last two tops did not test the top of the pattern. That's okay given I'm only looking for price to reach resistance at the late 2020 low for a 17%+ gain. The weekly PMO shows a whipsaw crossover BUY signal that has me forgiving the weekly RSI that is still in negative territory.

Silk Road Medical, Inc. (SILK)

EARNINGS: 7/28/2022 (AMC)

Silk Road Medical, Inc. develops and manufactures medical devices to treat neurovascular diseases. Its products include ENROUTE transcarotid neuroprotection system, ENROUTE transcarotid stent system, and ENROUTE transcarotid peripheral access kit. The company was founded by Tony M. Chou and Michi Garrison on March 21, 2007 and is headquartered in Sunnyvale, CA.

Predefined Scans Triggered: P&F Double Top Breakout.

SILK is unchanged in after hours trading.

We have a bull flag on the weekly chart and a positive weekly RSI that is rising. The weekly PMO is suspect as it sits on a crossover SELL signal, but it is flattening out already. The SCTR tells us that this has been a top performer and that internal strength is excellent. If it can challenge this year's high, that would be an over 33% gain.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

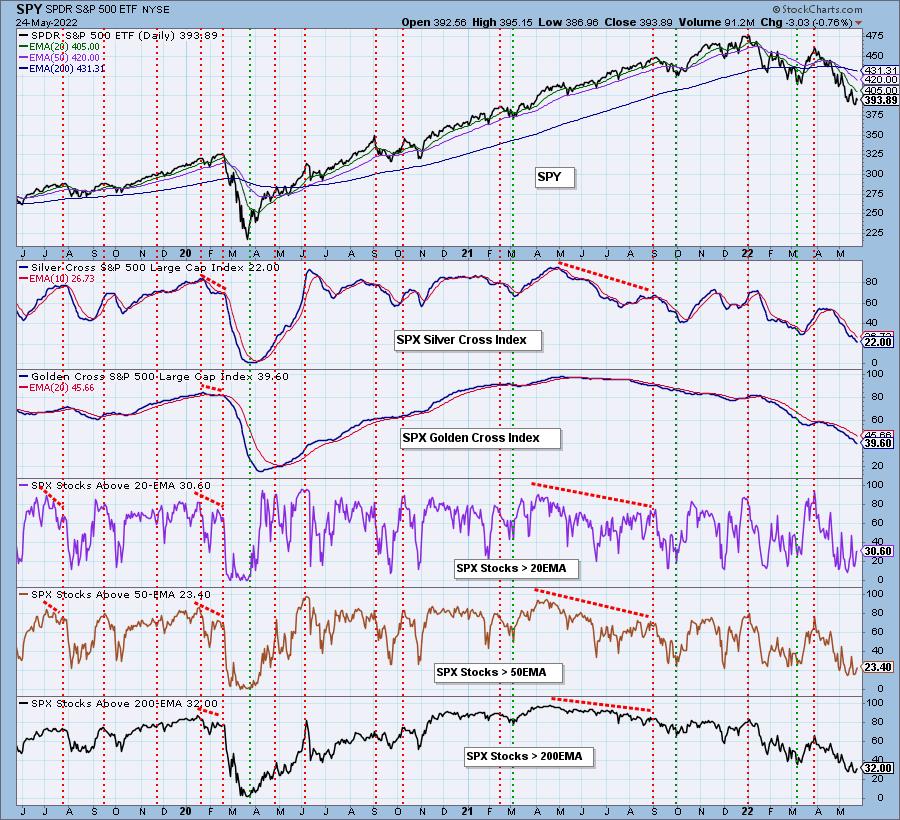

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 20% exposed with 10% hedge. I'm considering a purchase of AT&T (T).

I'm required to disclose if I currently own a stock and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.comIAMONDS