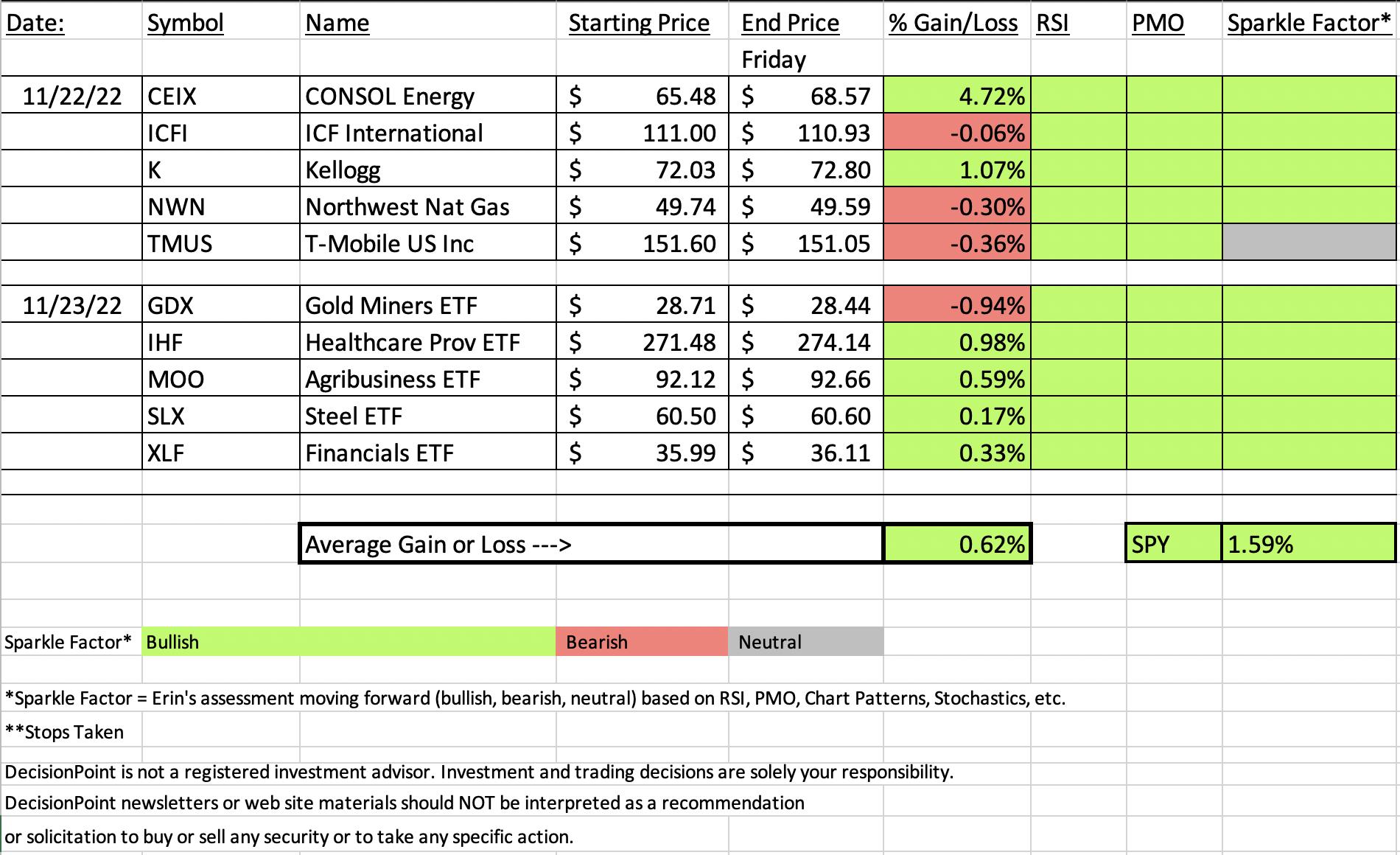

Hope everyone had a lovely Thanksgiving! The market was rather quiet today--not surprise given the holiday yesterday. "Diamonds in the Rough" finished higher overall this week. This morning only one was trading lower. We actually finished the day with four trading lower. However, the deepest of those declines was only -0.94%.

The Coal stock CONSOL Energy (CEIX) was the "Darling" this week finishing up 4.72% since being picked on Tuesday. The next highest gain was by Kellogg (K) which was up 1.07%.

Next week there will not be a Diamond Mine trading room and the Recap will be published on Saturday, December 3rd.

The link for today's Diamond Mine recording is below the diamonds logo.

Have a great weekend!

Good Luck & Good Trading,

Erin

TODAY'S RECORDING LINK (11/25/2022):

Topic: DecisionPoint Diamond Mine (11/18/2022) LIVE Trading Room

Start Time: Nov 18, 2022 09:00 AM

Passcode: Nov#18th

** NO DIAMOND MINE on December 2nd **

The Diamonds Recap will be published on December 3rd.

Our latest DecisionPoint Trading Room recording:

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

CONSOL Energy Inc. (CEIX)

EARNINGS: 02/07/2023 (BMO)

CONSOL Energy Inc. engages in the production of bituminous coal. It focuses on the extraction and preparation of coal in the Appalachian basin. The firm operates through the following segments: PAMC and CONSOL Marine Terminal. The PAMC segment includes mining, preparation and marketing of thermal coal. The CONSOL Marine Terminal segment provides coal export terminal services. The company was founded in 1864 and is headquartered in Canonsburg, PA.

Predefined Scans Triggered: New CCI Buy Signals, Bullish MACD Crossovers, Parabolic SAR Buy Signals, P&F Double Top Breakout and P&F Triple Top Breakout.

Below are the commentary and chart from Tuesday (11/22):

"CEIX is unchanged in after hours trading. At first I hesitated on this one given price is right in the middle of an intermediate-term trading range. However, seeing this industry group waking up last week and how it saw great improvement today, I wanted to include it. It was a scan result today. Price broke out strongly above resistance at key moving averages and the July high. There is a positive OBV divergence with price lows. The RSI just moved into positive territory and the PMO has given us a crossover BUY signal. Stochastics are rising again and the new PMO BUY signal is confirming them. Relative strength is pretty good, although the group only just began to perform again. The stop is set around 7.4% or $60.63."

Here is today's chart:

Interestingly even with the big rally, it never broke overhead resistance. It may need a bit more time to marinate at this price level, but the indicators are so positive, I don't imagine it will last long. Stochastics are above 80 and the PMO is now in positive territory. This one has higher to go despite being in the overbought Energy sector. Coal looks pretty good overall.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

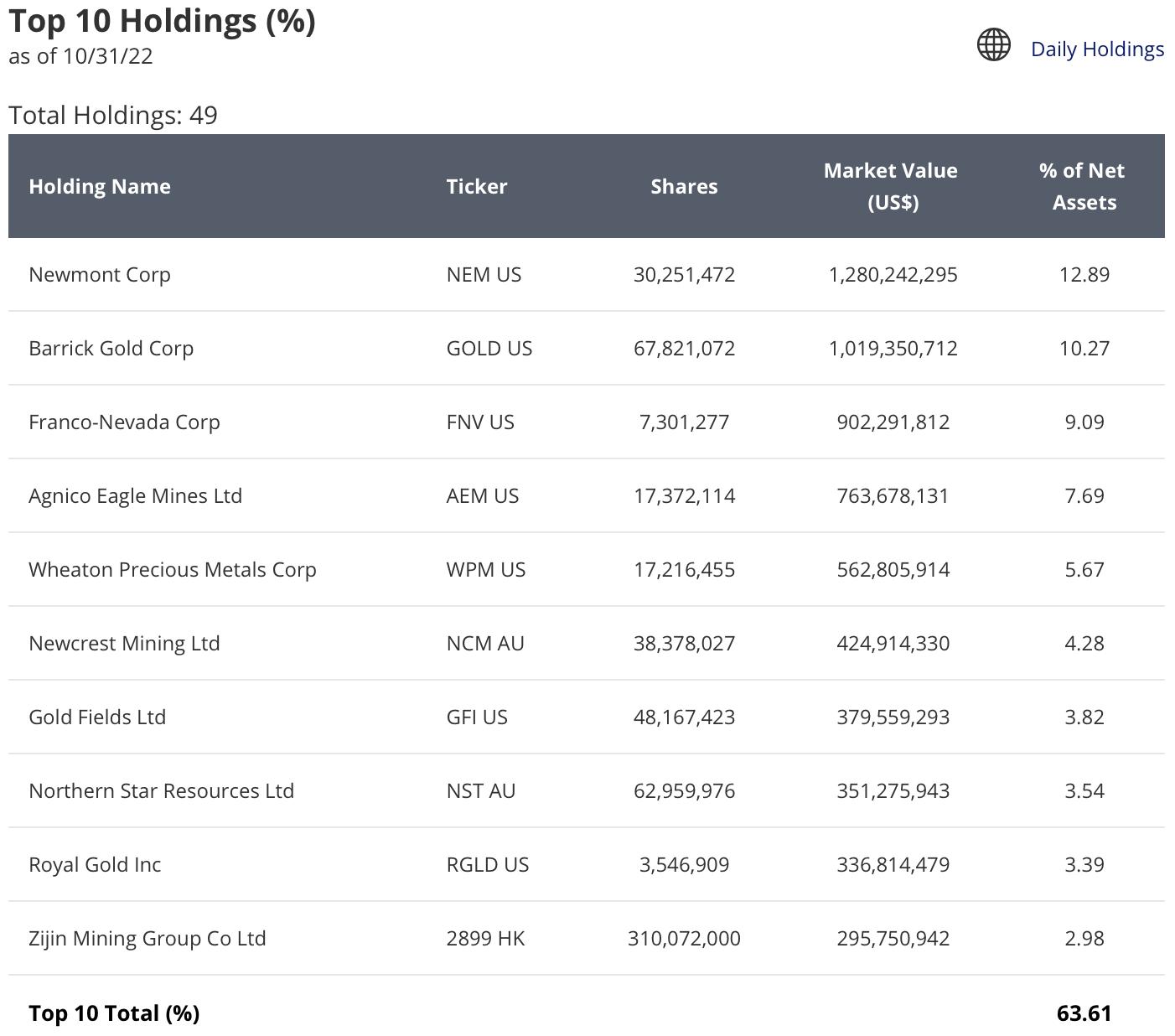

VanEck Vectors Gold Miners ETF (GDX)

EARNINGS: N/A

GDX tracks a market-cap-weighted index of global gold-mining firms. Click HERE for more information.

Predefined Scans Triggered: Stocks in a New Uptrend (Aroon), Moved Above Upper Price Channel and P&F Double Top Breakout.

Below are the commentary and chart from Wednesday (11/23):

"GDX is up +0.07% in after hours trading. I know this was a recent "Diamond in the Rough", but you'll find that we will end up with repeats over time on ETF Day simply because there is a smaller universe. We have "under the hood" indicators on GDX so we know far more about the participation in this ETF. It is outstanding! Even the Golden Cross Index (GCI) is picking up speed. Today's small breakout and close above the 200-day EMA suggests follow-through ahead. Stochastics are also oscillating above 80 alongside a positive/rising RSI. The PMO is accelerating. The stop is set at 7.8% or $26.47."

Here is today's chart:

I don't see GDX as a "Dud", it just happened to fall more than the others since Wednesday. I think Gold Miners will continue higher, but they are vulnerable to a bearish double-top pattern or at least a pullback to support again. However, participation is robust and the GCI is beginning to wake up. I like their chances, but having sold it recently, I want to see that pullback first for a better entry and more information on whether it can withstand another pullback. I may sound wishy washy, it's more a matter of watching GDX bounce back and forth like it has since September.

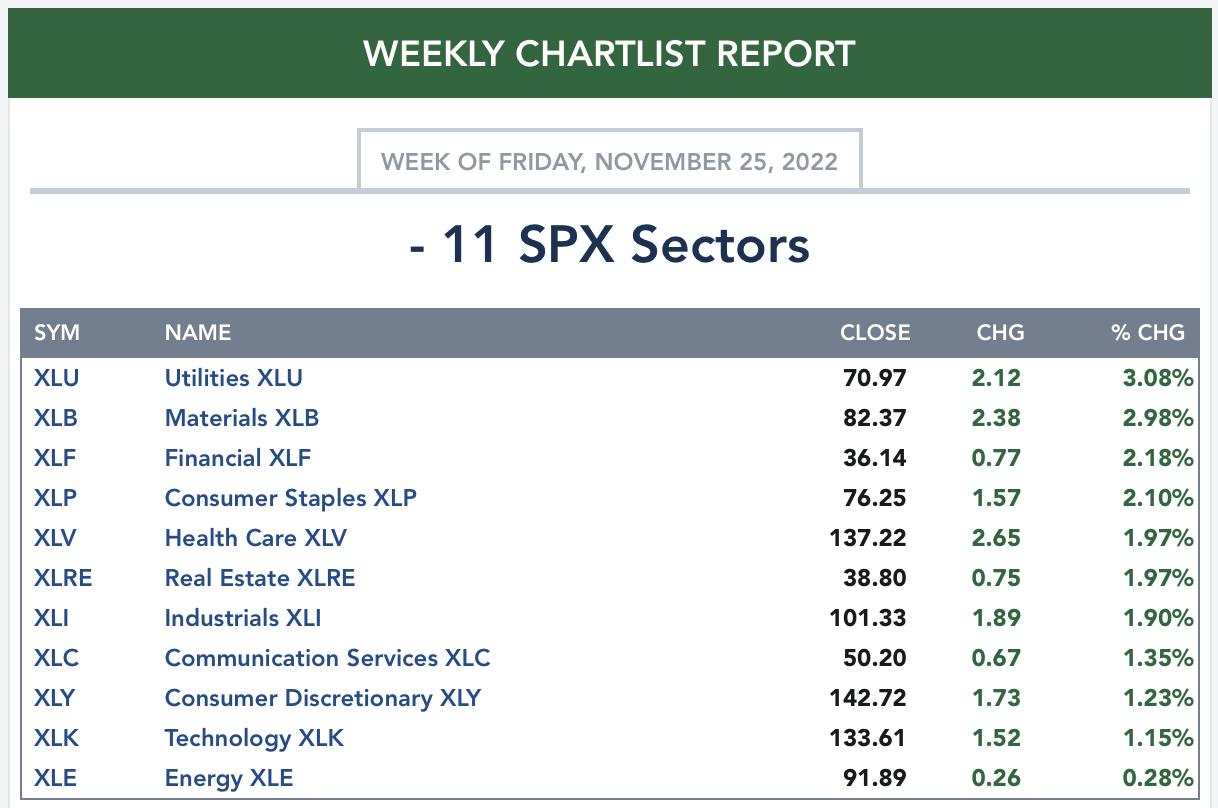

THIS WEEK's Sector Performance:

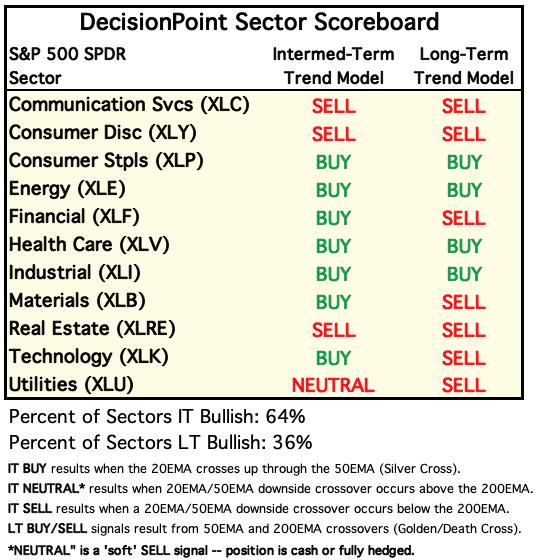

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

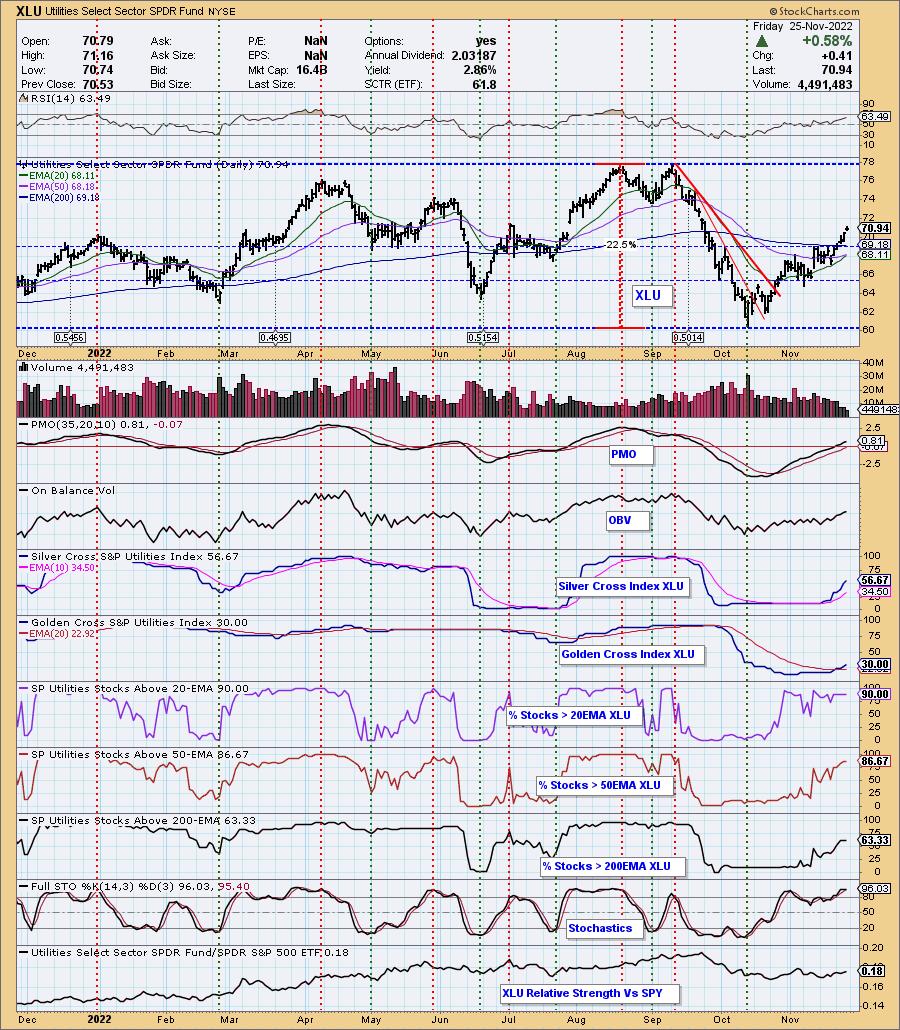

Sector to Watch: Utilities (XLU)

The Silver Cross Index (SCI) gave us early warning with its only signal line crossover back at the beginning of the month that XLU was going to resume the rally. The Golden Cross Index (GCI) followed through and confirmed the SCI crossover. The RSI is positive and the PMO just reached positive territory. Many of the sectors are overbought or weak. XLU, while rallying for some time, doesn't have an overbought PMO and it has plenty of upside potential to reach the September highs. Participation is excellent, and while overbought, it can maintain those conditions. Look at March and April to see how overbought conditions can persist. We also see that relative strength is beginning to trend higher.

Industry Group to Watch: Conventional Electricity ($DJUSVE)

In actuality, I like all of the industry groups within Utilities. We'll concentrate on Conventional Electricity today. I liked this group primarily because the PMO is not overbought and relative strength is looking good. The RSI is positive and the PMO just recently hit positive territory. Overhead resistance is nearing for the group but depending on which stocks you review in the group, you could see breakouts where you don't here. A few stocks that looked interesting were Consolidated Edison (ED), NextEra Energy (NEE) and PPL Corp (PPL).

Go to our Sector ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Have a great weekend! Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 35% exposed.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2022 DecisionPoint.com