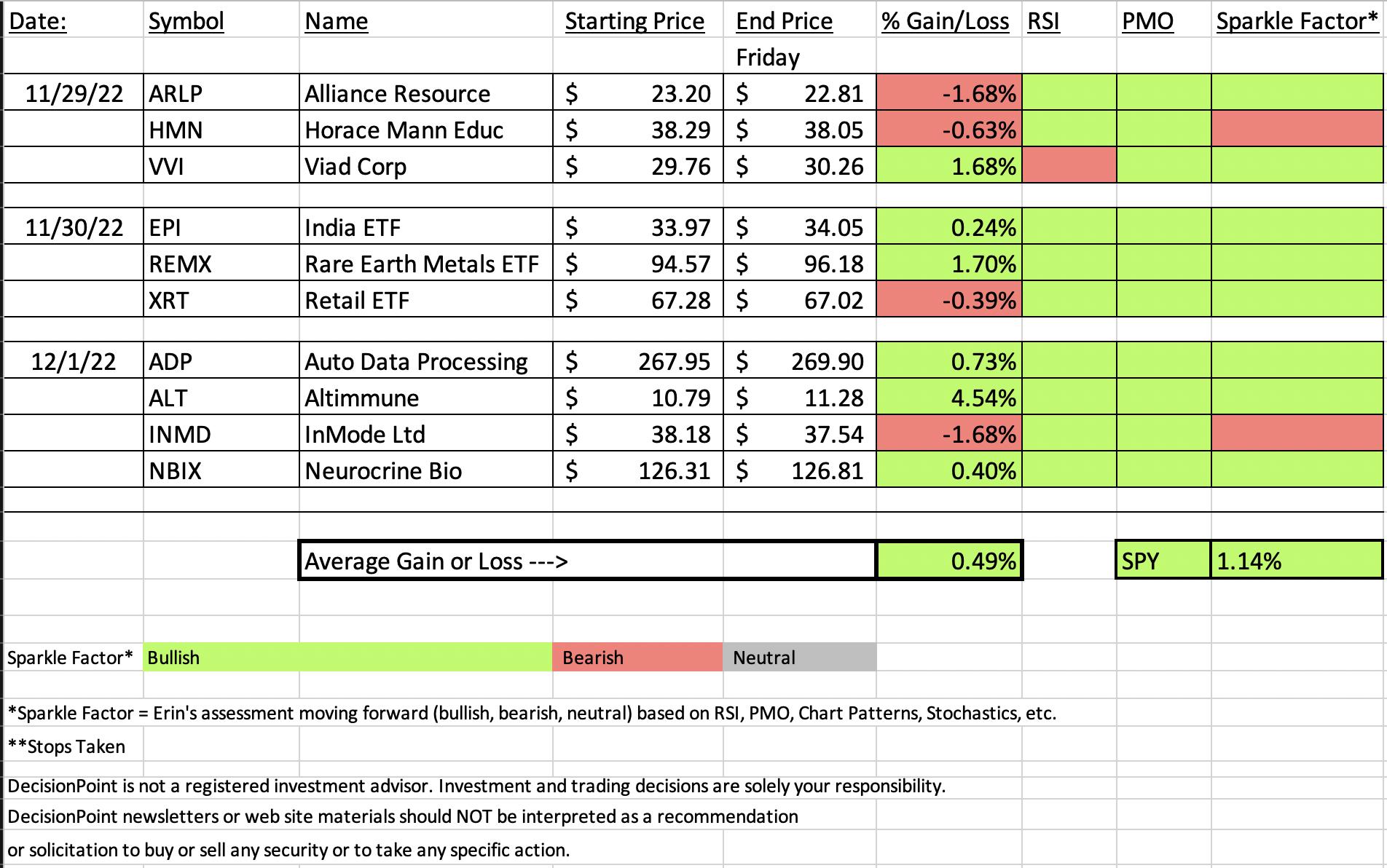

It was a good week for "Diamonds in the Rough" with more than half finishing in the green. The future still appears bright for eight out of the ten.

We're looking at the market possibly rising a bit more this month, but past that we aren't so optimistic.

This week's "Darling" was up 4.54% in one day. It was an excellent reader request. It definitely looks good moving forward. The "Duds" tied with both moving lower by 1.68%. Definitely not bad for losers. Only one looks suspect moving forward so I will cover (InMode Ltd - INMD). The other still has possibilities (Alliance Resource Partners - ARLP).

I appreciate your patience and understanding regarding the cancellation of last week's Diamond Mine and waiting until today to get the Recap. While my USC team lost, we had an incredible time with old friends and met new ones.

Since we didn't have a Diamond Mine Friday, I'm leaving the prior week's recording available. You can register for this week's trading room below the diamond logo below.

See you in tomorrow's free DecisionPoint Trading Room!

Good Luck & Good Trading,

Erin

RECORDING LINK (11/29/2022 - No Diamond Mine on 12/2):

Topic: DecisionPoint Diamond Mine (11/29/2022) LIVE Trading Room

Start Time: Nov 29, 2022 09:00 AM

Passcode: Nov#25th

REGISTRATION for 12/9/2022:

When: Dec 9, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (12/9/2022) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Our latest DecisionPoint Trading Room recording:

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Altimmune, Inc. (ALT)

EARNINGS: 03/15/2023 (BMO)

Altimmune, Inc. is a clinical stage biopharmaceutical company, which focuses on the development of novel peptide-based therapeutics for the treatment of obesity and liver diseases. The company's lead product candidate, pemvidutide, is a GLP-1/glucagon dual receptor agonist that is being developed for the treatment of obesity and NASH. In addition, Altimmune is developing HepTcell, an immunotherapeutic designed to achieve a functional cure for chronic hepatitis B. The company was founded in 1997 and is headquartered in Gaithersburg, MD.

Predefined Scans Triggered: None.

Below are the commentary and chart from Thursday:

"ALT is up +0.09% in after hours trading. Here we have a bullish double-bottom pattern forming. It won't confirmed until it breaks out above the October top and that would mean a huge rally so we'll see if it can push through. Indicators suggest it will. The RSI just moved into positive territory, the PMO just had a crossover BUY signal and Stochastics are rising nicely. I do not like that it had a recent "death cross" of the 50/200-day EMAs, but if price moves above the 200-day EMA, the 50-day EMA will follow and cancel out the signal. Relative strength is positive for the group and ALT is beginning to outperform both the group and consequently the SPY. The stop has to be very deep given today's 8.44% rally. I imagine you'll get a better entry and it won't be so daunting. The stop is at 10.3% around $9.67."

Here is today's chart:

The bullish double-bottom is still intact and price closed above the 50/200-day EMAs. Price whipsawed out of a "death cross" (50-day EMA below the 200-day EMA) and into a LT Trend Model "Golden Cross" BUY Signal. This puts ALT back into a bull market configuration. Stochastics are about above 80. All of this points to higher prices in the future.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

InMode Ltd. (INMD)

EARNINGS: 02/09/2023 (BMO)

InMode Ltd. designs, develops, manufactures and markets minimally-invasive aesthetic medical products. It also designs, develops, manufactures and markets non-invasive medical aesthetic products that target a array of procedures including permanent hair reduction, facial skin rejuvenation, wrinkle reduction, cellulite treatment, skin appearance and texture and superficial benign vascular and pigmented lesions. The company was founded by Moshe Mizrahy and Michael Kreindel on January 2, 2008 and is headquartered in Yokneam, Israel.

Predefined Scans Triggered: New CCI Buy Signals and Ichimoku Cloud Turned Green.

Below are the commentary and chart from Thursday:

"INMD is up +0.37% in after hours trading. The chart looks good, I would prefer to have confirmation with a strong breakout, but everything else looks pretty good. The RSI is positive and the PMO is on a crossover BUY signal and rising despite today's decline. Stochastics are in positive territory and rising. Relative strength for the group is improving. INMD is already a strong performer against the SPY. It's no wonder as it is also outperforming its industry group. I've set the stop at 8% below the 200-day EMA or around $35.12."

Here is today's chart:

I gave this one a red Sparkle Factor because price didn't get above resistance. In the process it appears a bearish double-top is forming. It's only been one day, but the PMO is about to turn over, as well as Stochastics. I believe there are better choices available.

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

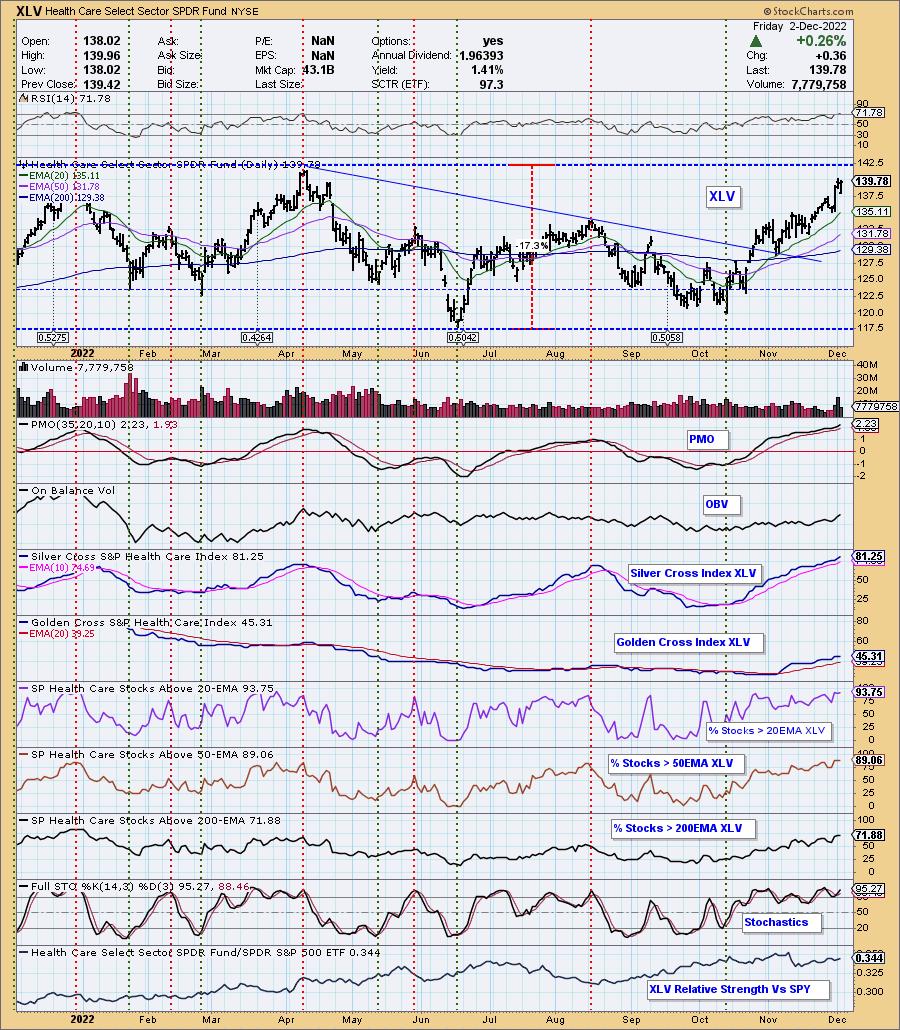

Sector to Watch: Healthcare (XLV)

It was a bit tough to make by selection of "Sector to Watch". The other two sectors I liked were Consumer Staples (XLP) and Industrials (XLI). The rest don't look too bad with the exception of Energy's rounded top. The only problem I have with Healthcare is that the RSI and PMO are overbought. The rest is great. Participation is robust and both the Silver Cross Index and Golden Cross Index are rising. I think all three sectors will have a good week if the overall market cooperates.

Industry Group to Watch: Medical Supplies/Devices (IHI)

I liked Medical Supplies the best in the industry summary and was able to find an ETF that tracks that group. IHI has been on a nice rally, but it is not overbought. The PMO may appear overbought, but the bottom of its range is about -3, so the upper range would be at +3. Currently the reading is below 2. Notice the PMO has had three bottoms above the signal line which is very bullish. The RSI is positive and not overbought. The OBV is confirming the rally, Stochastics are oscillating above 80 and relative strength is rising. The stop can be set below support at $50 or a bit tighter at the 50-day EMA.

Go to our Sector ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 10% exposed.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2022 DecisionPoint.com