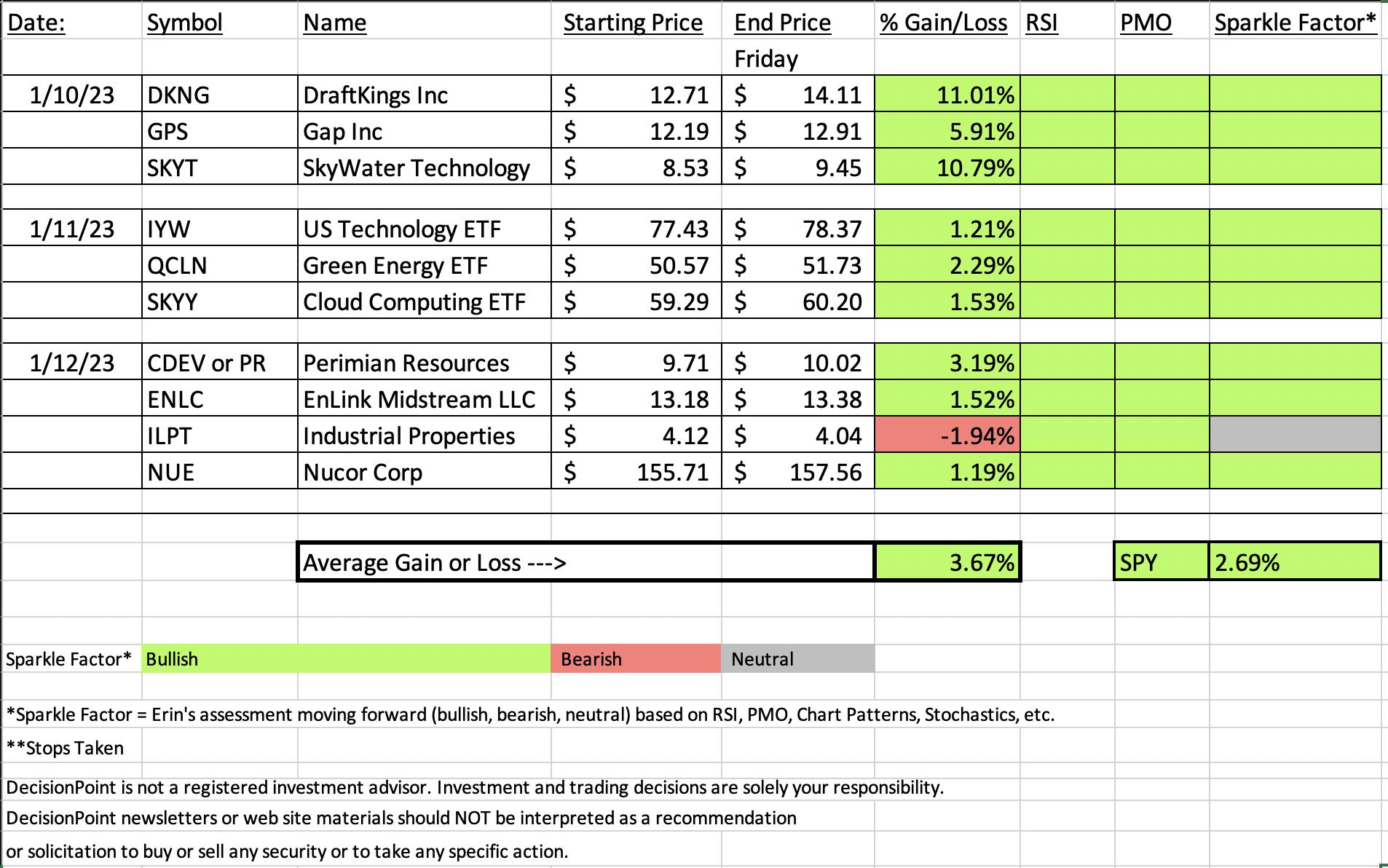

The market had a very good week and consequently "Diamonds in the Rough" outperformed. I'm happy to say that I picked up the second place finisher for my own portfolio as I stated I might. I also picked up the most successful ETF from ETF Day. If you picked others, you did good as only one position finished lower and it was only because it was chosen yesterday and had one bad day.

The position that is "Dog" of the week was that only position that finished lower; Industrial Properties (ILPT) was down -1.94% today. The "Darling" was given out on Tuesday; DraftKings (DKNG) was up +11.01%! The second place finisher, SkyWater Technology (SKYT) was up a whopping +10.79%!

The market is due for a pause and next week seems as good a place as any for that to happen. Trading will likely be a bit muted given the holiday on Monday, but we've been surprised before. Make sure you have your stops set as you head into the holiday!

BIG APOLOGY! In today's Diamond Mine trading room I managed to NOT share my screen for over 30 minutes. If you watch the recording, feel free to forward through the part where the screen doesn't change. I did do a quick recap at the very end of the program of what was missed previously.

Good Luck & Good Trading,

Erin

RECORDING LINK (1/13/2023):

Topic: DecisionPoint Diamond Mine (1/13/2023) LIVE Trading Room

Passcode: January#13

REGISTRATION for 1/20/2022:

When: Jan 20, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (1/20/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Our latest DecisionPoint Trading Room recording:

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

DraftKings Inc (DKNG)

EARNINGS: 02/17/2023 (BMO)

DraftKings, Inc. provides online fantasy sports and sports betting services. It provides users with daily fantasy sports, sports betting and iGaming opportunities, and is also involved in the design and development of sports betting and casino gaming platform software for online and retail sportsbook and casino gaming products. The company was founded on August 6, 2021 and is headquartered in Boston, MA.

Predefined Scans Triggered: None.

Below are the commentary and chart from Tuesday (1/10):

"DKNG is down -0.12% in after hours trading. We have a nice rounded price bottom and a breakout above near-term support at the October low and 20-day EMA. The RSI just moved into positive territory and the PMO had a crossover BUY signal today. Stochastics are rising and nearing territory above 80. The Gambling industry group is on fire right now. DKNG is just now starting to outperform the group, but is already outperforming the SPY. The stop is set at 7% around $11.82."

Here is today's chart:

Everything still looks solid on the chart. The indicators are continuing to climb. The only issue is overhead resistance which is quickly nearing. Given it has had a six day rally, this seems a good place for it to pause. I don't believe it is too late for entry, but there are probably other stocks that haven't run so far up. However, I think $17 is not out of the question.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Industrial Logistics Properties Trust (ILPT)

EARNINGS: 02/14/2023 (AMC)

Industrial Logistics Properties Trust is a real estate investment trust, which owns and leases industrial and logistics Properties. The company was founded on September 15, 2017 and is headquartered in Newton, MA.

Predefined Scans Triggered: None.

Below are the commentary and chart from yesterday (1/12):

"ILPT is up +1.70% in after hours trading. It hasn't quite overcome resistance, but it is above all three key moving averages. The PMO is rising strongly and should get into positive territory soon. The RSI is comfortably seated in positive territory. Stochastics are above 80 and rising again. Relative strength for the group has been excellent and we are starting to see ILPT slightly outperform the group and the SPY. The stop is set near the 20-day EMA at 8% or $3.79."

Here is today's chart:

It's basically a one-day dud. The only reason I have this listed with a Neutral Sparkle Factor is because it is struggling to overcome near-term resistance. The indicators are still very strong so it isn't out of the question that we will see a breakout. I would just be careful. This is a low-priced stock that carries plenty of volatility with it.

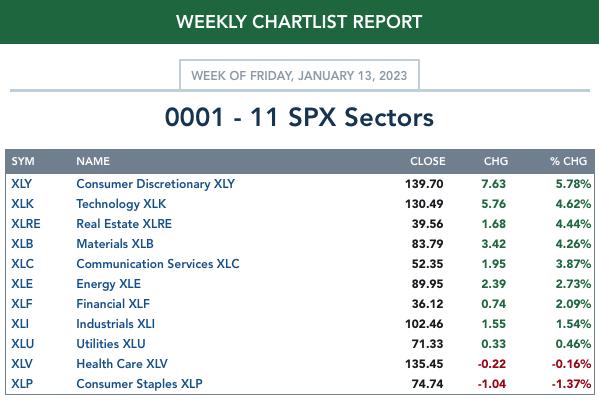

THIS WEEK's Sector Performance:

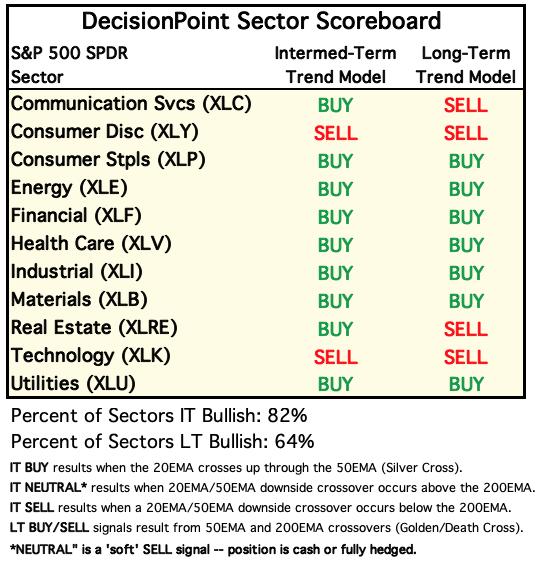

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

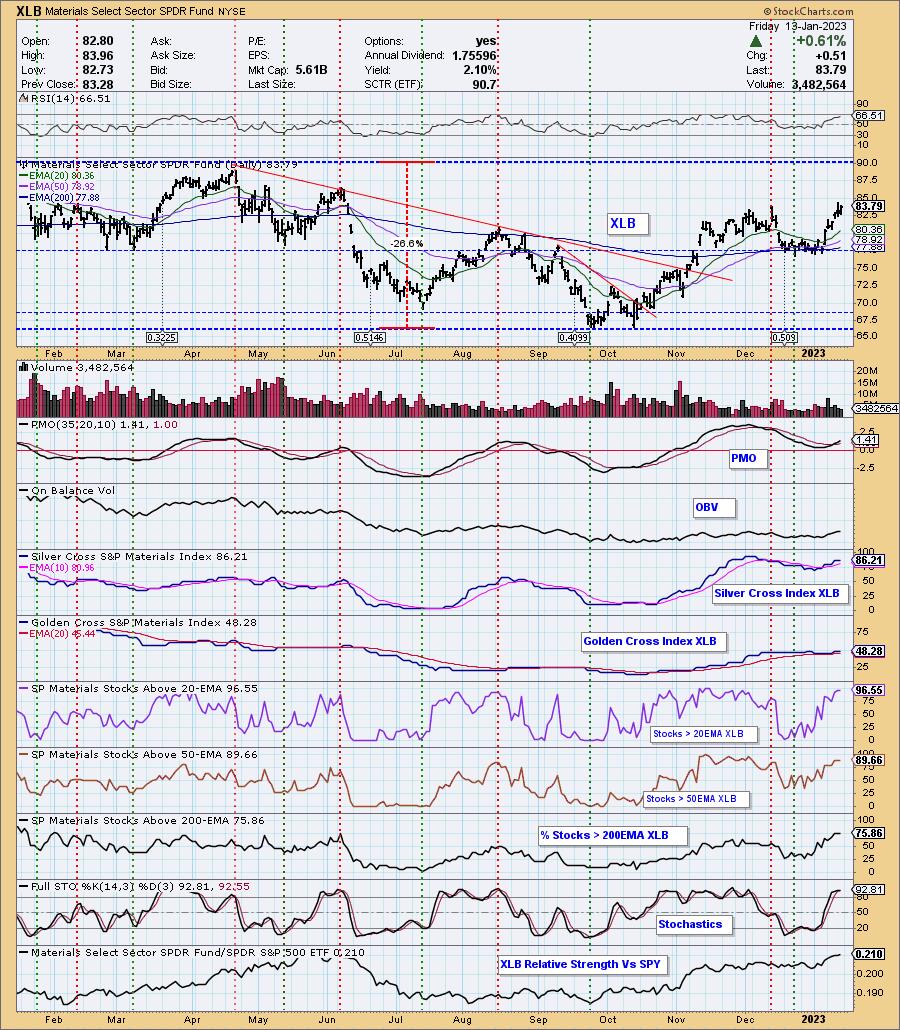

Sector to Watch: Materials (XLB)

XLB ultimately was an easy choice. It came down to relative strength as well as SCI/GCI configuration. Technology (XLK) was my runner up. XLK hasn't made a higher high and actually lost a tiny bit of relative strength today. XLB is making new relative highs as well as short-term price highs.

Industry Group to Watch: Metals & Mining (XME)

Gold Miners (GDX) looks great and I like General Mining (XME) as well. Honestly most every Materials industry group is doing well. We covered Nucor (NUE) yesterday which is in the Steel industry group. XME has had a price breakout. The RSI is positive, albeit getting a touch overbought. The PMO looks great on a crossover BUY signal. Stochastics are confirming internal strength and the OBV is confirming the rally. Relative strength is excellent and continuing to improve. We've missed a lot of the upside here, but with metals looking good (particularly Copper & Gold), I think this is a good choice for "Industry Group to Watch".

Go to our Sector ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 20% exposed. I own SKYT.

Watch the latest episode of theDecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com