It was grueling looking at symbols today. After running Diamond scans, I had a ChartList of over 300 symbols! If this doesn't tell you the market will likely go higher, I don't know what would. There was amazing strength on the charts. I'm second guessing my selections as I always do, but three came to the top.

The main reason these three floated to the top is that they have considerable upside potential before reaching overhead resistance. One of the ways I whittle down lists is by checking to see how far price could go before hitting the next resistance level. If it is a long way up, it will be on my radar for you.

Relative strength also helped me decide which had the most potential. I opted not to include those with industry groups that are not outperforming the SPY. Past that, the regular parameters applied with rising PMOs abundant, positive or rising RSIs and Stochastics moving up strongly. It also helped if the weekly chart had some potential.

Big news that I'll be discussing in the DP Alert today. The Silver Cross Index (SCI) had a positive crossover its signal line today which is a very bullish signal. I did not add to my portfolio today as I was stuck at the DMV most of the morning. While I can trade on my phone, I didn't want to rush into anything. All three of today's "Diamonds in the Rough" are on my radar for tomorrow.

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": DKNG, GPS and SKYT.

Runner-ups: TAN, CAT, MLI, AB, NIO, ALV, OZK, BIIB, APOG, MEI, NCLH, YUMC, FSLY, X, VOXX and CWEN.

Important: Your current subscription rates will ALWAYS stay the same when we raise prices on January 15th. **

** You must keep your subscription running and in good standing.

RECORDING LINK (1/6/2023):

Topic: DecisionPoint Diamond Mine (1/6/2023) LIVE Trading Room

Start Time: Jan 6, 2023 09:00 AM PT

Passcode: January#6

REGISTRATION for 1/13/2022:

When: Jan 13, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (1/13/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Here is the last recording (no recording on 12/26 or 1/2):

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Stop levels are all rounded down.

DraftKings Inc (DKNG)

EARNINGS: 02/17/2023 (BMO)

DraftKings, Inc. provides online fantasy sports and sports betting services. It provides users with daily fantasy sports, sports betting and iGaming opportunities, and is also involved in the design and development of sports betting and casino gaming platform software for online and retail sportsbook and casino gaming products. The company was founded on August 6, 2021 and is headquartered in Boston, MA.

Predefined Scans Triggered: None.

DKNG is down -0.12% in after hours trading. We have a nice rounded price bottom and a breakout above near-term support at the October low and 20-day EMA. The RSI just moved into positive territory and the PMO had a crossover BUY signal today. Stochastics are rising and nearing territory above 80. The Gambling industry group is on fire right now. DKNG is just now starting to outperform the group, but is already outperforming the SPY. The stop is set at 7% around $11.82.

Upside potential is crazy. I don't know that it will get even close to that, but you never know. I'd conservatively think of 21% to be sufficient to at least halve your position. The weekly RSI is negative, but rising slightly. The weekly PMO is on a crossover SELL signal, but it has already flattened and could come in with a BUY signal very soon. Best of all, there is a very strong OBV positive divergence in the long term (rising OBV bottoms, flat/falling price bottoms).

Gap, Inc. (GPS)

EARNINGS: 03/02/2023 (AMC)

Gap, Inc. operates as a global apparel retail company, which offers clothing, apparel, accessories, and personal care products for men, women, and children. The firm operates through the following segments: Gap Global, Old Navy Global, Banana Republic Global, Athleta, and Other. The Gap Global segment includes apparel and accessories for men and women under the Gap brand, along with the GapKids, BabyGap, GapMaternity, GapBody, and GapFit collections. The Old Navy Global segment offers clothing and accessories for adults and children. The Banana Republic Global segment provides clothing, eyewear, jewelry, shoes, handbags, and fragrances. The Athleta segment offers fitness apparel for women. The company founded by Donald G. Fisher and Doris F. Fisher in July 1969 and is headquartered in San Francisco, CA.

Predefined Scans Triggered: Bullish MACD Crossovers and P&F High Pole.

GPS is down -0.66% in after hours trading. I find this chart particularly attractive. I don't know exactly why, but I believe it is the price pattern and breakout above all three key moving averages. The RSI is rising and should hit positive territory soon. The PMO is rising after bottoming just below the zero line. Volume is beginning to come in based on the rising OBV. Stochastics are rising strongly in positive territory. Relative strength for the group has been excellent since about August. Typically GPS is an outperformer within the group, but the December decline really hit hard. It is now set up to recapture overhead resistance at the December high. The stop is set at 7.4% around $11.28.

My one issue with the weekly chart is that price is coming up against resistance at the 2019 low. It wasn't a problem on the last rally and the rest of the chart looks great. The weekly RSI is positive and the weekly PMO has bottomed above its signal line which is especially bullish. The SCTR is in the "hot zone" above 70 which tells us based on trend and condition primarily in the intermediate and long terms it is in the top 19% since its SCTR value is 81%. Upside potential is over 27% to get to the December high which I think is entirely possible.

SkyWater Technology Inc. (SKYT)

EARNINGS: 02/21/2023 (AMC)

Skywater Technology, Inc. is a holding company, which engages in the provision of semiconductor development, manufacturing services, and packaging services. The company was founded on October 3, 2016 and is headquartered in Bloomington, MN.

Predefined Scans Triggered: None.

SKYT is up +1.29% in after hours trading. The Semiconductors are starting to take off. This isn't a well-known name but this small-cap stock has plenty of upside potential as price has now overcome the 50-day EMA. It is technically stuck beneath resistance, but I like it for a breakout. The RSI just moved above net neutral (50). The PMO had a crossover BUY signal in oversold territory. Stochastics have now moved above 80. Relative performance is continuing to slowly improve for the stock. It may not be a big name, but if the group sees some love, this could be a nice low-priced option. Just position size appropriately. The stop is set at the 20-day EMA at 7.7% around $7.87.

We have what could turn into a bullish double-bottom on price. It's way too early but it is enticing. The weekly RSI is negative but rising. The weekly PMO has already reversed upward. The SCTR isn't in the "hot zone", but it is respectable given it is over 50%. Upside potential should it form the double-bottom pattern is over 48%.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

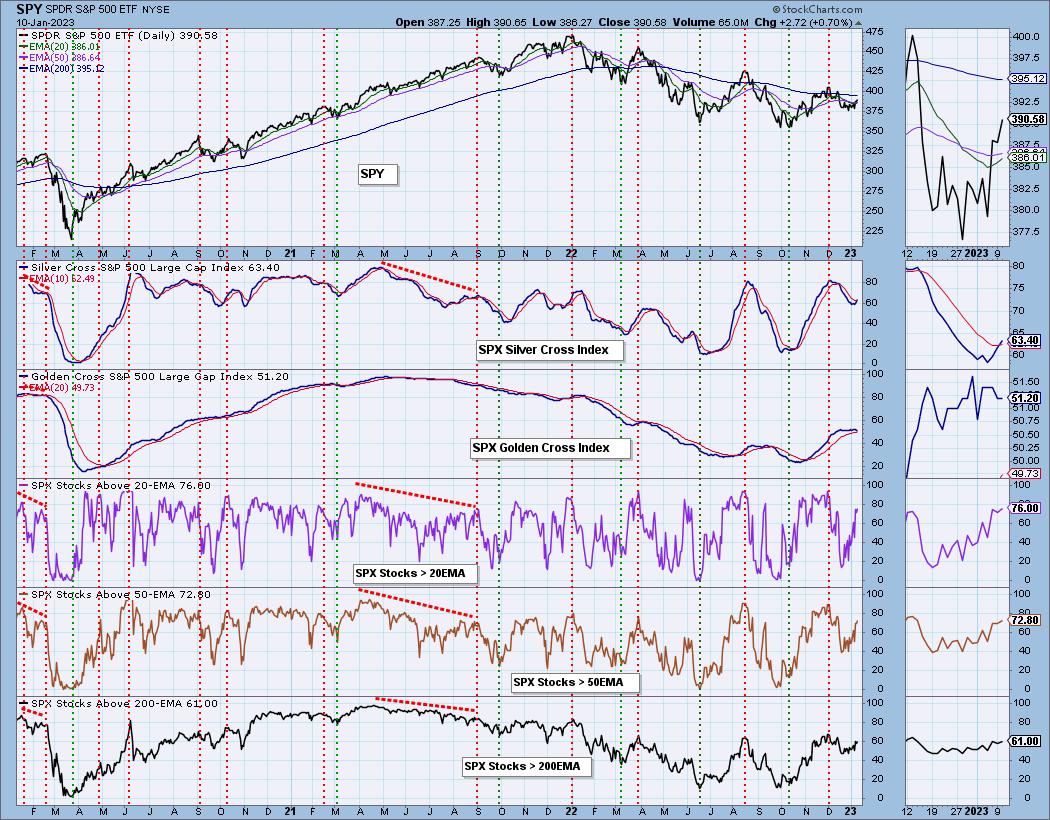

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 12% exposed with a 2% hedge.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Watch the latest episode of DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com