Thank you for sending in some very good selections for Reader Request Day. I was easily able to extract four "Diamonds in the Rough". What was interesting was that one industry group was prevalent. It isn't really a surprise given the Semiconductors have been outperforming the market for weeks.

One of the Semis was requested by two readers, Rambus Inc (RMBS) so that was an easy inclusion. The other I'm going to cover is Himax (HIMX).

The next request comes from the Gambling industry group. We covered DraftKings (DKNG) back in January and right now it looks like a very interesting add.

Finally, the last request is related to Crude Oil which I'm bullish on, Vista Oil & Gas (VIST).

IMPORTANT: I mistakenly set up registration for next week's Diamond Mine in this week's reports. Please use the correct link HERE. I've also updated it below. If you can't attend, I will be sending out the recording as soon as it is ready around 11:00a.

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": DKNG, HIMX, RMBS and VIST.

Other Requests: HESM, ARES, ECC, SPNT, SPR, ARW, WDAY, INFN, VKTX, CIVI, BP, MLCO, AXTA and PH.

RECORDING LINK (3/24/2023):

Topic: DecisionPoint Diamond Mine (3/24/2023) LIVE Trading Room

Recording Link

Passcode: March#24

REGISTRATION for 3/31/2023:

When: Mar 31, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (3/31/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Here is the last recording (3/27):

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Stop levels are all rounded down.

DraftKings Inc (DKNG)

EARNINGS: 05/05/2023 (AMC)

DraftKings, Inc. is a digital sports entertainment and gaming company, which engages in the provision of online sports betting, online casino, daily fantasy sports product offerings, DraftKings Marketplace, retail sportsbook, media, and other consumer product offerings. The company was founded by Jason D. Robins, Matthew Kalish, and Paul Liberman on December 31, 2011 and is headquartered in Boston, MA.

Predefined Scans Triggered: Filled Black Candles.

DKNG is unchanged in after hours trading. I really like the breakout from the bullish falling wedge and today's pause on the filled black candlestick. That is a one-day bearish formation, so we could see a decline tomorrow before the rally continues on. The RSI is positive above net neutral (50). The PMO is turning up and Stochastics are rising strongly in positive territory. Relative strength against the group has been very good and it is beginning to outperform the SPY as the group looks ready to get going again.

DKNG has been in a trading range since 2022 and it is certainly vulnerable to making a trip back down. However, notice that the reversal is occurring right on support at the 17/43-week EMAs. The weekly RSI is positive and the weekly PMO is rising. The SCTR has recaptured the "hot zone"* above 70.

*We call it the "hot zone" because it implies that the stock/ETF is in the top 30% of its "universe" (large-, mid-, small-caps and ETFs) as far as trend and condition, particularly in the intermediate and long terms.

Himax Technologies Inc. (HIMX)

EARNINGS: 05/09/2023 (BMO)

Himax Technologies, Inc. is a semiconductor solution provider dedicated to display imaging processing technologies. It operates through the Driver Integrated Circuit and Non-Driver Products segments. The company's products include display drivers, timing controllers, wafer level optics, video and display technology solutions, liquid crystal over silicon silicon, complementary metal-oxide semiconductor image sensor, and power integrated circuit. Its products used in TVs, laptops, monitors, mobile phones, tablets, digital cameras, car navigation, virtual reality (VR) devices and many other consumer electronics devices. Himax Technologies was founded by Biing Seng Wu and Jordan Wu on June 12, 2001 and is headquartered in Tainan, Taiwan.

Predefined Scans Triggered: New CCI Buy Signals, Moved Above Upper Bollinger Band, Stocks in a New Uptrend (Aroon), Moved Above Upper Price Channel and P&F Low Pole.

HIMX is up +0.12% in after hours trading. Today price broke out from a tight trading range. The RSI is positive and the PMO is on a relatively new crossover BUY signal. The OBV is rising slightly, confirming the current rally. Stochastics are headed back above 80. The group as noted in the introduction has been outperforming for some time. HIMX hasn't been the best performer against the group, but it is enough to stay on par with the SPY. It isn't one of the stronger Semiconductors, but it appears ready to make up for lost time. The stop is set below support at the last low around 7.6% or $7.53.

I spotted a reverse head and shoulders on this already bullish chart. The upside target of the pattern would take price upward more than 30%. The weekly RSI is possible and the weekly PMO is rising on a crossover BUY signal. The SCTR is right at the top of the "hot zone" above 70 so there is relative strength.

Rambus, Inc. (RMBS)

EARNINGS: 05/01/2023 (AMC)

Rambus, Inc. engages in the provision of cutting-edge semiconductor and Internet Protocol products, spanning memory and interfaces to security, smart sensors and lighting. Its products include Memory Interface Chips, Interface IP, and Security IP. The company was founded by P. Michael Farmwald and Mark A. Horowitz in March 1990 and is headquartered in Sunnyvale, CA.

Predefined Scans Triggered: Moved Above Upper Keltner Channel, New 52-week Highs, Stocks in a New Uptrend (Aroon), P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

RMBS is up +0.35% in after hours trading. This Semiconductor has rallied strongly the past two days so I was forced to set the stop uncomfortably above 8% (8.3% or $46.33). There is a high likelihood we will see a small pause or pullback toward the breakout point which would make that stop less deep upon entry. I do see it continuing higher given the positive RSI and new PMO BUY Signal. The PMO is also rising very strongly now. The OBV shows us that volume did come in on the move as expected. Price should follow volume. Stochastics are above 80 and relative strength is excellent across the board. This is clearly a stronger candidate than HIMX, but I do believe all Semis will continue to run hot.

The breakout is to new all-time highs. The weekly RSI is overbought, but that doesn't tend to lead to an immediate drop. The weekly PMO has bottomed above its signal line which is especially bullish even though the weekly PMO is overbought. Since it is at all-time highs and the stop is deep, consider an upside target of 18% which would bring price up to $59.63. The SCTR can't get much higher so it is showing excellent relative strength.

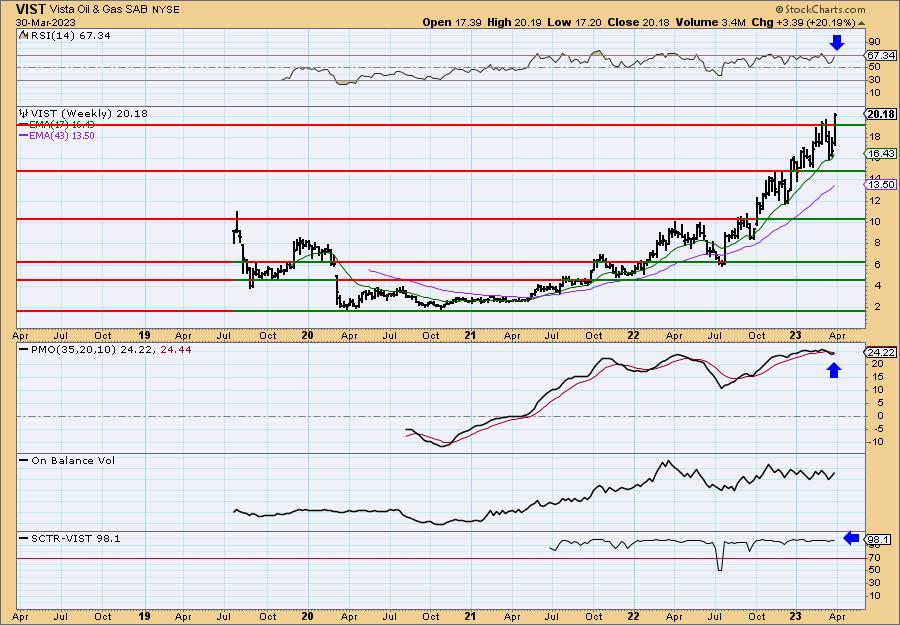

Vista Oil & Gas SAB (VIST)

EARNINGS: 04/25/2023 (AMC)

Vista Energy SAB de CV is an oil and gas company, which engages in the exploration and production of oil and gas. It operates through Argentina and Mexico geographical segments. The firm's assets include Vaca Muerta, the largest shale oil and gas play under development outside North AMerica. The company was founded on March 22, 2017 and is headquartered in Miguel Hidalgo, Mexico.

Predefined Scans Triggered: Moved Above Upper Keltner Channel, New 52-week Highs and P&F Double Top Breakout.

VIST is down -0.10% in after hours trading. If you're going fishing in Exploration & Production, you couldn't do much better than VIST given its outperformance of the group for months. It also outperformed the SPY during that period. Today it broke out to new 52-week highs. The RSI is positive and the PMO looks great as it has generated a crossover BUY signal above the zero line. Volume is coming in. Stochastics are above 80. The group isn't outperforming the SPY right now, but nor is it underperforming. The stop is set about halfway down the prior trading range at 7.5% or $18.66.

The weekly PMO was on its way lower on an overbought SELL signal, but it has already turned up. Look at the steady rising trend since 2022 and the excellent SCTR! The weekly RSI is positive and not overbought. Since it is at new all-time highs, consider an upside target of about 17% or $23.61.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

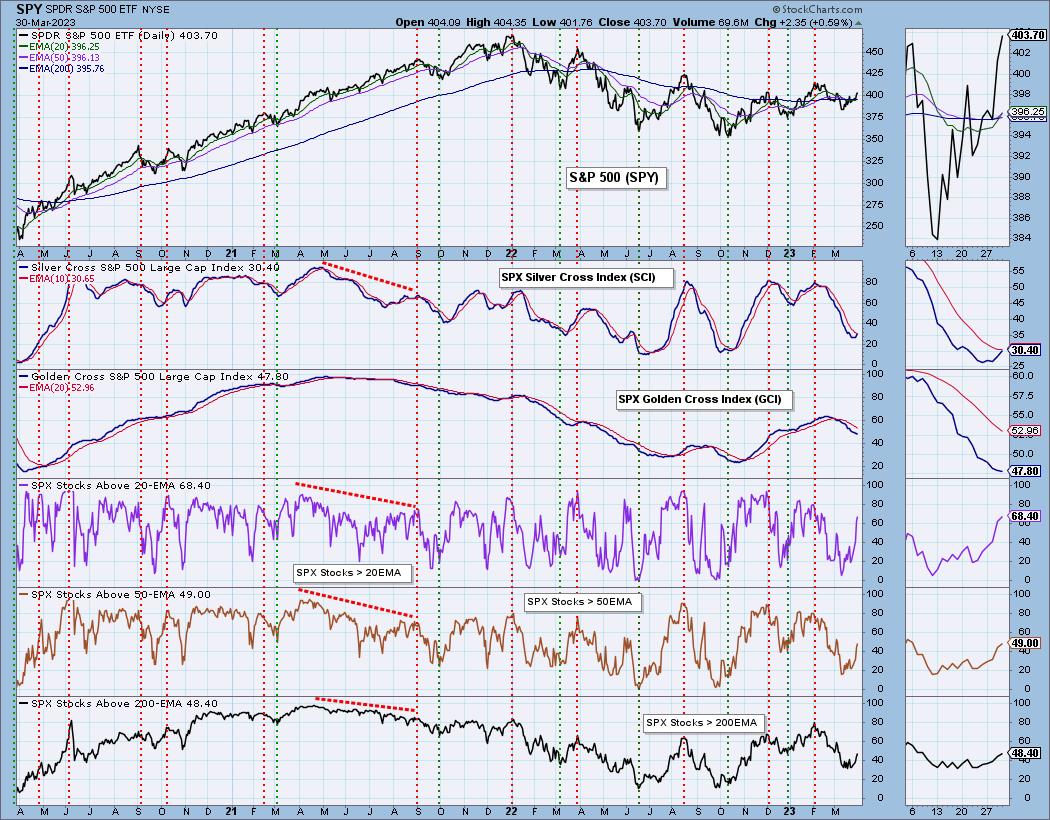

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 28% long, 2% short. Considering RMBS.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Watch the latest episode of DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com