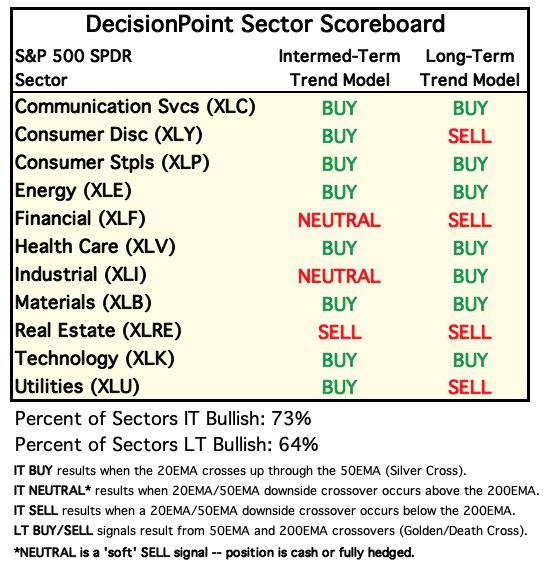

In this morning's trading room I discussed that I'm very bearish on the market right now. It doesn't surprise me that the two finalists for "Sector to Watch" were both defensive areas of the market, Utilities (XLU) and Consumer Staples (XLP). While many stocks will weather the storm, the majority will not, so it is important to watch your charts closely right now. Topping PMOs and Stochastics are a pretty good sign to book some profit or conversely, let go of losers. If they are losing in the current environment, it is doubtful they will perform during a market correction.

This week's "Darling" goes to Reader Requested Annexon Inc (ANNX). It had a great day and it is a low-priced Biotech stock. The swings to the positive and unfortunately the swings to the negative are going to be wide. I like it moving forward, but have the antacid ready.

This week's "Dud" was a surprise to me. Marine Transportation had looked particularly bullish at the beginning of the week, but that was the last hurrah as Frontline Ltd (FRO) fell heavily thereafter, triggering the -7.7% stop in the process.

As noted in the first paragraph, the two finalists for "Sector to Watch" were defensive Consumer Staples (XLP) and Utilities (XLU). Ultimately I decided to go with XLP, primarily because nearly all of its industry groups look bullish. I can't say the same for XLU. But I will say that the Water industry group looked interesting.

The "Industry Group to Watch" is General Retailers within Consumer Staples. There is no ETF for this group. On StockCharts the group is only made up of three stocks, Target (TGT), Dollar Tree (DLTR) and Dollar General (DG). I'd avoid Target, the chart has some problems, but DLTR and DG look good.

Have a great weekend!

Good Luck & Good Trading,

Erin

RECORDING LINK (4/21/2023):

Topic: DecisionPoint Diamond Mine (4/21/2023) LIVE Trading Room

Passcode: April#21

REGISTRATION for 4/28/2023:

When: Apr 28, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (4/28/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Our latest DecisionPoint Trading Room recording (4/17/2023):

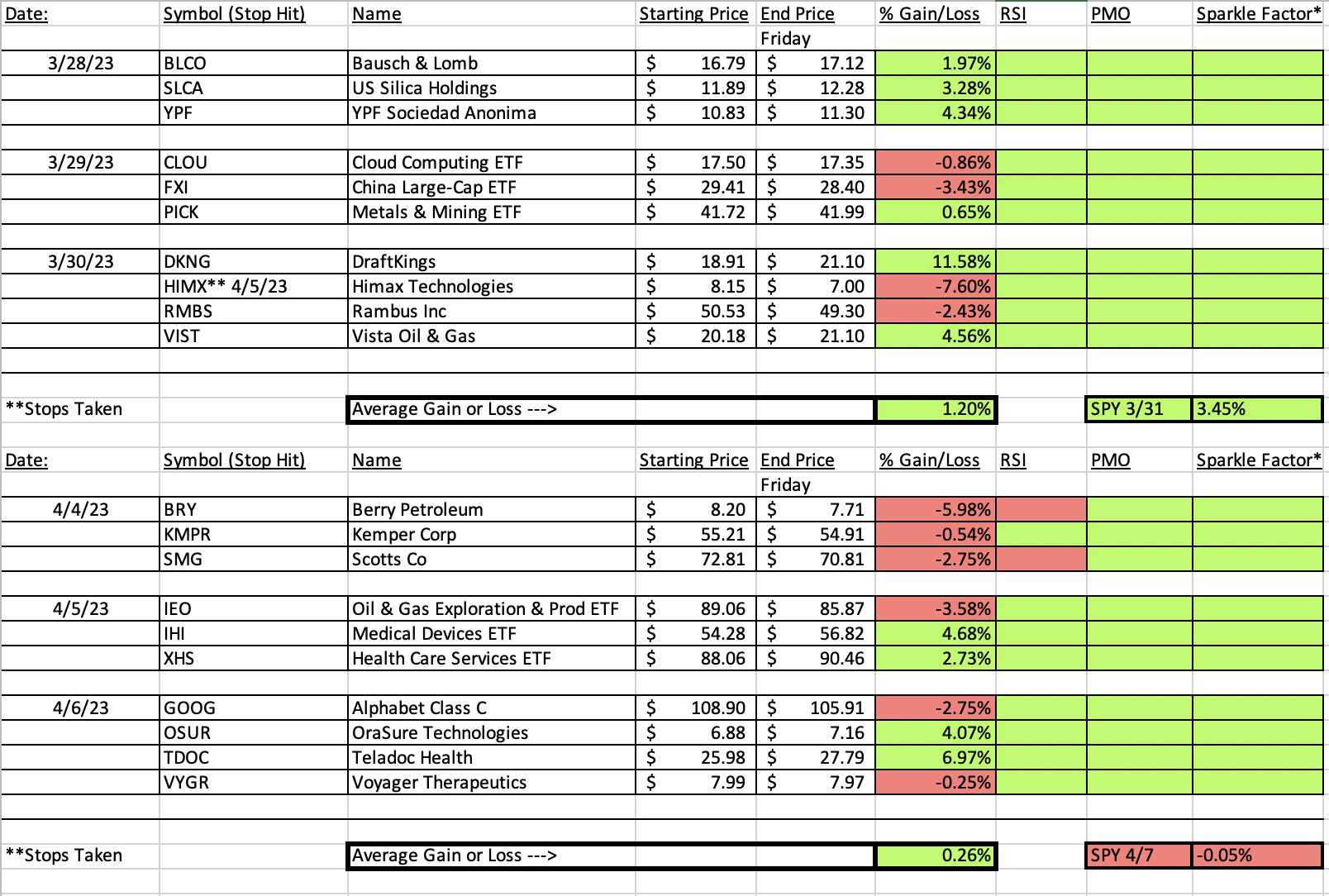

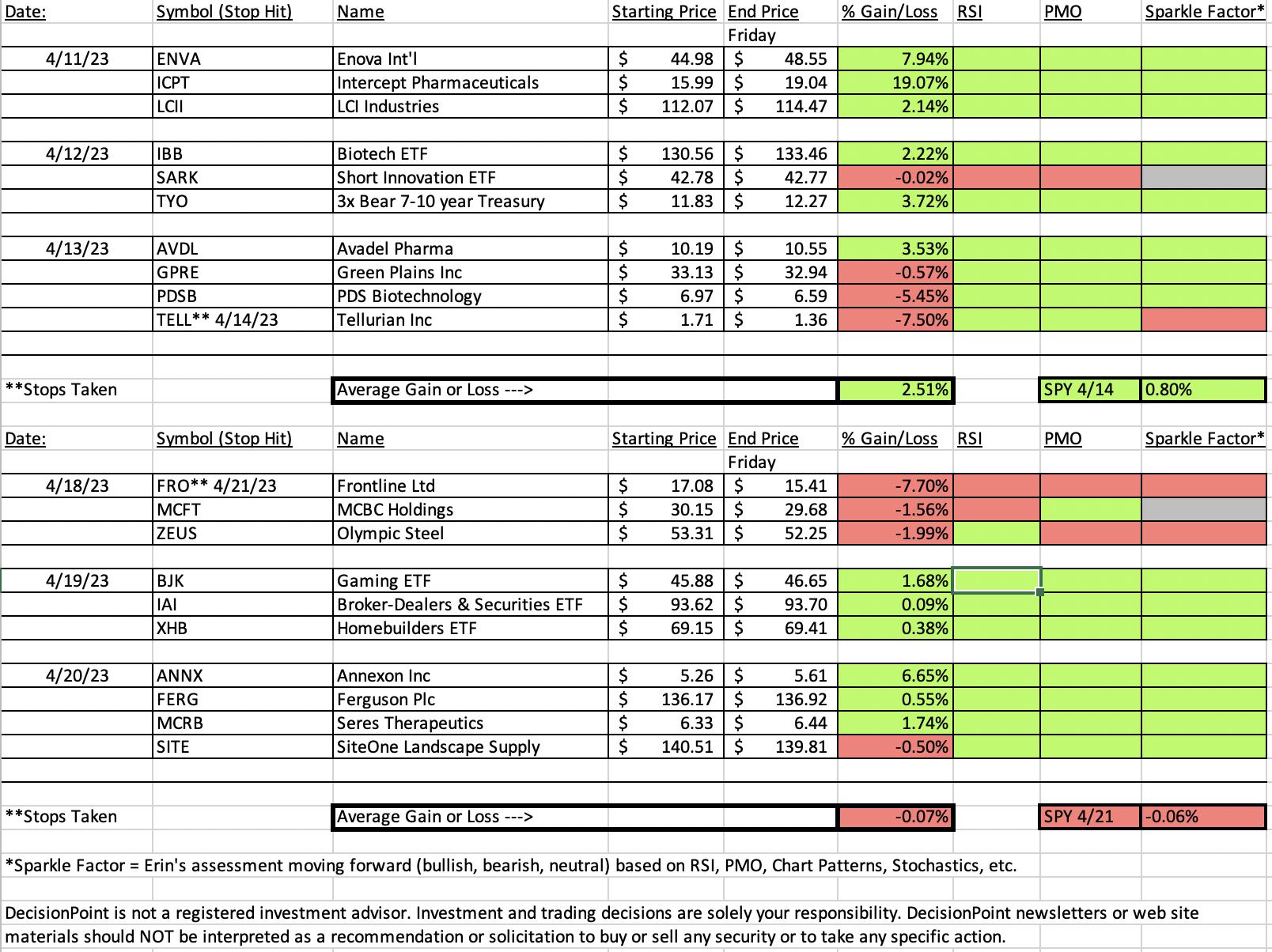

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Annexon Inc. (ANNX)

EARNINGS: 05/08/2023 (BMO)

Annexon, Inc. is a clinical-stage biopharmaceutical company, which develops a pipeline of novel therapies for patients with classical complement-mediated disorders of the body, eye and brain. It offers drugs that control or target huntington's and alzheimer's disease, multiple sclerosis, glaucoma, parkinson's disease, and spinal muscular atrophy. The company was founded by Ben Barres and Arnon Rosenthal on March 3, 2011 and is headquartered in Brisbane, CA.

Predefined Scans Triggered: Elder Bar Turned Blue and Moved Above Upper Keltner Channel.

Below are the commentary and chart from yesterday (4/20):

"ANNX is down -2.09% in after hours trading. It could be that it is pulling back after hours since it's hit overhead resistance. I would look for a breakout. The RSI is positive and not quite overbought. The PMO just hit positive territory and is on an oversold Crossover BUY Signal. The OBV is confirming the rising trend and Stochastics are very strong as they rise above 90 not just 80. Overall, relative strength is increasing against the SPY and the group. The group is doing fairly well relatively speaking. The stop is set at the 50-day EMA at 7.8% or $4.84."

Here is today's chart:

We have a very nice breakout today for ANNX. The only problem I detect is the overbought RSI. However, in a strong move higher, that condition will persist, so it shouldn't be a problem just yet. Keep an eye on Stochastics. They are an early warning system. If they drop below 80, it might be time to let it go or tighten the stop.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Frontline Ltd. (FRO)

EARNINGS: 05/31/2023 (BMO)

Frontline Plc is an international shipping company, which engages in the ownership and operation of oil and product tankers. It also offers the seaborne transportation of crude oil and oil products. The company was founded in 1985 and is headquartered in Limmasol, Cyprus.

Predefined Scans Triggered: None.

Below are the commentary and chart from Tuesday (4/18):

"FRO is up +0.64% in after hours trading. Price is breaking out of a bullish falling wedge. The RSI is positive, rising and not overbought. The OBV has a positive divergence with price lows. The PMO is about to trigger a Crossover BUY Signal above the zero line. Stochastics are above 80 now. As noted in the opening, the group isn't performing particularly well against the SPY, but this stock and the other three I mentioned (DHT, INSW and TNP) are showing improved relative strength against the group and the SPY. The stop is set as close to gap support as I could get without it being too deep. It is set at 7.7% or $15.76."

Here is today's chart:

I had four stocks from the Marine Transportation industry group hit my scan results on Tuesday so it was an obvious inclusion. Unfortunately, all four of the stocks slid right after being picked. FRO saw a bullish breakout from a falling wedge. That was all that was needed to confirm the pattern. Price opted to fail after that. The indicators look terrible and relative strength has fallen off the map. I don't see any redeeming qualities on this chart.

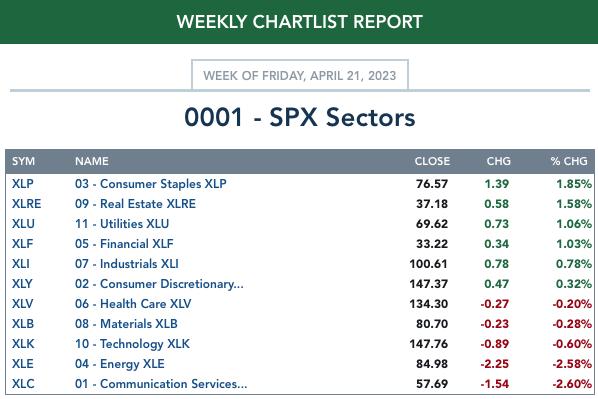

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Under the Hood ChartList!

Sector to Watch: Consumer Staples (XLP)

Really, this was an easy choice after the close. Price broke out today, but did close on overhead resistance. The PMO is starting to accelerate again. The Silver Cross Index (SCI) steady at a bullish reading of 78%. We have a higher percentage of stocks above their 20/50-day EMAs so the SCI should continue to rise. The GCI saw a whipsaw BUY Signal as it moved back above its signal line. Stochastics look great and relative strength is beginning to accelerate higher.

Industry Group to Watch: General Retailers ($DJUSGT)

As noted above this group only contains three stocks so it really doesn't matter that this group has no ETF. I like the breakout above the early April high. It is hitting resistance, but it pushed past it intraday. The RSI is positive and the PMO is accelerating higher. Volume is coming in and Stochastics are oscillating above 80. They are in XLP and are poised to rally.

Go to our Sector ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 26% long, 2% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com