We had another positive week with every position finishing higher with the exception of one which was only down -0.07%. It's amazing how much easier it is to stock pick in a bull market. Hopefully your portfolios have been enjoying the rally as much as "Diamonds in the Rough".

The "Darling" this week was a bit of surprise given it is from the less than exciting Consumer Staples sector. It was up over 7% this week and is still going strong.

The "Dud" was yesterday's reader requested PennyMac (PMT). The chart is still favorable with rising indicators, but admittedly it is looking a bit suspect. I still like it and it remains on a BUY. After today's Diamond Mine, I know there are better choices than this one, but it is far from being a real "Dud".

Hope you have a great weekend! Given the holiday on July 4th, Tuesday, I will be doing Tuesday's "Diamonds in the Rough" on Monday. If per chance I am unable to do it then, you will get six picks on Wednesday. I'll keep you posted.

It appears that I will be on Making Money with Charles Payne on Wednesday of next week. The appearance has been rescheduled a few times so I will send out notice via email when I know that it is set in stone.

Good Luck & Good Trading,

Erin

RECORDING LINK (6/30/2023):

Topic: DecisionPoint Diamond Mine (6/30/2023) LIVE Trading Room

Passcode: June#30th

REGISTRATION for 7/7/2023:

When: Jul 7, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (7/7/2023) LIVE Trading Room

Register in advance for this webinar HERE.

After registering, you will receive a confirmation email containing information about joining the webinar.

Our latest DecisionPoint Trading Room recording (6/26/2023):

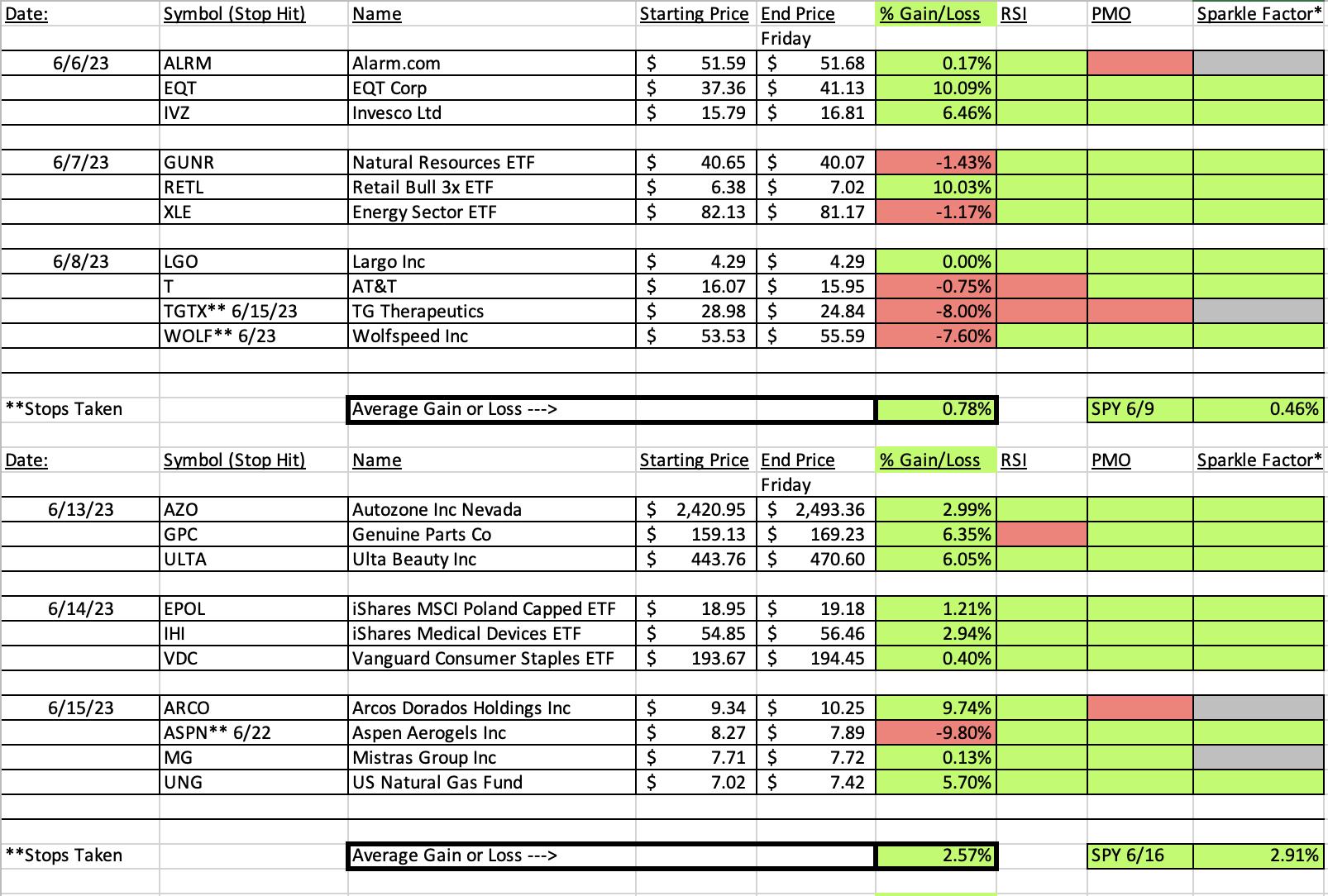

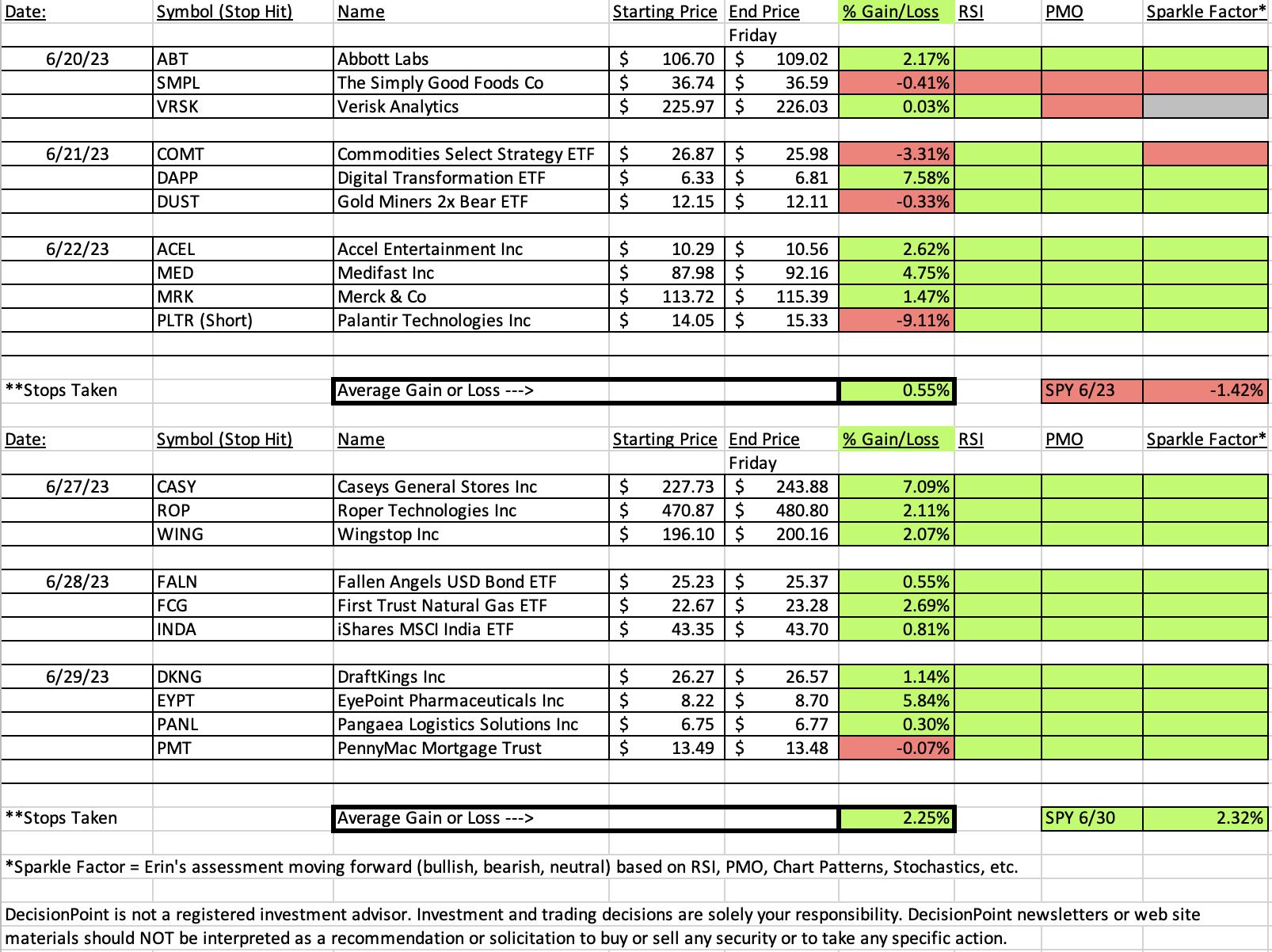

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Caseys General Stores, Inc. (CASY)

EARNINGS: 08/08/2023 (AMC)

Casey's General Stores, Inc. engages in the management and operation of convenience stores and gasoline stations. It provides self-service gasoline, a wide selection of grocery items and an array of freshly prepared food items. The firm offers food, beverages, tobacco products, health and beauty aids, automotive products, and other non-food items. The company was founded by Donald F. Lamberti in 1959 and is headquartered in Ankeny, IA.

Predefined Scans Triggered: None.

Below are the commentary and chart from Tuesday (6/27):

"CASY is unchanged in after hours trading. It nearly saw a bullish engulfing candlestick today. In any case, it was a strong rally continuation. Price did get above resistance. The RSI is now positive and there is a new PMO Crossover BUY Signal. Stochastics are also rising strongly and should find their way above 80 soon. Relative strength is rising against the SPY for both the industry group and CASY. CASY also happens to be outperforming the group. I've put the stop below support at 5.6% or $214.97."

Here is today's chart:

It was down slightly the day after being picked, but it rallied strongly today and formed a bullish engulfing candlestick. The RSI is trying to get overbought, so it may consolidate a bit here, but ultimately given the PMO Crossover BUY Signal and strong outperformance, it should move higher from this new support level.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

PennyMac Mortgage Investment Trust (PMT)

EARNINGS: 08/01/2023 (AMC)

PennyMac Mortgage Investment Trust is a finance company, which invests primarily in residential mortgage loans and mortgage-related assets. It operates through following segments: Correspondent Production, Credit Sensitive Strategies, Interest Rate Sensitive Strategies, and Corporate Activities. The Correspondent Production segment deals with purchasing, pooling, and reselling newly originated prime credit quality mortgage loans either directly or in the form of mortgage-backed securities in capital markets. The Credit Sensitive Strategies segment includes investments in distressed mortgage loans, real estate acquired in settlement of mortgage loans, real estate held for investment, credit risk transfer agreements, non-agency subordinated bonds, and small balance commercial real estate mortgage loans. The Interest Rate Sensitive Strategies segment focuses on investments in mortgage servicing rights, excess servicing spread, agency and senior non-agency mortgage-backed securities, and the related interest rate hedging activities. The Corporate segment includes management fee and corporate expense amounts and certain interest income. The company was founded by Stanford L. Kurland on May 18, 2009 and is headquartered in Westlake Village, CA.

Predefined Scans Triggered: P&F Double Top Breakout.

Below are the commentary and chart from yesterday (6/29):

"PMT is up +0.74% in after hours trading. After yesterday's breakout, price took a breather. This looks like a bull flag that has been confirmed with the breakout. The RSI is positive and not overbought. The weekly PMO has surged above its signal line. Stochastics are back above 80. If I had a complaint it would be the OBV declining tops v. price rising tops. Relative strength studies show PMT as well as the group outperforming. The stop is set beneath support at 6.8% or $12.57."

Here is today's chart:

It's only been one day of price action so I can't judge this chart harshly. It looks about the same as yesterday so all of the earmarks of a strong chart remain. Positive RSI, rising PMO and Stochastics above 80 all suggest higher prices ahead for this one. Beware though. Should this decline drop below the prior price top, we'll have a possible bearish double-top in the making. You don't want to hold through that.

THIS WEEK's Sector Performance:

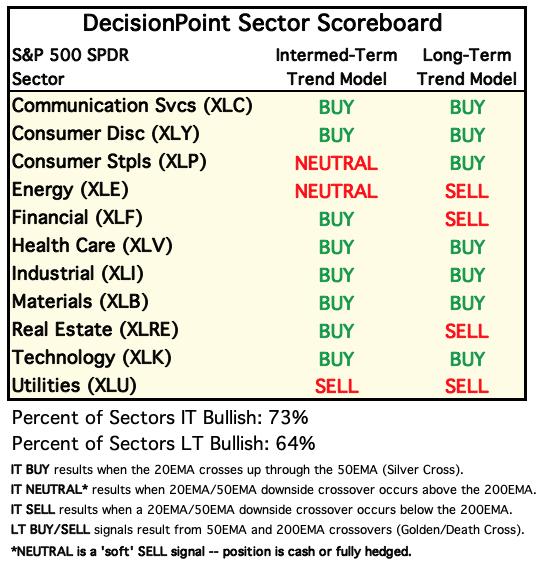

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Under the Hood ChartList!

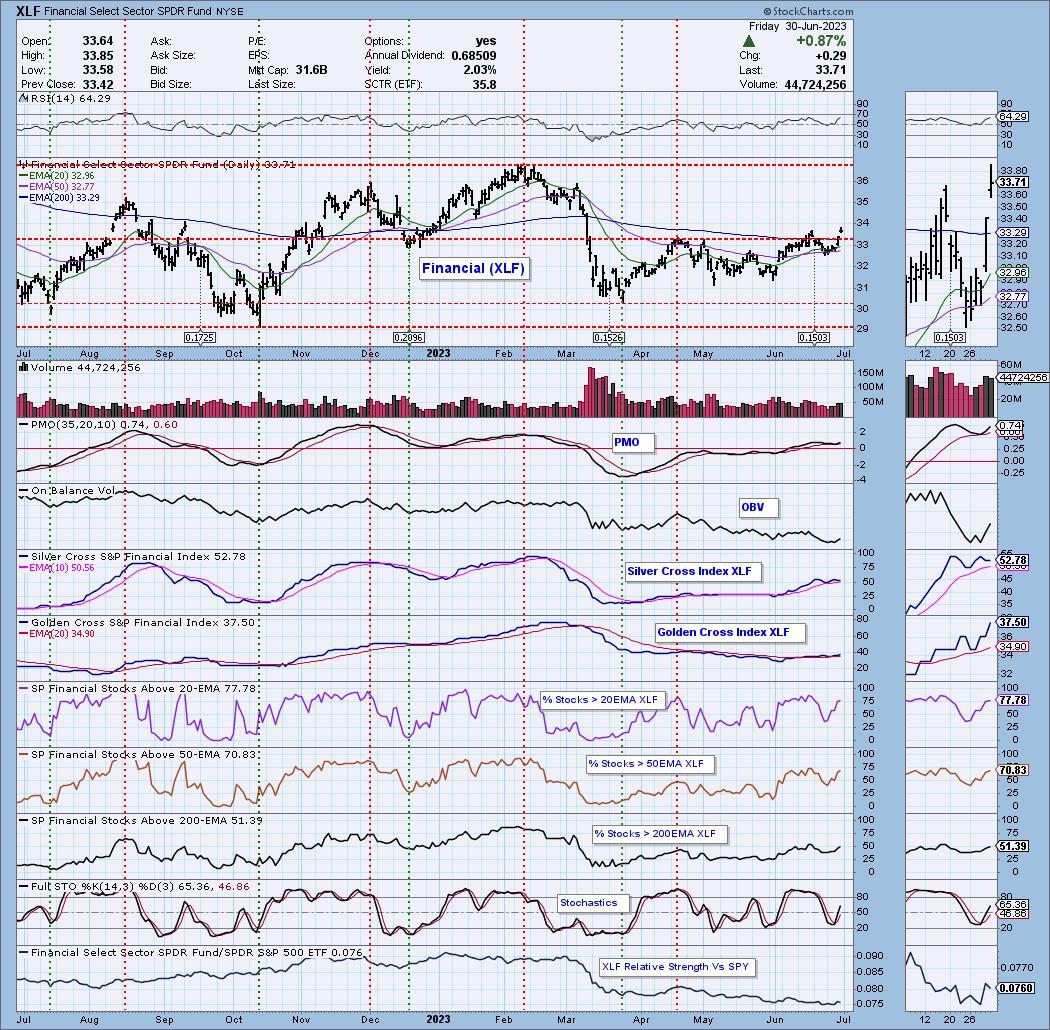

Sector to Watch: Financials (XLF)

It's been awhile since I picked XLF as the Sector to Watch. I will say that most of the sectors look healthy with the exception of Utilities (XLU). Industrials broke out strongly and Real Estate (XLRE) broke out above strong overhead resistance. Consumer Discretionary (XLY) and Materials (XLB) were close to being picked today, but like Technology (XLK) the sectors are overbought. XLF was the best choice as it was all about new momentum on a PMO Surge above the signal line. Participation is strong and not overbought. The Silver Cross Index (SCI) held its ground today rather than decline so I see this as an up and coming sector. Overall, it's hard to go wrong in a strong bull market like we currently have. XLF has plenty of upside potential.

Industry Group to Watch: Insurance (KIE)

Nearly all of the insurance groups within Financials look bullish so I decided to go with an ETF that covers Insurance as a whole, KIE. We saw a nice breakout today with price closing right on resistance. The RSI is positive and not overbought. The PMO is surging above the signal line and Stochastics are above 80. Relative strength is slowly picking up on the ETF. In particular I liked Life Insurance, but couldn't find an ETF to mimic it exactly.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 60% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com