Two sectors have had rising momentum, Energy (XLE) and Healthcare (XLV). Today XLE saw its PMO turn down. Healthcare is now the only sector with rising momentum. It shouldn't be surprising that today's picks all come from this sector.

The other thing that shouldn't surprise you is that all three come from the Biotechnology industry group. The group is slogging along when you look at the chart 'under the hood' below. It is nearing a PMO Crossover BUY Signal, but the RSI is negative. Participation is improving slightly in %Stocks > 20EMA, but the Silver Cross Index hasn't reversed yet. Stochastics paused but are still rising.

This is a very diverse industry group and has a plethora of members in comparison to the majority of groups out there. I still see this as an area of the market we can exploit with careful stock selections.

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": AKRO, SRPT and TECH.

Runner-ups: HXL, SPSC, FCN, TDY, COLL, ORLY, ALKS and WT.

RECORDING LINK (8/11/2023):

Topic: DecisionPoint Diamond Mine (8/4/2023) LIVE Trading Room

Passcode: August#11th

REGISTRATION for 8/18/2023:

When: Aug 18, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (8/18/2023) LIVE Trading Room

Register in advance for this webinar HERE.

After registering, you will receive a confirmation email containing information about joining the webinar.

Here is the last recording from 8/14:

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Stop levels are all rounded down.

Akero Therapeutics Inc. (AKRO)

EARNINGS: 11/03/2023 (BMO)

Akero Therapeutics, Inc. is a clinical-stage company, which engages in the development of treatments for patients with serious metabolic diseases. The firm's lead product candidate, efruxifermin (EFX), is an analog of fibroblast growth factor 21, or FGF21, which is an endogenously expressed hormone that protects against cellular stress and regulates metabolism of lipids, carbohydrates, and proteins throughout the body. The company was founded by Jonathan Young and Timothy Rolph in January 2017 and is headquartered in South San Francisco, CA.

Predefined Scans Triggered: Stocks in a New Uptrend (Aroon), Filled Black Candles, P&F Double Top Breakout and P&F Triple Top Breakout.

AKRO is up +0.38% in after hours trading. There is now a confirmed double bottom formation as price has overcome the confirmation line of the pattern. We do have a bearish filled black candlestick today, but price remained above the confirmation line. The RSI is positive and there is PMO Crossover BUY Signal. The OBV is rising to confirm the rally. Stochastics are above 80. Biotechs show a rising relative strength line against the SPY right now. AKRO is outperforming both the group and the SPY. The stop is set a little past halfway into the chart pattern at 7.7% or $43.81.

The weekly chart is improving. Price is managing to use the 43-week EMA as support. The weekly RSI is in positive territory and the weekly PMO is attempting to rise. I like that the StockCharts Technical Rank (SCTR) is in the hot zone* above 70. I am looking for a test of overhead resistance at $55, but it could move slightly higher than that to test all-time highs.

*If a stock/ETF is in the "hot zone" above 70, it implies that it is stronger than 70% of its universe (large-, mid-, small-caps and ETFs) primarily in the intermediate to long terms.

Sarepta Therapeutics, Inc. (SRPT)

EARNINGS: 11/01/2023 (AMC)

Sarepta Therapeutics, Inc. is a commercial-stage biopharmaceutical company, which is engaged in the discovery and development of therapeutics for the treatment of rare diseases. The company was founded on July 22, 1980, and is headquartered in Cambridge, MA.

Predefined Scans Triggered: Stocks in a New Uptrend (ADX).

SRPT is down -0.77% in after hours trading. Here we have another double-bottom that technically has been confirmed with today's close. The minimum upside target of the pattern would take price close to the next area of overhead resistance at about $130. The RSI is positive and the PMO previously surged above the signal line. Stochastics have just moved above 80. I really like the improving relative strength against the group and the SPY. The stop is set below the 20-day EMA at 6.5% or $106.66.

Price bounced right on very strong support and has plenty of upside potential. The weekly RSI is negative, but rising and near 50. The weekly PMO is decelerating and could turn up soon. The SCTR is rising vertically and should hit the hot zone in the next week if it rallies like I think it will.

Bio-Techne Corporation (TECH)

EARNINGS: 11/01/2023 (BMO)

Bio-Techne Corp. engages in the development, manufacture and sale of biotechnology reagents and instruments for the research and clinical diagnostic markets. It operates through the following segments: Protein Sciences and Diagnostics and Genomics. The Protein Sciences segment develops and manufactures purified proteins and reagent solutions most notably cytokines and growth factors, antibodies, immunoassays, biologically active small molecule compounds, tissue culture reagents and T-Cell activation technologies. This segment also includes protein analysis solutions that offer researchers efficient and streamlined options for automated western blot and multiplexed ELISA workflow. The Diagnostics & Genomics segment develops and manufactures diagnostic products, including FDA-regulated controls, calibrators, blood gas and clinical chemistry controls and other reagents for OEM and clinical customers, as well as a portfolio of clinical molecular diagnostic oncology assays, including the ExoDx Prostate (IntelliScore) test (EPI) for prostate cancer diagnosis. This segment also manufactures and sells advanced tissue-based in-situ hybridization assays (ISH) for research and clinical use. The company was founded in 1976 and is headquartered in Minneapolis, MN.

Predefined Scans Triggered: Parabolic SAR BUY Signals

TECH is down -0.13% in after hours trading. Price has now reached overhead resistance, but based on the positive indicators, I'm expecting a breakout. The RSI is positive and the PMO is nearing a Crossover BUY Signal. Stochastics are rising strongly. Relative strength against the group is up and down, but overall it has shown leadership among the Biotechs. It is outperforming the SPY. The stop is set below support at 6% or $79.53.

What caught my eye on the weekly chart was the bullish ascending triangle (flat top, rising bottoms). The weekly RSI is positive and the weekly PMO is on the rise on a Crossover BUY signal. Neither the weekly RSI or weekly PMO are overbought in the least. The SCTR is almost in the hot zone. I am looking for a breakout and a move to the next level of resistance at $110.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

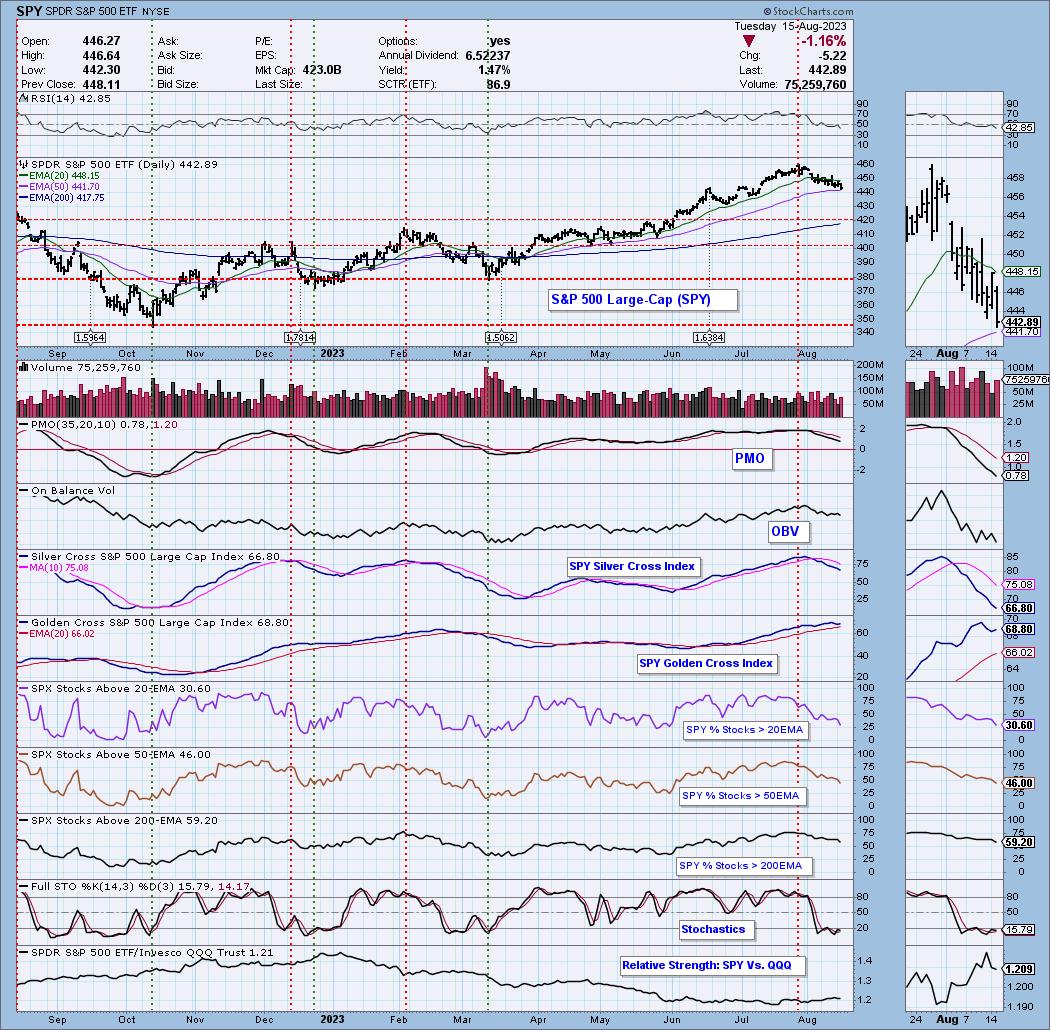

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 15% long, 4% short.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Watch the latest episode of DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com