It was a negative week for "Diamonds in the Rough", but they were only down -0.59% versus the SPY which was down a whopping -2.92%. It was a terrible week and it triggered the stops on many of our older picks. The market is very stretched to the downside and a rebound certainly is possible, but my sense is that any rally will likely turn into a pause, not an opportunity.

I hope that you have been setting your stops and staying true to them. There is also no reason you can't drop a position prior to the stop being hit if the chart is going south. I was put at a disadvantage this week given I was traveling at key moments when I could have strengthened and better protected my portfolio. I'll be doing a complete overhaul on Monday.

The beta test of the Scan Alert System is coming to a close. For those who participated, I thank you and hope to receive your reviews this week. I'll send a separate email on Monday with prompts you can use to express your thoughts. So far the comments I have received have been very helpful and have given me plenty to think about as we get ready to launch.

Good Luck & Good Trading,

Erin

RECORDING LINK (9/15/2023 - No recording on 9/22):

Topic: DecisionPoint Diamond Mine (9/15/2023) LIVE Trading Room

Passcode: Sept#15th

REGISTRATION for 9/29/2023:

When: Sep 29, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (9/29/2023) LIVE Trading Room

Register in advance for this webinar HERE.

After registering, you will receive a confirmation email containing information about joining the webinar.

Our latest DecisionPoint Trading Room recording (9/18):

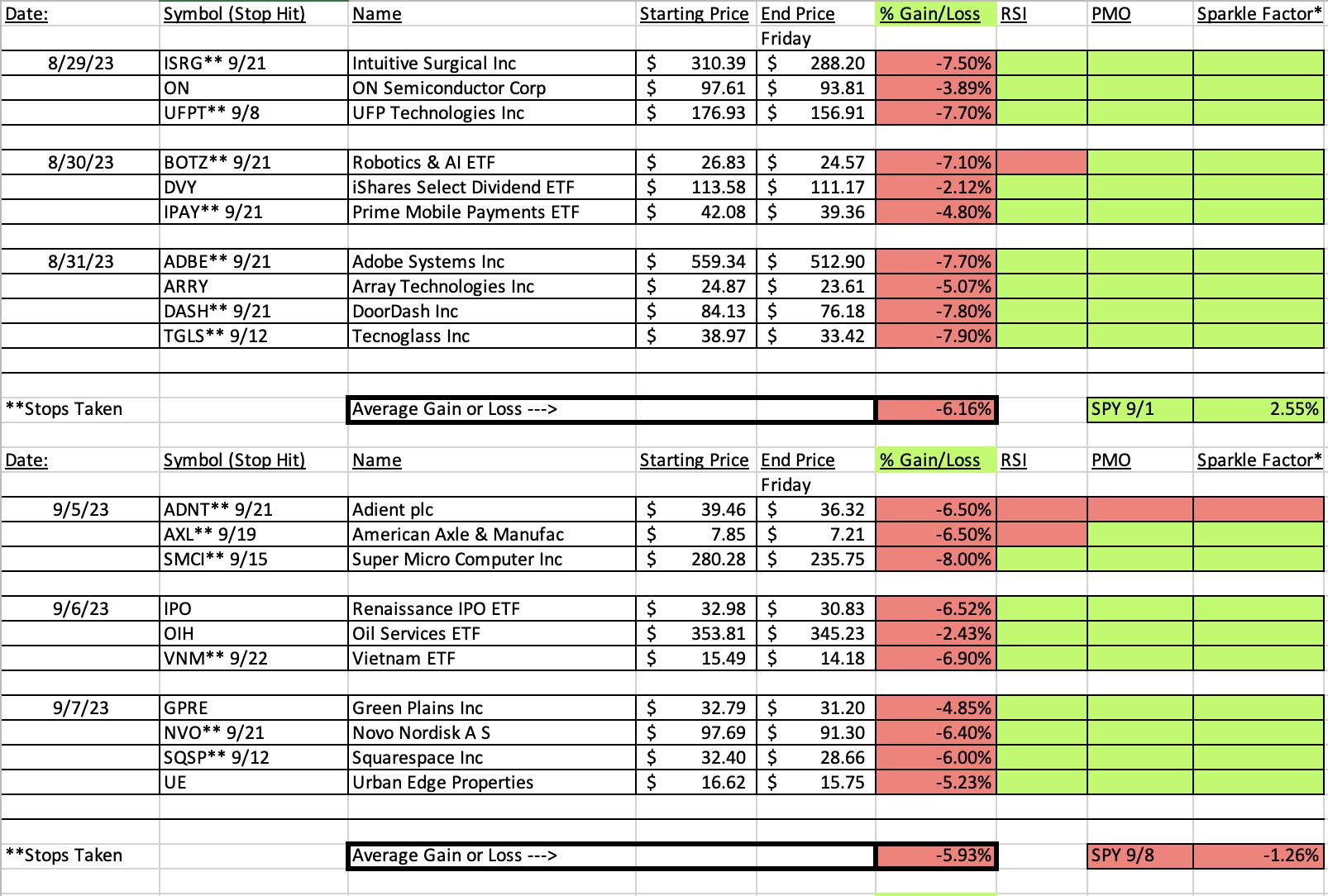

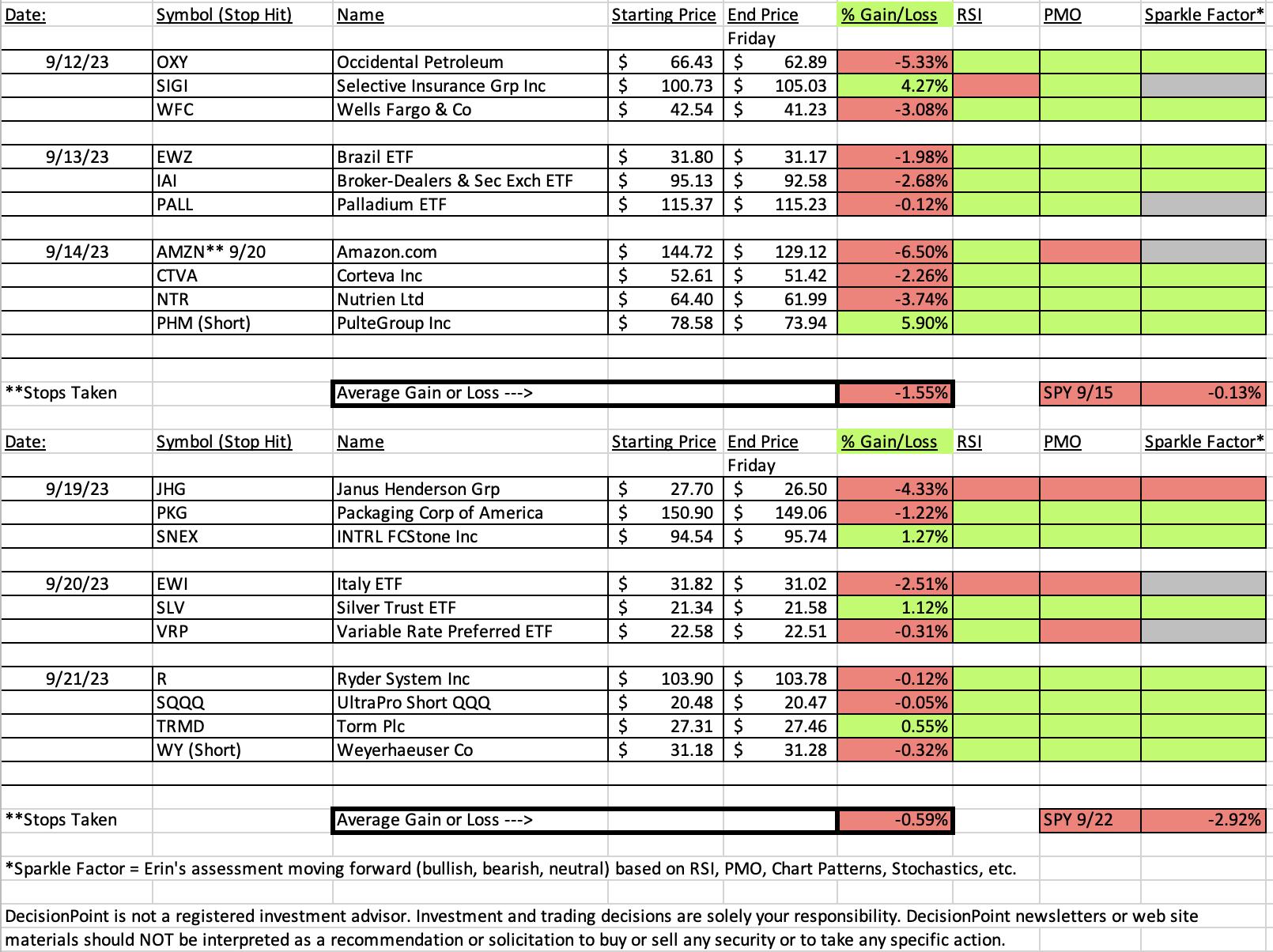

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

INTL FCStone Inc. (SNEX)

EARNINGS: 11/20/2023 (AMC)

StoneX Group, Inc. engages in the provision of brokerage and financial services. It operates through the following segments: Commercial Hedging, Global Payments, Securities, Physical Commodities, and Clearing and Execution Services. The Commercial Hedging segment offers risk management consulting services. The Global Payments segment includes global payment solutions for banks, commercial businesses, charities, non-governmental, and government organizations. The Securities segment consists of corporate finance advisory services and capital market solutions for middle market clients. The Physical Commodities segment consists of physical precious metals trading and the physical agricultural and energy commodity businesses. The Clearing and Execution Services segment refers to exchange-traded futures and options, foreign exchange prime brokerage, correspondent clearing, independent wealth management, and derivative voice brokerage. The company was founded by Diego J. Veitia in October 1987 and is headquartered in New York, NY.

Predefined Scans Triggered: Bearish Harami, Bullish MACD Crossovers, P&F Low Pole and Bullish 50/200-day MA Crossovers.

Below are the commentary and chart from Tuesday (9/19):

"SNEX is unchanged in after hours trading. I like the cup shaped low and subsequent breakout above resistance. Today it pulled back toward the breakout point. The RSI is positive and not overbought. The PMO is flattening a bit on today's decline, but it is rising overall and should give us a Crossover BUY Signal soon. Stochastics are rising strongly and the group is beginning to outperform the market. SNEX is already outperforming the market. I've set the stop below support at 6.2% or $88.67."

Here is today's chart:

SNEX survived the reckoning on Thursday. In fact, it saw a nice rally when most tanked. Friday it cooled, but I like the look. The indicators remain strong and positive suggesting we should see more follow-through. Having the EMAs configured positively likely helped this one weather the storm.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Janus Henderson Group plc (JHG)

EARNINGS: 10/26/2023 (BMO)

Janus Henderson Group Plc is a holding company, which engages in the provision of asset management services. It offers investment solutions including equities, quantitative equities, fixed income, multi-asset and alternative asset class strategies. The company was founded on Jan 23, 1998, is headquartered in London, the United Kingdom.

Predefined Scans Triggered: Stocks in an Uptrend (Aroon) and Parabolic SAR Buy Signals.

Below are the commentary and chart from Tuesday (9/19):

"JHG is unchanged in after hours trading. While this isn't a perfect cup-shaped low, it does have the earmarks of a cup with handle pattern. Price briefly broke out today, but settled below the late August top. I am expecting a breakout given the positive indicators and chart pattern. The RSI is positive and not overbought. The PMO surged above the signal line earlier this month. Stochastics are still rising and are in positive territory. Admittedly I don't like Stochastics' pause today, but ultimately they are above net neutral (50). Relative strength studies show the group and the stock are outperforming. The stop is set beneath the 200-day EMA at 5.1% or $26.28."

Here is today's chart:

The thin stop was almost hit on Friday and based on the double top price pattern, I would expect it to trigger on Monday. Price was slashed on Wednesday after it was picked. The chart was ripening and the rally had been strong so I can't point to anything in particular that caused this position to fail. Just a bad pick.

THIS WEEK's Performance:

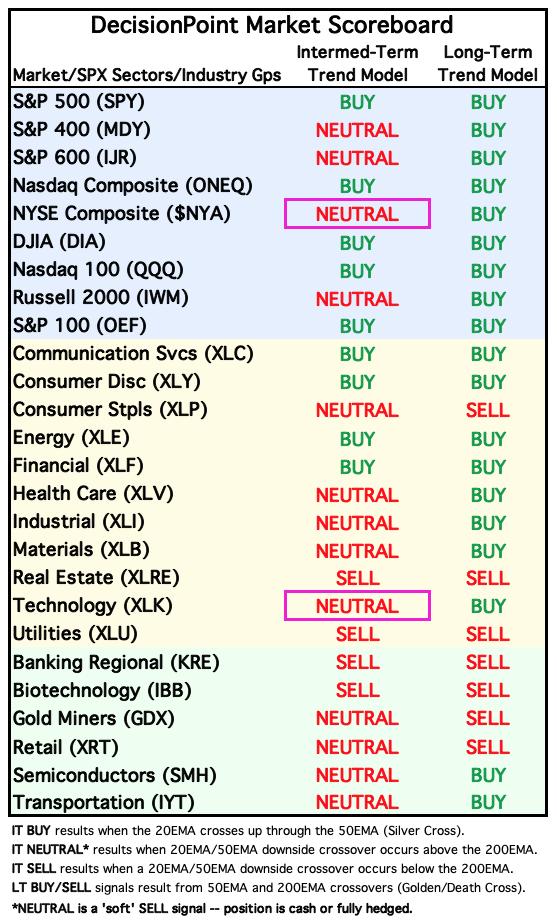

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Consumer Staples (XLP)

There are no bullish sectors out there. All them have problems. Utilities (XLU) still hold a Bullish Bias, but that is deteriorating not improving. I picked Consumer Staples (XLP) only because price is nearing very strong support. It is also a defensive area of the market and may find some favor in the current environment. Overall I wouldn't be looking to enter into any new positions this week until we see some kind of strength under the hood. Right now there is none.

Industry Group to Watch: Health Care Providers ($DJUSHP)

This was a surprisingly bullish chart from a struggling Healthcare sector. There's no denying the new strength that is coming in and the clear cut PMO Crossover BUY Signal. The RSI is positive and Stochastics are above 80 so it is showing internal strength. A few symbols to look at from this group: MOH, UNH and CI.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 40% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com