"Diamonds in the Rough" did outperform the SPY this week, but unfortunately that isn't saying much given they were down on average. Beating the SPY doesn't always mean a positive finish, but we do want to outperform the benchmark nonetheless.

This week's "Dog" was down -3.7% after being picked on Tuesday. Adient (ADNT) was showing new momentum, but that unfortunately reversed this week. This week's "Darling", Renaissance IPO ETF (IPO), was up a mere +0.24% after being picked on Wednesday, but it still looks favorable. ADNT should definitely move off your watch list at this point. We'll discuss below. All other "Diamonds in the Rough" still look bullish enough to hold onto in the short term.

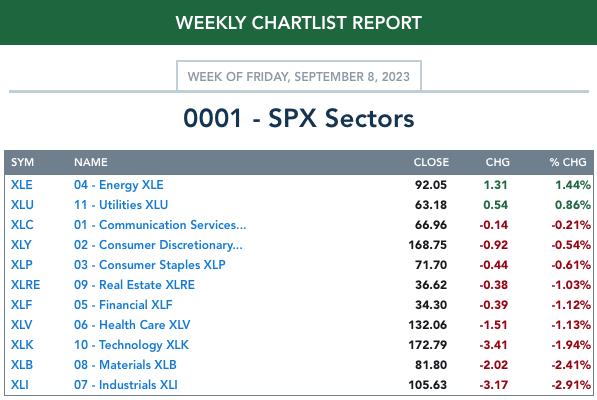

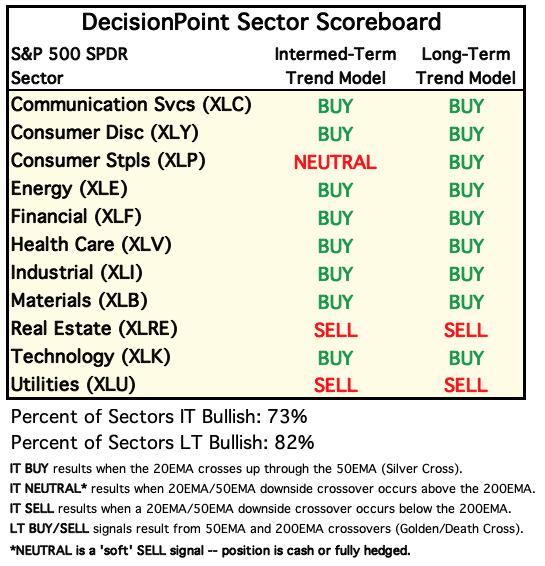

Picking a Sector to Watch this week was very difficult, but ultimately I opted to go with Utilities (XLU). Energy (XLE) is still the place to be with all but Pipelines looking very bullish, but that move has continued and I like to find you new momentum. Just know that XLE is currently the best performer and will likely continue to perform at least another week if not more. Real Estate (XLRE) was the runner-up. I opted not to go with it primarily because the Silver Cross Index turned down below the signal line while XLU's is rising.

Stay defensive and don't make excuses for losing positions. If the chart is getting sour it is best to release it. "Sour" meaning a topping PMO or PMO SELL Signal on tap. Stochastics will also be a good guide to internal strength and whether a decline may turn into something more serious.

Good Luck & Good Trading,

Erin

RECORDING LINK (9/8/2023):

Topic: DecisionPoint Diamond Mine (9/8/2023) LIVE Trading Room

Passcode: Sept#8th

REGISTRATION for 9/15/2023:

When: Sep 15, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (9/15/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

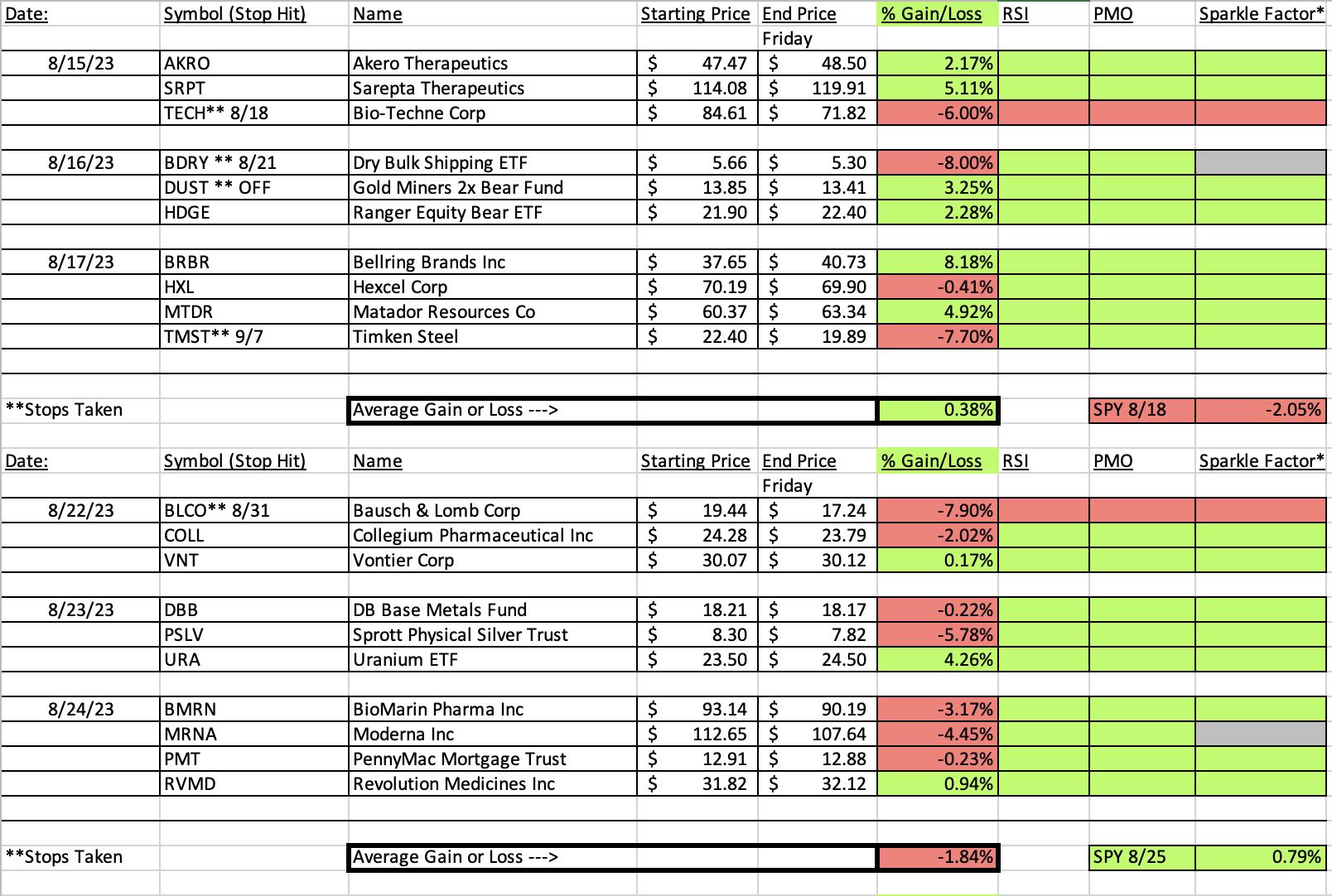

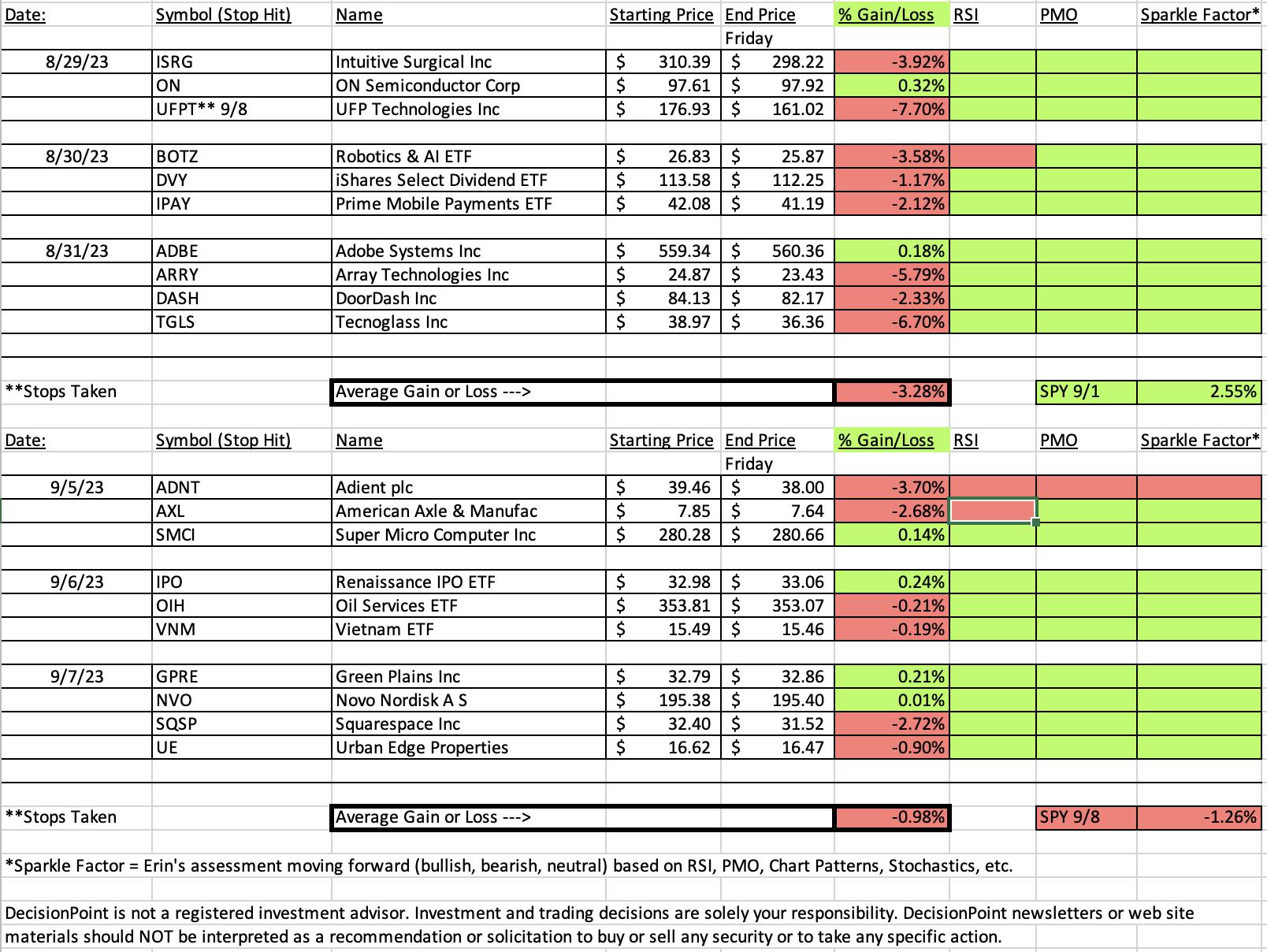

Our latest DecisionPoint Trading Room recording (8/28) - No recording on Labor Day:

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Renaissance IPO ETF (IPO)

EARNINGS: N/A

IPO tracks a market cap-weighted index of recent US-listed IPOs. The fund acquires issues within 90 days or sooner after IPO and sells after 3 years. Click HERE for more information.

Predefined Scans Triggered: P&F High Pole.

Below are the commentary and chart from Wednesday (9/6):

"IPO is down -0.70% in after hours trading. Price is up against overhead resistance and is in the process of consolidating the recent rally out of the bullish double-bottom. The minimum upside target of the double bottom pattern has pretty much been hit, but it is the 'minimum' target so we could see some followthrough. Based on the bullish PMO with its new Crossover BUY Signal, I like its chances. The RSI is positive and Stochastics are oscillating above 80 suggesting internal strength. Relative strength is excellent against the SPY. The stop is set beneath support at 7.2% or $30.60."

Here is today's chart:

It's gotten stuck below resistance, but other than that the bullish bias of the chart remains. The PMO rising tells me that a breakout should occur soon. Even Stochastics remain strongly above 80. There is a "Silver Cross" that is nearing as the 20-day EMA is about to cross above the 50-day EMA. I still like this ETF for entry.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Adient plc (ADNT)

EARNINGS: 11/02/2023 (BMO)

Adient plc manufactures automotive seating systems. It operates through the following geographical segments: Americas, EMEA, and Asia. The company was founded in 1985 and is headquartered in Plymouth, MI.

Predefined Scans Triggered: P&F High Pole

Below are the commentary and chart from Tuesday (9/5):

"ADNT is down -2.66% in after hours trading which does give me pause, but it could offer a better entry if the indicators don't break down. The RSI is negative given today's decline, but a rally will fix that. The PMO is rising toward a Crossover BUY Signal. I noticed a major OBV positive divergence with price leading into the current rally. Stochastics just moved above 80 and relative strength is rising in most cases. I've set the stop at 6.5% or $36.89."

Here is today's chart:

The best I can say is that we were operating on getting new momentum. Price had pulled back when this one was selected, but that pullback turned into more of a correction. Support is nearby, but the indicators have really gone south so I would likely cut this one loose and focus my efforts elsewhere.

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Utilities (XLU)

XLU is not an exciting selection, but it is an area that could see some love if the decline of this week continues. This is a defensive sector alongside Real Estate (XLRE) which was the runner-up. I selected XLU primarily because participation is beginning to expand as far as %Stocks > 20/50/200EMAs. The Silver Cross Index needs some help and given the expansion in participation, it will getting some. Stochastics are rising and the PMO has just turned back up. The RSI is negative and price is below the 20-day EMA, but given the configuration of the PMO, it seemed the best selection today.

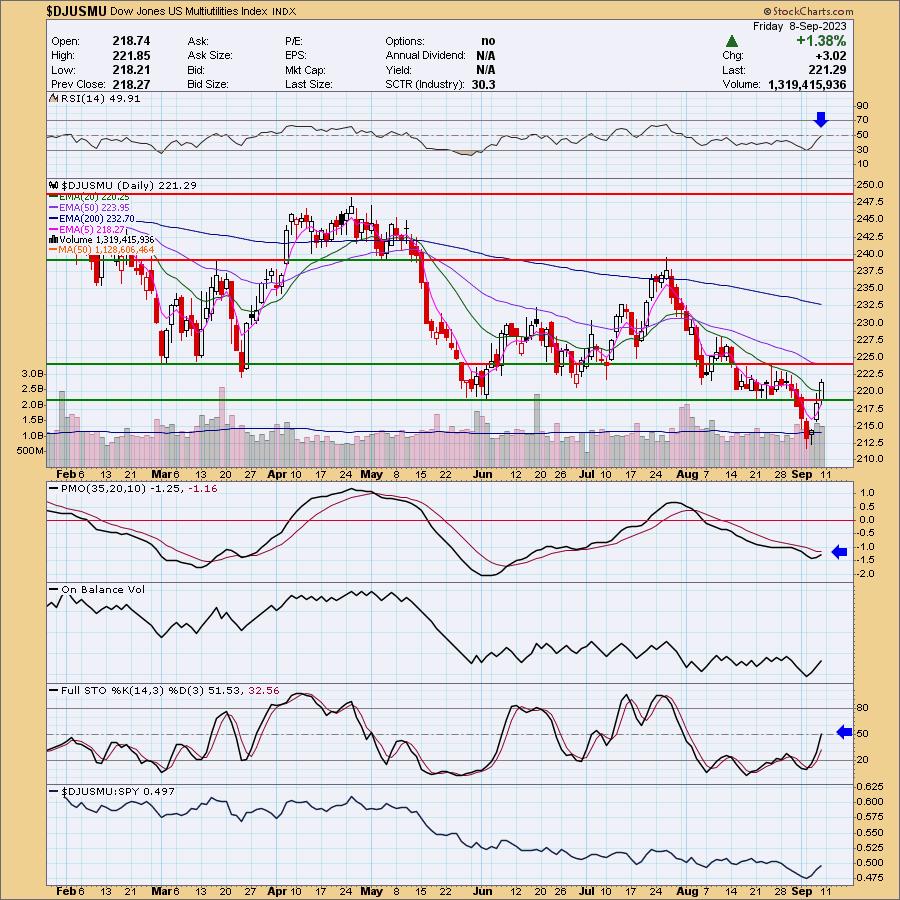

Industry Group to Watch: Multiutilities ($DJUSMU)

This looked like the most promising industry group within Utilities given the newly rising PMO, RSI near positive territory and Stochastics rising. Today's big rally also suggests followthrough ahead. A few stock symbols in this area: NGG, CNP and DUK. The runner-up industry group was Hotel & Lodging REITs had I picked Real Estate as the Sector to Watch. I only saw one symbol I liked from this group: APLE.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 50% long, 0% short. I own ON.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com