I've decided that I will be doing four picks on Tuesdays and then three each for Wednesday and Thursday. Today's four selections are long and short. I'm more bearish than bullish on the market in general. I also noticed that scans dried up somewhat on a rally day. Earnings may goose the market to rally a bit longer, but internals are still extremely weak so I wouldn't count on a rally with staying power. No runners-up today.

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": BRBR, CYTK (Short), MCFT (Short) and SAM.

RECORDING LINK (10/20/2023):

Topic: DecisionPoint Diamond Mine (10/20/2023) LIVE Trading Room

Passcode: October@20

REGISTRATION for 10/27/2023:

When: Oct 27, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (10/27/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Here is the last recording from 10/23:

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Stop levels are all rounded down.

Bellring Brands Inc (BRBR)

EARNINGS: 11/16/2023 (AMC)

BellRing Brands, Inc. is a holding company, which engages in the provision of ready-to-drink (RTD) protein shakes, other RTD beverages, powders, and nutrition bars. It offers products under the brands of Premier Protein and Dymatize, which are distributed across a network of channels including club, food, drug, mass, e-Commerce, specialty, and convenience. The company was founded on March 20, 2019 and is headquartered in St. Louis, MO.

Predefined Scans Triggered: Elder Bar Turned Green, New CCI Buy Signals and P&F Double Top Breakout.

BRBR is down -0.02% in after hours trading. This comes from the "Sector to Watch" last Friday. This looks like a bullish flag formation that is being confirmed with the recent breakout. The PMO is surging above the signal line (bottomed above the signal line) and Stochastics have tipped upward. The RSI is positive, rising and is not overbought. Relative strength lines are all angling higher. I've set the stop at the 50-day EMA around 7.2% or $41.29.

The weekly chart shows a winner that should keep on winning. The weekly RSI is overbought which could become a problem soon, but the weekly PMO is accelerating higher implying we should see price rise further. The StockCharts Technical Rank (SCTR) is at the top of the hot zone* above 70. Consider a 17% upside target around $52.06.

*If a stock is in the "hot zone" above 70, it implies that it is stronger than 70% of its universe (large-, mid-, small-caps and ETFs) primarily in the intermediate to long terms.

Cytokinetics Inc. (CYTK)

EARNINGS: 11/02/2023 (AMC)

Cytokinetics, Inc. is a biopharmaceutical company, which is focused on discovering, developing, and commercializing muscle activators and muscle inhibitors as potential treatments for people with debilitating diseases in which muscle performance is compromised and/or declining. The firm is developing small molecule drug candidates specifically engineered to impact muscle function and contractility. Its clinical-stage drug candidates include omecamtiv mecarbil, a novel cardiac myosin activator, CK-136, a novel cardiac troponin activator, reldesemtiv, a novel fast skeletal muscle troponin activator, aficamten, a novel cardiac myosin inhibitor, and CK-3772271, a novel cardiac myosin inhibitor. The company was founded by Ronald D. Vale, Lawrence S. B. Goldstein, James H. Sabry, and James A. Spudich in 1997 and is headquartered in South San Francisco, CA.

Predefined Scans Triggered: P&F Double Bottom Breakdown and Parabolic SAR Sell Signals.

CYTK is unchanged in after hours trading. It is losing support at the June low, but does have some support it could cling to around $30.50. Given the PMO is just now turning over and the RSI is now in negative territory, I do believe it will break down there. Stochastics are flashing internal weakness and relative strength is failing across the board. I forgot to mention the bearish double top that was confirmed with yesterday's breakdown. The stop is set upward since it is a short at 7% or $34.09.

CYTK has been in a declining trend since the 2022 top. It doesn't look like it will end yet. The weekly RSI is negative and the weekly PMO is topping beneath the signal line. The SCTR is falling and is below even a 50% bullish threshold. I see a possible 20%+ decline for CYTK.

MCBC Holdings, Inc. (MCFT)

EARNINGS: 11/08/2023 (BMO)

Mastercraft Boat Holdings, Inc. engages in the designing, manufacturing, and selling of boats. It operates through the following segments: MasterCraft, Crest, NauticStar, and Aviara. The MasterCraft segment offers recreational performance boats used for water skiing, wakeboarding, and wake surfing activities and general recreational boating under product brands, such as MasterCraft. The Crest segment produces pontoon boats at its Owosso, Michigan facility, which are used for general recreational boating. The NauticStar segment produces boats at its Amory, Mississippi facility, which are used for saltwater fishing and general recreational boating. The Aviara segment consists of the Aviara brand which manufactures luxury day boats. The company was founded in 1968 and is headquartered in Vonore, TN.

Predefined Scans Triggered: New CCI Sell Signals and Parabolic SAR Sell Signals.

MCFT is unchanged in after hours trading. Price topped at overhead gap resistance. The RSI is in negative territory and the PMO has topped well below the zero line. The OBV is in a declining trend. Stochastics are falling after once again failing to get above 80. Relative strength for the group is failing so even though MCFT is a leader against the group, it isn't translating in much outperformance against the SPY which is good for a short. The upside stop is set at 7.7% or $23.15.

The weekly chart suggests that MCFT could find support around $17.50, but that is over 14% away. The weekly RSI is falling in negative territory and the weekly PMO is in decline below the zero line. The SCTR is falling well below the hot zone.

Boston Beer Co. Cl A (SAM)

EARNINGS: 10/26/2023 (AMC) ** Reports on Thursday **

Boston Beer Co., Inc. engages in the production of alcoholic beverages. Its brands include Truly Hard Seltzer, Twisted Tea, Samuel Adams, Angry Orchard, Hard Cider and Dogfish Head Craft Brewery. Boston Beer produces alcohol beverages, including hard seltzer, malt beverages ("beers"), and hard cider at company-owned breweries and its cidery, and under contract arrangements at other brewery locations. The company was founded by C. James Koch in 1984 and is headquartered in Boston, MA.

Predefined Scans Triggered: Filled Black Candles and P&F Double Top Breakout.

SAM is unchanged in after hours trading. It is currently up against resistance and today we did see a bearish filled black candlestick. I picked the chart based on the nearing PMO BUY Signal and positive RSI. It is also in the Consumer Staples sector which I do favor right now. The RSI is positive and gently rising. Stochastics are rising and should move above 80 tomorrow barring a big decline. Relative strength is excellent suggesting we should see more outperformance from SAM. The stop is set at the 200-day EMA at 6.4% or $351.78.

It has been range bound and I don't think it is going to leave that range so our upside potential is limited to about 15%. The weekly RSI is positive and the weekly PMO is on a Crossover BUY Signal. It has flattened, but this looks fairly positive given it is back above the zero line. The SCTR is in the hot zone.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

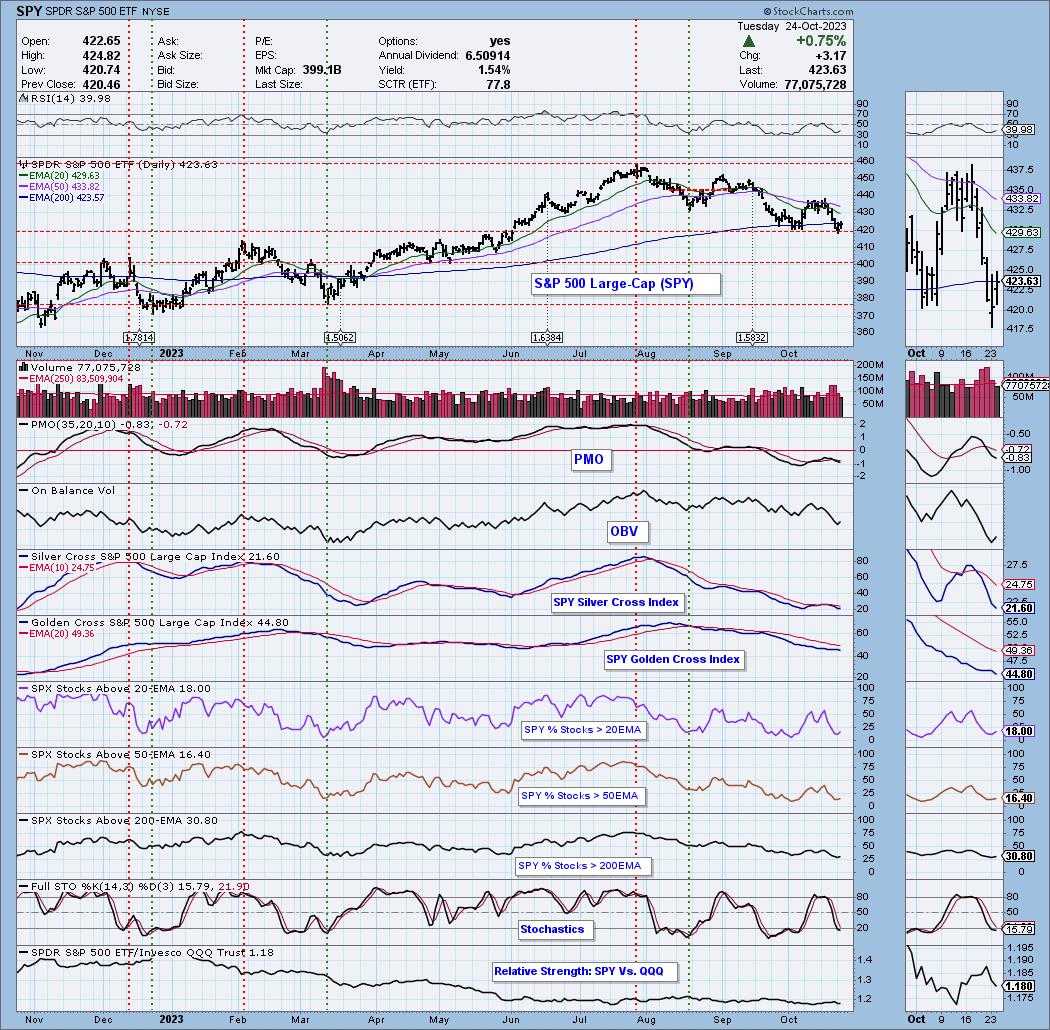

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 20% long, 6% short.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Watch the latest episode of DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com