The market's decline hit "Diamonds in the Rough" hard this week as it made its way lower. It wasn't a bad week for the SPY, but our positions could've done better. One thing you'll notice is that despite many charts beginning to break down, I've still got seven positions with bullish Sparkle Factors, meaning I see merit in them moving forward.

Right now based on my indicators, I'm expecting this decline to hit bottom next week with a rally to follow. Many of the positions are pulling back to support levels where a bounce could be had. Basically, if you aren't in right now, next week should offer some entries, just keep stops in play in case IT indicators aren't right and the decline continues throughout next week.

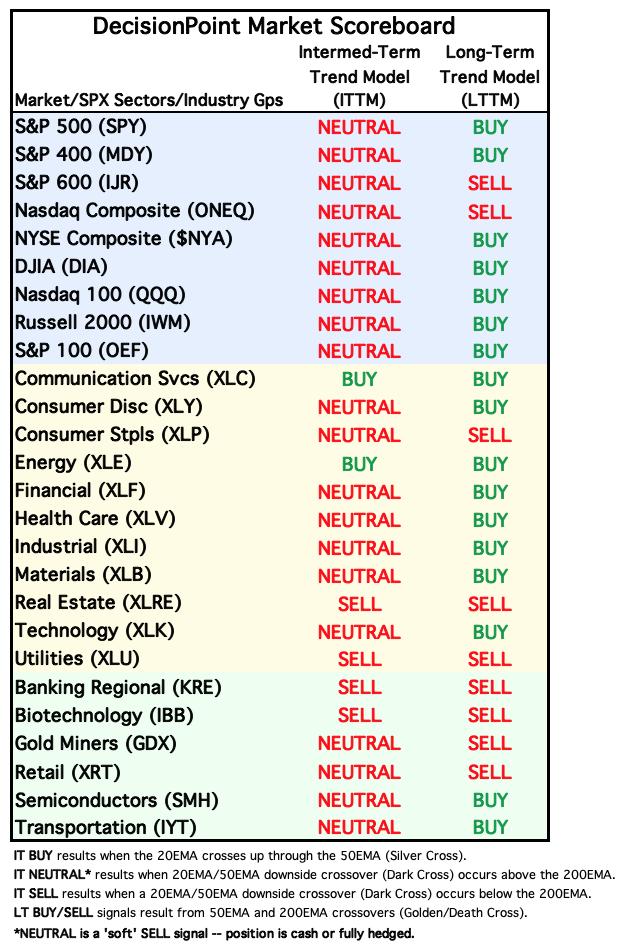

I changed the Sector to Watch from Financials (XLF) to Utilities (XLU) after reviewing participation. XLF was up on the day but participation shrunk which spooked me on this Friday the 13th. I opted to go with Utilities (XLU) which have been coming back to life. It is a defensive sector and hence may do alright even if the market continues to slide. I found that Multiutilities looked the most bullish, but all industry groups within XLU look good with the exception of Water.

Have a great weekend!

Good Luck & Good Trading,

Erin

RECORDING LINK (10/13/2023):

Topic: DecisionPoint Diamond Mine (10/13/2023) LIVE Trading Room

Passcode: October@13th

REGISTRATION for 10/20/2023:

When: Oct 20, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (10/20/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

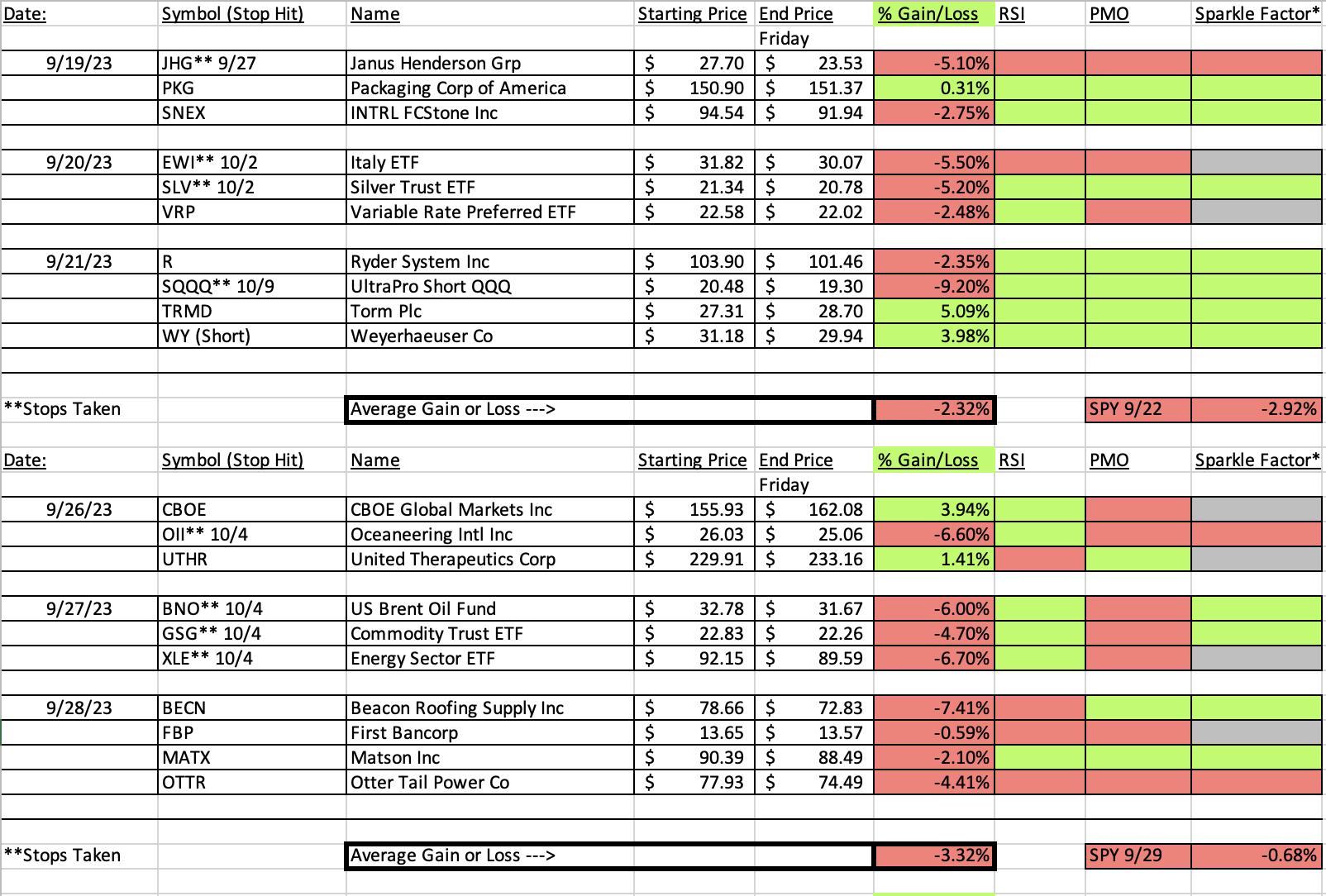

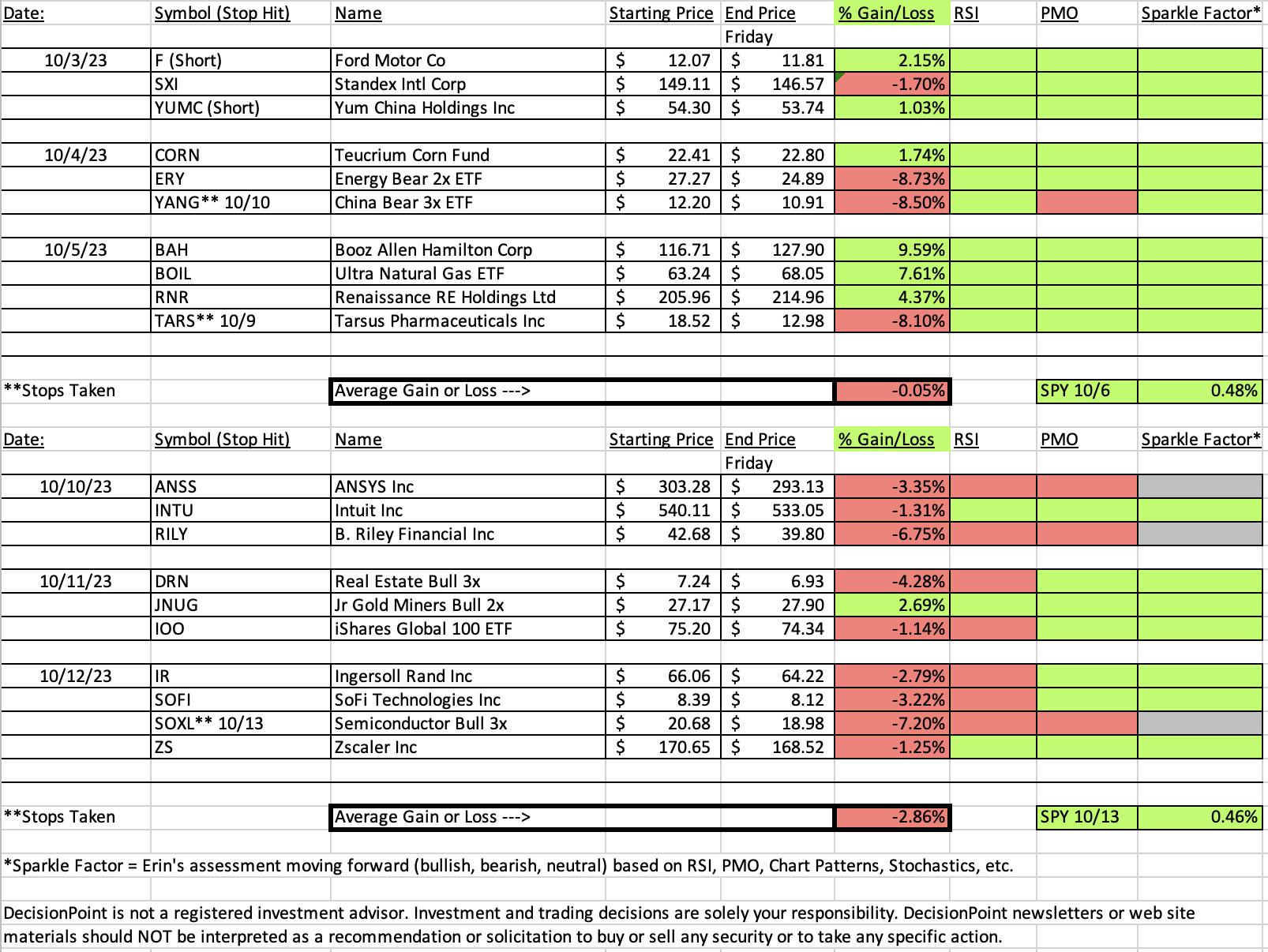

Our latest DecisionPoint Trading Room recording (10/9):

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Direxion Daily Junior Gold Miners Index Bull 2x Shares (JNUG)

EARNINGS: N/A

JNUG provides daily 2x exposure to an index of junior gold and silver mining companies from developed as well as emerging markets. Click HERE for more information.

Predefined Scans Triggered: None.

Below are the commentary and chart from 10/11:

"JNUG is up +0.04% in after hours trading. Before we look at JNUG, let's look "under the hood" at Gold Miners (GDX) in general. It's not junior miners, but it gives us insight nonetheless. GDX shows excellent participation right now. We do need to be careful as participation reached these levels right before the last two reversals. I suspect we will reach overbought conditions and those conditions will persist as in March/April. Relative performance is rising alongside a new PMO Crossover BUY Signal."

Here is today's chart:

I like Gold Miners in general so this was a fairly easy pick, one that I am not surprised turned out to be this week's "Darling". It is leveraged so be careful with it as it has hit overhead resistance, but given the new PMO Crossover BUY Signal and newly positive RSI, I think it has more upside to go particularly given Gold is on a roll.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

B. Riley Financial, Inc. (RILY)

EARNINGS: 11/09/2023 (AMC)

B. Riley Financial, Inc. engages in the provision of financial services and solutions to the capital raising and financial advisory needs of public and private firms. It operates through the following segments: Capital Markets, Wealth Management, Financial Consulting, Auction and Liquidation, Communications, and Consumer. The Capital Markets segment provides investment banking, corporate finance, research, wealth management, and sales and trading services to corporate, institutional, and high net worth clients. The Wealth Management segment offers retail brokerage, investment management, and insurance, and tax preparation services. The Financial Consulting segment focuses on a variety of specialized advisory services spanning bankruptcy, restructuring, turnaround management, forensic accounting, crisis and litigation support, appraisal and valuation, real estate, and operations management. The Auction and Liquidation segment deals with retail liquidation services. The Communications segment is composed of a portfolio of companies acquired for attractive risk-adjusted investment return characteristics. The Consumer segment includes Targus and the Brands investment portfolio. The company was founded in 1973 and is headquartered in Los Angeles, CA.

Predefined Scans Triggered: Ichimoku Cloud Turned Red.

Below are the commentary and chart from 10/10:

"RILY is unchanged in after hours trading. This one is barely ripe so tread carefully. The intermediate-term declining trend is still there, I prefer breakouts, but the technicals are positive. The RSI isn't above 50, but it is very near and is rising. The PMO hasn't quite given us a Crossover BUY Signal, but it is close. Stochastics are rising and are in positive territory. Relative strength is improving across the board. I also like that the 50-day EMA is above the 200-day EMA and that price has gotten back above both the 20/200-day EMAs. Setting the stop was somewhat arbitrary given there isn't a real support level nearby. I opted to set it around last month's low at 7.2% or $39.60."

Here is today's chart:

The stop survived by the end of the day, but it is likely to trigger next week if the decline continues on Monday as I suspect it might. However, I see this as a good place for a bounce. Stochastics aren't great but overall the chart isn't that terrible. This is watch list material or if you are in it, it's a possible hold until we see what happens at support.

THIS WEEK's Performance:

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Utilities (XLU)

XLU had a great rally today as we see investors slowly moving back into this defensive sector. Staples (XLP) hasn't come back to life yet, but beatdown Utilities have. The Silver Cross Index is very oversold (nowhere to go but up as they say). I like the expansion in stocks above their 20-day EMA. It's a start. Stochastics are rising and relative strength has picked up. It was an obvious choice today when you looked under the hood.

Industry Group to Watch: Multiutilities ($DJUSMU)

Price got above overhead resistance at the September low and while there is more resistance ahead, the PMO just triggered a new Crossover BUY Signal. The RSI is rising out of negative territory. Stochastics are rising in positive territory and relative strength is rising against the SPY. I think it will reenter the trading range between 220 and 240 and possibly make it back up to the top of that range.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 50% long, 2% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com