I had great intentions to do four picks for you yesterday and then three on Wednesday/Thursday. However, my back had other plans and prevented me from pulling off a report yesterday. Instead I will be doing five picks today and five picks tomorrow. Remember there will be no Diamonds Recap or Diamond Mine trading room on Friday.

I have a couple of 'winners that keep on winning' selections today as well as an early reversal candidate. I opted to include Chevron (CVX) which doesn't have the best chart, but I believe Crude Oil is going to reverse higher and this one has good upside potential and relative strength against its group.

Auto parts was the "Industry Group to Watch" on Friday and I've included one of the stocks we picked out in the trading room.

It wasn't that easy to pick today as the scans produced a relatively small amount of results. The main theme was Energy so an upside reversal may be in the works on this beaten down sector.

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": AFL, CEIX, COR, CVX and MPAA.

Other requests: MTDR, AIZ, BRBR, AZO, NEM and VYX.

RECORDING LINK (11/17/2023):

Topic: DecisionPoint Diamond Mine (11/17/2023) LIVE Trading Room

Passcode: November#17

REGISTRATION for 12/1/2023:

When: Dec 1, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (12/1/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Here is the last recording from 11/13 (no recording for 11/20):

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Stop levels are all rounded down.

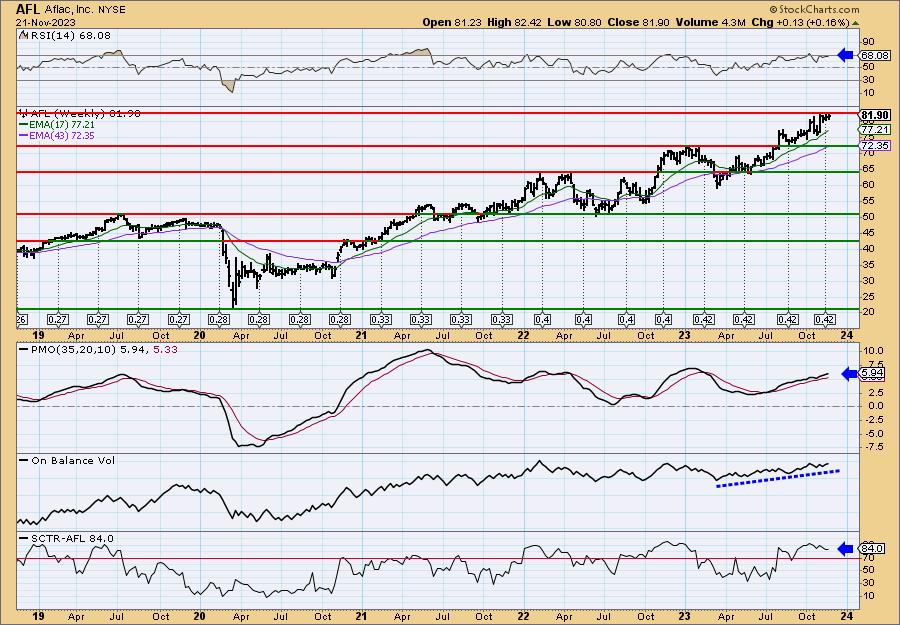

Aflac, Inc. (AFL)

EARNINGS: 01/31/2024 (AMC)

Aflac, Inc. is a holding company, which engages in the provision of financial protection services. It operates through the following segments: Aflac Japan and Aflac U.S. The Aflac Japan segment offers life insurance, death benefits, and cash surrender values. The Aflac U.S. segment sells voluntary supplemental insurance products for people who already have major medical or primary insurance coverage. The company was founded by John Amos, Paul Amos and William Amos on November 17, 1955 and is headquartered in Columbus, GA.

Predefined Scans Triggered: Elder Bar Turned Green, New 52-week Highs, Stocks in a New Uptrend (Aroon), P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

AFL is down -0.12% in after hours trading. I see a bullish ascending triangle (flat top, rising bottoms) that implies a breakout ahead. The RSI is positive. It isn't easy to see, but the PMO has surged twice above the signal line. Stochastics are above 80 and rising. The group is performing mostly in line with the SPY and AFL is staying in line with the SPY right now. It tends to have a leadership role within the group. If the group gets going again it would be smooth sailing for AFL. The stop is set beneath support at 5.8% or $77.14.

The weekly chart also implies a breakout ahead too. The weekly RSI is positive and not yet overbought. The weekly PMO is rising after an earlier surge above the signal line. The OBV is confirming the rally and the StockCharts Technical Rank (SCTR) is in the hot zone* above 70. Consider a 17% upside target to around $95.82.

*If a stock is in the "hot zone" above 70, it implies that it is stronger than 70% of its universe (large-, mid-, small-caps and ETFs) primarily in the intermediate to long terms.

CONSOL Energy Inc. (CEIX)

EARNINGS: 02/06/2024 (BMO)

CONSOL Energy, Inc. engages in the production of bituminous coal which focuses on the extraction and preparation of coal in the Appalachian Basin. It operates under the Pennsylvania Mining Complex (PAMC) and CONSOL Marine Terminal. The PAMC segment includes mining, preparation, and marketing of bituminous coal sold to power generators, and industrial and metallurgical end-users. The CONSOL Marine Terminal segment is involved in the provision of coal export terminal services. The company was founded in 1864 and is headquartered in Canonsburg, PA.

Predefined Scans Triggered: P&F Double Top Breakout and Shooting Star.

CEIX is down -0.98% in after hours trading. Price is rallying off a bullish double bottom chart pattern. It implies a test of overhead resistance at the October high. The RSI is positive and not overbought. The PMO is nearing a Crossover BUY Signal. Stochastics are now above 80. Relative strength is improving across the board. I've set the stop between the 50-day EMA and support around 7% or $94.25.

While I do see a large bull flag on the weekly chart, the weekly PMO is nearing a Crossover SELL Signal. The rest of the chart is favorable with the weekly RSI in positive territory and a SCTR in the hot zone. Upside target of about 17% would put price at $118.58.

Cencora Inc. (COR)

EARNINGS: 01/31/2024 (BMO)

Cencora, Inc. engages in the provision of pharmaceutical products and business solutions that improve access to care. It operates through the Pharmaceutical Distribution Services and Other segments. The Pharmaceutical Distribution Services segment distributes an offering of brand-name, specialty brand-name and generic pharmaceuticals, over-the-counter healthcare products, home healthcare supplies and equipment, and related services to healthcare providers, including acute care hospitals and health systems, independent and chain retail pharmacies, mail order pharmacies, medical clinics, and long-term care and alternate site pharmacies. The Other segment focuses on global commercialization services and animal health, and includes AmerisourceBergen Consulting Services ABCS, World Courier, and MWI. The company was founded by in Emil P. Martini in 1947 and is headquartered in Conshohocken, PA.

Predefined Scans Triggered: Elder Bar Turned Green and Stocks in a New Uptrend (Aroon).

COR is unchanged in after hours trading. It has been taking its time consolidating the big rally from the beginning of the month, but I think it is ready to breakout. We have what could be a breakaway gap. The RSI is positive, rising and not overbought. The PMO has surged above the signal line and Stochastics are above 80 now. Relative strength could be better. The group is performing in line with the SPY now. COR is beginning to outperform. In the longer term it has been an outperforming stock. Currently COR is performing in line with the group. The stop is set between the 50/200-day EMAs at 7.1% or $184.71.

I like the weekly chart. This period of consolidation is occurring above support. The weekly RSI is positive and the weekly PMO is on a rather new Crossover BUY Signal. The SCTR is in the hot zone. Consider an upside target of about 17% up to $232.63.

Chevron Corp. (CVX)

EARNINGS: 01/26/2024 (BMO)

Chevron Corp. engages in the provision of administrative, financial management, and technology support for energy and chemical operations. It operates through the Upstream and Downstream segments. The Upstream segment consists of the exploration, development, and production of crude oil and natural gas, the liquefaction, transportation, and regasification associated with liquefied natural gas, the transporting of crude oil by major international oil export pipelines, the processing, transporting, storage, and marketing of natural gas, and a gas-to-liquids plant. The Downstream segment consists of the refining of crude oil into petroleum products, the marketing of crude oil and refined products, the transporting of crude oil and refined products by pipeline, marine vessel, motor equipment, and rail car, and the manufacturing and marketing of commodity petrochemicals and plastics for industrial uses and fuel & lubricant additives. The company was founded in 1906 and is headquartered in San Ramon, CA.

Predefined Scans Triggered: P&F Double Bottom Breakdown and Hollow Red Candles.

CVX is unchanged in after hours trading. This is an ode to my scan results which pinpointed Energy as a place to consider. The chart is only now developing and it is still early so this one carries some risk. I didn't annotate it, but I see a possible reverse head and shoulders pattern which is bullish. Today candlestick was a bullish hollow red candle. The PMO just triggered a Crossover BUY Signal. Stochastics just moved into positive territory. The group hasn't really awakened yet, but when it does, CVX is typically a leader within the group and should do very well. The stop is set arbitrarily at 5.8% or $135.68.

Price hasn't quite overcome overhead resistance on the weekly chart. The rest of the chart is quite negative. Remember this is a reversal candidate so the weekly chart should look terrible and this one does. The weekly RSI is negative and the weekly PMO is declining in negative territory. The SCTR is in the basement. If we do get the breakout on a better Crude Oil trade, I would look for price to get to resistance for an 18% gain.

Motorcar Parts of America Inc. (MPAA)

EARNINGS: 02/08/2024 (BMO)

Motorcar Parts of America, Inc. engages in the manufacture, remanufacture, and distribution of automotive parts. It operates through the following segments: Hard Parts, Test Solutions and Diagnostic Equipment, and Heavy Duty. The Hard Parts segment is composed of light duty rotating electric products such as alternators and starters, wheel hub products, and brake-related products. The Test Solutions and Diagnostic Equipment segment represents bench top testers for alternators and starters, test solutions and diagnostic equipment for the pre- and post-production of electric vehicles, and software emulation of power systems applications for the electrification of all forms of transportation. The Heavy Duty segment deals with non-discretionary automotive aftermarket replacement hard parts for heavy-duty truck, industrial, marine, and agricultural applications. The company was founded by Mel Marks in 1968 and is headquartered in Torrance, CA.

Predefined Scans Triggered: Elder Bar Turned Blue.

MPAA is unchanged in after hours trading. I expect it is ready for a pullback so you may want to wait until that finishes. This is good as it will take the RSI out of overbought territory. This one did not come up in a scan, it is from Friday's Diamond Mine trading room. The rally is consistent and steady, it just needs to cool. The PMO is rising and Stochastics are above 80. Relative strength is in line for the group, but for MPAA, it is rising strongly against the group and the SPY. The stop is deep because I do think it will pull back first so I don't want the stop to be prematurely triggered. I've set it at 8.2% or $8.84.

MPAA is up against some strong overhead resistance so it isn't surprising that it is stumbling right now. Still price did trade above resistance this week. The weekly RSI is positive and not overbought. The weekly PMO has surged above the signal line. The SCTR is excellent at over 95%.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

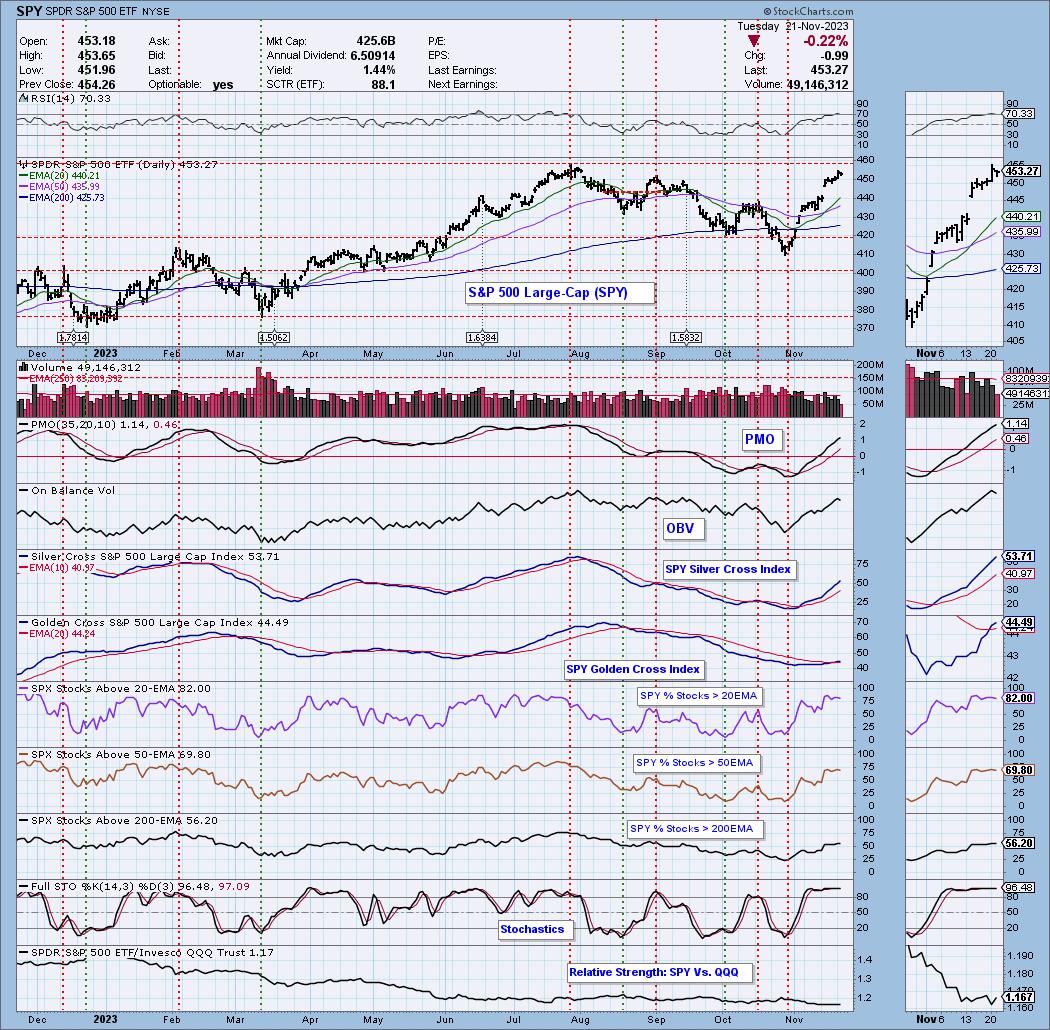

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 70% long, 0% short.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Watch the latest episode of DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com