I only received four reader requests today. All four of them could've been presented, but I only do three so I had to decide which stock to leave out. It was a difficult decision so I would say that the fourth symbol is worth your time for a look.

The symbol I'm not covering is Key Bank (KEY). It is set up well, I opted not to present it because the PMO had been rising for some time and was in overbought territory. Still, I do see more upside for KEY moving forward.

Tomorrow is the Diamond Mine trading room, so be sure to register below. Remember that recording links are published in every report so you don't have to be present.

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": CAKE, CPB and U.

Runner-up: KEY

RECORDING LINK (12/1/2023):

Topic: DecisionPoint Diamond Mine (12/1/2023) LIVE Trading Room

Passcode: December#1

REGISTRATION for 12/8/2023:

When: Dec 8, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (12/8/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Here is the last recording from 12/4:

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Stop levels are all rounded down.

Cheesecake Factory Inc. (CAKE)

EARNINGS: 02/21/2024 (AMC)

Cheesecake Factory, Inc. engages in the operation of restaurant chains. It operates through The Cheesecake Factory, North Italia, Other FRC and Other segments. The Cheesecake Factory segment offers appetizers, pizza, seafood, steaks, chicken, burgers, small plates, pastas, salads, sandwiches and omelettes, and a selection of gluten-free items. The North Italia segment specializes in Italian cuisine. The Other FRC segment includes brands acquired from Fox Restaurant Concepts. The Other segment consists of the Flower Child brand, along with other businesses. The company was founded by David M. Overton, Oscar Overton and Evelyn Overton in 1972 and is headquartered in Calabasas Hills, CA.

Predefined Scans Triggered: New CCI Buy Signals and Stocks in a New Uptrend (ADX).

CAKE is unchanged in after hours trading. I saw a large bullish cup with handle pattern. Price confirmed the pattern with this week's breakout. The RSI is positive and the PMO surged twice above the signal line. Stochastics reversed in positive territory and is headed toward 80. The group hasn't been outperforming, but it is staying in line with the SPY. CAKE is showing great relative strength against the group and consequently the SPY. The stop is set below the 50-day EMA at 7% or $31.44.

The weekly chart looks great and suggests this one could be held into the intermediate term. Price bounced off strong support and is headed to the top of its recent trading range. If it can reach the upper bound, it would be an over 19% gain. The weekly PMO is on a relatively new Crossover BUY Signal. The StockCharts Technical Rank (SCTR) has just reentered the hot zone* above 70.

*If a stock is in the "hot zone" above 70, it implies that it is stronger than 70% of its universe (large-, mid-, small-caps and ETFs) primarily in the intermediate to long terms.

Campbell Soup Co. (CPB)

EARNINGS: 12/06/2023 (BMO) ** Reported Yesterday **

Campbell Soup Co. engages in the business of manufacturing and marketing food and beverage products. It operates under the Meals and Beverages, and Snacks segments. The Meals and Beverages segment includes soup, meals, and beverage products in retail and foodservice. The Snacks segment offers cookies, crackers, bakery, and frozen products. The company was founded by Joseph Campbell and Abraham Anderson in1869 and is headquartered in Camden, NJ.

Predefined Scans Triggered: None.

CPB is down -1.01% in after hours trading. After popping on earnings, it appears price is ready to pullback a bit. That should get you a better entry. Good earnings usually mean follow-through. The RSI is positive. The PMO is charging higher on the rally and isn't overbought. Stochastics are in positive territory. They did pause, but are still rising. Relative strength studies are bullish. The stop is set below the 50-day EMA at 6.1% or $40.79.

The weekly chart is very bullish. We have a weekly RSI that just entered positive territory and the weekly PMO is crossing over its signal line for a BUY signal. The SCTR is not yet in the hot zone, but is rising vertically. I've marked upside potential to about 14.5%, but if it does breakout there, you could hold it further.

Unity Software Inc. (U)

EARNINGS: 02/21/2024 (AMC)

Unity Software, Inc. engages in the developing video gaming software. It also provides software solutions to create, run and monetize interactive, real-time two-dimensional and three-dimensional content for mobile phones, tablets, consoles, and augmented and virtual reality devices. Its platform is used by developers, artists, and designers to build content for gaming, film, retail, automotive, architecture, engineering, and construction industries. The company was founded by Joachim Ante and David Helgason in 2004 and is headquartered in San Francisco, CA.

Predefined Scans Triggered: P&F Double Top Breakout and P&F Bearish Signal Reversal.

U is up +0.03% in after hours trading. We have a nice cup shaped basing pattern that has developed. There is a new Silver Cross BUY Signal as the 20-day EMA just crossed above the 50-day EMA. Price is up against resistance so it may take a bit more time to break out. The RSI is positive and not overbought. The PMO is rising above the zero line and isn't overbought. Stochastics are a bit of a problem on this small pullback on resistance, but we can give it some time for now. Just be careful. The Software group has cooled its performance, but overall is staying in line with the SPY after outperforming in a big way. U is showing leadership against the group and is outperforming the SPY. The stop is set at the 50-day EMA at 7.1% or $29.63.

The weekly chart is coming together. The weekly RSI while not positive, is very close to net neutral (50). The weekly PMO is rising toward a Crossover BUY Signal. The SCTR is rising but is not in the hot zone, so keep this one in the short term.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

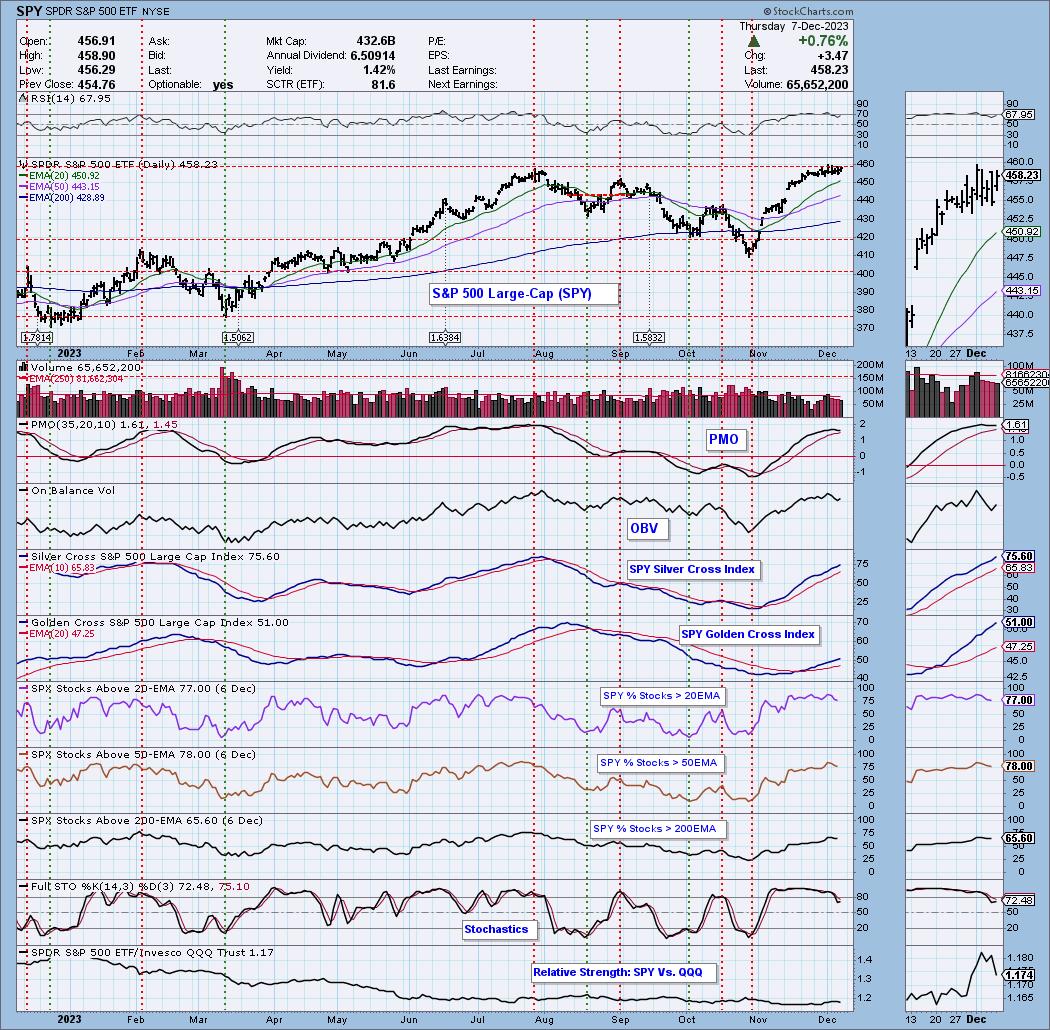

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 65% long, 2% short.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Watch the latest episode of DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com