It was a shaky week for "Diamonds in the Rough" and to me it exemplifies what is wrong with the market right now. We have strong leadership from mega-caps, but less than stellar performances by the broad market as a whole.

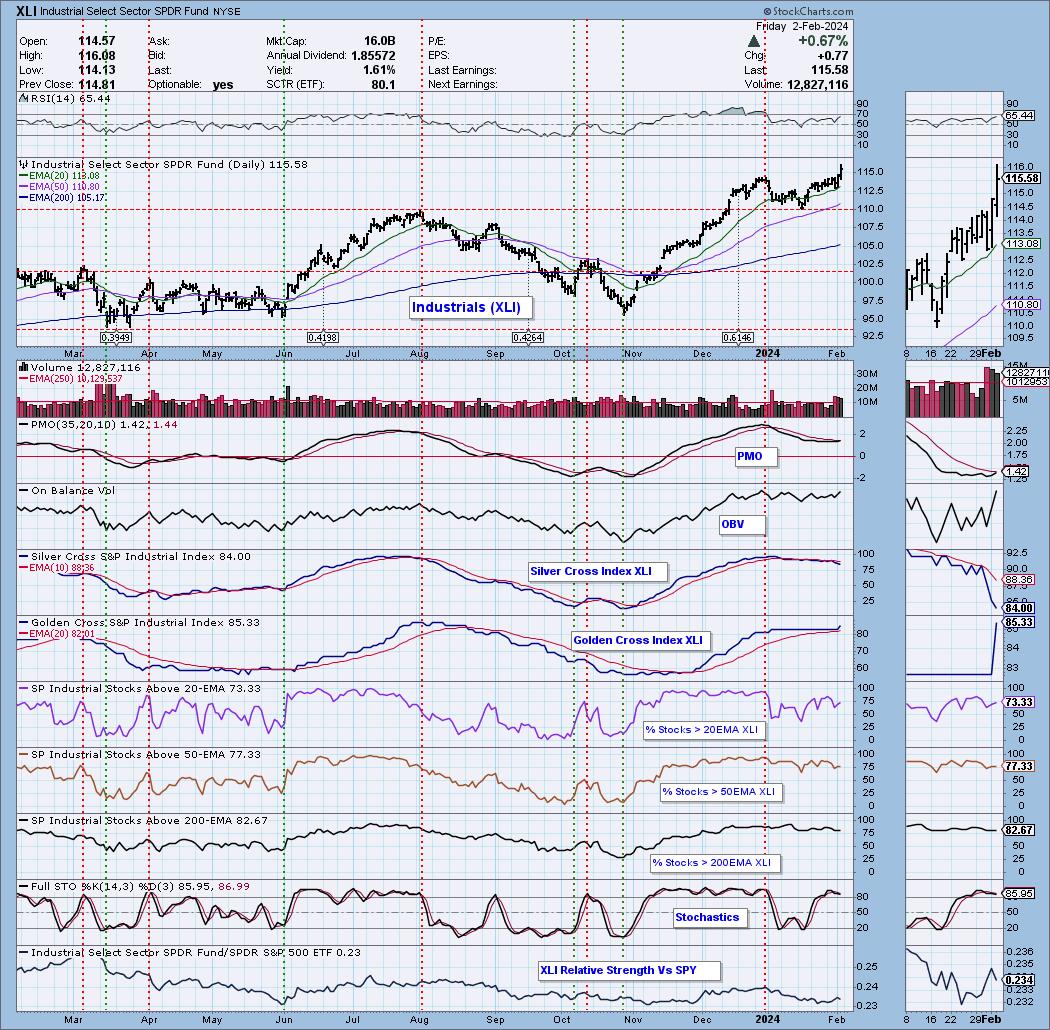

While I was feeling good about picking the Technology sector as our Sector to Watch, after pondering the choice and observing the other sectors into the close, I've changed my mind and am moving to Industrials (XLI). I could easily have picked Consumer Discretionary (XLY) as well. I feel less certain about earnings moving forward after watching data from the news channels so I don't want to go all in on Technology (XLK) this week.

Since I went with a different sector I decided to find an Industry Group to Watch from that sector. Building Materials looked excellent and offer quite a few selections within including one that I picked from Diamonds scans at the end of the program. BLDR, KNF and VMC.

I do want to share the symbols we 'mined' from the two industry groups that I thought I would pick within Technology. In Electrical Components & Equipment I found Jabil (JBL) which looks very good moving forward. It even came through on one of the Diamond scans I ran at the end of the program. The other Industry Group was Software. I found the following symbols that looked attractive within: NOW, CDNS, S and INFA.

The Diamond scans turned up quite a few selections that you may want to put on a watch list for next week: CPRT, BOOT, ROST, PLAY and DCI.

Have a great weekend!

Good Luck & Good Trading,

Erin

RECORDING & DOWNLOAD LINK (2/2/2024):

Topic: DecisionPoint Diamond Mine (2/2/2024) LIVE Trading Room

Recording & Download Link HERE.

Passcode: February#2

REGISTRATION for 2/9/2024:

When: Feb 9, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (2/9/2024) LIVE Trading Room

Register in advance for this webinar HERE.

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscriber HERE.

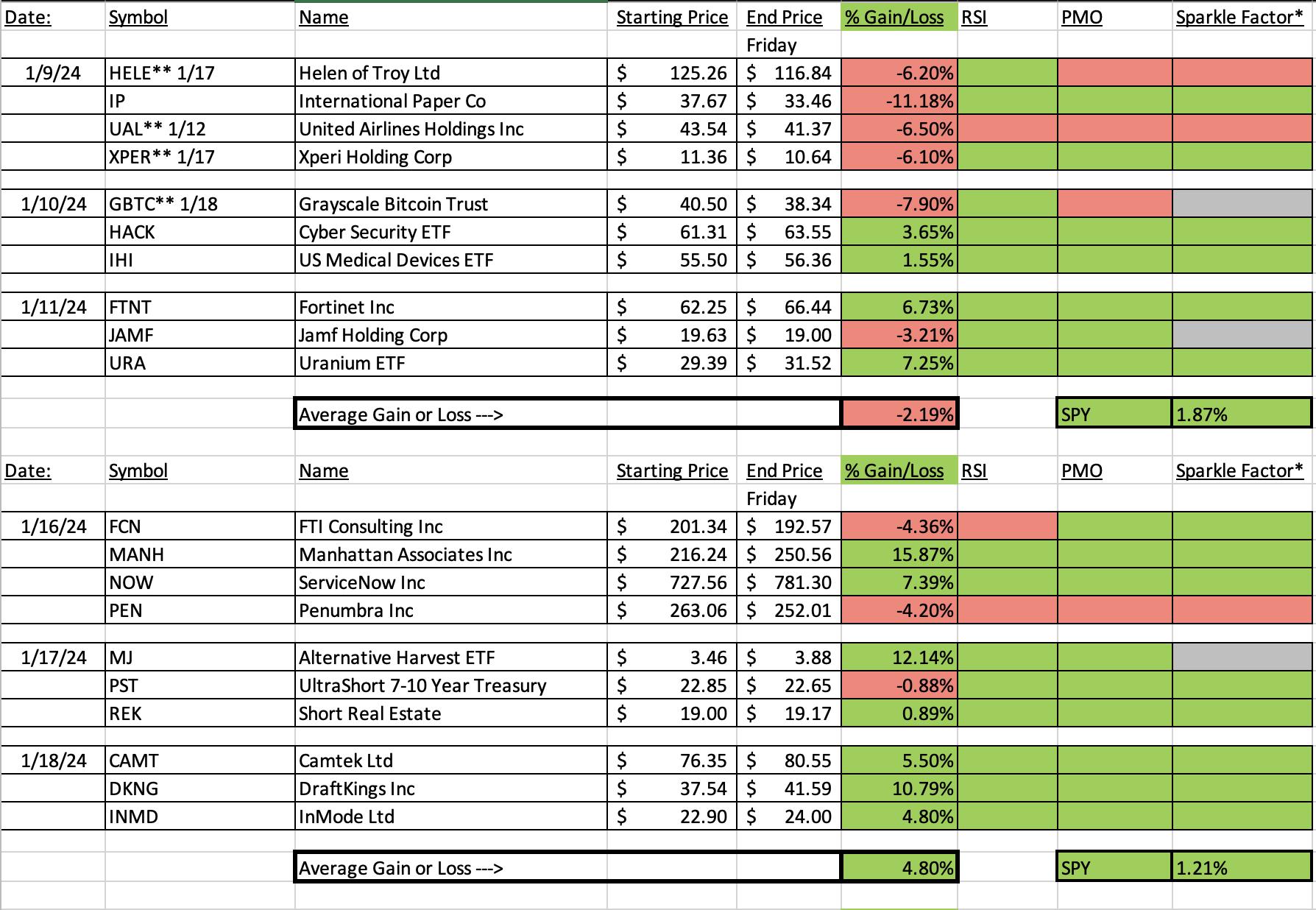

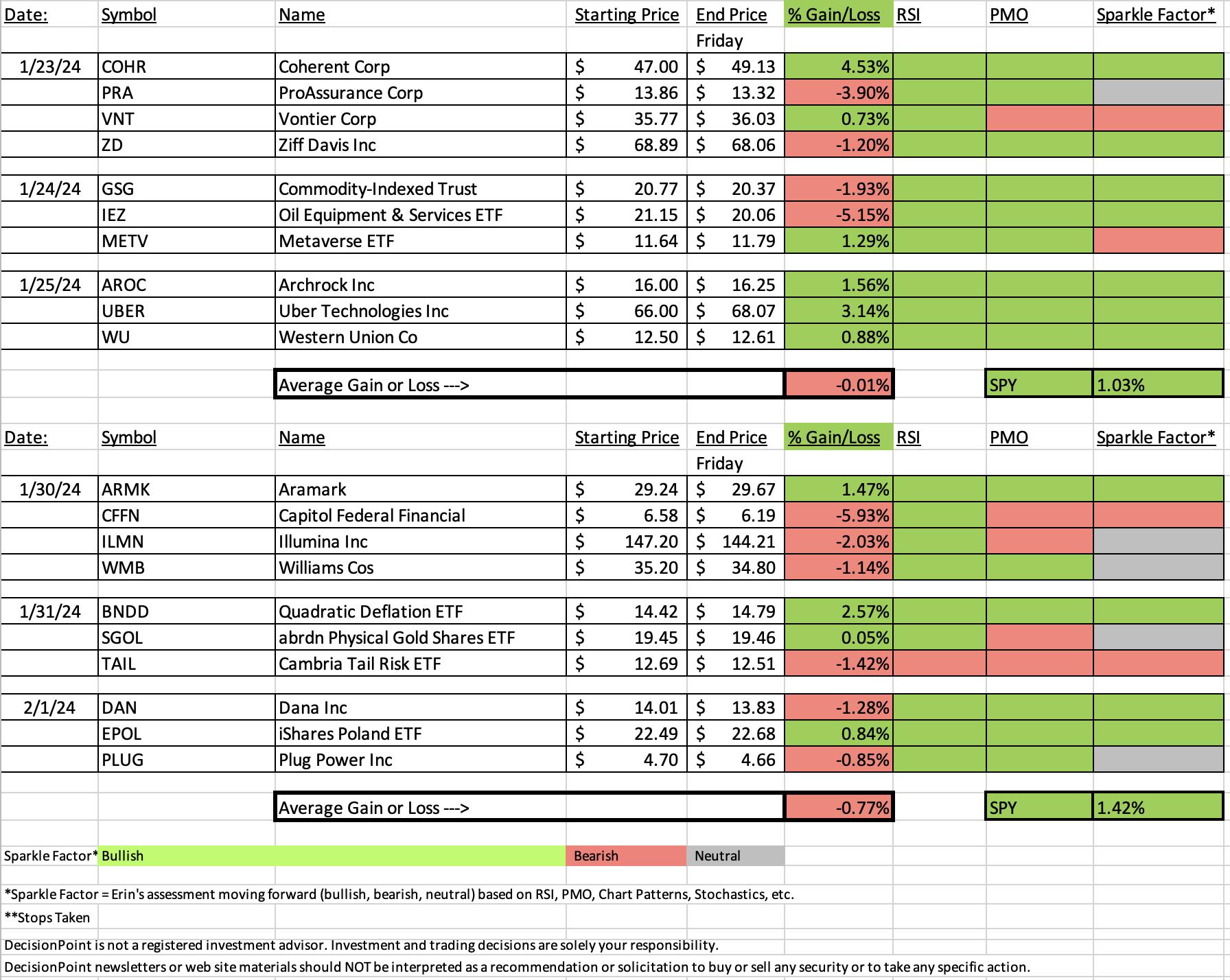

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Quadratic Deflation ETF (BNDD)

EARNINGS: N/A

BNDD is an actively managed portfolio of US Treasuries and options strategies tied to the shape of the US interest rate swap curve. Click HERE for more information.

Predefined Scans Triggered: None.

Below are the commentary and chart from Wednesday 1/31:

"BNDD is down -2.29% which does take the shine off, but it could offer a better entry. I'm bullish on Bonds and this one does seem to travel with them. Of course with the Fed holding things steady for their part, we could see some struggle here at overhead resistance. This one does have a nice yield to go along with it. The RSI did turn down and is in negative territory right now, but the PMO is turning back up and Stochastics are rising strongly. It is beginning to outperform the market. I've set a 4% stop beneath support around $13.84."

Here is today's chart:

When we picked this one, the RSI was still negative, but the expected rally pushed it into positive territory. The PMO has now triggered a Crossover BUY Signal. Stochastics are now above 80. This one looks very good moving forward.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Capitol Federal Financial (CFFN)

EARNINGS: 04/24/2024 (BMO)

Capitol Federal Financial, Inc. is a holding company, which operates as a community-oriented financial institution. It offers a variety of financial products and services, including checking and savings account, eBanking, trust and brokerage, and insurance. The company was founded in 1893 and is headquartered in Topeka, KS.

Predefined Scans Triggered: None.

Below are the commentary and chart from Tuesday 1/30:

"CFFN is unchanged in after hours trading. Many Banks are already on the move higher. I wanted to pick one near or about to overcome resistance. This one did not have an overbought RSI and it was showing excellent relative strength. There is a brand new PMO Crossover BUY Signal. The RSI is positive and not overbought. Stochastics are above 80. It may still be in for a bit of pullback at resistance. We nearly have a golden cross of the 50/200-day EMAs. I set the stop below the 20-day EMA at 6.6% or $6.14."

Here is today's chart:

Looking at the chart above I'm trying to figure out what went wrong as I don't see anything particularly telling that this would fail to this degree. Maybe it was the relative strength line against the group waning. It could be related to the negative P/E ratio which I do need to be more careful with, but it does have a good yield in spite of that. The trade has definitely gone south. Possibly one issue was that Banks as a whole had a really good Tuesday and that did skew the scan results.

THIS WEEK's Performance:

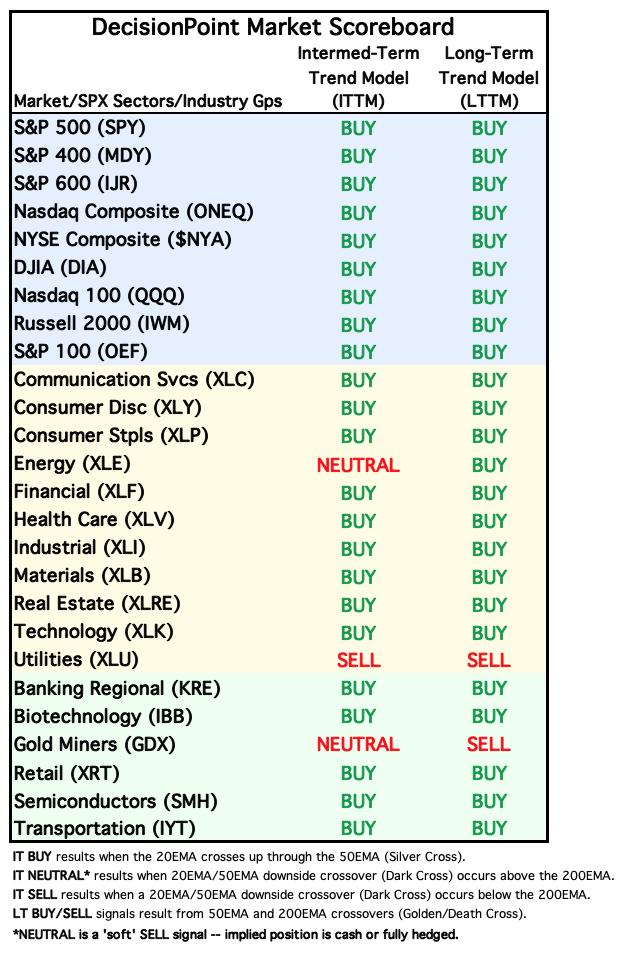

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Industrials (XLI)

We would keep a close eye on the Industrials (XLI) sector. Today saw a fantastic breakout above the 2023 high. The indicators are lined up well and looking "under the hood" participation suggests there is more upside to follow for the Industrials. The only part of the chart that isn't that positive is the Silver Cross Index which is still in decline and could continue to decline based upon the fact that we have fewer stocks holding above their 20/50-day EMAs compared to the number of Silver Crosses within the sector.

Past that we a positive RSI and nearing PMO Crossover BUY Signal well above the zero line. Participation is strong as far as %Stocks > 20/50/200EMAs and all of those indicators could accommodate more upside. The Golden Cross Index is angling higher and is above its signal line giving us a Bullish LT Bias. We even see relative strength beginning to rise against the SPY.

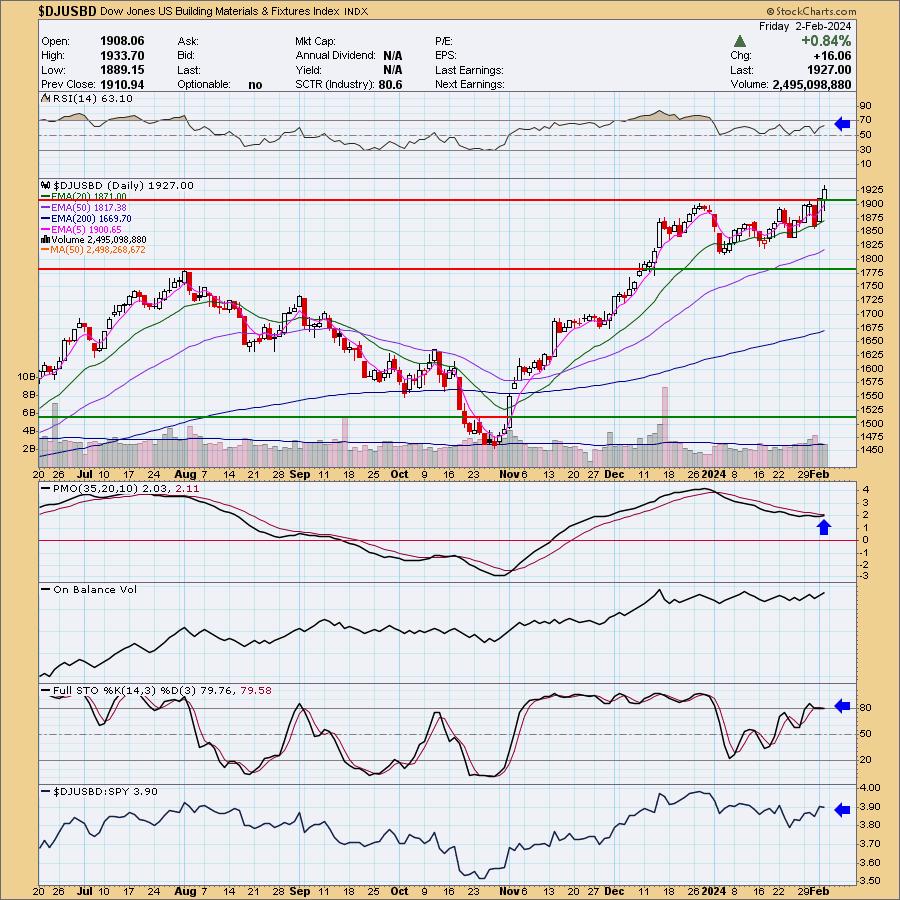

Industry Group to Watch: Building Materials ($DJUSBD)

I noticed while reviewing the Industry Groups within the Industrials sector that most are lined up to do well or are already doing well. I selected Building Materials primarily for the breakout, but the nearing PMO Crossover BUY Signal helped too. The RSI is positive and not overbought on this breakout move. Stochastics are almost back above 80 and look strong. Relative strength is also picking up for the group as a whole. A few symbols to consider from this area: BLDR, KNF and VMC.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 30% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2024 DecisionPoint.com