It was an excellent week for Diamonds in the Rough with our average being up +1.72% while the SPY was only up +0.36%. This is what we shoot for. The rest of the spreadsheet looks very positive as well with a handful of stocks up double digits.

This week's "Darling" was no surprise, Antero Resources (AR) which is an Exploration and Production stock. It is taking advantage of a Crude Oil trade that is going well. The week's "Dud" wasn't really a Dud. I still very much like the chart of Amgen (AMGN) and I happen to own it as well after reviewing it in the Diamond Mine this morning.

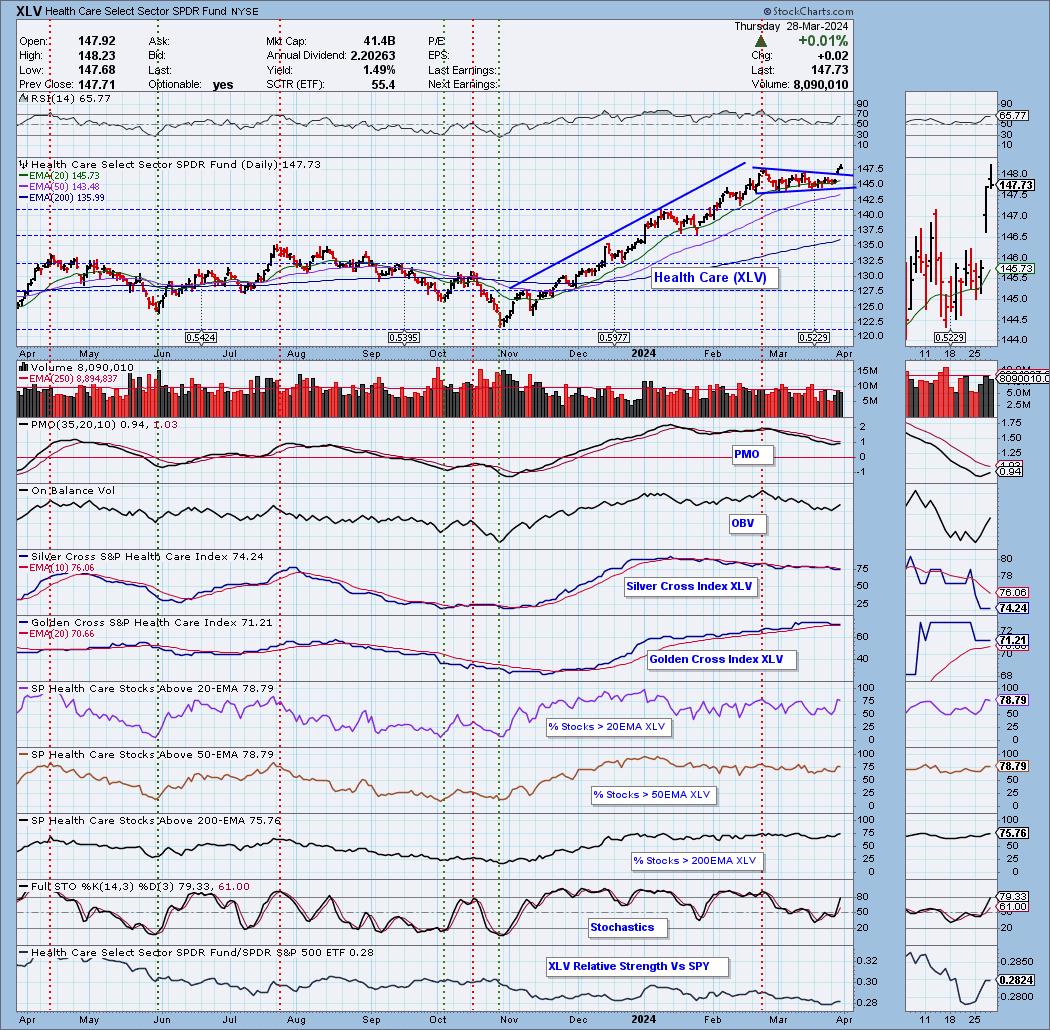

This morning the Sector to Watch was fairly easy to pick. I like the new rally in Healthcare. This is a sector that hasn't been performing well, but it appears rotation is making its way toward this sector. It was clear when looking for an Industry Group to Watch that this sector has internal strength. Every group had merit. Within the Pharmaceuticals industry group we found the following symbols for further review: CLVR, HOWL and CRNX. I took at chance on volatile CLVR. It is associated with the marijuana industry and thus will likely see some volatility.

Thanks to those that attended this morning's Diamond Mine trading room. We ran scans at the end of the program and found a handful of good looking stocks, APD, HSIC, KNX, SHOO and OTTR. I own KNX and OTTR.

Have a great long weekend! See you in the free DecisionPoint Trading Room on Monday at Noon ET!

Good Luck & Good Trading,

Erin

RECORDING & DOWNLOAD LINK (3/28/2024):

Topic: DecisionPoint Diamond Mine (3/28/2024) LIVE Trading Room

Recording & Download Link HERE.

Passcode: March#28

REGISTRATION for 3/29/2024:

When: Apr 5, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (4/5/2024) LIVE Trading Room

Register in advance for this webinar HERE.

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 3/25. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Antero Resources Corp. (AR)

EARNINGS: 04/24/2024 (AMC)

Antero Resources Corp. engages in the development, production, exploration, and acquisition of natural gas. It operates through the following segments: Exploration and Production, Marketing, and Equity Method Investment in Antero Midstream. The Exploration and Production segment deals with the development and production of natural gas, NGLs, and oil. The Marketing segment refers to marketing and utilization of excess firm transportation capacity. The Equity Method Investment in Antero Midstream segment represents midstream services. The company was founded by Paul M. Rady and Glen C. Warren, Jr. in June 2002 and is headquartered in Denver, CO.

Predefined Scans Triggered: Moved Above Upper Bollinger Band, Stocks in a New Uptrend (Aroon), Moved Above Upper Price Channel, Parabolic SAR Buy Signals and P&F Low Pole.

Below are the commentary and chart from Monday, 3/25:

"AR is down -0.15% in after hours trading. I liked this chart best of all today. Mainly I like it because of the breakout move and the upcoming "golden cross" of the 50/200-day EMAs. We have a PMO that has been running flat above the zero line and has triggered a Crossover BUY Signal. The RSI is getting overbought, so the rally could consolidate a bit before it moves back up, but it looks like we should still see some upside follow through on this breakout. The OBV is confirming the move as volume begins pouring in. Stochastics are rising above 80. Relative strength is picking up for AR and it is already in a good group. The stop is set at 7.4% below support around $25.42."

Here is today's chart:

We saw follow through on the breakout as we expected. I discussed that this may be too overbought for new entry and I do stand by that, but I will also tell you there is more upside to be had on this trade. It is definitely a hold if nothing else.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Amgen, Inc. (AMGN)

EARNINGS: 05/02/2024 (AMC)

Amgen, Inc. is a biotechnology company, which engages in the discovery, development, manufacture, and marketing of human therapeutics. It operates through Human Therapeutics segment. The company was founded by William K. Bowes, Jr., Franklin Pitcher Johnson, Jr., George B. Rathmann, and Joseph Rubinfeld on April 8, 1980 and is headquartered in Thousand Oaks, CA.

Predefined Scans Triggered: Moved Above Upper Price Channel and Moved Above Upper Bollinger Band.

Below are the commentary and chart from Wednesday, 3/27:

"AMGN is up +0.05% in after hours trading. This is probably my favorite of the bunch today. I really like the recent rally that has taken out the declining trend. We even have a small breakout above resistance at the October top. The RSI is not overbought and the PMO is rising on an oversold Crossover BUY Signal. Stochastics are now above 80 and still rising. Biotechs have not been performing well, but it appears they may be turning the corner. AMGN is already outperforming the SPY. The stop was set beneath support at 6.4% or $267.97."

Here is today's chart:

I hate listing this one as a "Dud". I do own this one and see more upside potential despite today's small decline. This decline seems a mechanical response to the prior breakout. Everything is still going right on the chart so I have it listed with a green Sparkle Factor moving forward. I like it for entry now.

THIS WEEK's Performance:

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Health Care (XLV)

XLV was an easy choice based on the price pattern and breakout. There is a bull flag/pennant visible. Yesterday's breakout confirmed the pattern. Upside potential based on the flag is considerable given you take the height of the flagpole and add that to the breakout point. I believe the back of the napkin calculation would bring price to $172. I'm not sure we'll see that, but nonetheless the pattern does suggest more upside ahead for the sector.

Industry Group to Watch: Pharmaceuticals (IHE)

We have an ETF that covers this industry group so I decided to use that as it is investable. You have to like this scooping price pattern. The PMO is just starting to turn up above the zero line and the RSI is positive and not overbought. Stochastics are rising strongly and we can see the beginning of some outperformance against the SPY. I've listed a very deep stop. I don't think I'd let it go that far before releasing it if the trade goes south.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 80% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2024 DecisionPoint.com