Scans are finally beginning to show results. My Momentum Sleepers scan came up with 771 candidates! I opted to cull from Carl's Scan again which had over 70 results today. I've been looking specifically for stocks with positive OBV divergences and while not all of these have that, the ones that do are very interesting. Yesterday's Diamond, SPAR had a great day and it came up again on the scan results. Might want to reread yesterday's report. I also added a new favorite area of the market right now. All that glitters may be Gold after all.

I am not adding new positions yet. I trade in a more intermediate-term timeframe and DecisionPoint indicators aren't showing bullish behavior yet in the timeframe. The short-term indicators are showing bullish aspects, so if you are a short-term trader, we could see another few days of upside.

Freshpet Inc (FRPT) - Earnings: 5/4/2020 (BMO)

When we see rising bottoms on the OBV, that tells me that while price has declined sharply, it didn't do so on heavy volume. You'll notice on all of these charts, the PMOs are bottoming in oversold territory. I like that typically PMO BUY signal on FRPT have been very accurate. I have a stop area set for the June/September 2019 tops. Price didn't close above the 20-EMA, but this one might be good given that it pulled back today.

Last week FRPT broke its rising trend, but this week it is easily trading back above it. The weekly PMO isn't great, which is proof to me that intermediate-term timeframe is shaky overall.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

SPDR Gold Shares (GLD) - Earnings: N/A

Gold is finding favor and I like the set ups on the various Gold ETFs. I would avoid Gold Miners simply because they are swayed by market forces, not just by the price of Gold. GLD is my favorite Gold ETF. I like that you could set a reasonable stop. The fact that GLD fell today also makes it very attractive. FYI, as of publishing, GLD is up 0.59% in after hours trading.

The PMO is moving back up sharply so far this week. It is overbought which is a difficult place to be in a bear market.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Kadmon Holdings Inc (KDMN) - Earnings: 5/7/2020 (AMC)

This is a very risky play so go in with eyes wide open and with a small position that you are comfortable losing at least 15% of. If we see KDMN get above the $4 mark, I think it could run especially given it is in the biotech area which seems to be doing fairly well (depending on the stock you're in). Be vigilant if you decide to try this one out. Technically it looks pretty solid if it can overcome that $4 resistance level.

There's some deceleration showing on the PMO. I am a bit unnerved that price is in the middle of this very wide trading range. I think that ramps up the risk.

Photronics Inc (PLAB) - Earnings: 5/20/2020 (BMO)

I like the positive divergence on the OBV. The SCTR is above 75 and the PMO is turning up in very oversold territory. Watch that gap that I've annotated in blue. If this is going to rally, we will want to see that gap closed. If it does, we would have a very favorable "V" bottom set up. $11 and the 20-EMA are posing strong resistance.

The weekly PMO is not good. In the intermediate term, price is near its lows, but there a few areas of overhead resistance that will need to be overcome.

RingCentral Inc (RNG) - Earnings: 5/4/2020 (AMC)

While I'm not a big fan of tech right now, I am seeing some interesting stocks coming to the forefront from that sector. This one could be good given that it pulled back over 7% today. You could also set a reasonable stop. There is an intermediate-term OBV positive divergence that is bullish. We also have a bullish "V" bottom trying to boost price to the February high. I do caveat that in a bear market we should expect bearish conclusions to chart patterns, so again, be safe.

The parabolic pattern broke down and price is working out that decline. I suspect there will be more volatility to deal with because it did come out of a parabolic. The weekly PMO isn't optimum. On the bright side, so far in after hours trading it is up 0.34%.

Current Market Outlook:

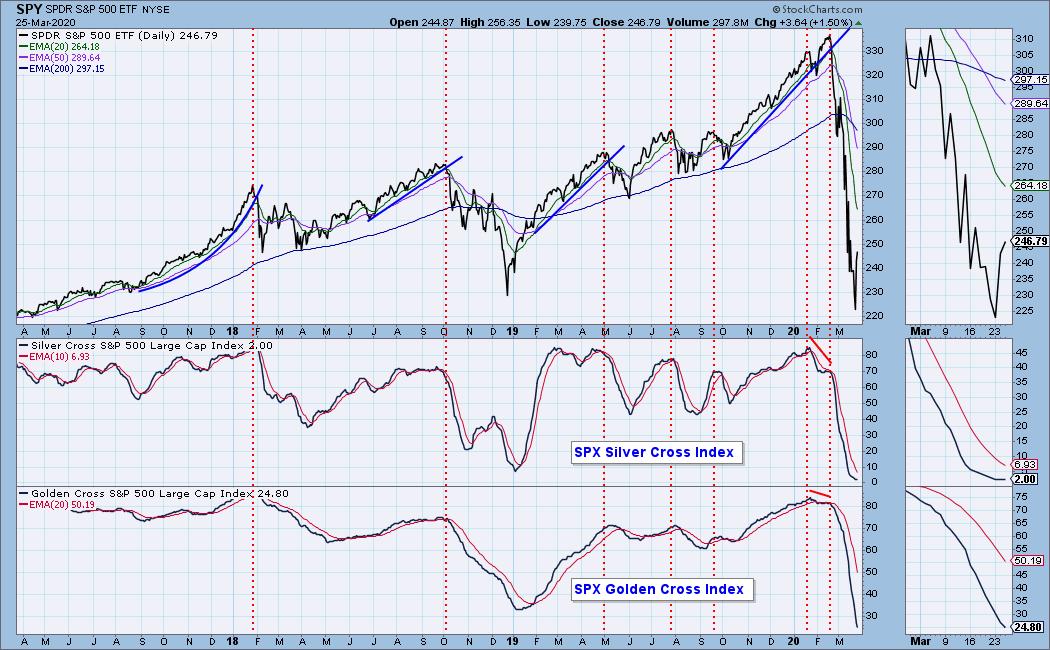

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 11

- Diamond Dog Scan Results: 3

- Diamond Bull/Bear Ratio: 3.67

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I do not own any of the stocks above. I'm currently 85% in cash.

If the show isn't called off and the virus is under control, Erin Swenlin will be presenting at the The MoneyShow Las Vegas May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!