Another day and still zero Diamond Scan results. However, I am finally seeing some action in my Momentum Sleepers scan. Today five Truckers hit the scan results. I questioned the viability of truckers in this 'new normal' as Transports are continuing to be knocked hard. Yet, when I thought about it longer, it seems reasonable to think they will prosper during this time as more and more product is having to be stocked in stores and distributed country wide. As with all industries right now, they are vulnerable to market swings, but I found the relative strength chart of the Trucking industry group below to be impressive. I continue to discourage investing right now unless you have very aggressive accounts that can take the volatile swings of the market. Someone brought up a great point, the rallies we are seeing are likely short-covering. They made the money on the historic decline one day and cover the next. Know your risk tolerance. Take a look at these five diamonds in the rough Truckers that came from our scan.

ArcBest Corp (ARCB) - Earnings: 4/30/2020 (AMC)

This one will be difficult to set a stop on. The PMO has just triggered a new BUY signal in oversold territory. The OBV is showing a strong positive divergence and you can see that like the Truckers industry group, its SCTR has reached the "hot zone" above 75.

Price bounced off important long-term support, but I do note that prices have certainly been lower. The weekly PMO is decelerating, but hasn't turned up just yet.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Heartland Express Inc (HTLD) - Earnings: 4/16/2020 (BMO)

I feel this is one of the weaker choices from the scan results mainly because of today's price action. It closed near its lows for the day. While that could make it a possible 'bargain', it tells me there may be problems under the surface. Setting a stop is much easier here. The PMO is rising, although it did decelerate today. The OBV in the intermediate-term, is in a positive divergence with price lows. The SCTR is now firmly in the hot zone.

Major long-term support hasn't quite been tested. This would normally be a positive, but with the trading environment right now, I believe it will need to test that level more closely.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Knight-Swift Transportation Holdings Inc (KNX) - Earnings: 4/22/2020 (BMO)

We have a slight positive divergence on the OBV. The PMO is rising nicely out of oversold territory. The SCTR is strong, reading above 90. Price closed above its 20-EMA which I find positive.

While price did technically bounce off the 2019 low, like HTLD, I think it may need to test the next level down first, especially given the weekly PMO configuration.

Marten Transport Ltd (MRTN) - Earnings: 4/16/2020 (AMC)

The PMO turned up sharply in oversold territory. There is a short-term positive divergence between OBV bottoms and price lows. The SCTR has been trending higher for some time and it is currently in the hot zone above 75.

The weekly PMO is still declining and we see that the rising trend has been broken. Price is attempting to bounce off the 2018 low. I would want a stop just below $15.

Werner Enterprises Inc (WERN) - Earnings: 4/23/2020 (AMC)

Another Trucker with a positive divergence between the OBV and price lows. Like the others, the SCTR is very strong and rising. The PMO turned up in oversold territory and is headed to a crossover BUY signal. Currently price is trading above support at the July top and October low. Price closed above the 20-EMA yesterday and today.

The weekly PMO is likely the weakest of all of the diamonds today. It is decelerating, but it is only in Neutral territory. It could use more unwinding.

Current Market Outlook:

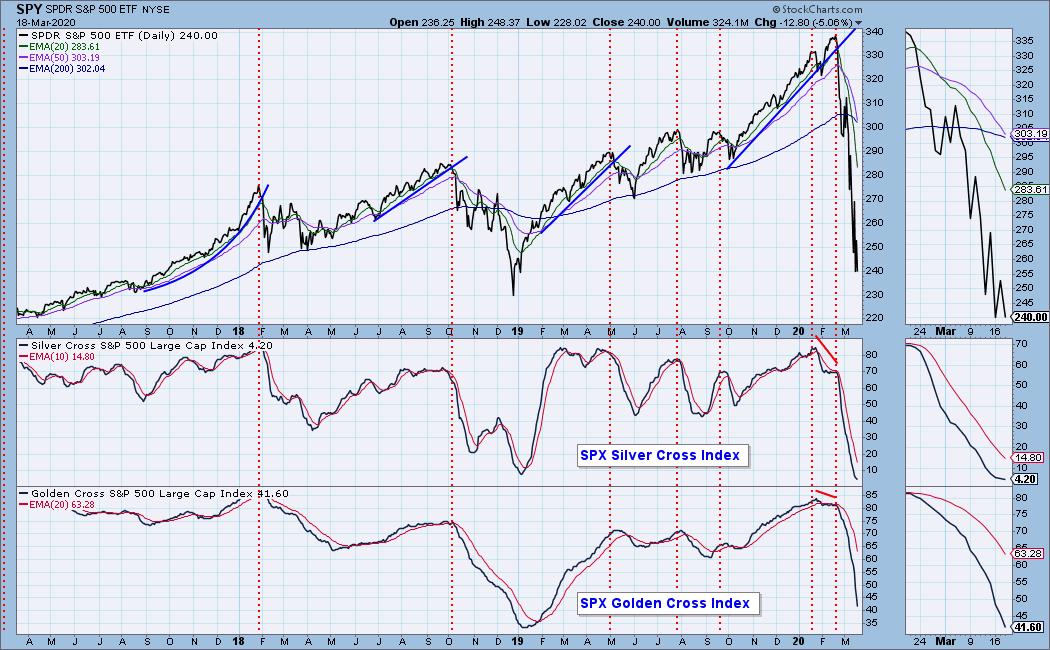

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 0

- Diamond Dog Scan Results: 0

- Diamond Bull/Bear Ratio: 0.00

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I do not own any of the stocks above. I'm currently 80% in cash.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!