As we continue to see sector rotation, it appears that Consumer Discretionary (XLY) is reaping the benefits of this rally. I decided to do a manual scan of all of the Restaurants & Bars industry group and find possible diamonds in the rough. I found some very interesting choices within this industry. As America begins to slowly reopen, it seems that restaurants and bars are an area with true pent up demand. Since I didn't use a scan today, you'll notice the SCTRs aren't that great. In a way I believe this is an advantage. My sense is that this area of the market is the new "virus play" and hasn't seen price run back to pre-bear market highs like Technology and Health Care stocks.

I very much look forward to paying three times the cost for a beer or glass of wine away from home. Before quarantine I preferred to be thrifty and imbibe at home. However, now I really crave the camaraderie of watching a sporting event in the company of other people in a bar or restaurant. Speaking of sports, for those of you who know me well, I am super psyched for the postponed hockey playoffs to begin even though my Anaheim Ducks won't be playing. I must admit that the lack of sports on TV has improved my knowledge as I've been inspired to watch documentaries. As someone coined, "History does not repeat itself, but it often rhymes". Tomorrow is Reader Request Day and I have a few very interesting symbols that are crossing my desk. I would love to see more! Email me at erin@decisionpoint.com to put in your requests!

** Announcements **

I will be traveling July 1 - July 15. I will be writing on the road, but broadcasting will be suspended during that time. It's going to be an adventurous road trip for me and my husband. We will be taking a train from Los Angeles to New Orleans, visiting family, checking out retirement areas and then renting a car and making our way back to California with various stops along the way. I'll be sure to post a picture or two and I'm sure I'll have funny stories to share along the way. It'll be interesting to see the various stages of the reopening of America.

A heads up to Bundle subscribers, after tomorrow the LIVE Trading Room will be going on hiatus as Mary Ellen will also be out of pocket in the upcoming month. We hope to reopen in late-July. If you recently upgraded to get the Trading Room, I do hope you'll continue the subscription while we are on hiatus. Please direct questions to erin@decisionpoint.com.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

BJ's Restaurants Inc (BJRI) - Earnings: 7/23/2020 (AMC)

BJ's Restaurants, Inc. engages in the ownership and operation of casual dining restaurants. The firm operates BJ's Restaurant and Brewery, BJ's Restaurant & Brewhouse, BJ's Pizza and Grill or BJ's Grill. It offers pizzas, appetizers, specialty salads, soups, pastas, sandwiches, entrées, desserts, and proprietary craft beers.

Okay, this one was up over 13% today and will definitely need a pullback. Watch the 5/15-min charts for possible clues. The stop would have to be set around yesterday's close and that would still be a deep stop. The set up on the chart is great though with today's breakout above the April top. BJRI has been in a rising trend channel but from top to bottom of that channel is a big gain or loss as the case may be. I like to see a rising trend channel versus a rising wedge any day of the week. The PMO triggered a BUY signal last week. The OBV is rising nicely. The RSI is above 50.

The PMO looks phenomenal on the weekly chart and will be above zero soon. I do note that very long-term overhead resistance is nearing. I am looking for a move past that given the bullish daily chart, but even a move there would be a 15% gain from where we are today.

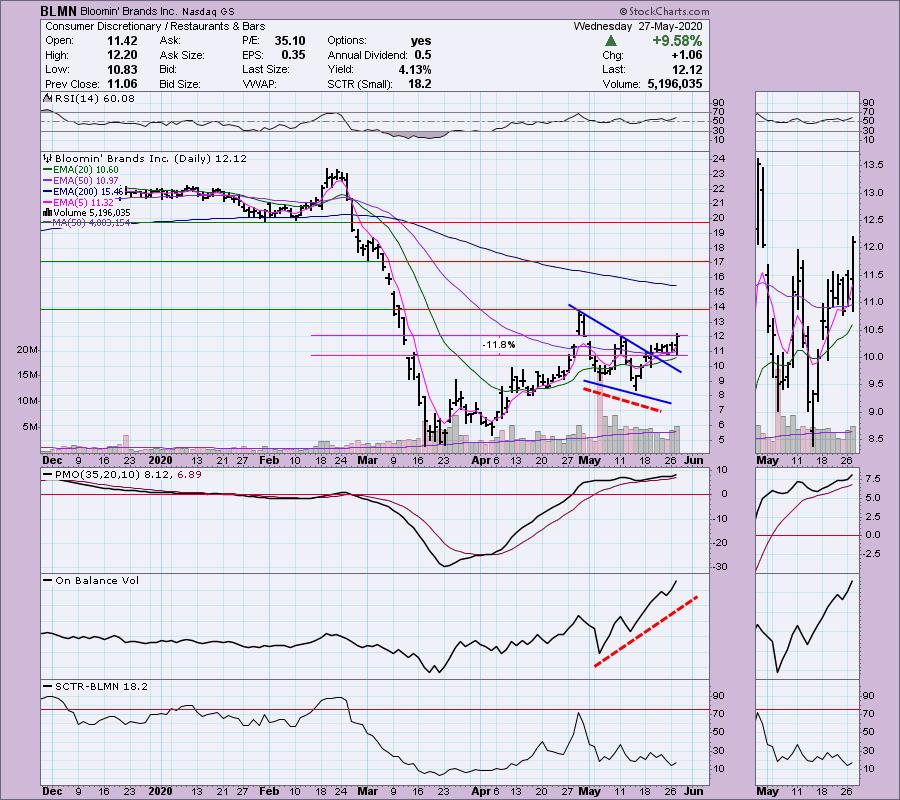

Blooming' Brands Inc (BLMN) - Earnings: 7/30/2020 (BMO)

Bloomin' Brands, Inc. engages in the acquisition, operation, design, and development of restaurant concepts. It operates through the following segments: U.S. and International. The U.S. segment operates in USA and Puerto Rico. The International segment operates in Brazil, South Korea, Hong Kong, and China. Its brands include Outback Steakhouse, Carrabba's Italian Grill. Bonefish Grill, and Fleming's Prime Steakhouse & Wine Bar.

This one is definitely on my radar for tomorrow. Notice that we haven't really seen the kind of rally we would usually see after a positive OBV divergence. I am looking at today short-term breakout as a sign that the rally will now get going. Price drifted out of the bullish falling wedge. I do prefer a strong breakout, but today's rally suggests new life for BLMN.

BLMN is very oversold right now. Even if it reaches near-term overhead resistance, it would be a 23% gain. The weekly PMO has triggered a BUY signal and is rising strongly.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Brinker Intl Inc (EAT) - Earnings: 8/12/2020 (BMO)

Brinker International, Inc. engages in owning, developing, and franchising Chili's Grill and Bar and Maggiano's Little Italy restaurant brands. It operates through the following segments: Chili's, and Maggiano's. The Chili's segment includes the results of company-owned Chili's restaurants in the U.S. and Canada as well as the results from domestic and international franchise business. The Maggiano's segment comprises the results of company-owned Maggiano's restaurants.

This symbol makes me hungry. Another giant gain on the day that will likely require a pullback before entry. The RSI is just above 70 which is somewhat overbought, but given the new "silver cross" of the 20/50-EMAs, an IT Trend Model BUY signal was generated. The PMO is rising nicely after a bullish bottom above the signal line.

We can see that this week price has moved up above long-term resistance. The PMO is on a BUY signal and rising strongly.

Noodles & Company (NDLS) - Earnings: 7/21/2020 (BMO)

Noodles & Co. develops and operates fast-casual restaurants which offers lunch and dinner meals. It serves cooked-to-order dishes, which include noodles and pasta, soups, salads, sandwiches, and appetizers.

There is a double-bottom on the chart and a breakout that constitutes an execution of the pattern. The minimum upside target would put price at the April top. The PMO just triggered a BUY signal. The OBV is confirming the rally and the RSI is above net neutral (50).

It may shock you, but if price can get back up to the 2020 top, that would be a 68% gain. I can't speak to it rising that high, but even a move to $6.50 where near-term overhead resistance lies (easiest seen in the thumbnail) that would be a 20% + gain.

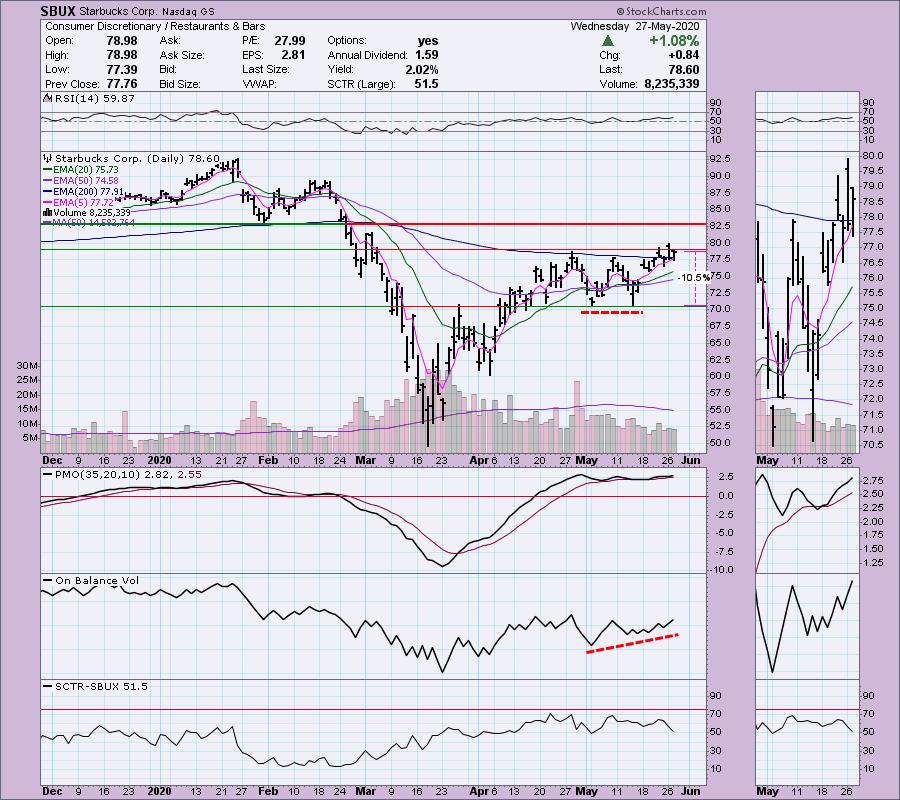

Starbucks Corp (SBUX) - Earnings: 7/28/2020 (AMC)

Starbucks Corp. engages in the production, marketing, and retailing of specialty coffee. It operates through the following segments: Americas; China/Asia Pacific (CAP); Europe, Middle East, and Africa (EMEA); and Channel Development. The Americas, CAP, EMEA segments sells coffee and other beverages, complementary food, packaged coffees, single-serve coffee products, and a focused selection of merchandise through company-oriented stores, and licensed stores. The Channel Development segment include sales of packaged coffee, tea, and ready-to-drink beverages to customers outside of its company-operated and licensed stores.

I would've liked for price to close above the April high, but overall SBUX looks pretty good. The RSI is above 50, the OBV just had a positive divergence and the PMO is rising. The yield is nice at just over 2%. I'd set a stop below the double-bottom.

Best part of this weekly chart is the new PMO BUY signal. Upside potential is a healthy 24%. Getting above the late 2019 low would be significant in my estimation and could suggest higher prices to come.

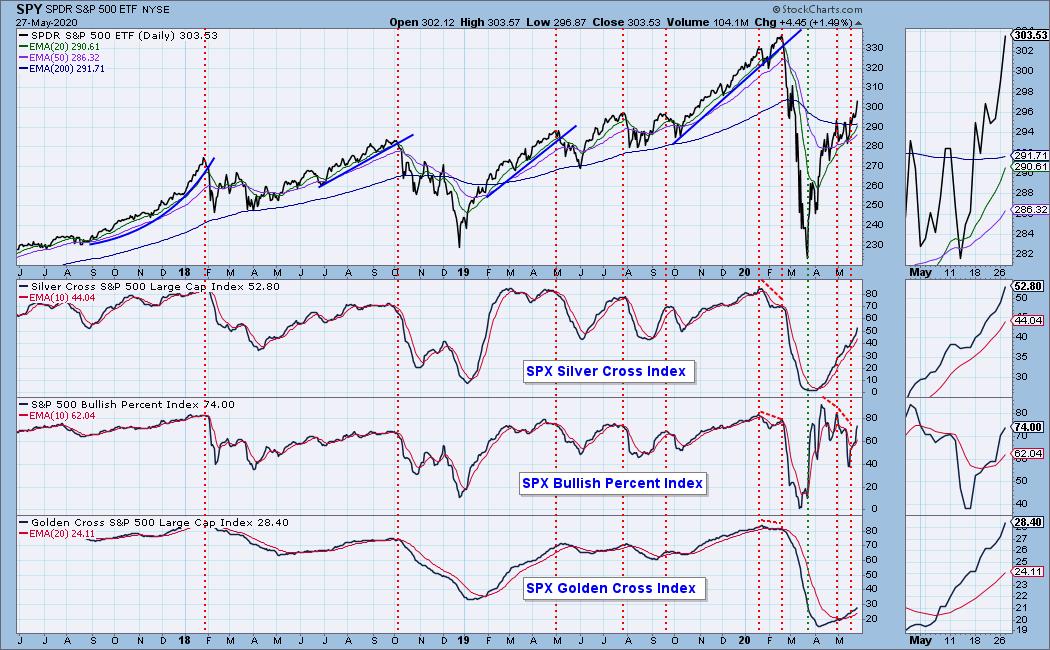

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 2

- Diamond Dog Scan Results: 3

- Diamond Bull/Bear Ratio: 0.67

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I do not currently own any of the above stocks. I'm contemplating adding more positions tomorrow. My current faves are BLMN, KO and SBUX. I am currently 55% in cash.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!