I am really impressed with the choices coming out of my Diamond PMO Scan. Interestingly, Sprouts Farmers Market (SFM) appeared in the results today, but I already covered it last Thursday. It's doing well. I did open positions in NEM and SFM on Friday after I presented them to you. Another Diamond, RAD, continues to impress; it was up 21.6% last week on earnings and it is already up 14%+ on trading today. They aren't all winners, but it is certainly satisfying when a Diamond has double-digit gains so quickly. This week's Diamond scan gave me more Miners & Metals to review and the Food Products and Retailers dominated the scan. I also have a 'wild card' Software stock. Below are RAD, NEM and SFM for your review.

** Announcements **

I will be traveling July 1 - July 15. I will be writing on the road, but broadcasting will be suspended during that time. It's going to be an adventurous road trip for me and my husband. We will be taking a train from Los Angeles to New Orleans, visiting family, checking out retirement areas and then renting a car and making our way back to California with various stops along the way. I'll be sure to post a picture or two and I'm sure I'll have funny stories to share along the way. It'll be interesting to see the various stages of the reopening of America.

A heads up to Bundle subscribers, the LIVE Trading Room will be going on hiatus as Mary Ellen will also be out of pocket in the upcoming month. We hope to reopen in late-July. Please direct questions to erin@decisionpoint.com.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Accenture Ltd (ACN) - Earnings: 9/24/2020 (BMO)

Accenture Plc engages in the provision of management consulting, technology, and outsourcing services. It operates through the following segments: Communications, Media, and Technology; Financial Services; Health and Public Service; Products; Resources; and Other. The Communications, Media, and Technology segment serves communications, media, high-tech, and software and platform companies through acceleration and delivery of digital transformation, development of comprehensive and industry-specific solutions, and enhance efficiency and business results. The company's services include helping clients capture new growth by shifting to data-driven and platform-based models, optimizing their cost structures, increasing product and business model innovation, and differentiating and scaling digital experiences for their customers. The Financial Services segment serves the banking, capital markets, and insurance industries by addressing growth, cost and profitability pressures, industry consolidation, regulatory changes and the need to continually adapt to new digital technologies. The Health and Public Service segment serves healthcare payers and providers, as well as government departments and agencies, public service organizations, educational institutions, and non-profit organizations through provision of insights and offerings, including consulting services and digital solutions. The Products segment serves the following: Consumer Goods, Retail, and Travel Services group; Industrial group; and Life Sciences. The company helps clients enhance their performance in distribution and sales and marketing; in research and development and manufacturing; and in business functions such as finance, human resources, procurement and supply chain while leveraging technology. The Resources segment serves the chemicals, energy, forest products, metals and mining, utilities, and related industries by working to develop and execute innovative strategies, improve operations, manage complex change initiatives and integrate digital technologies. The Other segment represents the pension settlement charge.

Starting off with the wild card, Accenture (ACN). I like the price action in particular on this chart. We had a breakout move and then a pullback to that $210 level. The PMO wasn't damaged, the RSI remains strong and the SCTR is in the "hot zone" above 75. The OBV could look better, but it is neutral not bearish.

Got to love that weekly PMO. It is rising strongly and isn't overbought even on the breakout to a new all-time high last week.

VanEck Vectors Junior Gold Miners (GDXJ) - Earnings: N/A

GDXJ tracks a market-cap-weighted index of global gold- and silver-mining firms, focusing on small-caps.

I'm a fan on the Miners right now as my regular readers likely know. I hadn't look at the Juniors, but it came up on my scan and I thought this ETF is looking ready to breakout. The breakout from the bullish falling wedge has happened. Unfortunately it got caught up against resistance at $48. Given the positive PMO, RSI and SCTR I am expecting this one to break out. I think you could also make a case for a bull flag/pennant that has begun to resolve as expected to the upside.

Near-term upside potential is 5% and after that it will require a breakout. The PMO is very healthy and with a corresponding bullish daily chart, I am expecting that breakout to occur.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

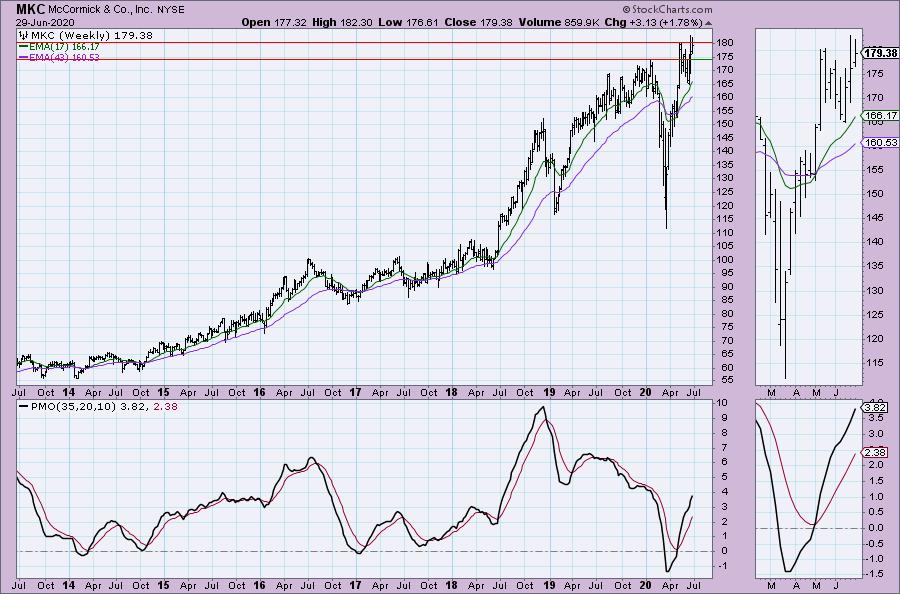

McCormick & Co (MKC) Earnings: 9/29/2020 (BMO)

McCormick & Co., Inc. engages in the manufacture, market and distribution of spices, seasoning mixes, condiments and other flavorful products to retail outlets, food manufacturers and foodservice businesses. It operates through the following segments: Consumer and Flavor Solutions. The Consumer segment operates by selling to retail channels, including grocery, mass merchandise, warehouse clubs, discount and drug stores, and e-commerce through the following brands: McCormick, Lawry's, Zatarain's, Simply Asia, Thai Kitchen, Ducros, Vahine, Schwartz, Club House, Kamis, Kohinoor and DaQiao. The Flavour Solutions segment provides products to multinational food manufacturers and foodservice customers.

This stock has been in a declining trend but last week broke out. It did get hung up on overhead resistance at the May top, but it is poised to break out with a positive RSI, PMO nearing a crossover BUY signal and the high SCTR. I'll admit that the OBV is negative given its declining tops and price's new rising tops.

The weekly chart shows a large flag that formed off the bear market low. The PMO is rising strongly.

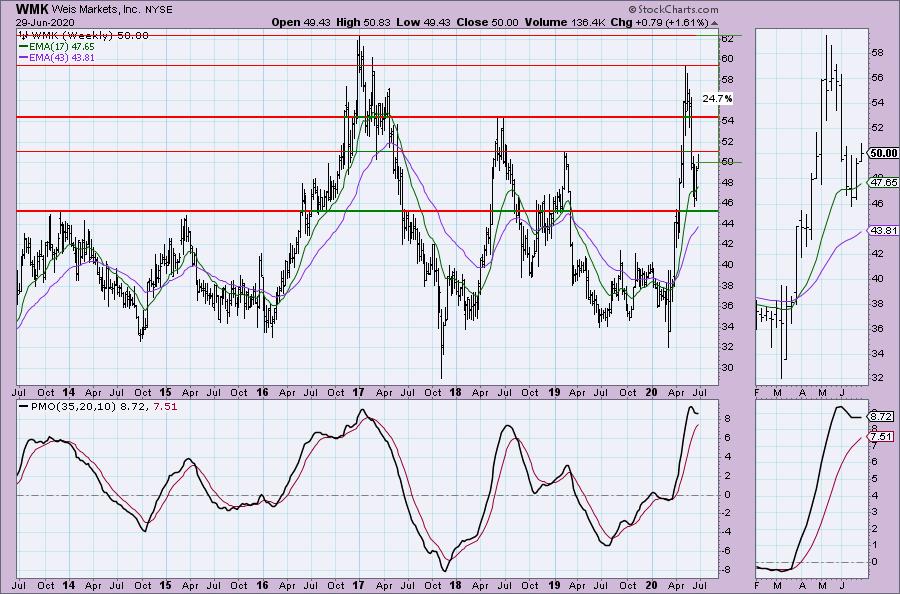

Weis Markets Inc (WMK) -Earnings: 7/31/2020 (AMC)

Weis Markets, Inc. engages in the ownership and operation of retail food stores. Its retail stores offer groceries, dairy products, frozen foods, meats, seafood, fresh produce, floral, pharmacy services, deli products, prepared foods, bakery products, beer and wine, fuel, and general merchandise items.

This is a small-cap food retailer. Small-caps have had a tough time of it but this one looks ready to breakout. The PMO has turned up just below the zero line in oversold territory. We have a double-bottom that executed with today's intraday breakout. The minimum upside target of that pattern would bring price right up to resistance at the lows from May. The RSI just moved into positive territory.

Lots of upside potential if it can reach its 2017 high but it does have three levels of overhead resistance to overcome. The PMO doesn't look great but it is turning up. May want to babysit this one to make sure it can move above resistance when the time comes.

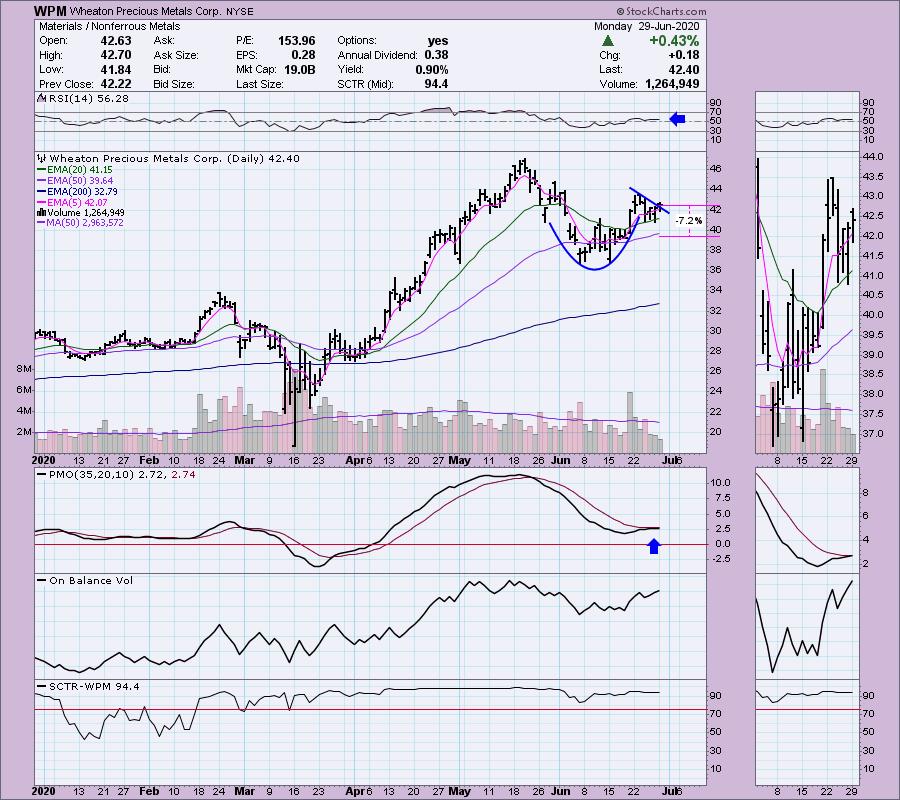

Wheaton Precious Metals Corp (WPM) -Earnings: 8/6/2020 (AMC)

Wheaton Precious Metals Corp. is a mining company, which engages in the sale of precious metals and cobalt production. It operates through the following segments: Gold, Silver, Palladium, Cobalt, and Other. It focuses on the following precious metals streams: Salobo, Penasquito, Antamina, Constancia, Stillwater, San Dimas, Sudhury, Zinkgruvan, Yauliyacu, Neves-Corvo, Pascua-Lama, Rosemont, Voisey's Bay, and others.

This is metal-related and I thought the chart looks great. At first I looked at this as a double-bottom, but I decided it made more sense as a "cup and handle" bullish formation. These patterns usually resolve to the upside and past the previous highs (like the May top). It is trying right now to breakout of the short-term declining trend that formed the "handle". The RSI is very positive and the PMO has nearly generated a crossover BUY signal. The OBV is confirming the move with rising bottoms.

The PMO was headed in the wrong direction, but it has made a turnaround. It is overbought, but not extremely so.

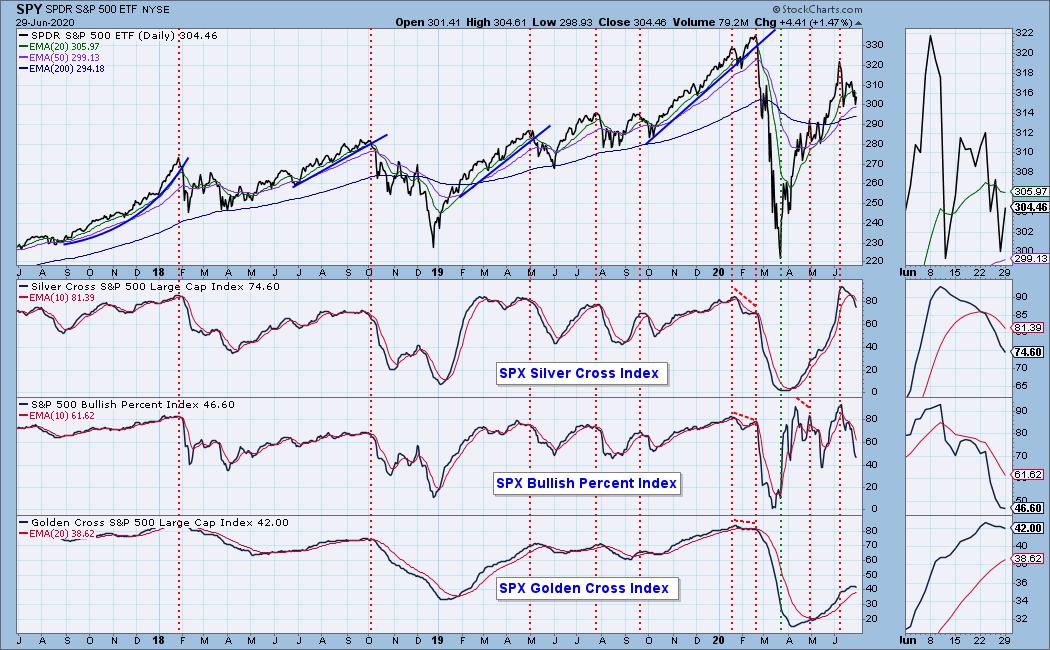

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 14

- Diamond Dog Scan Results: 2

- Diamond Bull/Bear Ratio: 7.00

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: As noted above, I added NEM and SFM to my portfolio on Friday. I'm about 50% invested right now.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!f