Today I found a few interesting stocks from my "Momentum Sleepers" scan. It's an excellent scan to find bottom fishing opportunities as it finds stocks that are showing positive momentum under the surface. I was tempted to put Natural Gas (UNG) on the list today after it showed up on that scan, but I've been burned (no pun intended) by UNG too many times to count, but if you're interested in a real bottom fish with higher than normal risk but excellent upside potential if it can maintain this rally, take a peek:

My big problem with UNG is it honestly hasn't found a true low. The one on the chart was a new all-time low for UNG. That one isn't for the faint of heart.

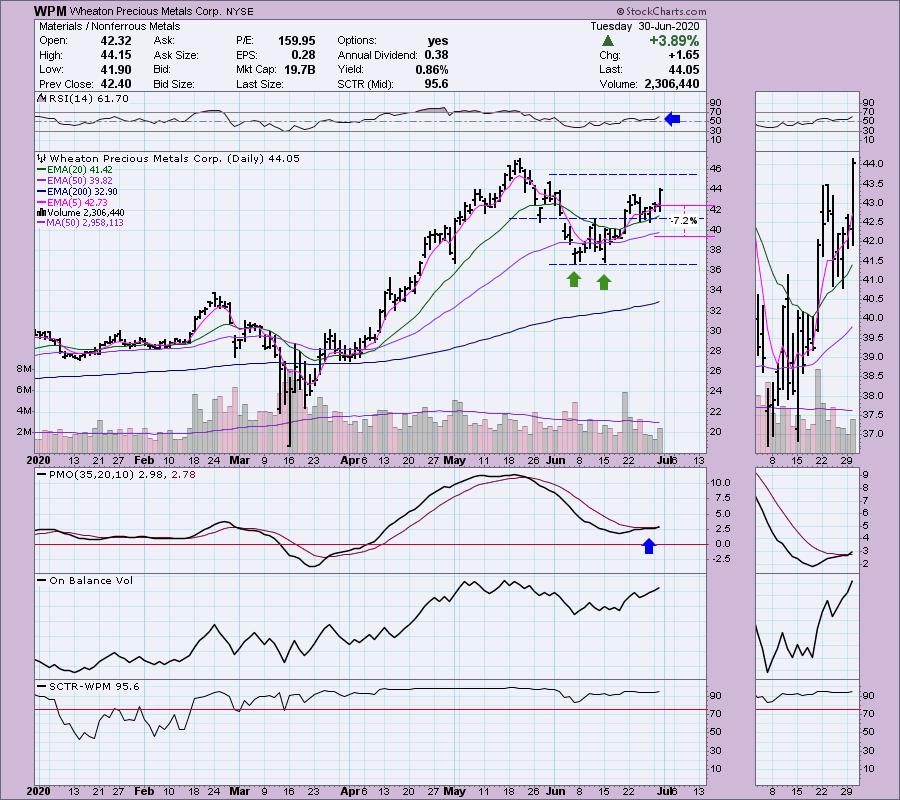

Here's a quick relook at WPM from yesterday. It had a beautiful breakout. The Miners are continuing to perform well too.

I leave for my trip tomorrow night so I won't likely be trading much. At this point I'm not adding any positions, although TLT is one that I'm considering. Check out the DP Alert for more on Bonds.

I plan on blogging about my trip adventures over the next two weeks within this blog. Writing will still be happening so you won't miss any reports while I'm gone! We plan on being very very careful. We have our masks and gloves packed and our itinerary is somewhat fluid now depending on openings/closings of various states and attractions.

** Announcements **

I will be traveling July 1 - July 15. I will be writing on the road, but broadcasting will be suspended during that time. It's going to be an adventurous road trip for me and my husband. We will be taking a train from Los Angeles to New Orleans, visiting family, checking out retirement areas and then renting a car and making our way back to California with various stops along the way. I'll be sure to post a picture or two and I'm sure I'll have funny stories to share along the way. It'll be interesting to see the various stages of the reopening of America.

A heads up to Bundle subscribers, the LIVE Trading Room will be going on hiatus as Mary Ellen will also be out of pocket in the upcoming month. We hope to reopen in late-July. Please direct questions to erin@decisionpoint.com.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Big Lots Inc (BIG) - Earnings: 8/28/2020 (BMO)

Big Lots, Inc. engages in the operation of retail stores. It operates through the Discount Retailing segment which includes merchandising categories such as furniture, seasonal, soft home, food, consumables, hard home, and electronics, toys, and accessories.

As of writing, this one is trading down 1% in after hours trading so you might be able to get this one at an even lower price point. Just make sure the PMO doesn't turn down too harshly. I like the way this one broke out of a bullish flag decisively which means an over 3% breakout move. The RSI is getting less overbought with the current pullback. The PMO is ready for a BUY signal. Note that volume really kicked in on the breakout. Remember that we want to see the OBV breakout at the same time price does. If the OBV breaks out and price doesn't, that is a reverse divergence that indicates that despite added volume, it was unable to make a new high. The SCTR has been very healthy.

Upside potential is great at the two upper levels that I expect price to challenge. The PMO is obviously going crazy. It is very overbought, but I'm more interested in the strength and direction.

Emergent BioSolutions Inc (EBS) - Earnings: 7/30/2020 (AMC)

Emergent BioSolutions Inc. engages in the development, manufacture, and commercialization of medical countermeasures. It offers specialty products for civilian and military populations that address accidental, intentional and naturally occurring public health threats. The firm's products include ACAM2000, BioThrax, Raxibacuma, Vaxchora, and VIGIV. Its business units include Vaccines and Anti-Infectives; Antibody Therapeutics; Devices; and Contract Development and Manufacturing.

I notice in the description of this company the words "public health threats", "antibody therapeutics" and "vaccines". I'm not very familiar with them, but it does appear they are in the right business during the virus threat. They did gap down considerably in early June, but after a nice positive divergence with the OBV it has begun to rally. It is making its way up to cover the original gap. The RSI just turned positive above "net neutral" or 50. The PMO is reaching up for a BUY signal. It was up quite a bit today so look for a possible entry on a pullback from this price. I've used the February top as a stop area.

I see no reason why EBS couldn't challenge its all-time high given the daily chart. The weekly PMO has decelerated and could be turning up to confirm this move and breakout above the 2018 top.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

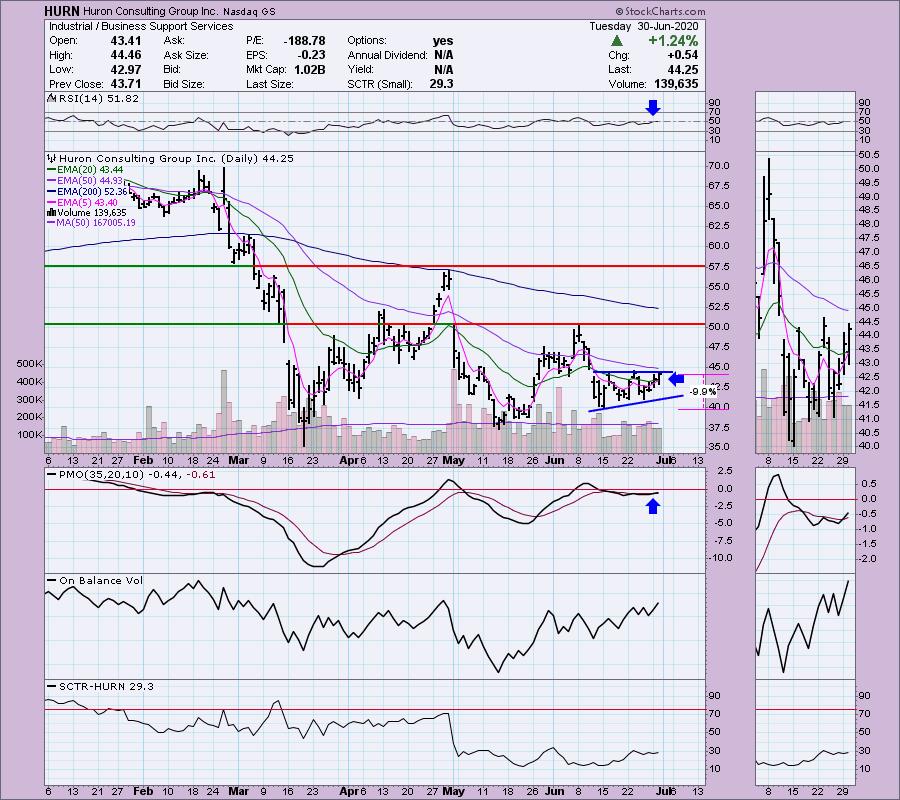

Huron Consulting Group Inc (HURN) Earnings: 7/28/2020 (AMC)

Huron Consulting Group, Inc. engages in the provision of operational and financial consulting services. It operates through the following business segments: Healthcare, Business Advisory, and Education. The Healthcare segment provides advisory services in the areas of care transformation, financial and operational excellence, technology and analytics, and leadership development to national and regional hospitals and integrated health systems, academic medical centers, community hospitals, and medical groups. The Business Advisory segment offers services to large and middle market organizations, not-for-profit organizations, lending institutions, law firms, investment banks, and private equity firms. The Education segment includes consulting and technology solutions to higher education institutions and academic medical centers.

This is a bottom fishing opportunity. Price has continued to struggle along the 20-EMA. It has formed a bullish ascending triangle which suggests a breakout and a move to test overhead resistance at the June high. The RSI has just made it above net neutral. The OBV isn't all that pretty given that it has begun to challenge its tops from the April top and June top while price hasn't. I suspect it will take a lot of volume to turn this around. Keep an eye on this one if you test the waters. It's a 10% drop to the June low and that is a large percentage stop to take on.

The weekly PMO has just turned up in oversold territory. There was a previous 'fake out' move by the PMO. Another good reason to watch this carefully if you jump in or time it so that your stop won't be quite so deep.

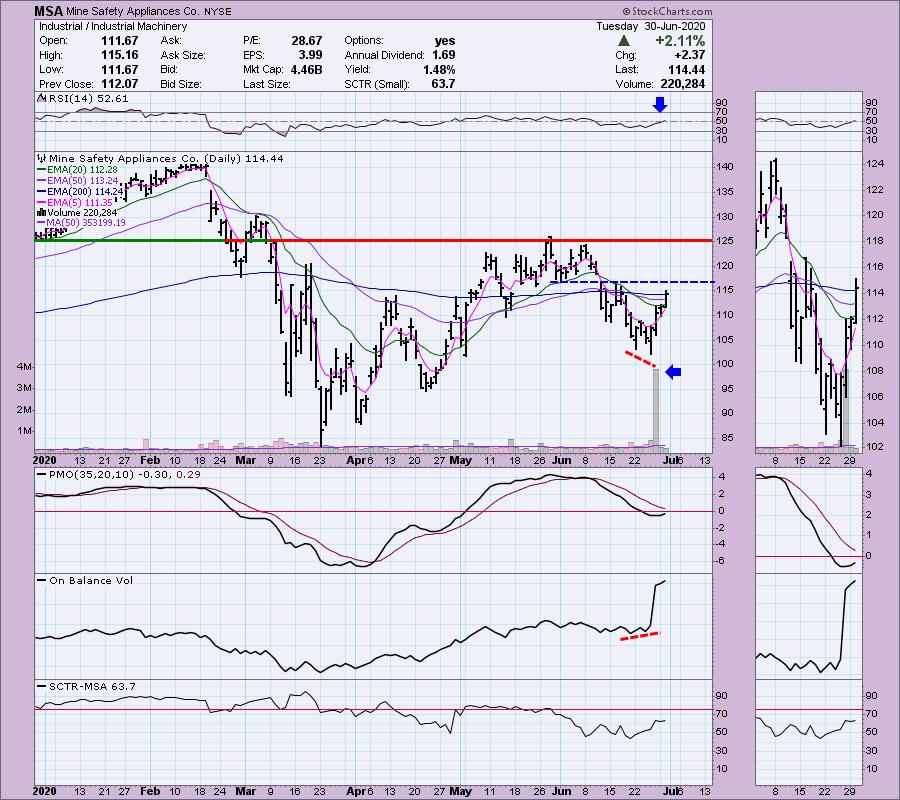

Mine Safety Appliances Co (MSA) - Earnings: 7/29/2020 (AMC)

MSA Safety, Inc. engages in developing, manufacturing, and sale of innovative products, which enhances the safety and health of workers and protect facility infrastructures. It operates through the following geographical segments: Americas, International, and Corporate. The Americas segment consists of manufacturing and research and development facilities in U.S., Mexico, and Brazil. The International segment comprises of companies in Europe, Middle East, Africa, and the Asia Pacific region.

This one is coming off a nice positive divergence with the OBV that generally precedes rallies. (You'll see the same OBV positive divergence on the SPX coming out of its bear market low.) Today it stayed almost exclusively above its 20-EMA. The PMO has started to rise just below the zero line. The RSI is now above net neutral and boy oh boy! The volume is coming in. The first challenge will be around $117. The strongest resistance will likely be at $125.

We did just see a PMO SELL signal, but it has already turned back up. Upside potential to the all-time high is considerable. But even a 12% gain at reaching the $125 area would be great.

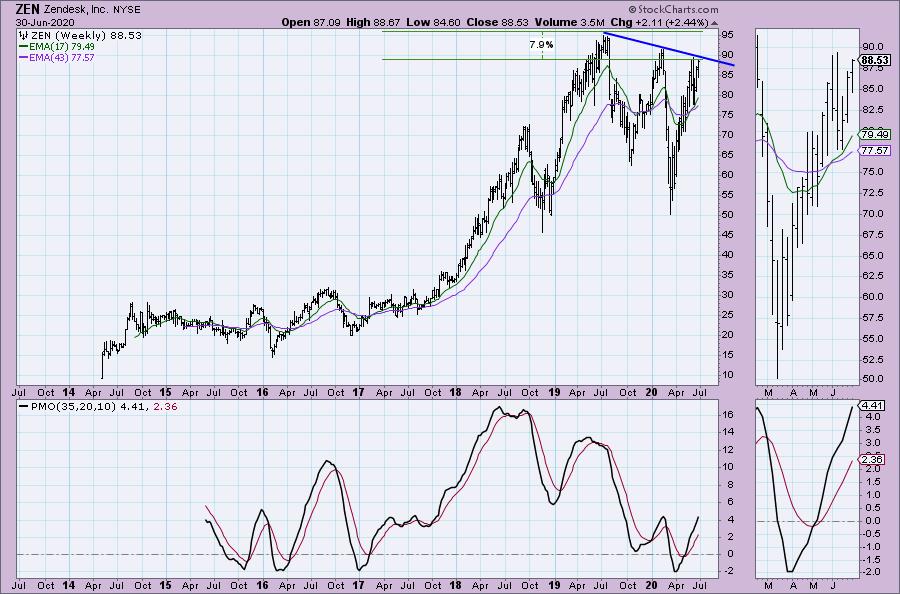

Zendesk Inc (ZEN) -Earnings: 7/28/2020 (AMC)

Zendesk, Inc. engages in the provision of customer service platform which enables companies to provide customer support. Its products and services include support; guide; chat; talk; message; inbox team email; explore; connect plus outbound; integrations and apps; embeddables; insights and analytics; and products update. Its also features ticketing system; community forums; help desk software; IT help desk; security; and tech specs.

Here we have another OBV positive divergence that came before the rally back into the trading zone. Given the PMO and strong SCTR and RSI, I am looking for a breakout to new all-time highs. Software still continues to be a top performer.

A nicely rising weekly PMO on a BUY signal that is oversold gives ZEN a very nice outlook for the intermediate term. I would like to see a breakout from the declining tops trendline.

Current Market Outlook:

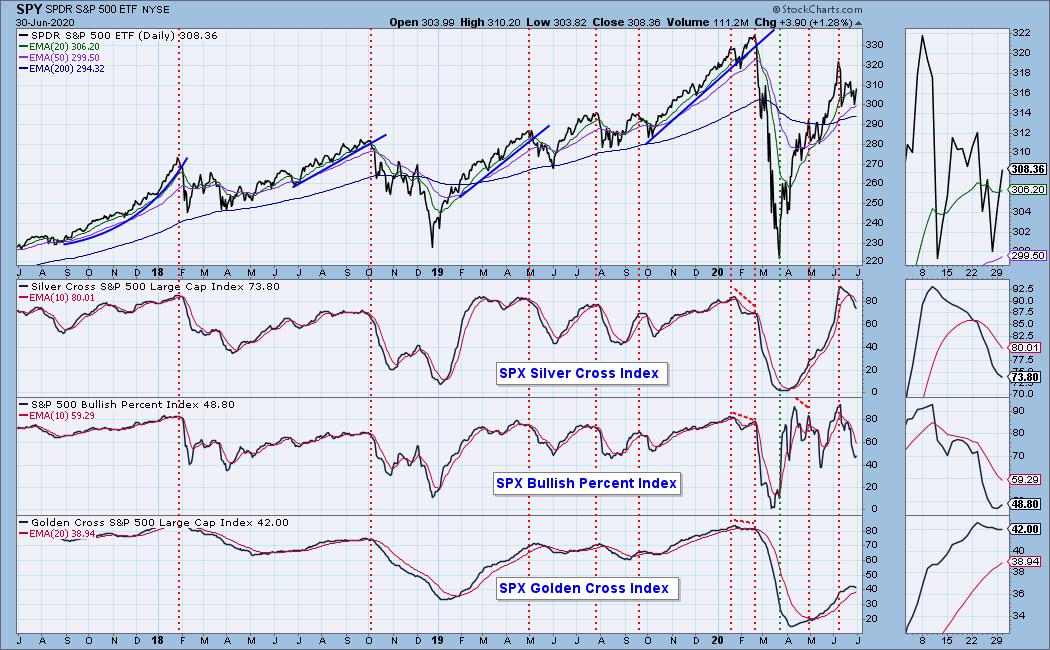

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 14

- Diamond Dog Scan Results: 1

- Diamond Bull/Bear Ratio: 14.0

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I'm considering adding TLT to my portfolio as a bit of a hedge right now. I'm about 50% invested right now.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!f