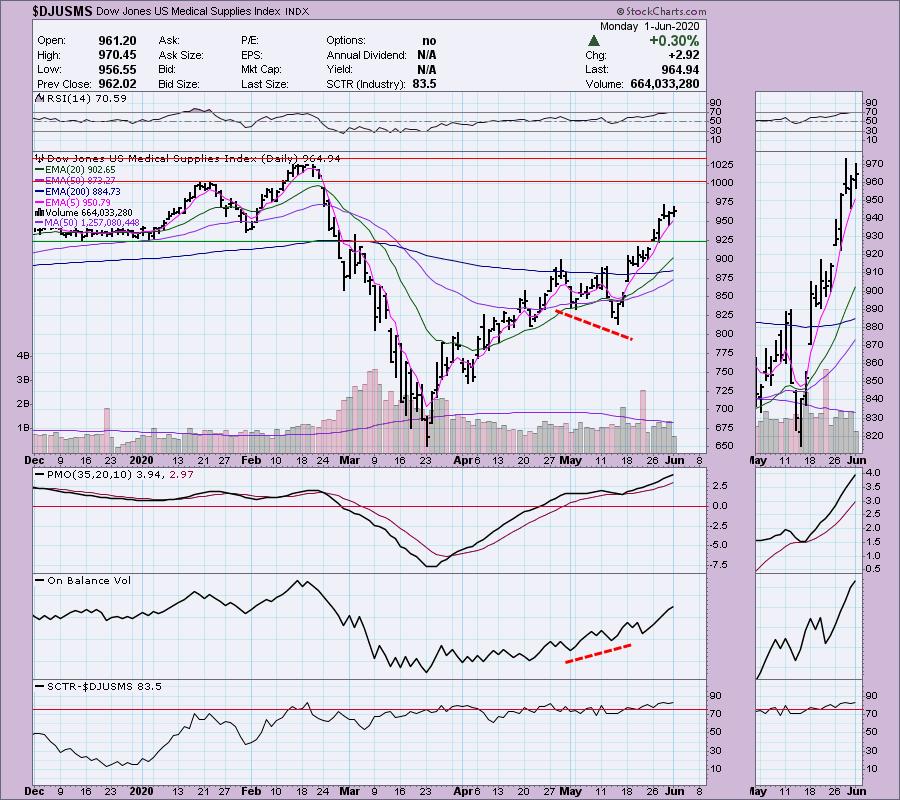

I noticed today that a few medical supply companies came up in the scans today along with the Health Care ETF (XLV). XLV came in last today among the SPX Sectors as investors likely take profits and relocate funds to some of the more beaten down areas of the market that are picking up. The scans may be picking up on something below the surface as investors may find themselves moving back into that sector based on coronavirus news. I wish I'd seen this chart of the DJUS Medical Supplies Index ($DJUSMS) back in mid-May when we saw the gap up. The OBV had set up a nice positive divergence and it continued higher after the gap. At this point it does appear that momentum is going to carry this industry group to test all-time highs. I've included a Medical Supply company in today's Diamonds as well as a Medical Equipment stock.

** Announcements **

I will be traveling July 1 - July 15. I will be writing on the road, but broadcasting will be suspended during that time. It's going to be an adventurous road trip for me and my husband. We will be taking a train from Los Angeles to New Orleans, visiting family, checking out retirement areas and then renting a car and making our way back to California with various stops along the way. I'll be sure to post a picture or two and I'm sure I'll have funny stories to share along the way. It'll be interesting to see the various stages of the reopening of America.

A heads up to Bundle subscribers, the LIVE Trading Room will be going on hiatus as Mary Ellen will also be out of pocket in the upcoming month. We hope to reopen in late-July. If you recently upgraded to get the Trading Room, I do hope you'll continue the subscription while we are on hiatus. Please direct questions to erin@decisionpoint.com.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

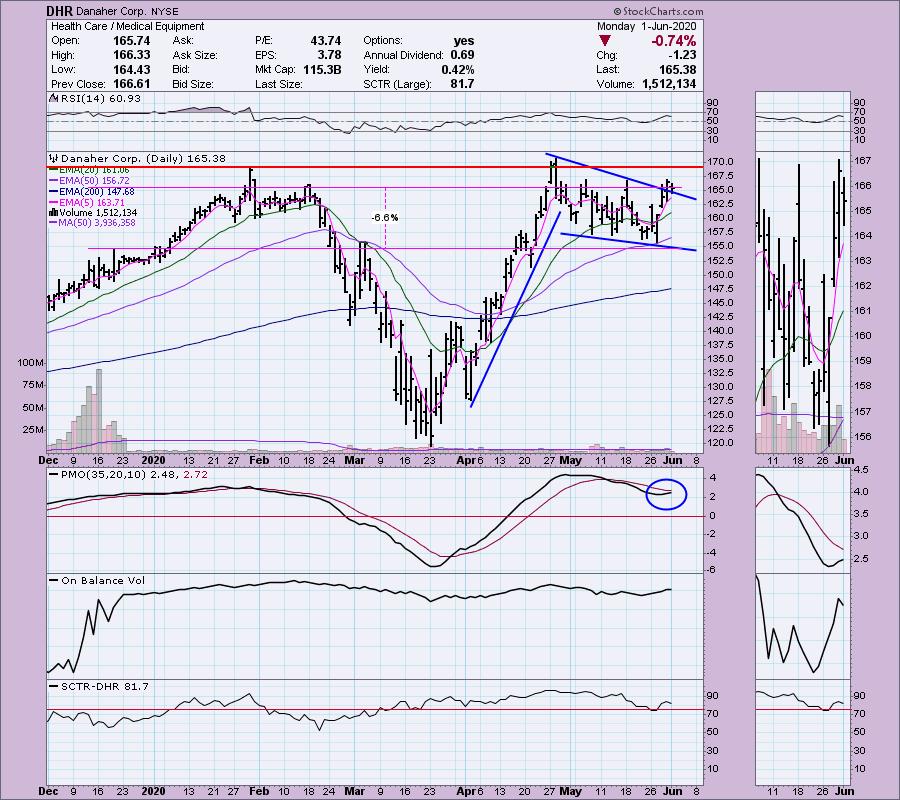

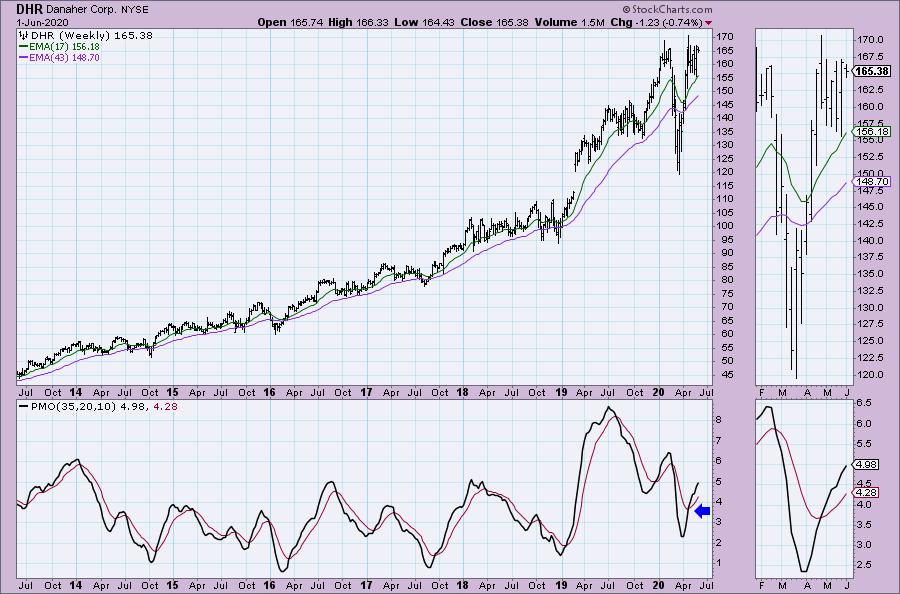

Danaher Corp (DHR) - Earnings: 7/30/2020 (AMC)

Danaher Corp. operates as a medical company, which designs, manufactures, and markets professional, medical, industrial and commercial products and services. It operates through the following segments: Life Sciences, Diagnostics, and Environmental & Applied Solutions. The Life Sciences segment offers a range of research tools that scientists use to study the basic building blocks of life, including genes, proteins, metabolites and cells, in order to understand the causes of disease, identify new therapies and test new drugs and vaccines. The Diagnostics segment comprises of analytical instruments, reagents, consumables, software, and services that hospitals, physician's offices, reference laboratories, and other critical care settings use to diagnose disease and make treatment decisions. The Environmental & Applied Solution segment offers products and services that help protect important resources and keep global food and water supplies safe.

As I noted in my intro, Health Care is coming up on my scans despite that sector ETF (XLV) being one of only two sectors to decline today (Technology XLK being the other). DHR has one of the highest SCTR ranks in the Medical Equipment space and we had a pullback today that didn't move back below the declining tops trendline. The RSI is above net neutral. If you look at the OBV, today's tick down tells you that while DHR fell today, it wasn't that harmful in regards to volume. The previous week, positive volume was heavy. The pattern dominating the chart is a bullish flag formation. If we get a continuation of this breakout (preferably above the April top), the upside target would be the length of that flag pole added to the breakout point or roughly $220. I make no promises that it'll reach that level, but it does look like DHR will be breaking to new all-time highs sooner rather than later.

The weekly PMO is on a BUY signal and you can see that giant flag coming out of the bear market low.

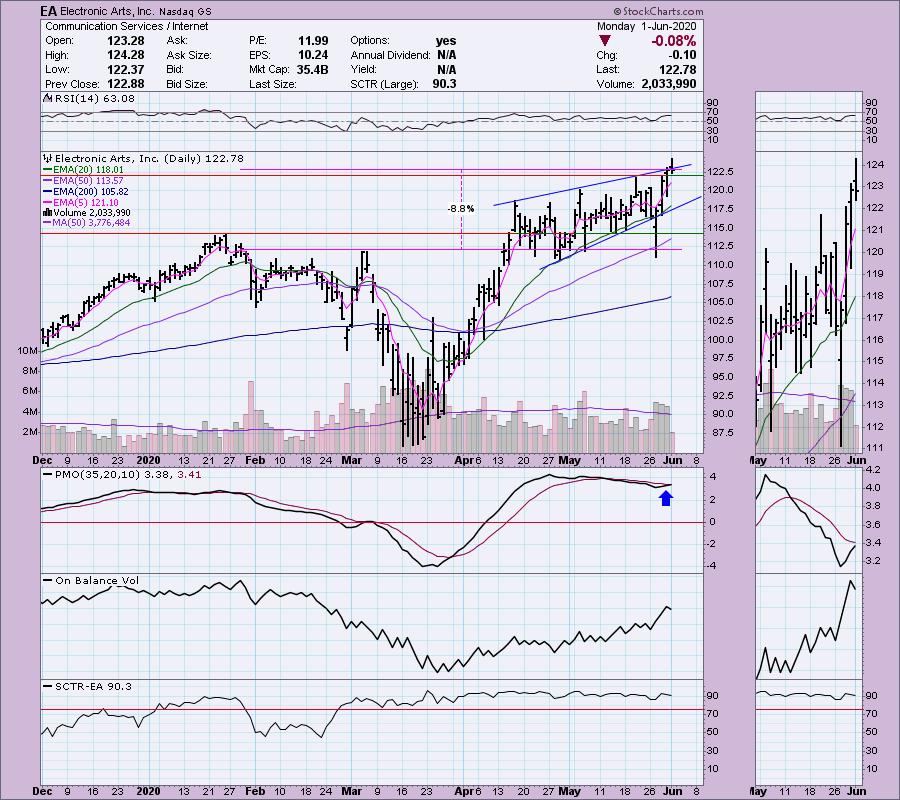

Electronic Arts Inc (EA) - Earnings: 7/30/2020

Electronic Arts, Inc. develops, markets, publishes, and distributes games, content, and services for game consoles, PCs, mobile phones, and tablets worldwide. The company develops and publishes games and services across various genres, such as sports, first-person shooter, action, role-playing, and simulation primarily under the Battlefield, The Sims, Apex Legends, Anthem, Need for Speed, and Plants v. Zombies brands; and license games, including FIFA, Madden NFL, and Star Wars brands. It also provides advertising services; licenses its games to third parties to distribute and host its games. The company markets and sells its games and services through digital distribution channels, as well as through retail channels, such as mass market retailers, electronics specialty stores, and game software specialty stores.

Right now EA is breaking out of a bearish rising wedge. A bullish conclusion out of a bearish pattern is especially bullish. The PMO is now rising up to trigger a BUY signal. The RSI is healthy above net neutral (50). OBV bottoms have been rising since late April. This is another stock that fell today but on very light volume in comparison to the positive volume building up on the accumulation phase.

EA has plenty of upside potential and is on a weekly PMO BUY signal.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

ICU Medical Inc (ICUI) - Earnings: 8/5/2020 (AMC)

ICU Medical, Inc. engages in the development, manufacture, and sale of innovative medical devices used in vascular therapy and critical care applications. Its product portfolio includes intravenous smart pumps, sets, connectors, closed transfer devices for hazardous drugs, cardiac monitoring systems, IV solutions, IV smart pumps with pain management and safety software technology, dedicated and non-dedicated IV sets and needle-free connectors.

Here is a medical supply company that is rallying nicely and has a PMO that is ready to confirm on a crossover BUY signal. OBV bottoms have been rising with price lows. The SCTR isn't great, but it isn't horrible either. The RSI just pressed past 50. I have a stop set at the February low that I've marked with an arrow. The pink arrow shows you the new ST Trend Model BUY signal that was triggered by a 5/20-EMA crossover.

The weekly PMO has just turned up. Upside targets could be set at various levels.

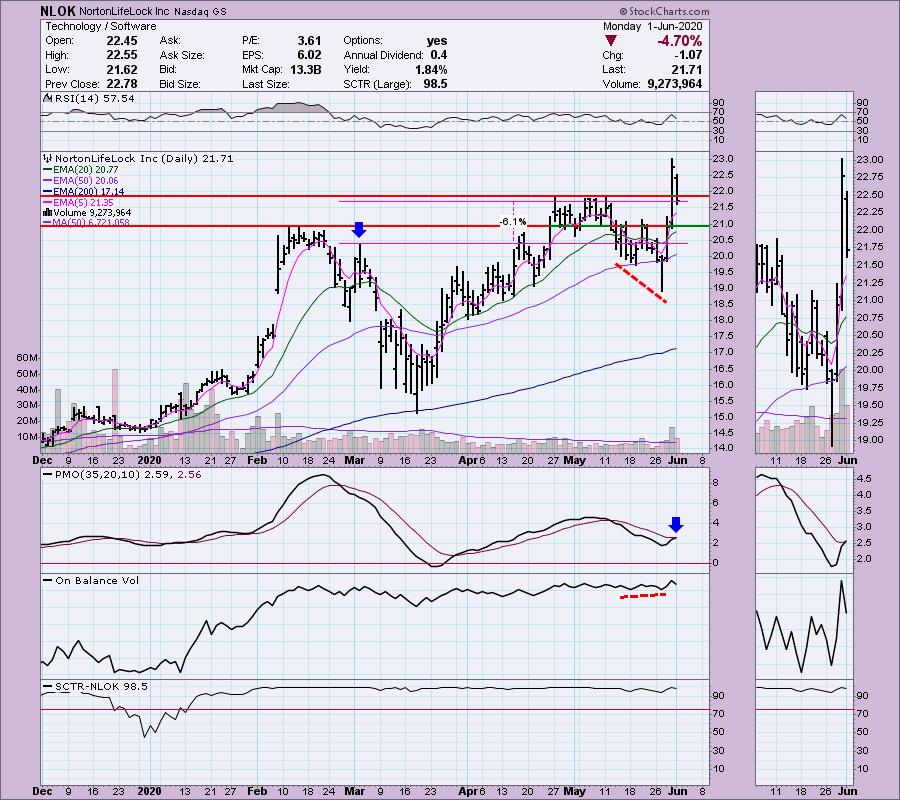

NortonLifeLock Inc (NLOK) - Earnings: 8/6/2020 (AMC)

NortonLifeLock, Inc. engages in the provision of security, storage, and systems management solutions. It operates through Enterprise Security and Consumer Digital Safety segments. The Enterprise Security segment focuses on the provision of solutions to protect organizations so they can securely conduct business while leveraging new platforms and data. The Consumer Digital Safety segment provides solutions to protect information, devices, networks and the identities of consumers.

Giant pullback on NLOK. I think it makes it more interesting given it mostly held support at the April/May tops. Notice we got a new PMO BUY signal today. There was a clear positive divergence on the OBV when the rally got started. This could be one to watch and see if it pulls back more tomorrow. You'll want support to hold at the February tops.

The weekly PMO is overbought, but it is rising.

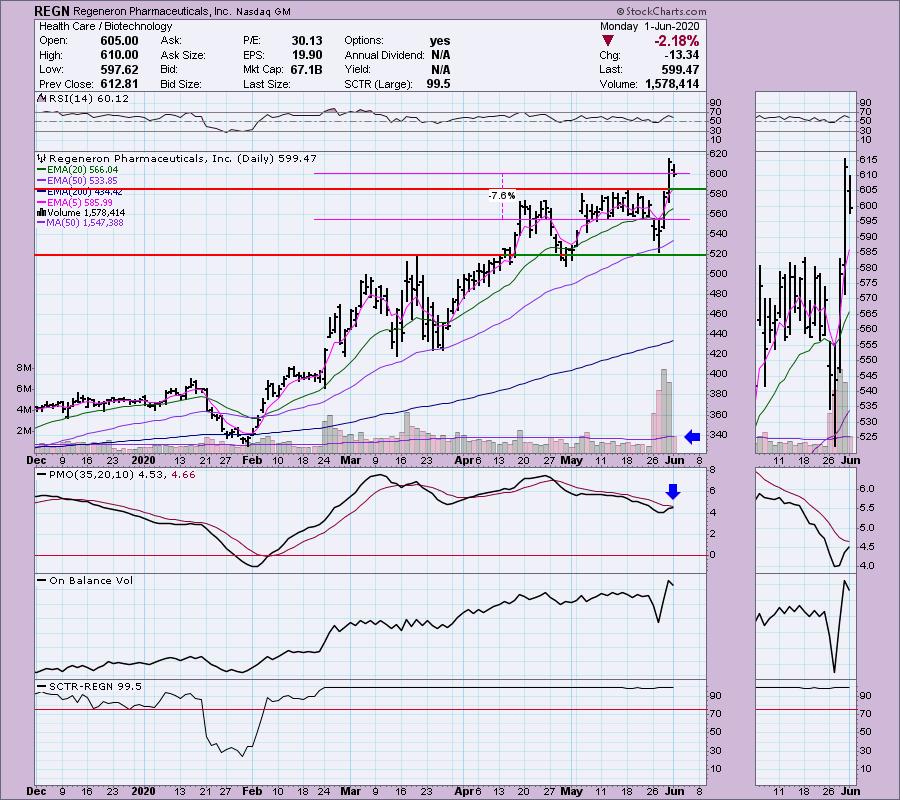

Regeneron Pharmaceuticals Inc (REGN) - Earnings: 8/4/2020 (BMO)

Regeneron Pharmaceuticals, Inc. is a biotechnology company, which engages in the discovery, invention, development, manufacture, and commercialization of medicines. It product portfolio includes the following brands: EYLEA, Dupixent, Praluent, Kevzara, Libtayo, ARCALYST, and ZALTRAP.

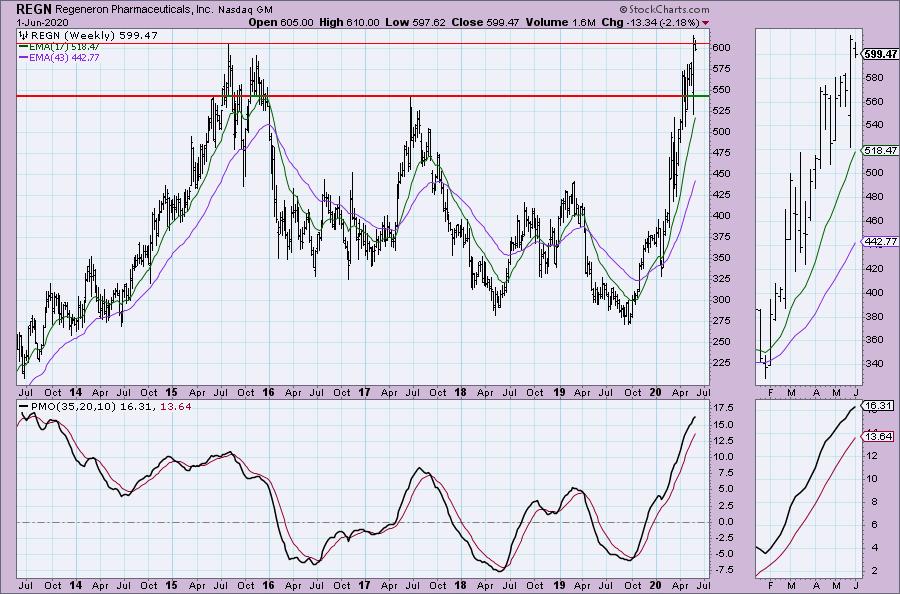

I own this one and while I didn't like today's hit on price, I am still looking for REGN to turn back around. The PMO is nearing a crossover BUY signal. The RSI is healthy above 50 and the SCTR tells us that REGN is part of the cream of the crop of large-cap stocks. While we did get that big pullback today, notice that selling volume didn't get much past its 50-MA. I plan on holding this one. My line in the sand will be $580. I want to preserve the profit I have on it.

I suspect today's pullback was due to reaching overhead resistance at the all-time high. The PMO is very healthy so I am expecting a breakout to new all-time highs.

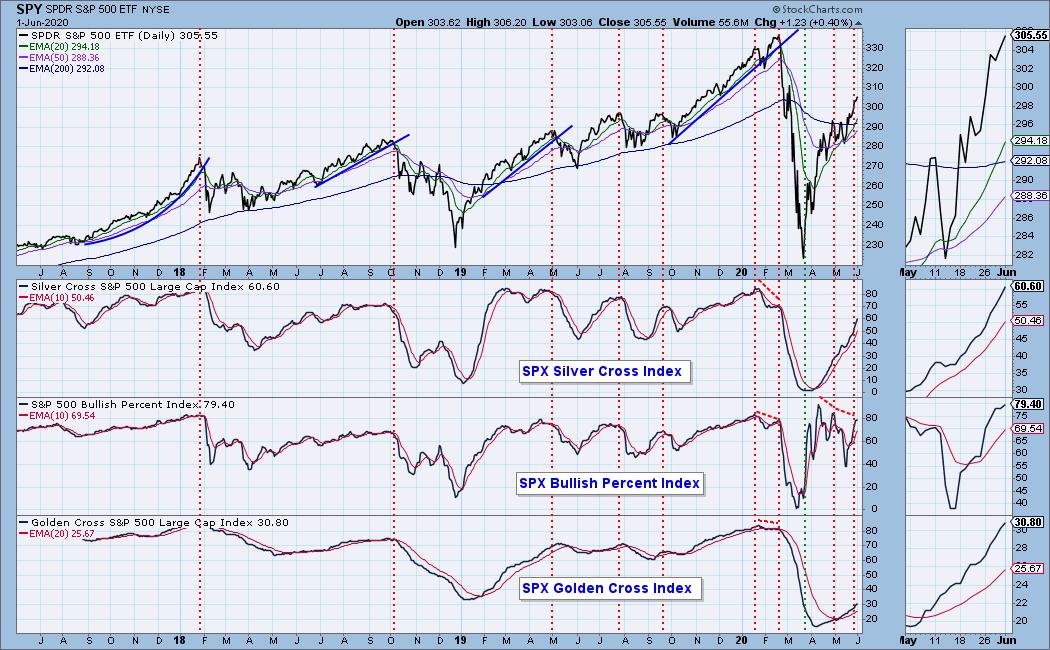

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 14

- Diamond Dog Scan Results: 18

- Diamond Bull/Bear Ratio: 0.78

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I currently own REGN. I'm closing out two positions tomorrow, IBB and HD. I've got a good profit and those charts are looking unfavorable. I'm entering KO and SBUX tomorrow if my limit is reached. I am currently 75% in cash.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!