We just got home about an hour ago but I was able to find a few Diamonds for you to consider. I'll be putting together my closing diary for Wednesday's articles. Suffice it to say that the Grand Canyon was life-changing. If you haven't experienced it, you MUST! I can give you some helpful hints based on our experience. I never took my kids, but this year that will change. I'm so surprised by how close it is. Saddle up for these five diamonds in the rough that came from a scan that selects Bullish EMA configurations and a mid-range StockCharts Technical Rank (SCTR).

** Announcements **

I am traveling July 1 - July 15. I will be writing on the road, but broadcasting will be suspended during that time. It's going to be an adventurous road trip for me and my husband. We will be taking a train from Los Angeles to New Orleans, visiting family, checking out retirement areas and then renting a car and making our way back to California with various stops along the way. I'll be sure to post a picture or two and I'm sure I'll have funny stories to share along the way. It'll be interesting to see the various stages of the reopening of America.

A heads up to Bundle subscribers, the LIVE Trading Room will be going on hiatus as Mary Ellen will also be out of pocket in the upcoming month. We hope to reopen in late-July. Please direct questions to erin@decisionpoint.com.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Smith AO Corp (AOS) - Earnings: 7/30/2020 (BMO)

A. O. Smith Corp. manufactures residential and commercial water heating equipment and air purification products. It operates through the following two segments: North America and Rest of World. The North America segment manufactures and markets comprehensive lines of residential and commercial gas and electric water heaters, boilers, tanks. The Rest of World segment comprises of China, Europe, and India; and manufactures and markets water treatment products.

This was the first chart I opened today and I immediately saw a reverse head & shoulders pattern. It broke out and executed the bullish head and shoulders today. The minimum upside target of that pattern would bring price well above the June top. The RSI is positive and the PMO is about to trigger a crossover BUY signal. I would set my spot at the 50-EMA, although I would probably dump it sooner if it turned the wrong way and took the PMO with it.

Upside potential is sizable and the PMO is rising strongly.

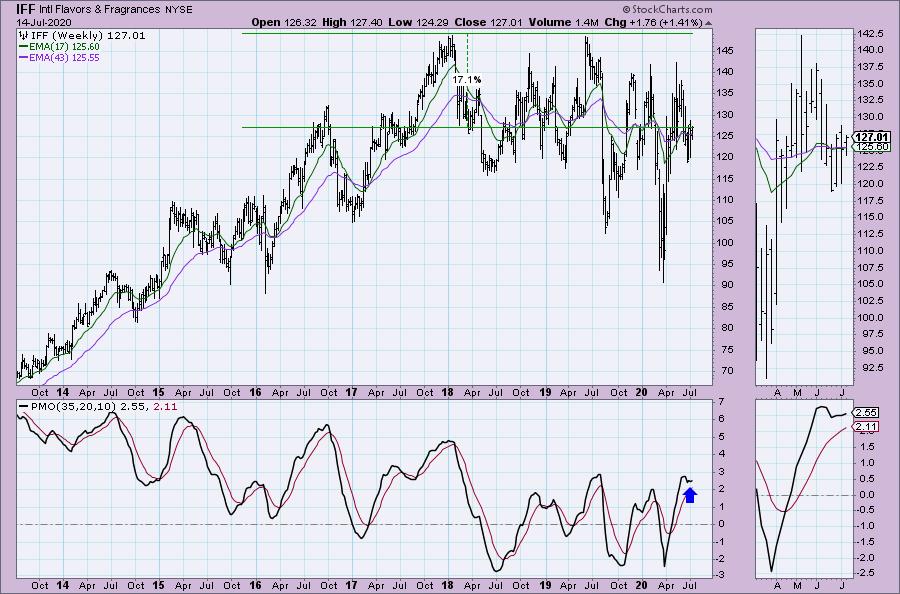

Intl Flavors & Fragrances (IFF) - Earnings: 8/3/2020 (AMC)

International Flavors & Fragrances, Inc. engages in the manufacture and supply of flavors and fragrances used in the food, beverage, personal care, and household products. It operates through Taste and Scent segments. The Taste segment is sold to the food and beverage industries for use in consumer products such as prepared foods, beverages, dairy, food, and sweet products. The Scent segment comprises of fragrance compounds, fragrance ingredients, and cosmetic active ingredients.

I liked the double-bottom on this one. Materials had a good day and I suspect that was why so many landed in the scan results. I liked this one best. You can set a reasonable stop. It just barely broke above the declining tops trendline. The RSI did go positive today and the OBV bottoms are rising with price.

The weekly PMO is turning around and upside potential is pretty good.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

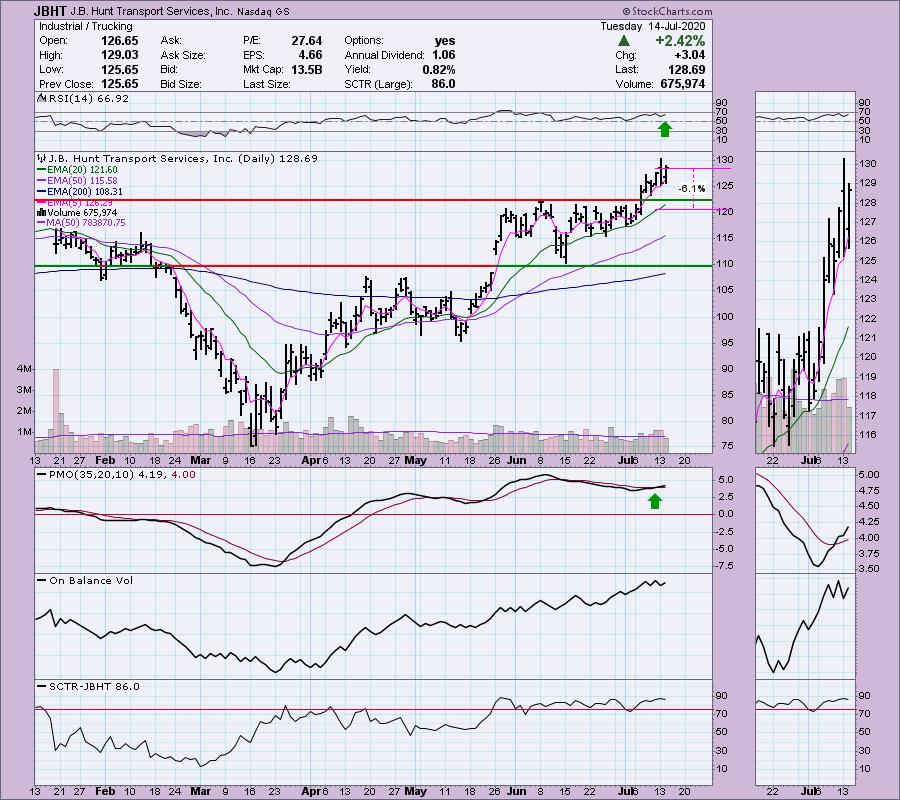

J.B. Hunt Transport Services Inc (JBHT) Earnings: 7/16/2020 (AMC)

J.B. Hunt Transport Services, Inc. engages in the provision of logistics solutions. It operates through the following segments: Intermodal (JBI), Dedicated Contract Services (DCS), Integrated Capacity Solutions (ICS), and Truckload (JBT). The JBI segment offers intermodal freight operations for rail carriers. The DCS segment includes private fleet conversion and final-mile delivery services. The ICS segment provides a single-source logistics management for clients who intends to outsource their transportation activities. It offers flatbed, refrigerated, expedited, less-than-truckload, dry-van, and intermodal freight services. The JBT segment is responsible for full-load, dry-van freight that is transported via roads and highways.

Truckers have begun to outperform. JBHT is not an exception. The PMO has just triggered a PMO BUY signal, the RSI is positive and the SCTR is in the hot zone. We can see that there are no reverse divergences with the OBV, in fact it is currently confirming the rally.

It's already making new all-time highs. The PMO suggests it will make more.

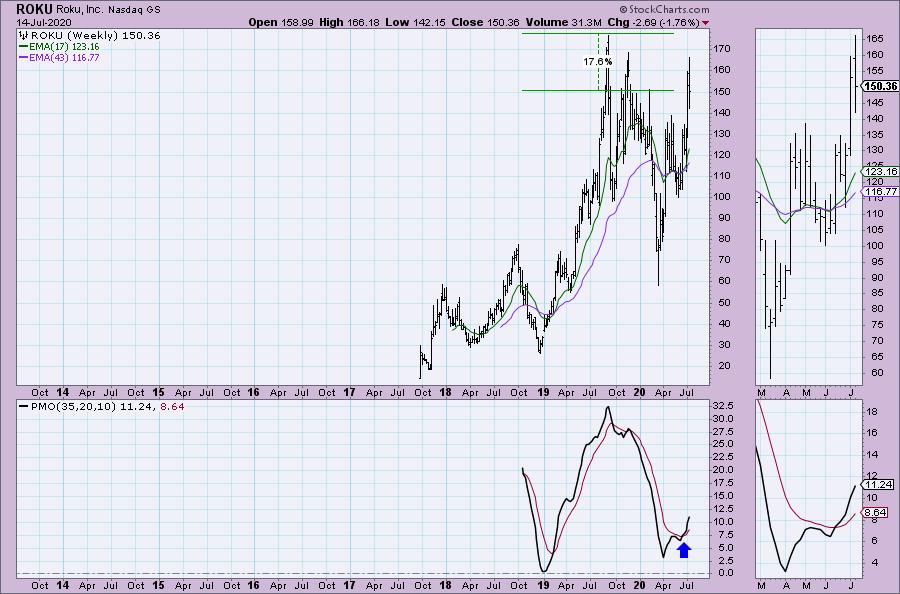

Roku Inc (ROKU) - Earnings: 8/5/2020 (AMC)

Roku, Inc. engages in the provision of a streaming platform for television. It operates through the following business segments: Player and Platform. The Player segment consists of net sales of streaming media players and accessories through retailers and distributors, as well as directly to customers through the company's website. Its Roku platform allows users to personalize their content selection with cable television replacement offerings and other streaming services that suit their budget and needs. Its product categories include advertising, Roku TVs and Streaming Players.

I like the pullback on ROKU. This is a pretty strong company and a favorite of many Technology investors. The PMO is rising nicely even with yesterday's big decline. The OBV and RSI are confirming and the SCTR is in the hot zone above 75.

Nice upside potential and an even nicer looking PMO.

T. Rowe Price Associates Inc (TROW) -Earnings: 7/29/2020 (BMO)

T. Rowe Price Group, Inc. is a financial services holding company, which engages in the provision of investment management services through its subsidiaries. It provides an array of company sponsored U.S. mutual funds, other sponsored pooled investment vehicles, sub advisory services, separate account management, recordkeeping, and related services to individuals, advisors, institutions, financial intermediaries, and retirement plan sponsors.

TROW just had a symmetrical triangle resolve to the upside. That could be a pennant on a flagpole. The RSI is now positive but not overbought and the PMO is reaching up for a crossover BUY signal. The SCTR just popped back into the hot zone above 75.

The weekly PMO is on a BUY signal and new all-time highs should not be a problem.

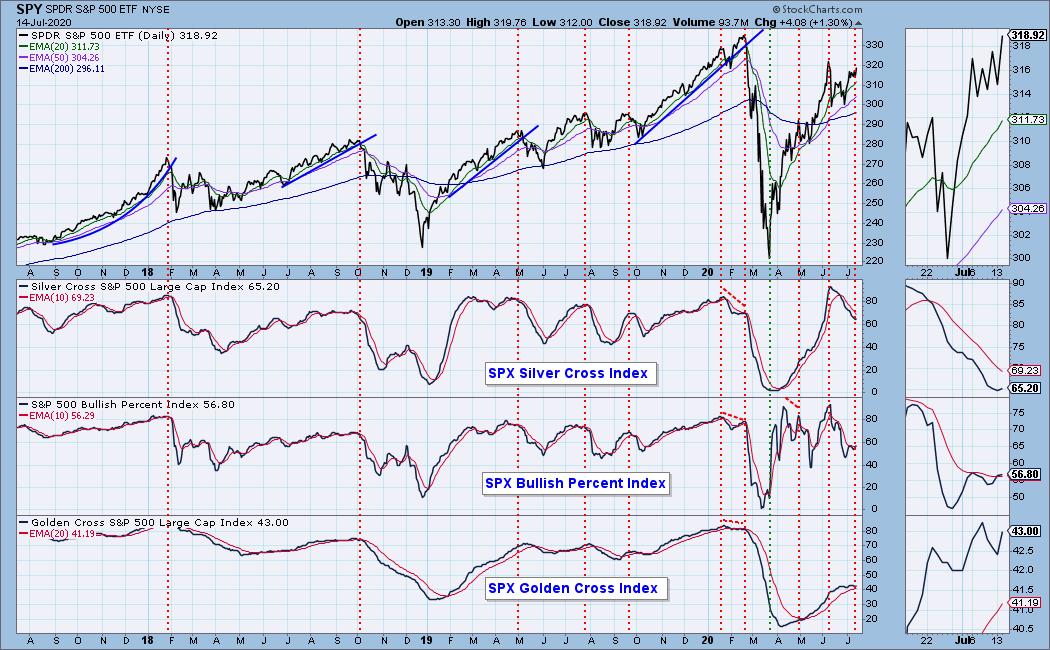

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 7

- Diamond Dog Scan Results: 5

- Diamond Bull/Bear Ratio: 1.40

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I'm about 50% invested right now.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!