Reader requests came in early for the most part so many of the stocks selected may've run their course. I decided I'd add a new Diamond of my own today just to round it out. Thanks to Olivia, George, Stephane and Brandon for your suggestions! Today was a down day and those are never fun, but it has opened up more interesting entries on some of these stocks.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

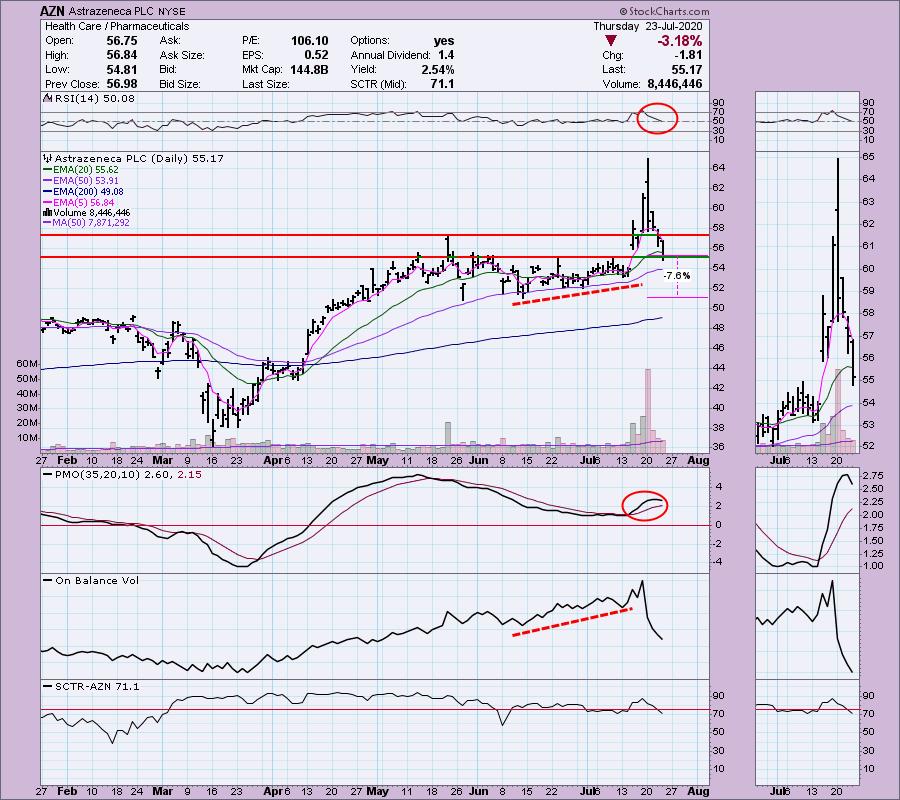

Astrazeneca PLC (AZN) - Earnings: 7/30/2020 (BMO)

AstraZeneca Plc is a holding company, which engages in the research, development, and manufacture of pharmaceutical products. Its pipeline are used for the following therapy areas: oncology, cardiovascular, renal, metabolism, and respiratory.

This request actually came in for last week's Diamond Report just after the gap up. I liked the set-up. At this point, the trade is going south. It is holding on support at $55 so this could offer an entry. I just prefer to start a new investment with momentum moving higher not lower. The RSI tumbled with price, but has remained positive which could tell us that a rebound is possible. The volume on the decline was substantial and that is generally a sign to bail. If you do want to get in, I would set the stop at the June low. Note that price did close below the 20-EMA. It's attempting to close the gap.

The weekly PMO is faltering but still rising. Looking at the rising bottoms trendline, price is just now up against it so this could be the time for a bounce; I'm just not thrilled with the daily chart.

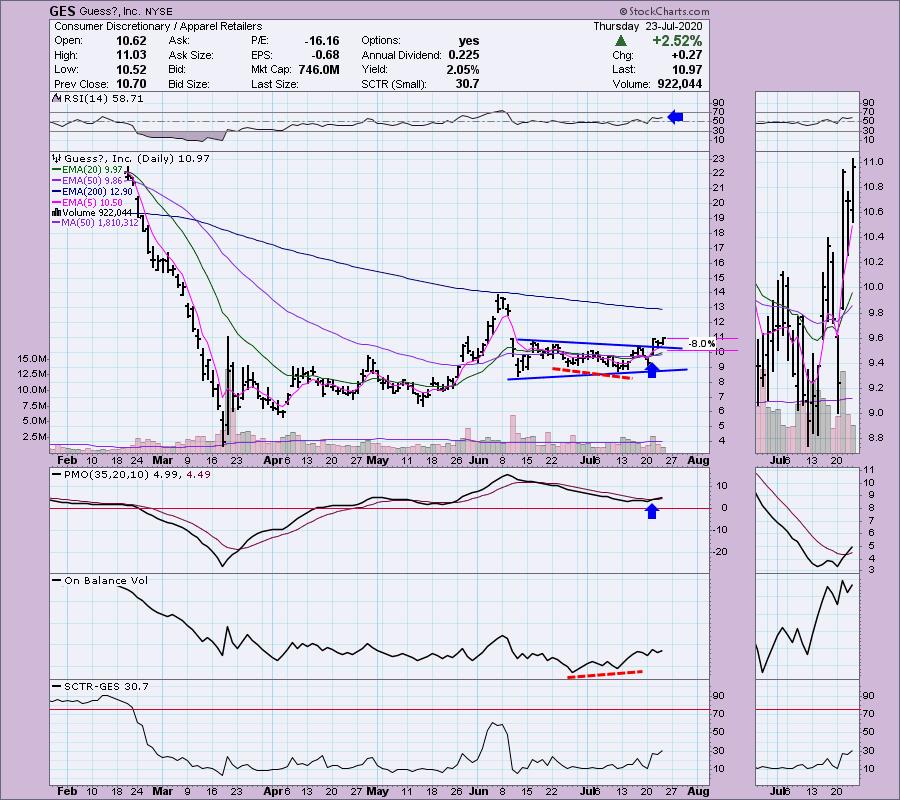

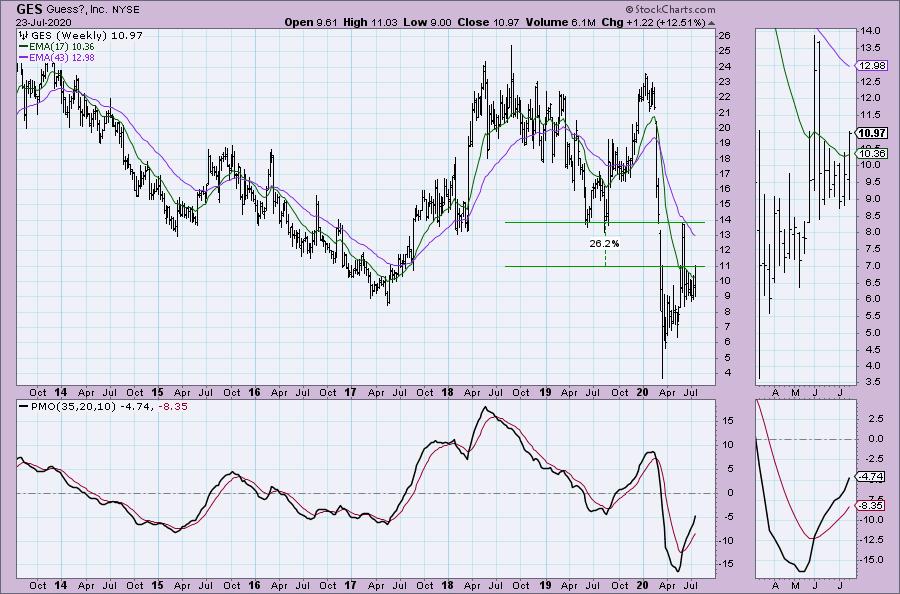

Guess? Inc (GES) - Earnings: 8/26/2020 (BMO)

Guess?, Inc. engages in designing, marketing, distributing and licensing of contemporary apparel and accessories for men, women and children that reflect the American lifestyle and European fashion sensibilities. It operates through the following segments: Americas Retail, Americas Wholesale, Europe, Asia, and Licensing. The Americas Retail segment includes the Company's retail and e-Commerce operations in North and Central America and its retail operations in South America. The Americas Wholesale segment consists of the Company's wholesale operations in the Americas. The Europe segment comprises the Company's retail, e-commerce and wholesale operations in Europe and the Middle East. The Asia segment refers to the Company's retail, e-commerce and wholesale operations in Asia and the Pacific. The Licensing segment includes the worldwide licensing operations of the Company.

I'm not a fan of Consumer Discretionary stocks right now, but this one looks pretty good. We are getting a decisive (+3% move) breakout from the symmetrical triangle. The 20-EMA has just crossed above the 50-EMA for a "silver cross" IT Trend Model BUY signal. The PMO just generated a BUY signal and the RSI is healthy. Notice that a positive OBV divergence was a launch for this current rally. I would set a stop around the 20-EMA.

Upside potential looks fabulous, as does the weekly PMO. Upside potential is sizable even if it can just reach overhead resistance around the 2019 lows.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

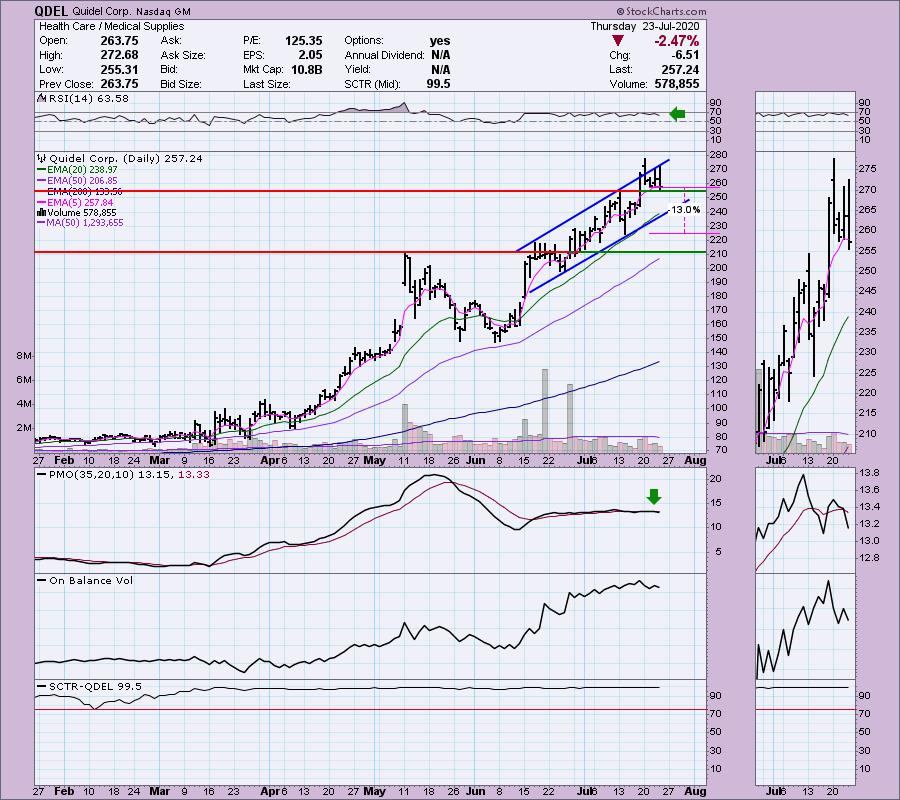

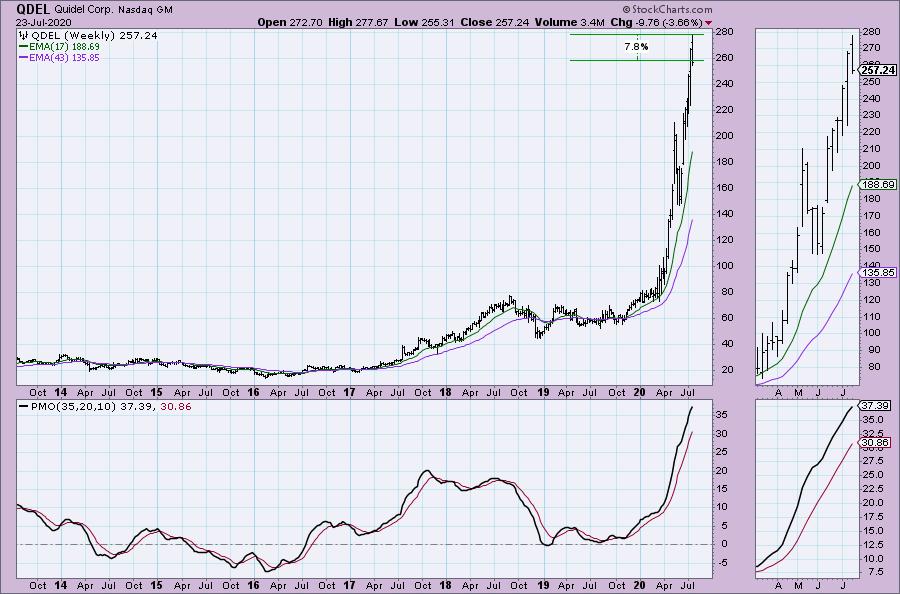

Quidel Corp (QDEL) - Earnings: 7/30/2020 (AMC)

Quidel Corp. engages in the development, manufacture and market of rapid diagnostic testing solutions. Its portfolio includes rapid immunoassays, cardiac immunoassays, specialized diagnostic solutions and molecular diagnostic solutions. The products are directly sold to end users and distributors and for professional use in physician offices, hospitals, clinical laboratories, reference laboratories, urgent care clinics, universities, retail clinics, pharmacies and wellness screening centers.

QDEL is up 2.63% in after hours trading which could virtually extinguish today's losses. This one is in a nice rising trend and has now pulled back to support at the mid-June top. The RSI is positive and OBV bottoms are confirming the rising trend. The problem is the PMO SELL signal that generated today. I wouldn't necessarily tell you to not get into this one based solely on that. The PMO has been flat as the acceleration has been nil. Right now the PMO whipsawing. If price holds support here, which after hours trading implies, it could be an interesting pick up.

From here the all-time high is about 7.5% away. The PMO looks perfectly healthy. Price action however is vertical and that can be dangerous. I'd be sure to set a hard stop.

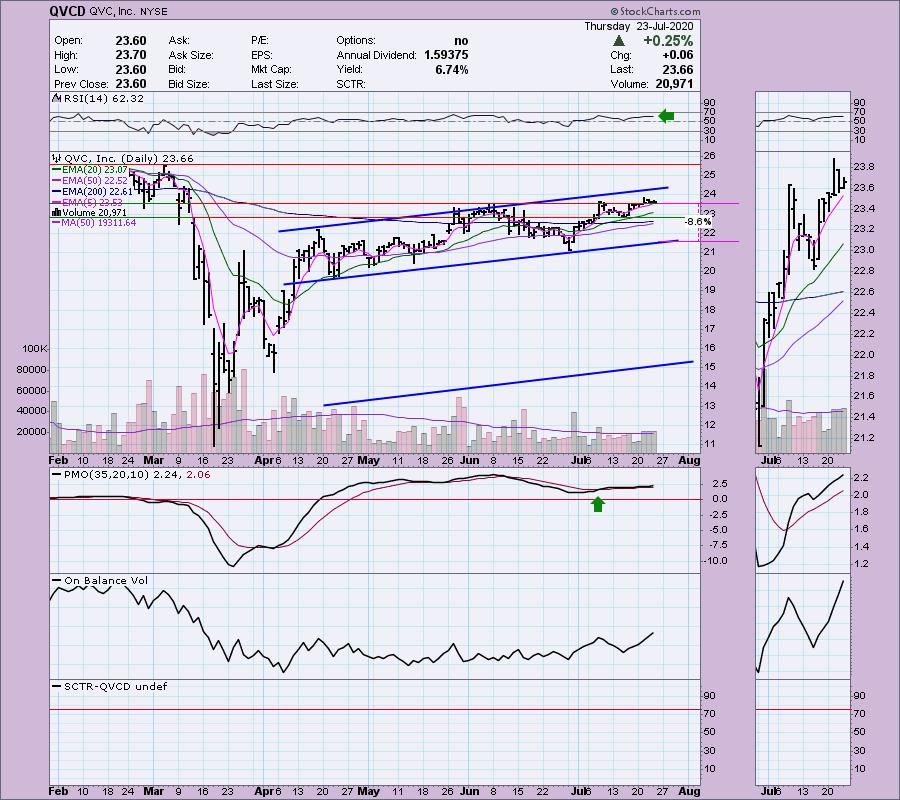

QVC Inc (QVCD) - Earnings: N/A

QVC was founded in 1986 by Joseph Segel, an entrepreneur who saw an opportunity to create a new and engaging shopping experience through television broadcasts. He named the company QVC to represent its three guiding principles: Quality, Value, and Convenience. These values were created to build trust with consumers, creating lifetime, avid fans.

This is highly liquid given the very low volume, so be aware of that. I prefer to trade stocks that have a higher average daily volume to prevent getting caught in speculative moves. However, after that, the stock chart looks good. The RSI is positive and the OBV bottoms are rising with price. The 50-EMA is nearing a golden cross with the 200-EMA for a nice LT BUY signal. It's been a gently rising trend channel and could be ready to move lower toward the bottom of the channel.

I like the weekly PMO. It would be a nice 9.4% gain if price can get back to all-time highs.

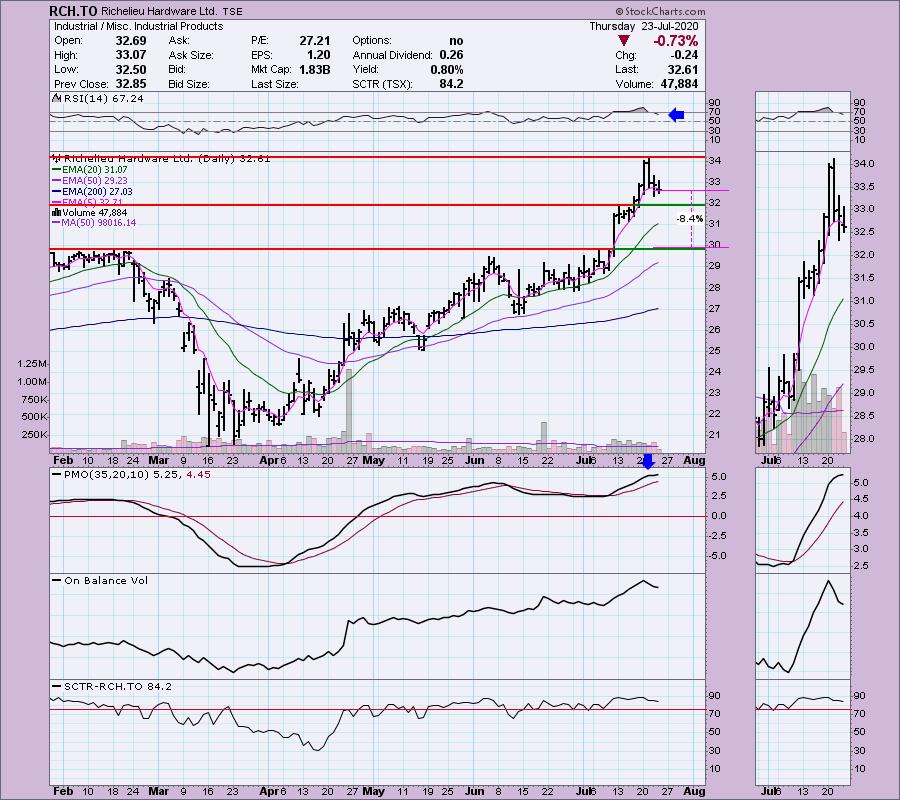

Richelieu Hardware Ltd (RCH.TO) - Earnings: 8/19/2020 (BMO)

Richelieu Hardware Ltd. engages in the import, distribution and manufacture of specialty hardware and complementary products. Its products include decorative hardware, screws and fasteners, general hardware, furniture equipment, hinges, slides and opening systems, kitchen and bathroom accessories, closet and storage, lighting hardware and accessories, sinks, wash basins and faucets, office accessories, glass hardware, commercial display hardware, surfaces, panels and edge banding, custom-made cabinet doors and drawers, moldings, corbels and wood components, glues, silicones and caulking, tools and shop supplies, abrasive and finishing products.

Not a great day for Richelieu, but now the RSI isn't overbought which is a plus. The PMO is topping in overbought territory which could signal further pullback. I would look for a possible entry closer to $32, but that would guarantee getting in while the PMO is moving toward a SELL signal. If you're holding it, set a stop around $30 support, although I might adjust that upward depending on where I entered.

Upside potential is okay, but it doesn't have to stop at all-time highs. In the intermediate term the PMO looks a lot better, but we do have another near vertical rising trend and those are very difficult to maintain.

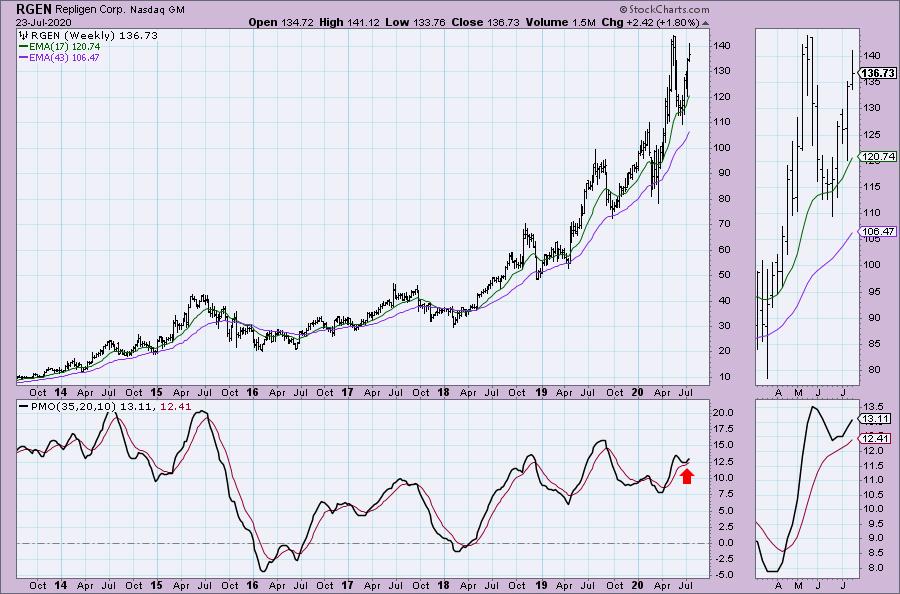

Repligen Corp (RGEN) - Earnings: 7/30/2020 (BMO)

Repligen Corp. provides advanced bioprocessing technologies and solutions used in the process of manufacturing biologic drugs. The firm serves through the following product lines: Chromatography; Filtration; and OEM Products (Proteins). The Chromatography product line includes a number of products used in the downstream purification and quality control of biological drugs. The Filtration products offer a number of advantages to manufacturers of biologic drugs at volumes that span from pilot studies to clinical and commercial-scale production. The OEM products are represented by Protein A affinity ligands, which are a critical component of Protein A chromatography resins used in downstream purification, and cell culture growth factor products.

This is my pick for you today. I thought about including a Gold Miner because they are still showing up in my scan results but they have started to get overbought. Biotechs and Health Care seem to be surging again. RGEN showed up on my scan today. It is in a nice rising trend. Setting a stop is a bit tricky given support areas, but you could set a tighter stop at around $130 instead of the area I've annotated. The RSI is positive and the PMO is rising and not overbought after bottoming above the zero line. You can see the OBV positive divergence that preceded this rally. Overhead resistance is nearing, but the indicators suggest to me it will overcome.

The current move is near vertical and if we turn down at all-time highs that would set up a double-top. For now seeing a weekly PMO bottom above the signal line is very bullish. I think it will run higher.

Current Market Outlook:

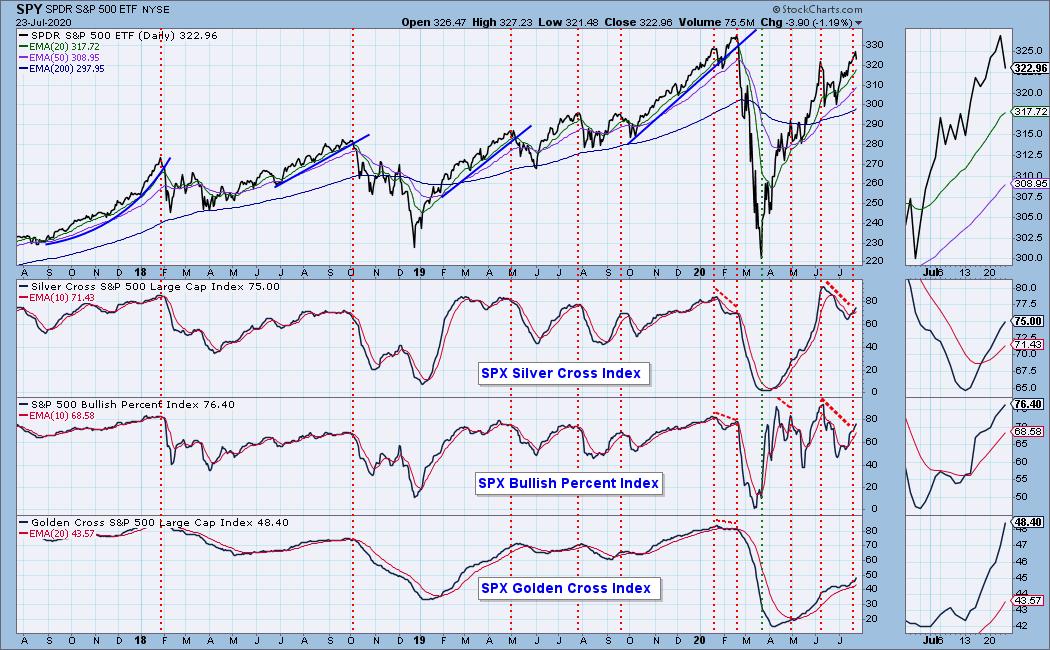

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 11

- Diamond Dog Scan Results: 7

- Diamond Bull/Bear Ratio: 1.57

Full Disclosure: I am considering RGEN for my portfolio. No recent additions or subtractions to report. I'm about 65% invested right now. 35% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

ANNOUNCEMENT:

The MoneyShow Las Vegas has been canceled "in person", but I will still be presenting during their video production. As soon as I have information, I will forward it! In the meantime, if you haven't already, click to get your free access pass!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!