Happy Monday! A quick overall view of my scans shows that we are still seeing strength in the Materials sector with Gold and Silver soaring. There were plenty of Miners and metals ETFs that came up, but I wanted to find some diamonds that were a bit more "rough" and that hadn't experienced such a run to the upside. If you've got 'em, hold 'em. If you don't, I suspect you will still see some great upside if you want to get in on the tail end of the rally.

Today, Health Care and Technology poked their heads into many of my scans and I was pleased to find diamonds that show great upside potential in areas that are mostly teflon. I also included a Staple from Food Products that you might like as well.

I wrote about UNG in ChartWatchers on Saturday. Not a good day. However, Carl and I are still in it and now there could be a better entry out there. The updated chart is below. You can see that it hasn't shown too much deterioration as far as indicators go and the rising trend is still intact.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

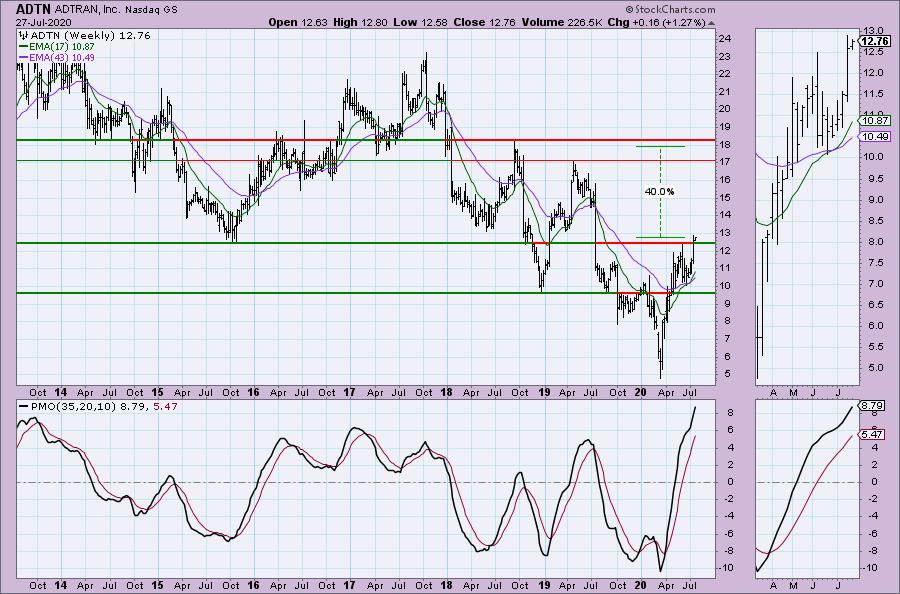

ADTRAN, Inc (ADTN) - Earnings: 8/5/2020 (AMC)

ADTRAN, Inc. engages in the provision of networking and communications equipment. It operates through the Network Solutions and Services and Support business segment. The Network Solutions segment includes hardware products and next-generation virtualized solutions used in service provider or business networks, as well as prior-generation products. The Services and Support segment offers ProCloud managed services, network installation, engineering and maintenance services, and fee-based technical support and equipment repair/replacement plans.

Many of today's Diamonds were much higher on the day so I personally would try and get an entry in on a pullback. ADTN broke out above the June top and has held that support level. The RSI is very strong albeit a little on the overbought side. The PMO is excellent. I like to see pullbacks to the zero line and a nice clean crossover. The SCTR is healthy and volume is coming in on this breakout based on the OBV.

I picked most of the Diamonds today based on upside potential and this one has got that. The PMO is overbought, but given it is moving straight up, I think we'll be okay.

Addus HomeCare Corp (ADUS) - Earnings: N/A

Addus HomeCare Corp. engages in the provision of in-home personal care services. It operates through the following segments: Personal Care, Hospice, and Home Health. The Personal Care segment provides non-medical assistance with activities of daily living, primarily to persons who are at risk of hospitalization or institutionalization, such as the elderly, chronically ill or disabled. The Hospice segment includes physical, emotional, and spiritual care for people who are terminally ill as well as for their families. The Home Health segment offers services that are primarily medical in nature to individuals who may require assistance during an illness or after surgery, and include skilled nursing and physical, occupational and speech therapy.

Here we have a nice breakout from a bullish falling wedge. Additionally, we have a positive divergence with the OBV, a new PMO BUY signal and a positive RSI. I've put a 10% stop area in, but I don't think I'd let it run that far past the 50-EMA if it fails.

The PMO has now turned up on the weekly chart. We could be looking at a very large flag off the "V" shaped bottom. "V" bottoms in general will see at least a breakout above the previous cardinal top that creates the dip down into the "V".

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

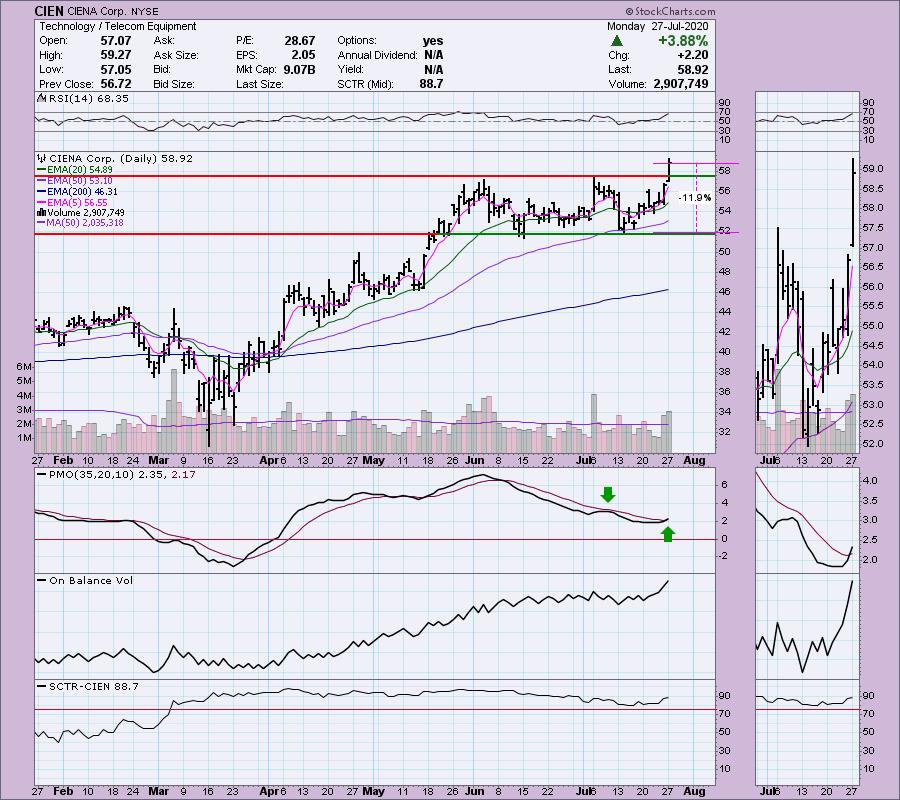

CIENA Corp (CIEN) - Earnings: 9/3/2020 (BMO)

Ciena Corp. engages in the provision of network and communication infrastructure. It operates through the following segments: Converged Packet Optical; Packet Networking; Optical Transport; and Software and Services. The Converged Packet Optical segment develops and sells optical processors, switching systems and operating system software. The Packet Networking segment includes service delivery switches, services aggregation switches, and ethernet packet configurations. The Optical Transport segment manufactures and trades optical transport systems, common photonic layer, data networking products, data center interconnection and virtual networks. The Software and Services segment provides wide area network controller, network functions virtualization platform, and software applications.

I really like today's breakout on CIEN. It did make the RSI a bit overbought, but I'll forgive that given the beautiful PMO crossover BUY signal that came through on this breakout. The RSI is strong and volume came in on this breakout. It was a big upside move for CIEN so you might be able to get in on a pullback. It is a long way down to strong support for setting a stop so I'd raise it once I was comfortable that price was going to stay above the 50-EMA.

This one made the cut partly based on its strong weekly chart. A rising PMO that is not overbought and a glimpse of a bullish flag formation.

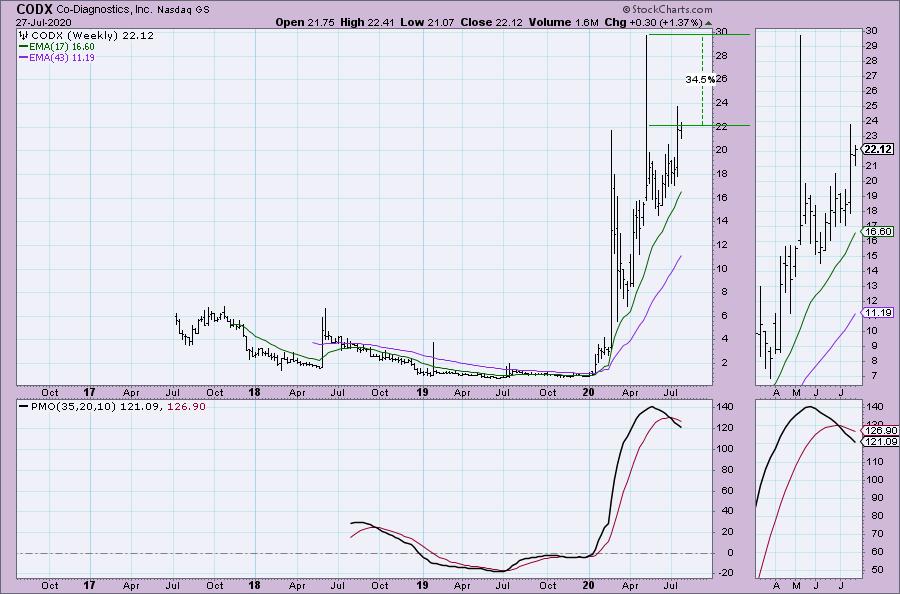

Co-Diagnotics Inc (CODX) - Earnings: N/A

Co-Diagnostics, Inc. engages in the development, manufacture, and marketing of diagnostics technology. It offers design services, vector control, equipment, diagnostic, and research solutions.

This one just broke out above resistance at $22. The PMO just triggered a crossover BUY signal and the RSI is very positive, yet not overbought. Looking in the thumbnail, we can see that the OBV is confirming this rally.

I do not like the weekly PMO here so I would watch this investment closely as a short-term play rather than an initial intermediate-term investment.

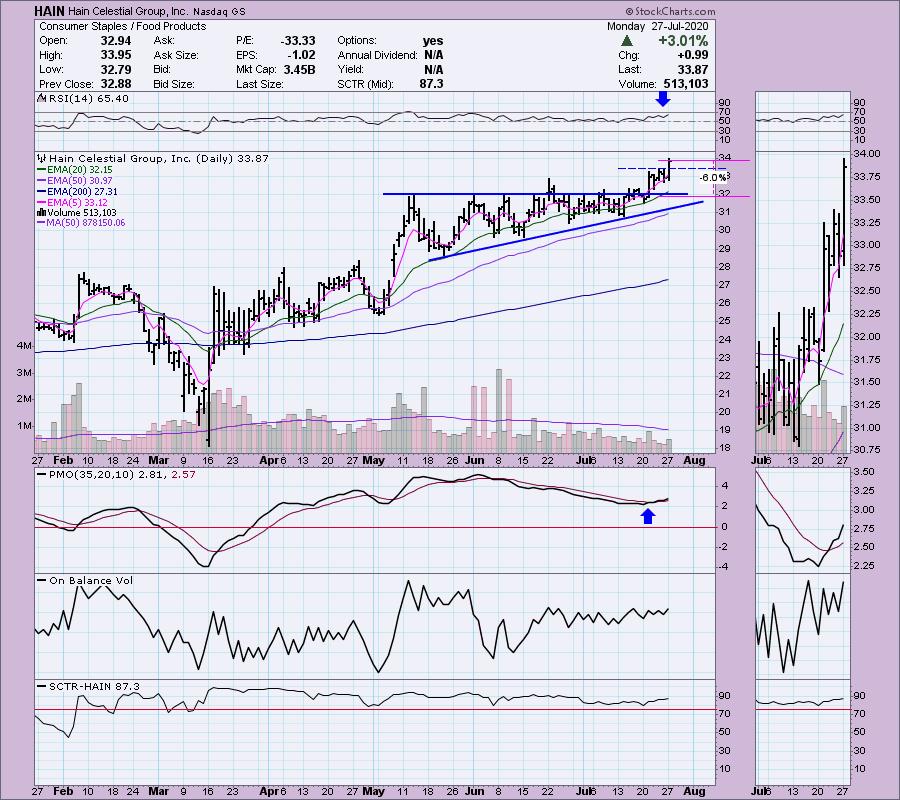

Hain Celestial Group Inc (HAIN) - Earnings: 8/27/2020 (BMO)

Hain Celestial Group, Inc. engages in the production and distribution of organic and natural products. It operates through the following geographical segments: United States, United Kingdom, Rest of World, and Corporate and Other. The United States segment comprises of baby, pantry, snack food, fresh, personal care, and tea products. The United Kingdom segment offers frozen and chilled products. The Rest of World segment distributes products in Canada and Europe. The Corporate and Other segment includes expenses related to the firm's administrative functions.

I think the only thing I don't like about this chart is that the OBV didn't make new highs on this breakout. Other than that, I like the breakout from what I'd consider a bullish ascending triangle. The PMO just triggered a BUY signal and the RSI is positive and not overbought. The SCTR is first rate. Look at the $32.50 level and note that price has been trading above it for a few days now...

$32.50 on the weekly chart was a very strong resistance area based on the lows from 2016/2017. It's take over two years to get back here and it didn't waste much time on making that breakout. The PMO is now accelerating upward. It is overbought right now, but its moving vertically up so I'll forgive it.

Current Market Outlook:

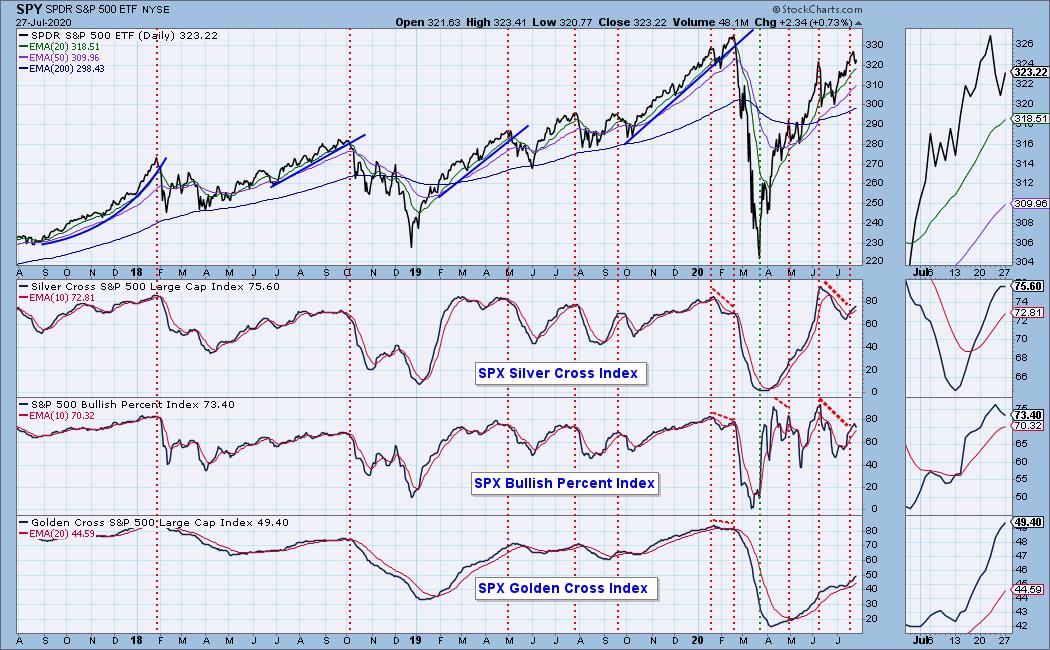

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 2

- Diamond Dog Scan Results: 17

- Diamond Bull/Bear Ratio: 0.12

Full Disclosure: I have set some tighter stops to lock in profit. I did enter UNG on Friday and I wish I'd added RGEN, so I might tomorrow depending on its intraday chart. I'm about 65% invested right now. 35% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

ANNOUNCEMENT:

The MoneyShow Las Vegas has been canceled "in person", but I will still be presenting during their video production. As soon as I have information, I will forward it! In the meantime, if you haven't already, click to get your free access pass!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!