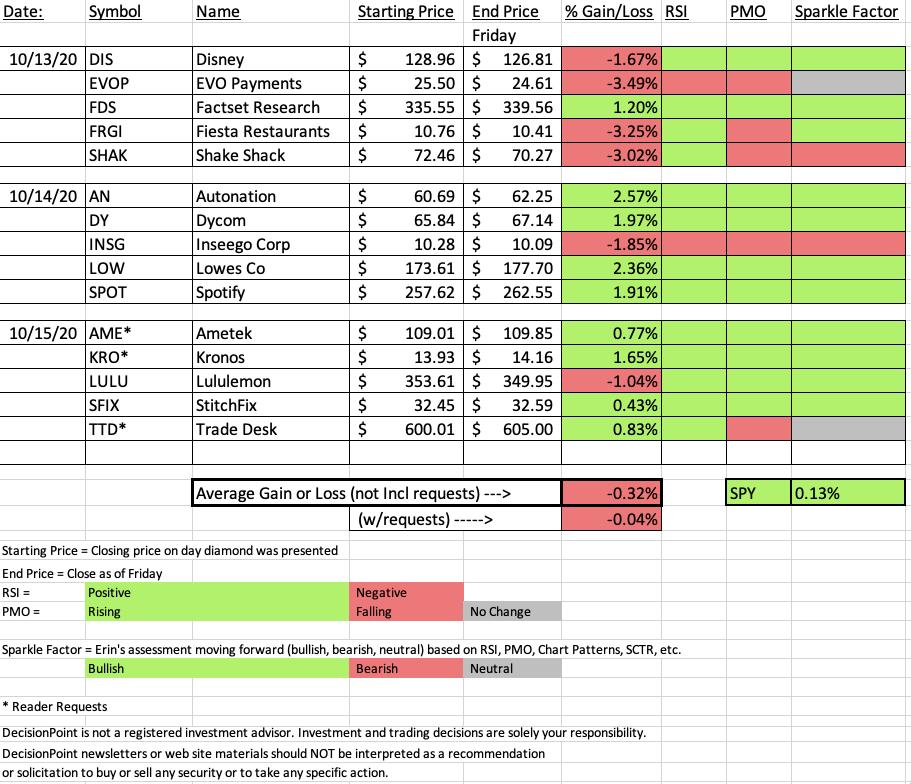

It was a mixed week with the SPY finishing up +0.16%. In today's Diamond Mine we took a look at all of the "diamonds in the rough" to determine if any were polishing up and becoming real diamonds. At the same time we had to review Tuesday's picks. Ouch. The good news is that of those really rough diamonds, I am still comfortable moving forward on three of them.

Reviewing this week's spreadsheet, I see that the "lump of coal" for the week was EVO Payments (EVOP). The chart really looked good on Tuesday, but it is a different story right now. I'll cover that below so we can see what went wrong. The "Diamond of the Week" turned out to be Autonation (AN). We'll look at what went right and see if there might be another "diamond in the rough" within that same industry!

To close, I want to apologize for sending out the "draft" of Wednesday's report that was confusing and incomplete. It has now been added to the "checklist" so I don't miss that before hitting "Publish".

Diamond Mine Information:

Diamond Mine Information:

Recording from Today's (10/16/2020) is at this link. Access Passcode: P^DiW2A!

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (10/23/2020) 12:00p ET:

Here is the registration link for Friday, 10/23/2020. Password: friday

Please do not share these links! They are for Diamonds subscribers ONLY!

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

It's FREE!

***Click here to register for this recurring free DecisionPoint Trading Room!***

Did you miss the 10/12 trading room? Here is a link to the recording (password: qE58C9.E).

For best results, copy and paste the password to avoid typos.

EVO Payments, Inc. (EVOP)

EARNINGS: 11/5/2020 (BMO)

EVO Payments, Inc. is a holding company, which provides payments technology and services. It offers payment and commerce solutions. It operates through the Americas and Europe geographical segments. The Americas segment is composed of the United States, Canada, and Mexico. The Europe segment includes operations in the Czech Republic, Germany, Ireland, Poland, Spain, and the United Kingdom, as well as supporting merchants in France, Austria, Italy, the Nordics, and other Central and Eastern European. The company was founded by Rafik R. Sidhom in 1989 and is headquartered in Atlanta, GA.

When I presented this one, the RSI had just entered positive territory and the PMO was on a BUY signal. I noticed on the chart from the October 13th Diamond Report, that we didn't have a breakout yet. It broke out the next day but closed beneath overhead resistance. After that, the breakout completely failed. I have this one listed with a "neutral" Sparkle Factor. It hasn't broken down, it just hasn't broken out yet. It could be worth a relook later next week.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Autonation, Inc. (AN)

EARNINGS: 10/21/2020 (BMO)

AutoNation, Inc. engages in the provision of automotive products and services. It operates through the following segments: Domestic, Import, Premium Luxury, and Corporate & Other. The Domestic segment comprises retail automotive franchises that sell new vehicles manufactured by General Motors, Ford and Chrysler. The Import segment includes retail automotive franchises that sell new vehicles manufactured primarily by Toyota, Honda, and Nissan. The Premium Luxury segment consists of retail automotive franchises that sell new vehicles manufactured primarily by Mercedes-Benz, BMW, Audi, and Lexus. The Corporate & Other segment involves in the collision centres, auction operations and stand-alone used vehicle sales and service centres. The company was founded by Steven Richard Berrard and Harry Wayne Huizenga Sr. in 1991 and is headquartered in Fort Lauderdale, FL.

I presented this one in the October 14th before it had broken out and executed the flag formation. After breaking out nicely yesterday, it pulled back. Notice in the thumbnail, it did close above the high from last week. I like this chart and I like this industry group so I decided for fun and your benefit to look for another strong chart in this industry group.

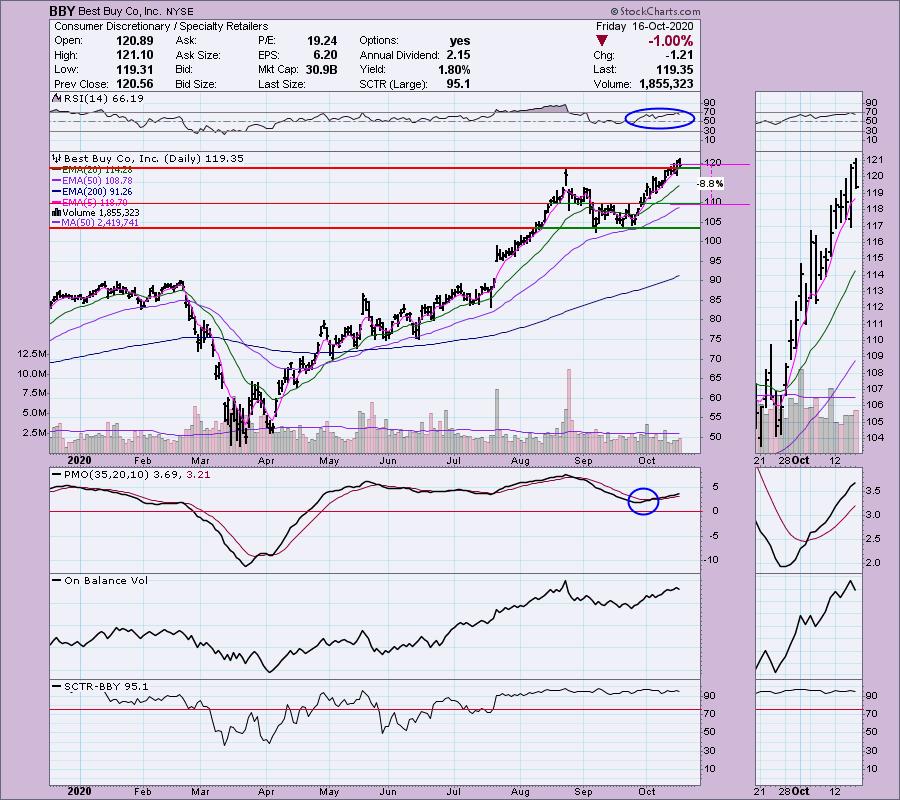

Best Buy Co, Inc. (BBY)

EARNINGS: 11/24/2020 (BMO)

Best Buy Co., Inc. engages in the provision of consumer technology products and services. It operates through two business segments: Domestic and International. The Domestic segment comprises of the operations in all states, districts, and territories of the U.S., operating under various brand names, including Best Buy, Best Buy Mobile, Geek Squad, Magnolia Audio Video, Napster, and Pacific Sales. The International segment includes all operations outside the U.S. and its territories, which includes Canada, Europe, China, Mexico, and Turkey. It also markets its products under the brand names: Best Buy, bestbuy.com, Best Buy Direct, Best Buy Express, Best Buy Mobile, Geek Squad, GreatCall, Magnolia and Pacific Kitchen and Home. The company was founded by Richard M. Schulze in 1966 and is headquartered in Richfield, MN.

Here is another Specialty Retailer that looks very interesting. The RSI is positive and it has recently broken out and today pulled back. That rising trend is strong and remains intact. I set the stop just below the mid-September tops.

THIS WEEK's Sector Performance:

CONCLUSION:

Sector to Watch: Health Care (XLV)

Industry Group to Watch: Electronic Components & Equipment ($DJUSEC)

John Murphy wrote about Health Care today and I think he is onto something. All of the industries within should do well. As far as a particular industry group, I like the breakout on $DJUSEC. I don't have high hopes for the market, but when asked for my opinion for the Wall Street Sentiment Survey, I said that the market would finish "neutral" by the end of the week. I suspect we will continue this rally, but it will fail mid-week. We can't ignore news and should the pressure prove strong enough for Speaker Pelosi to relent on the stimulus, that will undoubtedly lift the market. The question is whether that is already being priced in, it likely has been. It has become obvious that bipartisan support is beginning to emerge and that suggests a deal before the election.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Have a Great Weekend! Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I own Disney (DIS) on the spreadsheet. I'm about 45% invested right now and 55% is in 'cash', meaning in money markets and readily available to trade with. I have no interest in adding positions right now.

Technical Analysis is a windsock, not a crystal ball.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!