After sifting through the reader requests today, I decided that clearly great minds do think alike. I ran my scans and picked my "diamond in the rough" for today before sifting through the requests. One of today's reader requests was Big Five Sporting Goods (BGFV). While I like that chart quite a bit, the chart I came up with for today's report was from the same industry group so I didn't want to cover two from that group; the charts are very similar.

One of the requests was Fastly (FSLY) which was the "Diamond of the Week" for ChartWatchers and the DecisionPoint Show. I will review that chart in the Diamond Mine, but I will say that I still very much like FSLY.

Before I begin, I want to remind everyone to register for tomorrow's subscriber-only "Diamond Mine" trading room at the registration link provided below or here. The room is especially robust when we have lots of live participants.

Today's "Diamonds in the Rough" are: ABR, CHWY, HIBB, RUN and SABR.

Diamond Mine Information:

Diamond Mine Information:

Here is Friday November 6th's recording link. I apologize, but I forgot to hit the record button for last Friday's Diamond Mine. I have left the recording link available from 11/6 available using the Access Passcode: #g8G^J&3

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (11/20/2020) 12:00p ET:

Here is the registration link for Friday, 11/20/2020. Password: resource

Please do not share these links! They are for Diamonds subscribers ONLY!

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

Did you miss the 11/16 free trading room? Here is a link to the recording. Access Code: =8STr92*

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Arbor Realty Trust Inc. (ABR)

EARNINGS: 2/12/2021 (BMO)

Arbor Realty Trust, Inc. operates as real estate investment trust, which engages in the provision of loan origination and servicing for multifamily, seniors housing, healthcare, and diverse commercial real estate assets. It operates through the Structured Business and Agency Business segments. The Structured Business segment offers structured loan origination and investment services. The Agency Business segment involves in agency loan origination and servicing. The company was founded in June 2003 and is headquartered in Uniondale, NY.

Down -0.98% in after hours trading, ABR has a favorable chart with only one exception, the OBV downside confirmation. Carl and I both agree that divergences are far more important than confirmations and this one is now on a nice short-term rising trend. The Real Estate sector has been coming back to life, but today XLRE broke down back into its trading channel, so I'm concerned this area is running out of steam. Right now we have a PMO BUY signal and a PMO bottom above the signal line which is especially bullish. This one has been on a steady uptrend which has kept the RSI mostly positive since August. The SCTR is in the "hot zone" above 75. The stop level is obvious based on support and resistance.

We have another PMO bottom above the signal line on the weekly chart. The RSI is positive, although getting slightly overbought.

Chewy Inc. (CHWY)

EARNINGS: 12/8/2020 (AMC)

Chewy, Inc. engages in the provision of pure-play e-commerce business. It supplies pet medications, food, treats and other pet-health products and services for dogs, cats, fish, birds, small pets, horses, and reptiles. The company was founded by Ryan Cohen and Michael Day in September 2011 and is headquartered in Dania Beach, FL.

Down -0.56% in after hours trading, CHWY was covered in the October 30th Diamonds Report and since then is down -1.40%. It hasn't done much since I picked it clearly and it does remain in a declining trend. The current rally has turned the PMO back up and put the RSI back into positive territory. The OBV currently is confirming the declining trend, but if I see an OBV breakout alongside price, that would be a green light based on volume. It's too young to have a SCTR.

The weekly chart doesn't have much data, but the OBV is confirming the rising trend and the RSI is positive. The PMO isn't telling us much.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Hibbett Sports Inc. (HIBB)

EARNINGS: 11/20/2020 (BMO)

Hibbett Sports, Inc. engages in the provision of sporting goods business. Its stores are operating under the Hibbett Sporting Goods and City Gear banners and an omni-channel platform. The firm features a core selection of brand name merchandise emphasizing athletic footwear, athletic and fashion apparel, team sports equipment and related accessories. Its shopping channel includes store locations, and websites or apps. The company was founded in 1945 and is headquartered in Birmingham, AL.

HIBB is my sporting goods pick, but as I said BGFV (a reader request) looked good too and another contender would be Dick's Sporting Goods (DKS). Be aware that HIBB reports earnings tomorrow and it is currently down -0.97% in after hours trading. The PMO has turned up right above the zero line. The chart pattern is a bullish double-bottom. It hasn't executed yet and if price turns down and loses the rising trend off the second bottom, it would be best to let it go which is why the stop is set to represent that breakdown. Normally I would set it at the bottom of the pattern, but that would be a 13% stop level and that doesn't appeal to me.

The weekly chart does show a PMO top, but the PMO is flattening out and the RSI is now positive and not overbought. We can also see that price has bounced off the 17-week EMA.

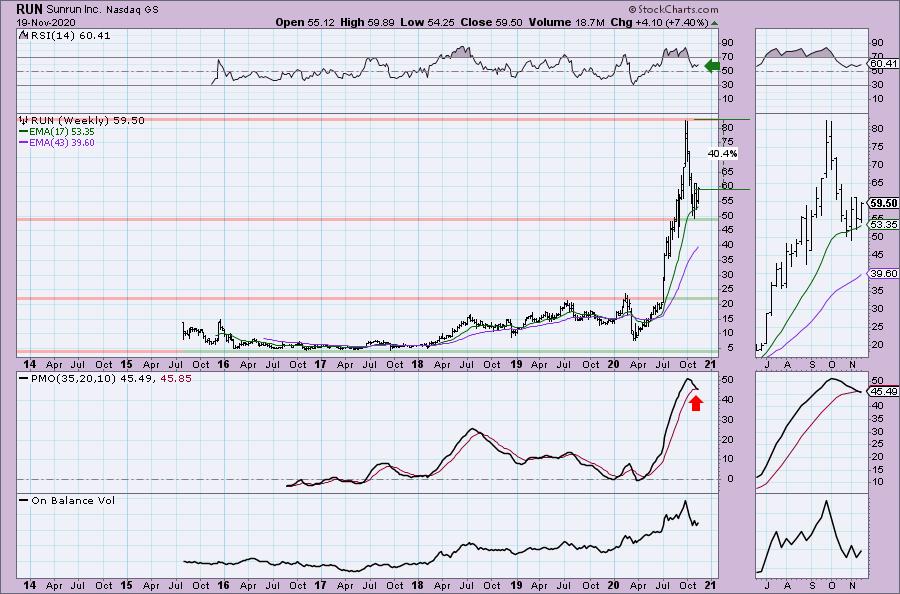

Sunrun Inc. (RUN)

EARNINGS: 2/25/2021 (AMC)

SunRun, Inc. engages in the design, development, installation, sale, ownership and maintenance of residential solar energy systems. It sells solar service offerings and install solar energy systems for homeowners through its direct-to-consumer channel. It also offers plans such as monthly lease, full amount lease, purchase system, and monthly loan. The company was founded by Edward H. Fenster, Robert N. Kreamer and Lynn M. Jurich in January 2007 and is headquartered in San Francisco, CA.

Most of your know that I have been very bullish on the Renewable Energy space. I own SPWR and TAN...and unfortunately RUN which basically shaved most of my profits on the other two. However, I was pleased to this one requested as I am considering adding to my position right now given the chart setup. We have a double-bottom pattern that formed well above the 200-EMA. They had a nice pop on earnings on 10/27. The OBV isn't ideal, but the RSI just hit positive territory and the PMO will trigger a BUY signal tomorrow. It hasn't executed the double-bottom yet so I set the stop level at the point where the short-term rising trend would be broken. This is another case where setting the stop at the support level of the double-bottom would make it too deep. I already don't like this stop, but RUN is very volatile so it's the premium you pay to trade this one.

I don't like the weekly PMO at all, but given the extensive correction or bear market move on RUN, it isn't surprising. The RSI is still positive and price is finding support along the 17-week EMA. If it can get back to its high, that would be a 40%+ gain. You just might have to endure more volatility on the way up.

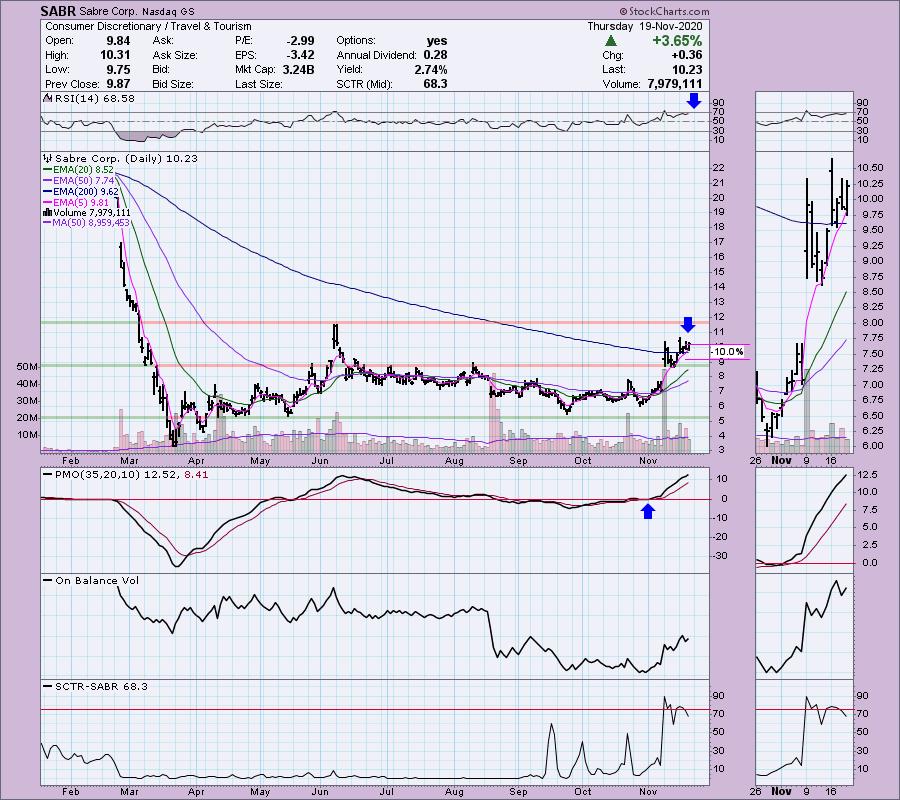

Sabre Corp. (SABR)

EARNINGS: 2/25/2021 (BMO)

Sabre Corp. is a technology solutions provider to the global travel and tourism industry. It provides data-driven business intelligence, mobile, distribution and software-as-a-service solutions. The company operates through the following segments: Travel Network, Airline Solutions and Hospitality Solutions. The Travel Network segment is a global B2B travel marketplace for travel suppliers and travel buyers. The Airline Solutions segment offers a portfolio of software technology products and solutions, through software-as-a-service. The Hospitality Solutions segment provides software and solutions, through SaaS and hosted delivery model, to hoteliers around the world. Sabre was founded in December 2006 and is headquartered in Southlake, TX.

I was pretty impressed with this chart, but it should be noted that currently it is down -2.25% in after hours trading. Considering it gained 3.65% just today, it is likely a healthy pullback. It must stay above the 200-EMA to be a viable investment in my opinion. The RSI is positive but a bit overbought. The PMO looks great, although overbought. The OBV is confirming the rally with rising bottoms. The SCTR is losing some ground, but it is still respectable at 68. The stop was difficult here because I don't like to set them at much more than 10%. I basically set it at 10%; that would imply a loss of the 200-EMA.

The weekly chart is incredibly enticing. We have a PMO BUY signal and a very positive RSI. Overhead resistance is nearing at the confirmation line of a double-bottom. There is a positive OBV divergence that setup this rally. The upside potential is pretty fantastic.

Full Disclosure: I have orders in for HIBB and PHM (Diamond from yesterday). Additionally, I repurchased RGEN (previous Diamond and covered in "The Pitch" on SCTV). I'm about 45% invested and 55% is in 'cash', meaning in money markets and readily available to trade with, but if these trades go through that will change.

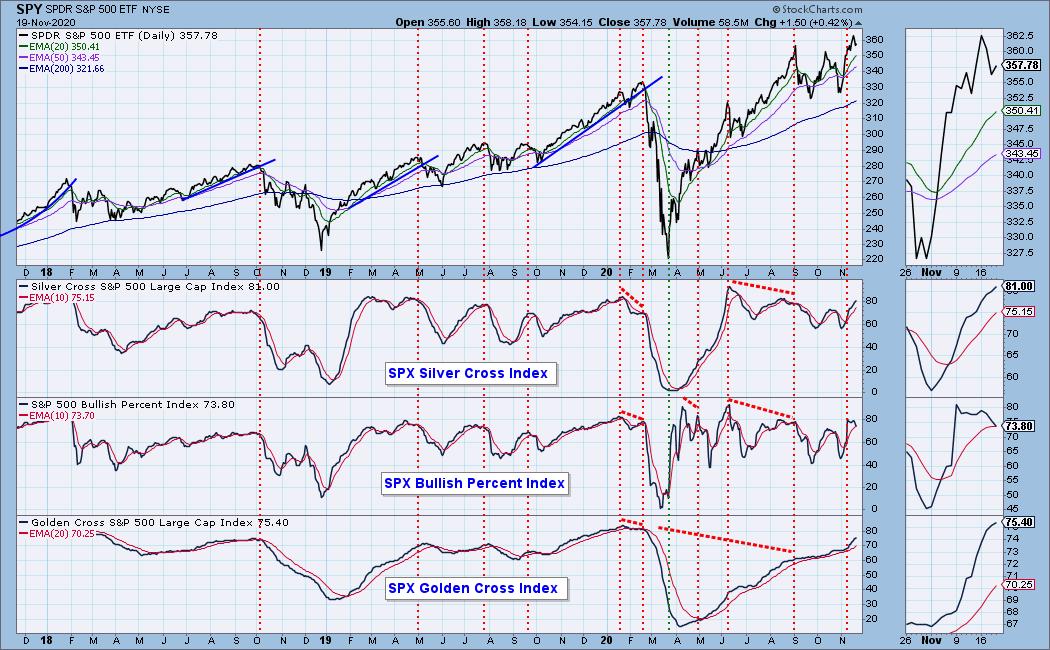

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 7

- Diamond Dog Scan Results: 8

- Diamond Bull/Bear Ratio: 0.88

I'm in the process of trying to plot the Diamond Index, but with time at a premium, it is on the back burner.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!I