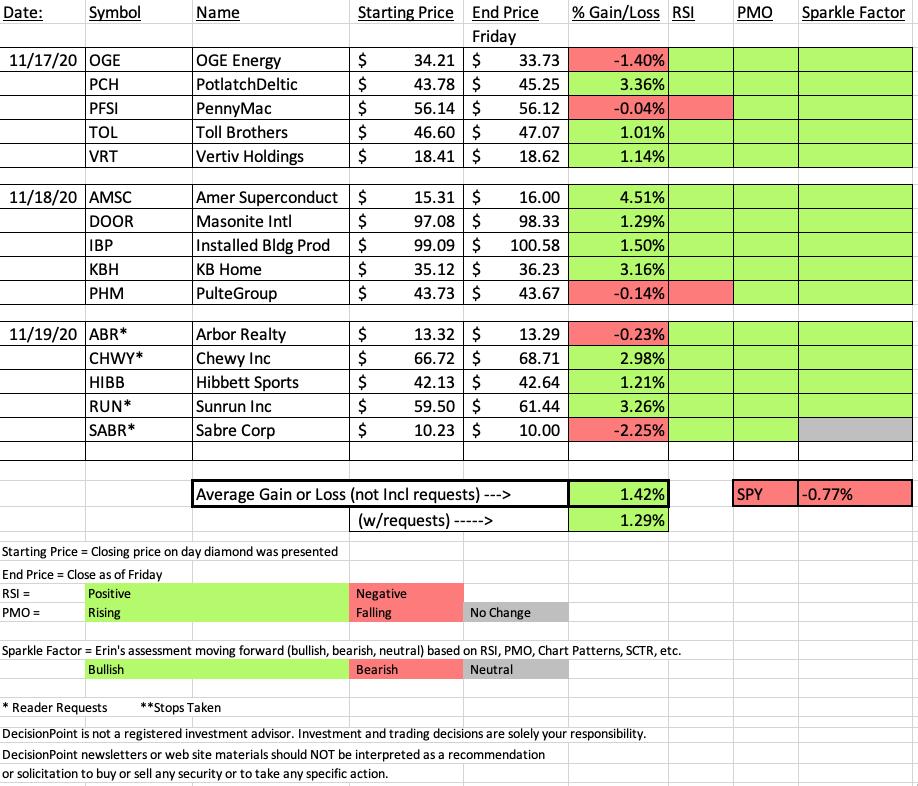

Welcome to this holiday week Diamonds Recap. I hope everyone is having a wonderful Thanksgiving weekend! This week we get another prize for beating the SPY again. While that isn't the goal of DecisionPoint Diamonds, I always feel satisfaction when we do. To be clear, I am not picking diamonds that are only good for the week presented. Few people trade that way and I certainly wouldn't suggest it. Remember, I include the "Sparkle Factor" on the spreadsheet so that you can see what my analysis says regarding Diamonds going forward.

This week's "Darling" turned out to be Gamestop (GME) with a 17.63% gain! I expected it to do well, but this was spectacular! Of course, that wasn't one of the diamonds I added to my portfolio last week. It's overbought right now, but I still like it.

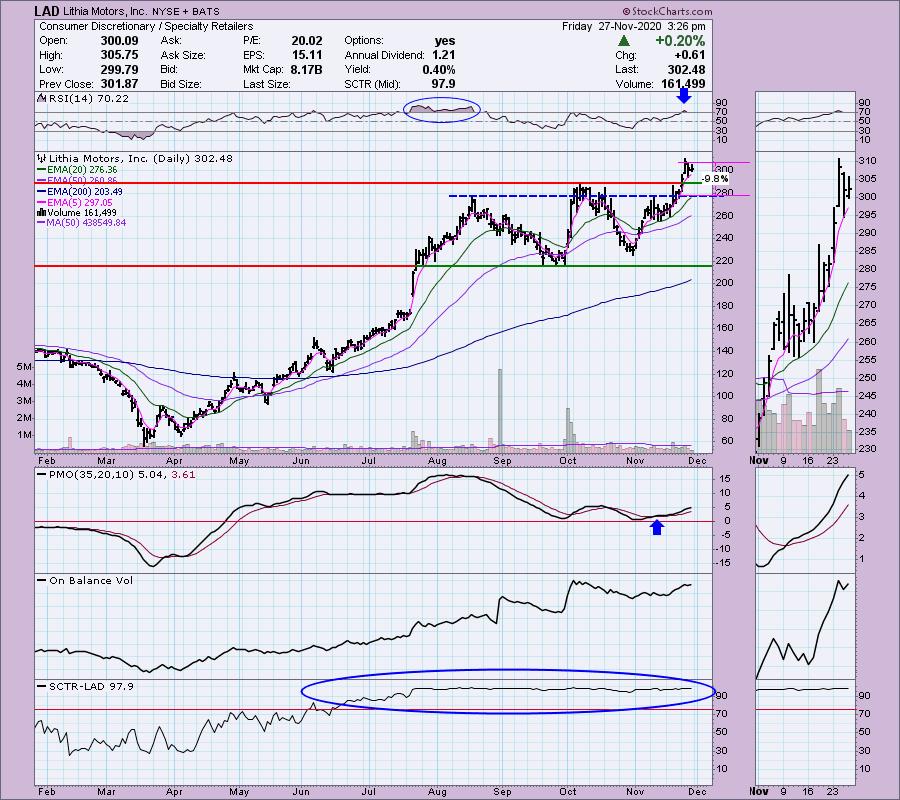

This week's "Dud" was Lithia Motors (LAD). It was down only 1.99% so that is good. Enable Midstream (ENBL) was a close second at -1.89% (which of course is the diamond I chose to add to my portfolio this week). I'm possibly going to unload it next week if it doesn't begin performing like the indicators suggest it will.

Interestingly, you'll see that all but one of the diamonds (AUDC) still have positive RSIs and rising PMOs. I believe each of them has potential to keep on winning, even the duds.

The new Diamond Mine registration link is available below. Remember to save your confirmation email from Zoom. It has all of the information needed to join the room. Many times Zoom doesn't send out the one-hour reminder email on time.

Diamond Mine Information:

Diamond Mine Information:

Here is today's (11/20/2020) recording link. Access Passcode: @f#x+6qP

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (12/4/2020) 12:00p ET:

Here is the registration link for Friday, 12/4/2020. Password: turkey

Please do not share these links! They are for Diamonds subscribers ONLY!

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

It's FREE!

***Click here to register for this recurring free DecisionPoint Trading Room!***

Did you miss the 10/26 (no meeting on 11/2) trading room? Here's a link to the recording (Passcode: X+2gJfpd)

For best results, copy and paste the password to avoid typos.

Don't miss the November 30th free DP Trading Room! I will have guest Julius de Kempenaer from RRG Research. He will show us how he uses RRG to trade!

***Click here to register for this recurring free DecisionPoint Trading Room!***

DUD:

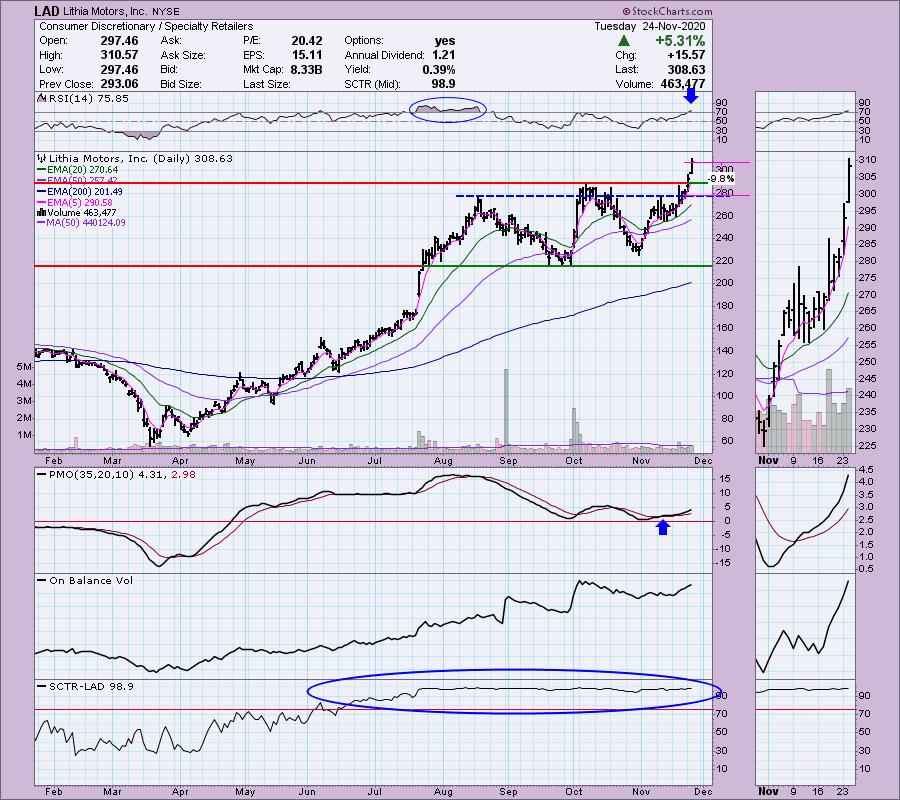

Lithia Motors, Inc. (LAD)

EARNINGS: 2/10/2021 (BMO)

Lithia Motors, Inc. engages in the operation of automotive franchises and retail of new and used vehicles. It operates through the following segments: Domestic, Import and Luxury. The Domestic segment comprises of retail automotive franchises that sell new vehicles manufactured by Chrysler, General Motors, and Ford. The Import segment composes of automotive franchises that sell new vehicles manufactured by Honda, Toyota, Subaru, Nissan, and Volkswagen. The Luxury segment includes retail automotive franchises that sell new vehicles manufactured by BMW, Mercedes-Benz, and Lexus. The company was founded by Walt DeBoer and Sidney B. DeBoer in 1946 and is headquartered in Medford, OR.

Here is Tuesday's commentary for LAD:

"Currently LAD is up +0.77% in after hours trading even after a +5.31% rally today. The PMO is rising on a BUY signal and not overbought. The breakout from the basing pattern is strong. The SCTR is nearly perfect at 98.9. I do have one problem and that is the RSI moving into overbought territory. I looked back and noted that overbought conditions (and even oversold conditions) can persist on this one--just look at July/August."

The updated chart is below. There's very little damage on this small pause and decline. The RSI is overbought now which could explain why we are seeing price digest the strong rally that preceded it. I'd expect this pause could last a bit longer so that the RSI can clear those overbought conditions. The stop level is still good.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Darling:

Mattel, Inc. (MAT)

EARNINGS: 2/11/2021 (AMC)

Mattel, Inc. is a global children's entertainment company that specializes in the design and production of toys and consumer products. The company engages consumers through its portfolio of iconic franchises, including Barbie, Hot Wheels, American Girl, Fisher-Price, Thomas & Friends, UNO and MEGA. It operates through the following segments: North America, International and American Girl. The North America and International segments market and sell products organized into four categories: 1.) Dolls, 2.) Infant, Toddler and Preschool, 3.) Vehicles and 4.) Action Figures, Building Sets, and Games. The American Girl Brands segment markets and sells historical dolls, books and accessories through Truly Me, Girl of the Year, Bitty Baby, and WellieWishers brands. The company was founded by Elliot Handler, Ruth Handler and Harold Matson in 1945 and is headquartered in El Segundo, CA.

Here is Tuesday's commentary on MAT:

"The iconic Mattel toys is our final diamond in the rough today. Other than being a bit overbought on the RSI, the rest of the chart looks good to me. The PMO is on a BUY signal and rising. The OBV is confirming the rally and the SCTR has moved into the "hot zone" above 75. I set the stop halfway down the trading range that it originally broke out of."

Below is the updated chart for Mattel. MAT is very overbought so I would expect to see a pause or pullback toward breakout point. I would raise the stop now that it has run. I believe a pause or pullback here would give us an excellent future entry.

THIS WEEK's Sector Performance:

CONCLUSION:

Last week my top sector pick was the Energy Sector (XLE). The two runners up were Financials and Materials. Looks like I nearly hit the trifecta with Materials only finishing fourth and not third. I suspect Energy will still be hot, but I'm shifting toward Consumer Discretionary as we go into the holiday season. I believe all of those industry groups will do well, but Retailers will likely be the biggest winners.

Sector to Watch: Consumer Discretionary (XLY)

Industry Group to Watch: Broadline Retailers (DJUSRB)

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Have a great rest of your Thanksgiving weekend! Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 65% invested right now and e5% is in 'cash', meaning in money markets and readily available to trade with. I will continue to add to my portfolio next week if the market outlook remains bullish in the short term.

Technical Analysis is a windsock, not a crystal ball.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!