The Diamond PMO Scan only produced two results. I always get concerned when this happens because it suggests there are not that many momentum trades available and that could signal market weakness. This is why I have more than one scan. The Diamond PMO Scan requires the PMO to only be rising 3 days after turning up. Well, in a bull market where many stocks are doing well, PMOs will be rising much longer than the 3 day requirement. Hence, we see fewer scan results.

Specialty Retailers are looking really good right now, especially before the holidays. Additionally, a Toy retailer found its way in my scan results. 'Tis the season after all so I included it too.

Finally, I patrolled the Energy Pipelines industry group and found a mid-cap with a spectacular yield if earnings come through. It is very low priced so I caution you; be ready to experience some volatility (hopefully in the right direction!).

Today's "Diamonds in the Rough" are: ENBL, GME, HZO, LAD and MAT.

Diamond Mine Information:

Diamond Mine Information:

Here is Friday's (11/20) recording link. Use Access Passcode: @f#x+6qP

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (12/4/2020) 12:00p ET:

Here is the registration link for Friday, 12/4/2020. Password: turkey

Please do not share these links! They are for Diamonds subscribers ONLY!

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

Did you miss the 11/23 free trading room? Here is a link to the recording. Access Code: EE4Xi6Y$

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

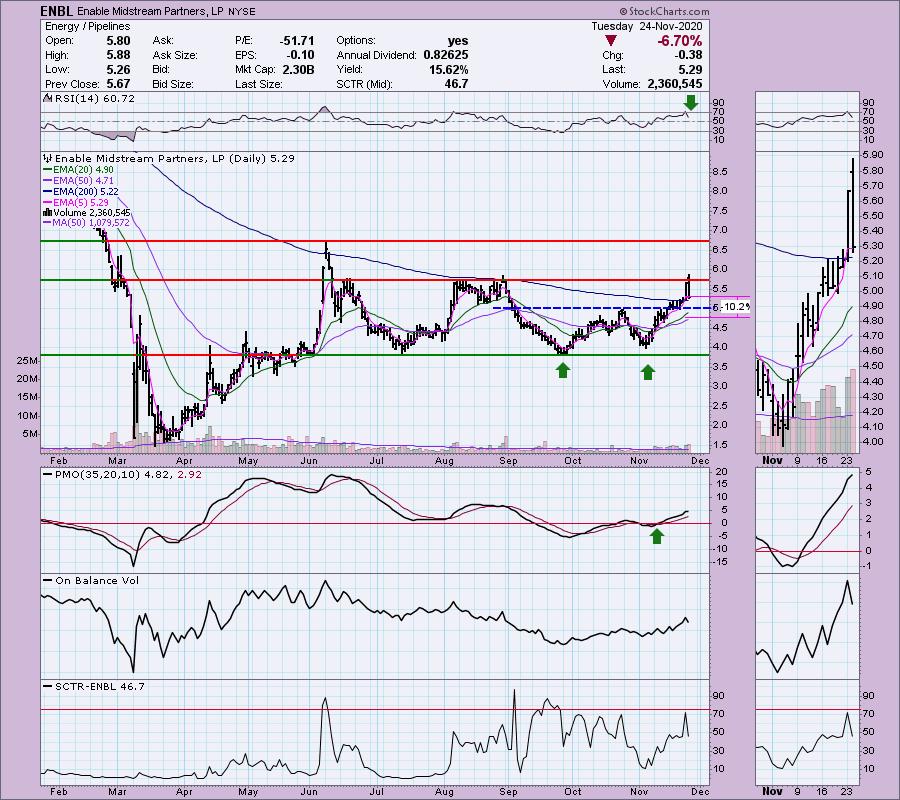

Enable Midstream Partners, LP (ENBL)

EARNINGS: 2/17/2021 (BMO)

Enable Midstream Partners LP owns, operates and develops natural gas and crude oil infrastructure assets. It operates through the following segments: Gathering & Processing, and Transportation & Storage. The Gathering and Processing segment provides natural gas gathering, processing, and fractionation services, as well as crude oil gathering services for its producer customers. The Transportation and Storage segment offers interstate and intrastate natural gas pipeline transportation and storage services to natural gas producers, utilities, and industrial customers. The company was founded in May 2013 and is headquartered in Oklahoma, OK.

Up +0.48% in after hours trading, here is today's Energy stock for you. Carl and I talked today about taking advantage of the Energy stock rally and Pipelines were where he was focusing. I really like this particular stock. It has a double-bottom which has resolved upward as expected. Granted price was turned away today at overhead resistance, but I think this one, especially after today's decline is very interesting. The 200-EMA is holding as support. The PMO is on a BUY signal. You can this month's "silver cross" of the 20/50-EMAs which triggered an IT Trend Model BUY signal. Today's drop took the RSI out of overbought territory. I set the stop level around the 50-EMA. This is a low priced stock so setting a stop is difficult; too tight and it can trigger in a day (like today) or too loose and you have to suck up quite a loss if it doesn't turn back around. Tread carefully.

The weekly chart looks great with an RSI just moving into positive territory and a PMO bottom above the signal line. We can see that the declining trend was broken this week, but it is stuck below overhead resistance right now.

Gamestop Corp. (GME)

EARNINGS: 12/8/2020 (AMC)

GameStop Corp. engages in the retail of multichannel video game, consumer electronics, and wireless services. It operates through the following segments: United States, Canada, Australia, and Europe. The United States segment includes the retail operations and electronic commerce websites www.gamestop.com and www.thinkgeek.com, Game Informer magazine, and Kongregate. The Canada segment comprises of retail and e-commerce business. The Australia segment refers to the retail and e-commerce operations in Australia and New Zealand. The Europe segment pertains to the retail and e-commerce operations in the European countries. The company was founded by Daniel A. DeMatteo in June 2000 and is headquartered in Grapevine, TX.

Up a big +1.32% in after hours trading, GME is making up for today's loss. I covered GME in the June 9th Diamonds Report. This one I can report has a healthy 175.6% gain since! I like it once again. It has triggered a double-bottom pattern which gives us a minimum upside target at the October top. The RSI is positive and the PMO is turning up and going in for a BUY signal. The SCTR is top notch. It's a rather deep stop. I aligned with the 20-EMA.

The upside potential on this one is still eye-opening even after a 175% move since June. Price was stopped at overhead resistance last time, but it is set up to break above with a positive RSI and a strongly rising PMO.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Marinemax, Inc. (HZO)

EARNINGS: 1/21/2021 (BMO)

MarineMax, Inc. engages in the provision of boating-related activities. The firm sells used and new sport boats, sport cruisers, sport yachts and fishing boats through retail stores. It also provides maintenance, repair, slip and storage services. The company was founded in January 1998 and is headquartered in Clearwater, FL.

HZO is trying to breakout above overhead resistance at the August top. I believe it will overcome given the positive RSI and rising PMO. Bonus is the recent PMO bottom above the signal line. Volume is steady, not much to see on the OBV. The SCTR looks great. I set the stop at the mid-October top.

The PMO just triggered a BUY signal on the weekly chart. The RSI is getting overbought, but only slightly. It's making all-time highs and I suspect it will continue to.

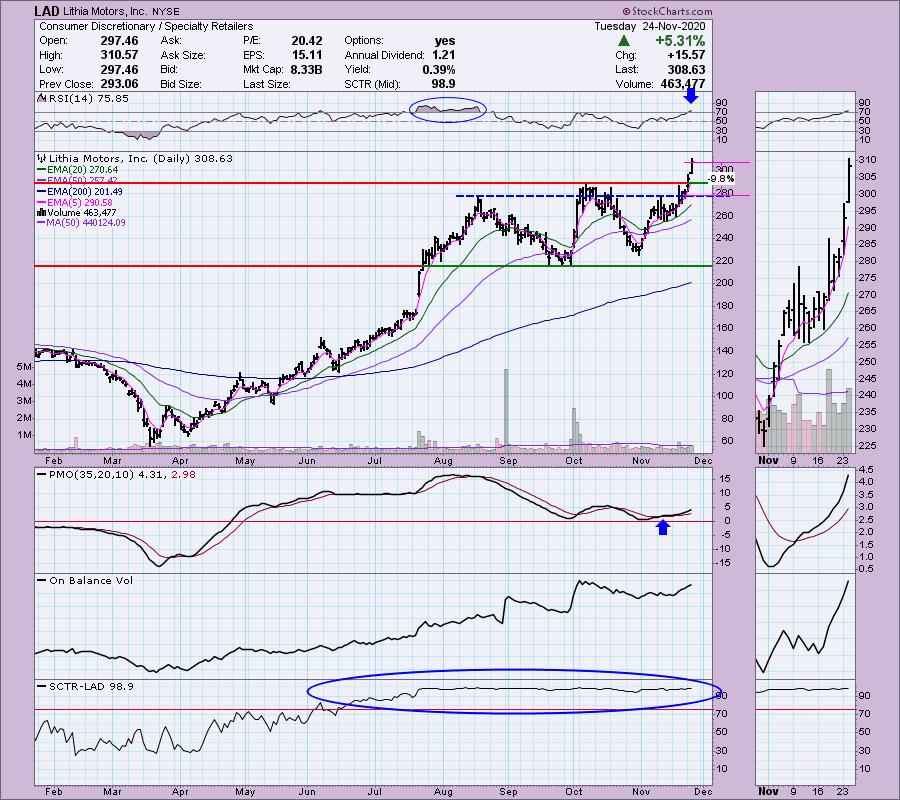

Lithia Motors, Inc. (LAD)

EARNINGS: 2/10/2021 (BMO)

Lithia Motors, Inc. engages in the operation of automotive franchises and retail of new and used vehicles. It operates through the following segments: Domestic, Import and Luxury. The Domestic segment comprises of retail automotive franchises that sell new vehicles manufactured by Chrysler, General Motors, and Ford. The Import segment composes of automotive franchises that sell new vehicles manufactured by Honda, Toyota, Subaru, Nissan, and Volkswagen. The Luxury segment includes retail automotive franchises that sell new vehicles manufactured by BMW, Mercedes-Benz, and Lexus. The company was founded by Walt DeBoer and Sidney B. DeBoer in 1946 and is headquartered in Medford, OR.

Currently LAD is up +0.77% in after hours trading even after a +5.31% rally today. The PMO is rising on a BUY signal and not overbought. The breakout from the basing pattern is strong. The SCTR is nearly perfect at 98.9. I do have one problem and that is the RSI moving into overbought territory. I looked back and noted that overbought conditions (and even oversold conditions) can persist on this one--just look at July/August.

The weekly PMO is overbought, but it is bottoming above its signal line which I always find especially bullish. The weekly RSI is getting overbought as well, but I'll take it. The weekly OBV does have a negative divergence, so keep an eye on this one.

Mattel, Inc. (MAT)

EARNINGS: 2/11/2021 (AMC)

Mattel, Inc. is a global children's entertainment company that specializes in the design and production of toys and consumer products. The company engages consumers through its portfolio of iconic franchises, including Barbie, Hot Wheels, American Girl, Fisher-Price, Thomas & Friends, UNO and MEGA. It operates through the following segments: North America, International and American Girl. The North America and International segments market and sell products organized into four categories: 1.) Dolls, 2.) Infant, Toddler and Preschool, 3.) Vehicles and 4.) Action Figures, Building Sets, and Games. The American Girl Brands segment markets and sells historical dolls, books and accessories through Truly Me, Girl of the Year, Bitty Baby, and WellieWishers brands. The company was founded by Elliot Handler, Ruth Handler and Harold Matson in 1945 and is headquartered in El Segundo, CA.

The iconic Mattel toys is our final diamond in the rough today. Other than being a bit overbought on the RSI, the rest of the chart looks good to me. The PMO is on a BUY signal and rising. The OBV is confirming the rally and the SCTR has moved into the "hot zone" above 75. I set the stop halfway down the trading range that it originally broke out of.

Again, other than an RSI that is getting overbought, I like the weekly chart quite a bit. Strong PMO that is rising as well as the OBV confirming the rising trend. What I really liked was the breakout above strong overhead resistance on the weekly chart. I think it could move higher than the upside target I've listed.

Full Disclosure: I'm about 65% invested and 35% is in 'cash', meaning in money markets and readily available to trade with. I am going to add ENBL and possibly COG (from yesterday's report) tomorrow depending on the 5-minute candlestick charts.

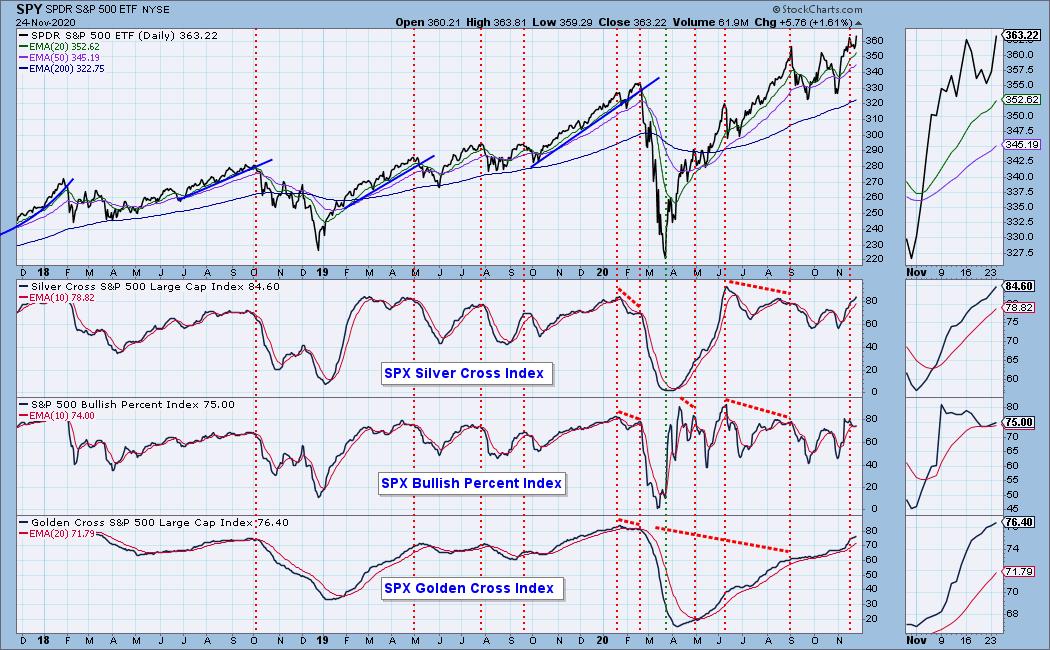

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 2

- Diamond Dog Scan Results: 6

- Diamond Bull/Bear Ratio: 0.33

I'm in the process of trying to plot the Diamond Index, but with time at a premium, it is on the back burner.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!I