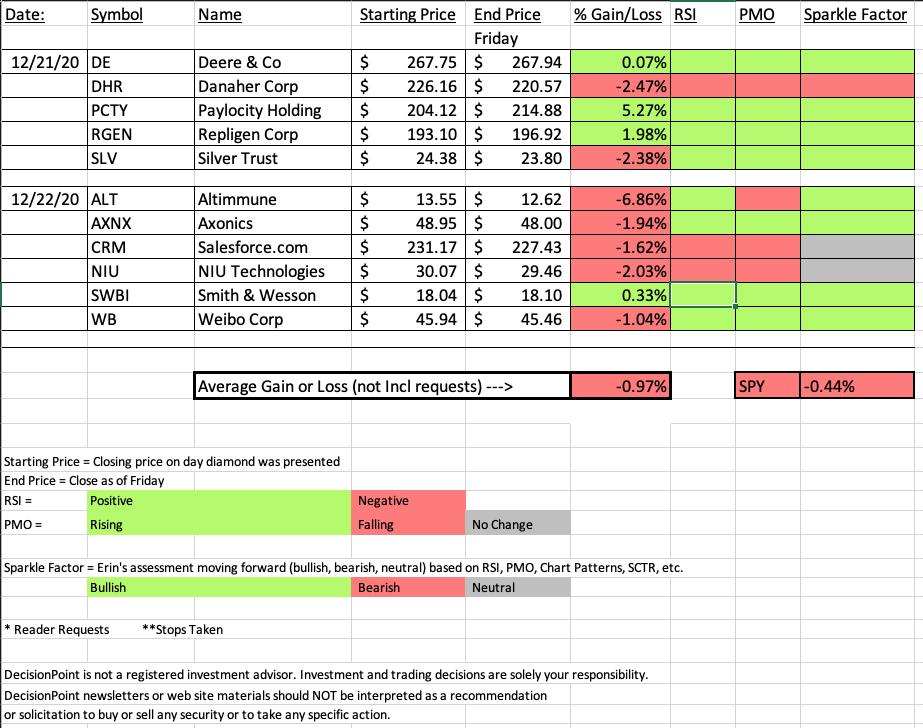

It's a short week so our "diamonds in the rough" didn't get too much time to marinate. However, we did see our best performer up +5.27%. You'll notice on the spreadsheet that of the eleven Diamonds this week, I'm completely bearish on only one. There were two that I am neutral about going forward. The neutral positions are determined based on lack of follow-through on the indicators and price action, but they aren't completely off the table.

We will look at Paylocity (PCTY), the big winner this week. The biggest loser was Altimmune (ALT), but you'll notice that despite a PMO that is now falling, I am still bullish going forward. I'll explain below in my analysis why I still am bullish on it.

The new Diamond Mine registration link is available below. Remember to save your confirmation email from Zoom. Also remember it will held on WEDNESDAY (12/30) at Noon ET.

** HOLIDAY SCHEDULE 12/21/2020 - 1/1/2021 **

Diamonds:

Monday & Tuesday --Eleven Diamonds in the Rough (no reader requests).

Wednesday: Diamonds Recap & LIVE Diamond Mine Trading Room at 9:00a PT

DecisionPoint Alert:

Publishing Monday - Wednesday

Weekly Wrap - Thursday

Diamond Mine Information:

Diamond Mine Information:

Here is today's (12/23/2020) recording link. Access Passcode: 89JUgya&

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Wednesday (12/30/2020) 12:00p ET:

Here is the registration link for WEDNESDAY, 12/30/2020. Registration & Entry Password: new-year

Please do not share these links! They are for Diamonds subscribers ONLY!

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

It's FREE!

***Click here to register for this recurring free DecisionPoint Trading Room!***

Did you miss the 12/14 DP Trading Room! Here's a link to the recording with Passcode: 7dJNVe6+

For best results, copy and paste the password to avoid typos.

Darling:

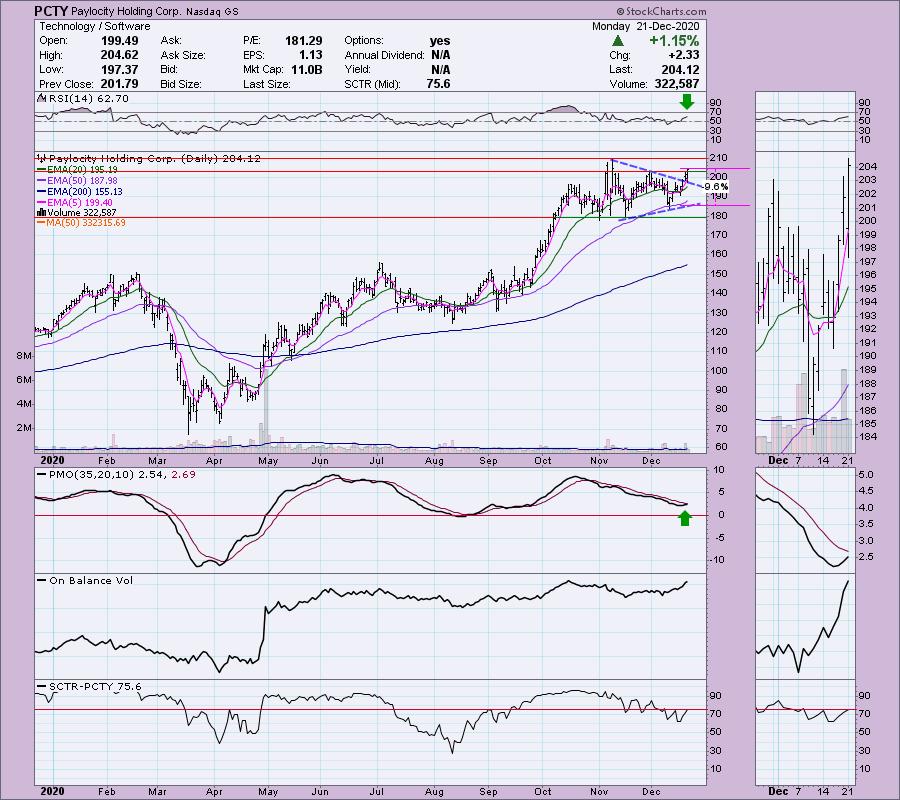

Paylocity Holding Corp. (PCTY)

EARNINGS: 2/4/2021 (AMC)

Paylocity Holding Corp. engages in the development and provision of cloud-based software solution. It offers cloud-based payroll, human capital management applications, time labor tracking, benefits administration, and talent management. The company was founded by Steve I. Sarowitz in 1997 and is headquartered in Arlington Heights, IL.

Below is the chart and commentary from 12/21:

"PCTY is unchanged in after hours trading. We saw a breakout from a symmetrical triangle. It is a continuation pattern so that was expected. Now PCTY has to deal with some overhead resistance at the November tops. I like the PMO which is only now turning up and moving in for a crossover BUY signal. The RSI has entered positive territory. The SCTR just entered the "hot zone" above 75. The stop level is rather deep. It is set below the 50-EMA."

Here is today's chart:

We got follow-through on the breakout from the symmetrical triangle. The PMO still looks fantastic and is not at all overbought. The RSI is getting overbought so we could see this rally cool down, but overall I still like the chart and am bullish going forward.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Altimmune, Inc. (ALT)

EARNINGS: 3/26/2021 (AMC)

Altimmune, Inc. is a clinical stage immunotherapeutic biotechnology company. It focuses on the discovery and development of products to stimulate robust and durable immune responses for the prevention and treatment of diseases. The company's portfolio includes RespirVec and Densigen that targets to stimulate the elements of the human immune system to treat respiratory diseases, chronic infections, and cancer. Altimmune was founded in 1997 and is headquartered in Gaithersburg, MD.

Below is the chart and commentary from 12/22:

"ALT is currently down -0.52% in after hours trading. Here is the first stock with a brand new IT Trend Model BUY signal. These are triggered when the 20-EMA crosses above the 50-EMA. The PMO has begun to accelerate higher out of oversold territory. The RSI is positive and not overbought. We could be looking at a reverse head and shoulders-type reversal pattern. I would mainly consider it a nice basing pattern. We don't actually have a breakout yet, but this is honestly another reason I like it. I want to enter beforehand if possible. This chart's bullish characteristics suggest I could."

Below is today's chart:

The breakout has not yet occurred, but as you can see, price is still trading above both the 20/50-EMAs as it continues to consolidate sideways. I think we picked this one a bit early. In any case, even with today's giant drop, it's still holding support and basically remains in the consolidation zone. We didn't hit the stop. If you're not in, I would definitely wait to see if it holds this support area and see if the PMO avoids a SELL signal. If not it is a sell or short.

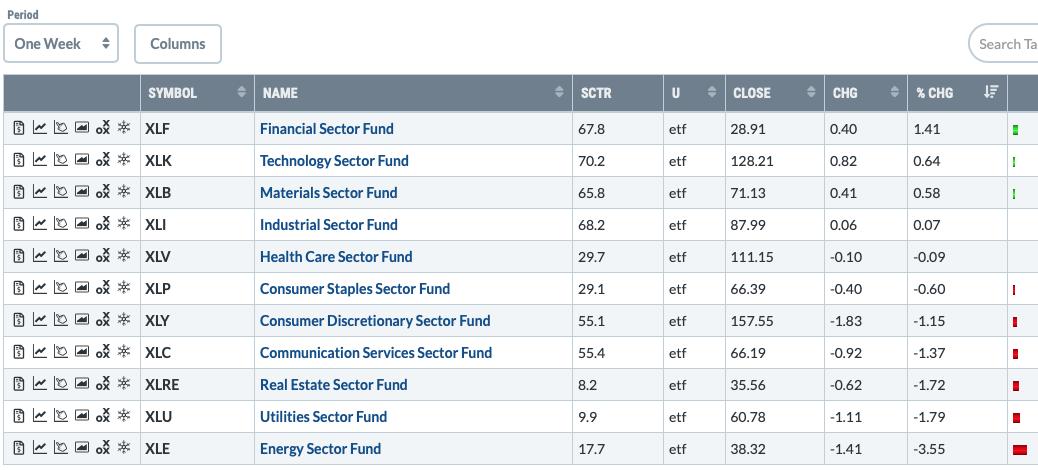

THIS WEEK's Sector Performance: Since we still have trading to go this week, here is what the sectors have done so far this week.

Click Here to view Carl's annotated Sector ChartList!

CONCLUSION:

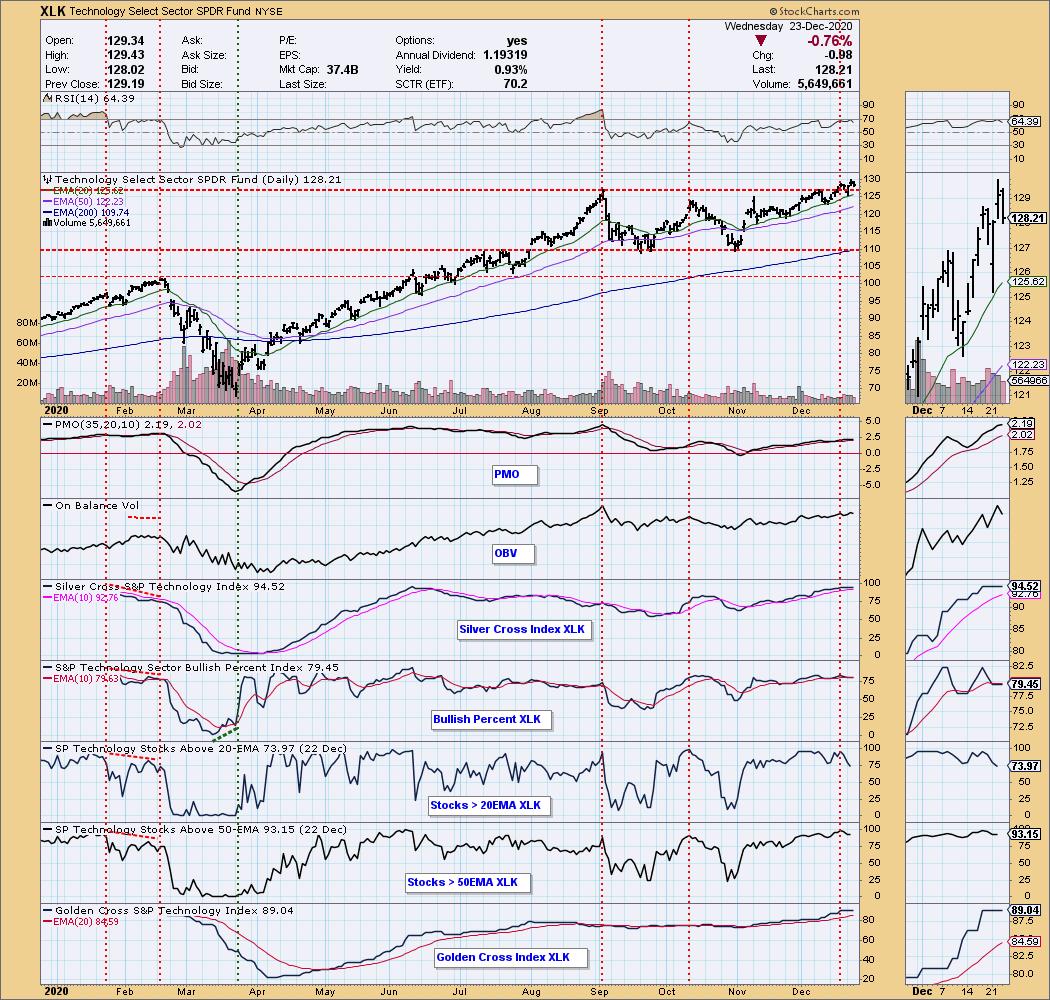

There is only one sector with rising momentum, so I'll have to go with Technology (XLK) as the sector to watch. I'm not a fan of the market overall right now and Technology usually leads the market. The market is ready for a decline. I believe we still have another week of favorable seasonality still left.

Sector to Watch: Technology (XLK)

Industry Group to Watch: It appears that the Computer Hardware industry group is ready for a breakout. The SCTR is nice and high and the PMO is rising and clearly not overbought based on the previous top.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Have a great weekend! Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 50% invested right now and 50% is in 'cash', meaning in money markets and readily available to trade with. I'm not going to add to my portfolio until January.

Technical Analysis is a windsock, not a crystal ball.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!