I had a huge selection of reader requests today so consequently, I was able to pick out four requests that are definitely "Diamonds in the Rough". The Diamond that I added today is a follow-on to the Home Builders Diamonds I presented on Tuesday.

Solar and Lithium are still hot and yesterday's Lithium picks were all up nicely today. I suspect these will be longer-term holds in my portfolio.

I have been receiving lots of interest and emails regarding Gold and Gold Miners. While I am short-term bullish on these stocks, they weren't "ripe" enough in my opinion. They are still vulnerable to the machinations of Gold and while it is looking bullish again, we know how Gold goes.

Announcement today! Mark Young, CMT of Wall Street Sentiment will be joining me in the free DecisionPoint Trading Room on February 1st! He is THE sentiment guru and has plenty to tell us regarding the current historically high bullish sentiment out there. Be sure to register if you haven't already.

Today's "Diamonds in the Rough" are: CAR, EPAM, LGIH, QDEL and TRP.

Diamond Mine Information:

Diamond Mine Information:

Here is the 1/15/2021 recording link. Access Passcode: mp+.Uj4q

===============================================================================

Register in advance for the next "DecisionPoint Diamond Mine" trading room on FRIDAY (1/22/2021) 12:00p ET:

Here is the Registration Link & Entry Password: poppy

Please do not share these links! They are for Diamonds subscribers ONLY!

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

There was no Trading Room on Monday January 18th due to the holiday.

Did you miss the 1/11/2021 free trading room? Here is a link to the recording. Access Code: ?H++t+d5

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Avis Budget Group, Inc. (CAR)

EARNINGS: 2/16/2021 (AMC)

Avis Budget Group, Inc. engages in the provision of vehicle sharing and rental services. It operates through the Americas and International segments. The Americas segment licenses the company's brands to third parties for vehicle rentals and and ancillary products and services in North America, South America, Central America, and the Caribbean. The International segment leases out vehicles in Europe, the Middle East, Africa, Asia, and Australasia. The company was founded by Warren E. Avis in 1946 and is headquartered in Parsippany, NJ.

CAR is currently down -0.29% in after hours trading. This reader request is very timely. It nearly broke out yesterday to confirm the ascending triangle pattern, but today, it did finish outside of the pattern. The RSI is positive and the PMO is rising strongly out of oversold territory. Folks may not be comfortable with air travel, but they are comfortable with renting a car. The OBV is confirming the uptrend and the SCTR is showing great improvement.

CAR is in a clear long-term trading range. The PMO is very overbought, but it has now turned up on this week's strong showing. The RSI remains positive. I set the upside target at the top of the trading range. I am not confident that it will break out of this range.

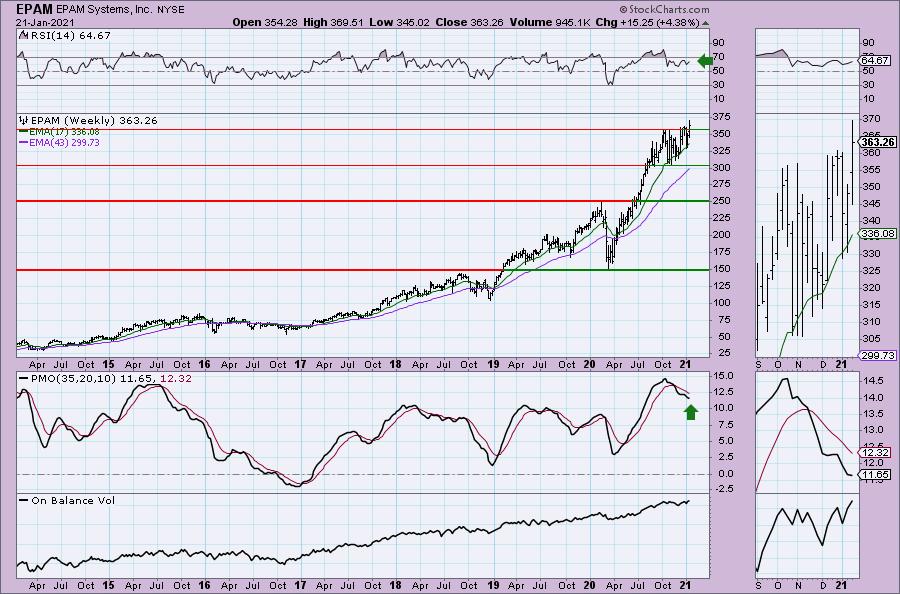

EPAM Systems, Inc. (EPAM)

EARNINGS: 2/18/2021 (BMO)

EPAM Systems, Inc. engages in the provision of software product development and digital platform engineering services. It operates through the following segments: North America, Europe, and Russia. The company was founded by Leonid Lozner and Arkadiy Dobkin in 1993 and is headquartered in Newtown, PA.

EPAM is unchanged in after hours trading. I covered it on October 7th 2020. It hit its 7.8% stop fairly quickly after a small 3.9% gain. Here we have another breakout from an ascending triangle pattern. The minimum upside target can be calculated by taking the range from the back of the pattern and adding to the breakout point. That would give us upside minimum target of $420. The RSI is positive and the PMO just triggered an oversold BUY signal. I set the stop level at the January lows, but you don't have to wait that long if the trade begins to go south.

The weekly PMO is decelerating and appears ready to turn back up on the new all-time highs. The RSI is positive and the OBV is confirming this breakout.

LGI Homes, Inc. (LGIH)

EARNINGS: 2/23/2021 (BMO)

LGI Homes, Inc. engages in the design, construction, marketing, and sale of new homes. It also deals with the residential land development business. It operates through the following segments: Central, West, Southeast, Florida, and Northwest. The company was founded by Eric Thomas Lipar in 2003 and is headquartered in The Woodlands, TX.

Here's my pick today and I think a lot of other people are considering it given it is already up +1.52% in after hours trading. Home Builders are hot and seem to be getting hotter. This is a rather "beat down" stock in that industry group. Today it broke from an intermediate-term falling wedge and traded above the 50-EMA most of the day. The PMO has just given us a BUY signal and the RSI has only recently hit positive territory. I didn't look at KB Homes (KBH), but it is another Home Builder to consider.

The weekly RSI has just hit positive territory and the weekly PMO is beginning to decelerate. I also see a positive OBV divergence. If price can reach its 2020 high that would be a 22%+ gain.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Quidel Corp. (QDEL)

EARNINGS: 3/11/2021

Quidel Corp. engages in the development, manufacture and market of rapid diagnostic testing solutions. Its portfolio includes rapid immunoassays, cardiac immunoassays, specialized diagnostic solutions and molecular diagnostic solutions. The products are directly sold to end users and distributors and for professional use in physician offices, hospitals, clinical laboratories, reference laboratories, urgent care clinics, universities, retail clinics, pharmacies and wellness screening centers. The company was founded in 1979 and is headquartered in San Diego, CA.

QDEL is up +0.23% in after hours trading. I covered it on July 23rd as a "reader request". I did like it at the time. The 13% stop was hit on the August correction, but it was up over 18% at the August top. Today it had a nice breakout from a trading range and double-bottom pattern. The PMO is rising nicely and has just reached above the zero line. The stop was a little tricky as it would require a nearly 13% stop if you lined it up with the 200-EMA so I opted to go with a drop below the 20/50-EMAs.

The weekly chart suggests QDEL might be ready to take another go at overhead resistance at the 2020 top. The weekly PMO hasn't quite bottomed yet, but another rally will fix that. The RSI is back in positive territory and not overbought.

TC Energy Corp. (TRP)

EARNINGS: 2/11/2021 (BMO)

TC Energy Corporation engages in the provision of energy infrastructure services. It operates through the following business segments: Canadian Natural Gas Pipelines, U.S. Natural Gas Pipelines, Mexico Natural Gas Pipelines, Liquids Pipelines, Power and Storage, and Corporate. The Canadian Natural Gas Pipelines segment consists of regulated natural gas pipelines. The U.S. Natural Gas Pipelines segment manages the regulated natural gas pipelines, regulated natural gas storage facilities, midstream, and other assets. The Mexico Natural Gas Pipelines invests on regulated natural gas pipelines in Mexico. The Liquids Pipelines handles investments on crude oil pipeline systems. The Power and Storage segment consists of power generation plants and non-regulated natural gas storage facilities. The company was founded on May 15, 2003 and is headquartered in Calgary, Canada.

TRP is unchanged in after hours trading. This reader request has potential. We haven't gotten the breakout to confirm the large double-bottom, but the PMO and RSI suggest it will. The PMO is on an oversold BUY signal and has reached positive territory again. The RSI is positive and not yet overbought. You can set a conservative stop about halfway back down into the pattern.

The weekly RSI has just reached positive territory and the weekly PMO recently triggered a BUY signal. The weekly PMO hasn't quite reached positive territory, but it's very close. The OBV does confirm the rising trend, but it is showing a reverse divergence. Meaning, we have an OBV that has hit highs while price has definitely not. If we see a challenge of its bull market top, that would be a sizable gain.

Full Disclosure: I'm about 85% invested and 15% is in 'cash', meaning in money markets and readily available to trade with. Dropped a few positions including BHLB, last week's Diamond. I also added previous Diamonds, ARKG and BLL. I like to keep you all apprised of my comings and goings with my Diamond positions, especially since I don't do a "model portfolio".

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 9

- Diamond Dog Scan Results: 3

- Diamond Bull/Bear Ratio: 3.00

I'm in the process of trying to plot the Diamond Index, but with time at a premium, it is on the back burner.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!