"Diamonds in the Rough" outperformed the SPY, but honestly I'm not pleased since we were down for the week (just down less than the SPY). My sense is that we got on board some of the defensive sectors and stocks too early. I believe these will outperform over time should the market continue to decline as I am expecting.

Next Friday I am going to see how the Diamonds performed starting in December by going back and entering current prices. I think it will be a good exercise to measure the performance of our scans over time. I'll be curious to see how many stop levels were hit. It's my birthday weekend, so I'm trying to wrap up my writing more quickly today and am opting to wait until next week to do that.

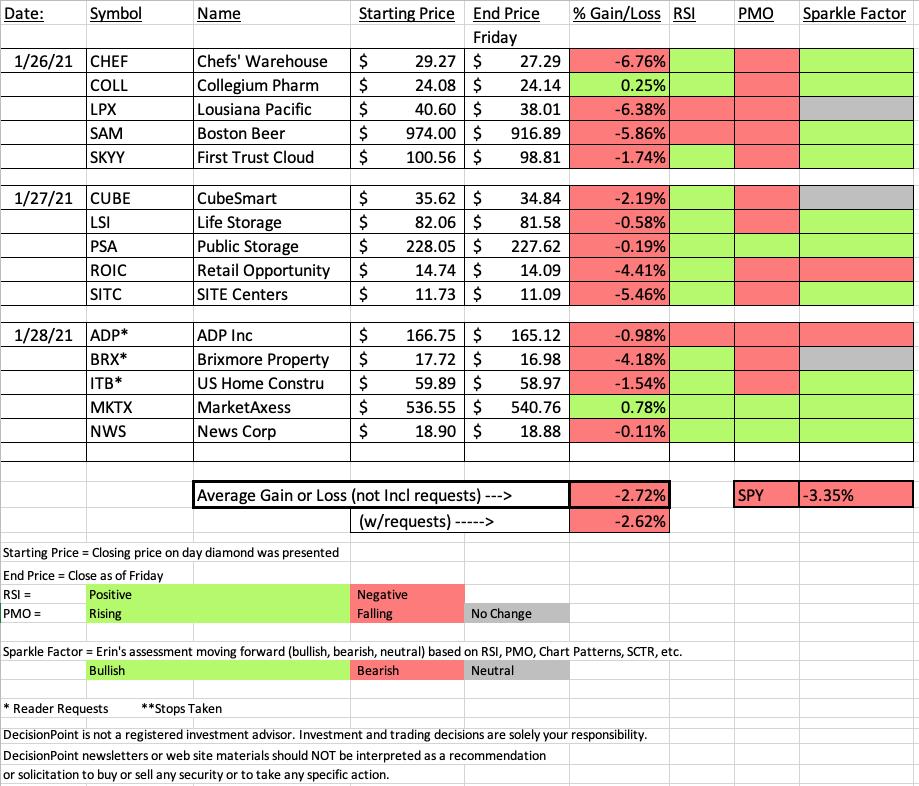

This week's "Darling" is MarketAxess Holdings (MKTX) which was up a modest +0.75% in one day of trading since I picked it yesterday. This week's "Dud" is Chef's Warehouse (CHEF) which is down -6.38% since I picked it. Interestingly, that was the big winner on Wednesday, but the pullback today and yesterday hung it out to dry.

Folks are still having some issues with registering and getting into the Diamond Mine. The best way to ensure you will get in is to register EARLY. This also helps me fix any issues that may be coming up. Make sure you are clicking on the registration link and not the recording. I am mailing out the "join" links right before I open the room, but they will only reach those who registered for the Diamond Mine. Register early to avoid any future issues.

Diamond Mine Information:

Diamond Mine Information:

Here is today's (1/29/2021) RECORDING link. Access Passcode: xqh%L59J

===============================================================================

Register in advance for the next "DecisionPoint Diamond Mine" trading room on FRIDAY (2/5/2021) 12:00p ET:

Here is the latest REGISTRATION LINK.

Password: market

Please do not share these links! They are for Diamonds subscribers ONLY!

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time. I will send out the link to join right before the webinar to REGISTERED attendees. Register early.

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

It's Free!

Mark Young, CMT of WallStreetSentiment.com will be joining me in the free trading room on February 1st! He has all the latest sentiment data and will give his opinion on your symbol requests too!

Mark Young, CMT of WallStreetSentiment.com will be joining me in the free trading room on February 1st! He has all the latest sentiment data and will give his opinion on your symbol requests too!

"Investor sentiment is one of the most powerful forces in the stock market. It can make the difference between selling out at a market low and buying there." -- Mark Young, CMT

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

We didn't hold a 1/18 Trading Room. Did you miss the 1/11 trading room? Here is a linkto the recording -- access code: ?H++t+d5

For best results, copy and paste the access code to avoid typos.

Darling:

MarketAxess Holdings Inc. (MKTX)

EARNINGS: 4/28/2021 (BMO)

MarketAxess Holdings, Inc. operates as an electronic trading platform that allows investment industry professionals to trade corporate bonds and other types of fixed-income instruments. It also provides data and analytical tools that help its clients to make trading decisions and facilitate the trading process by electronically communicating order information between trading counterparties. The firm's patented trading technology allows institutional investor clients to request competitive, executable bids, or offers from multiple broker dealers simultaneously and to execute trades with the broker dealer of their choice. The company was founded by Richard M. Mcvey on April 11, 2000 and is headquartered in New York, NY.

Below is the chart and analysis from Tuesday:

"This is my second pick. MKTX is unchanged in after hours trading. They reported earnings yesterday and based on the big breakout move, they were well-received. The rally continued today and now the PMO is rising toward a crossover BUY signal. The RSI just moved positive today. The OBV shows plenty of interest based on increased positive volume. The SCTR is rather low, but it is improving."

Here is today's chart:

It decided to pause after the big rally earlier in the week. I don't see much in the way of damage here based on the intraday low reaching below the 5/20-EMAs. I still like this one going forward given the newly positive RSI and continued rise of the PMO.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Chefs' Warehouse, Inc. (CHEF)

EARNINGS: 2/10/2021 (BMO)

The Chefs' Warehouse, Inc. engages in the distribution of specialty food products. It focuses on serving the specific needs of chefs who own and operate some of the menu-driven independent restaurants, fine dining establishments, country clubs, hotels, caterers, culinary schools, bakeries, patisseries, chocolatiers, cruise lines, casinos and specialty food stores. Its product portfolio includes artisan charcuterie, specialty cheeses, unique oils and vinegars, truffles, caviar, chocolate and pastry products. The firm operates through East Coast, Midwest and West Coast segments. It also offers a line of center-of-the-plate products, including custom cut beef, seafood and hormone-free poultry, as well as broad line food products, such as cooking oils, butter, eggs, milk and flour. The company was founded by Christopher Pappas, John D. Pappas, and Dean Facatselis in 1985 and is headquartered in Ridgefield, CT.

Here is the chart and analysis from Thursday:

"CHEF is unchanged in after hours trading. It's on an accelerating rally that has finally triggered a PMO BUY signal. The RSI is positive although slightly overbought. The OBV is confirming the rally as accumulation has picked up in the last week. The SCTR is in the "hot zone" above 75. It isn't obvious that overhead resistance is around $32.50 until you look at the weekly chart. The stop is set just below the December top."

Below is today's chart:

As noted in the intro, this one was a great pick until today as it took back gains we had just begun to see. I still actually like this stock and feel it is worth a home within your watch list. Today's drop pulled it back to support and it did manage to close above the 20-EMA.

THIS WEEK's Sector Performance:

Click Here to view Carl's annotated Sector ChartList!

CONCLUSION:

The market continues to act toppy and weak and given that we likely should continue to look toward defensive sectors. I will take us where the scans lead on Tuesday, but since I don't write on Monday I think having some guidance going in is helpful to my readers.

Sector to Watch: Utilities Sector (XLU)

Currently there is no sector with rising momentum. I like the idea of defensive stock plays right now and given the decent amount of participation and the rising trend on the indicators, this could be an excellent area to concentrate on.

Industry Group to Watch: Multiutilities ($DJUSMU)

Look at the bullishness on this industry group. Nice breakout from a bullish falling wedge. An RSI that is getting positive again and a PMO BUY signal. Obviously you can trade this chart, but you can begin to look for outperforms in this pocket of strength.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend!

Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 80% invested right now and 20% is in 'cash', meaning in money markets and readily available to trade with. I will not be adding to my portfolio unless stocks within the defensive sectors are looking positive enough to swap out a more aggressive position for a more defensive position.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!