Very successful week for Diamonds which isn't a surprise given that the wind was at our backs with a rising market. This week's positions were primarily in defensive areas of the market, particularly Utilities and Consumer Staples. I still believe these are great places to be exposed in the market going forward, at least until we see Healthcare and Technology improve.

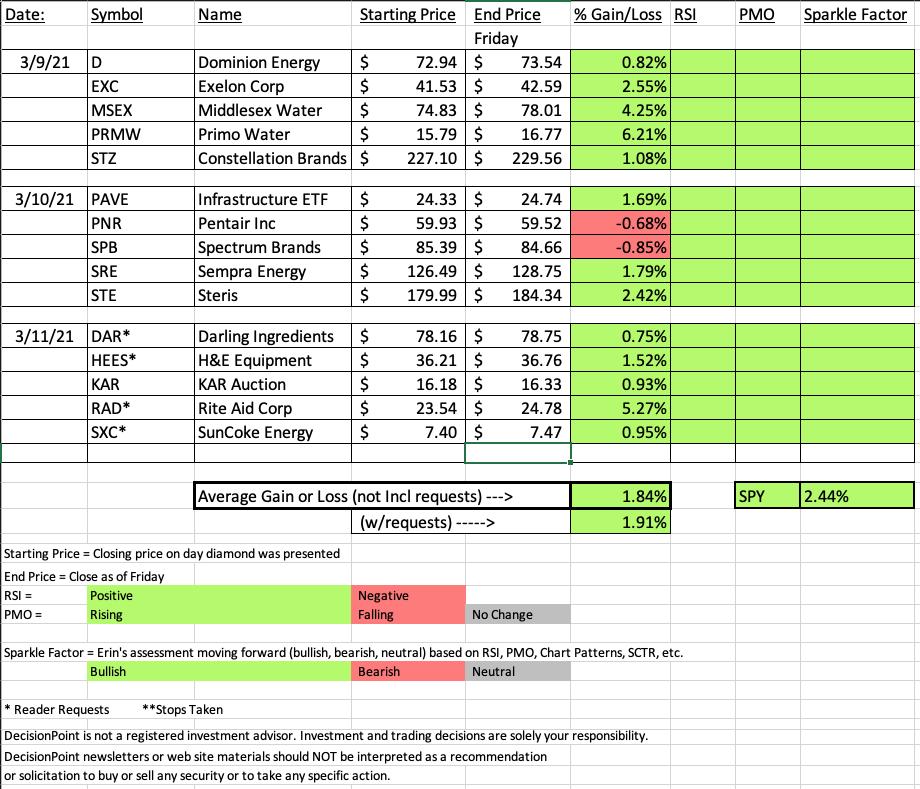

This week's "darling" was Primo Water (PRMW) which was up +6.21%. The "dud" was Spectrum Brands (SPB) which was down a modest -0.85%.

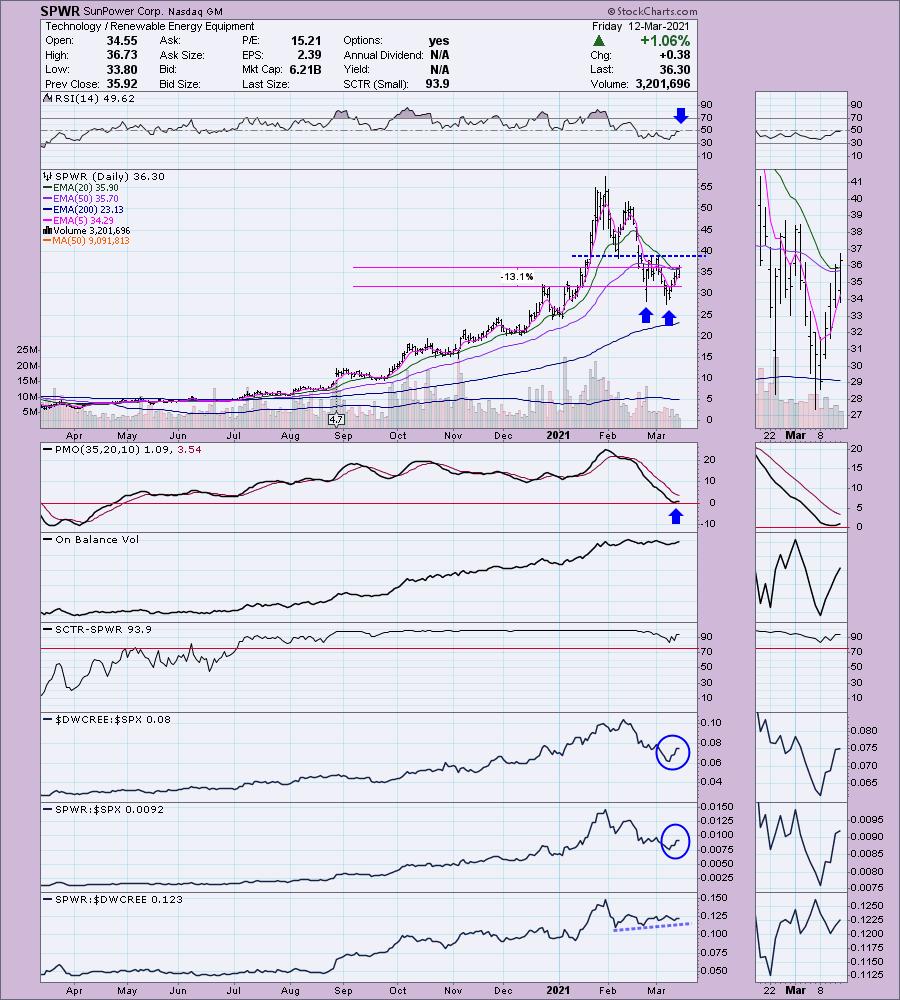

The industry group that is finally reawakening is Renewable Energy! I nearly included TAN in yesterday's report, but I was expecting to see a pullback AND I wanted to make sure the PMO was going to continue higher with price back above the 20-EMA. I just reentered Sunpower (SPWR). The stop is deep due to the volatility this stock often experiences. The PMO has now turned up for the first time since it lost its BUY signal. The 20-EMA avoided a negative crossover the 50-EMA. The confirmation line for the double-bottom hasn't been reached. If it cannot push past it, I'll likely sell it and wait for a better entry.

I like Tesla (TSLA) right now, but it hasn't vaulted the 20-EMA yet, so I'm stalking it.

Only two of our 15 positions finished down with the worst only down -0.85%. You'll notice that all of the picks this week continue to have rising momentum and positive RSIs, hence every one of this week's Diamonds has a green Sparkle Factor moving ahead. I like them all.

The market is testing new all-time highs but negative divergences are persisting. Keep your stops in force and don't talk yourself into staying when you shouldn't. Stay alert and consider staying in the more defensive sectors.

Time to register for next week's Diamond Mine! Here is the link. Just do it now to avoid missing out!

Diamond Mine Information:

RECORDING LINK:

Topic: DecisionPoint Diamond Mine (03/12/2021) LIVE Trading Room

Start Time : Mar 12, 2021 08:53 AM

Access Passcode: &hJ8Vv^P

REGISTRATION:

When: Mar 19, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (3/19/2021) LIVE Trading Room

Diamond Mine Registration Link

Please do not share these links! They are for Diamonds subscribers ONLY!

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Free DecisionPoint Trading Room on Mondays, Noon ET

*Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!*

=======================================

BELOW is a link to Monday's recording:

Topic: DecisionPoint Trading Room

Start Time : Mar 8, 2021 08:50 AM

Free Trading Room Recording Link

Access Passcode: G@W.$M5B

For best results, copy and paste the access code to avoid typos.

Darling:

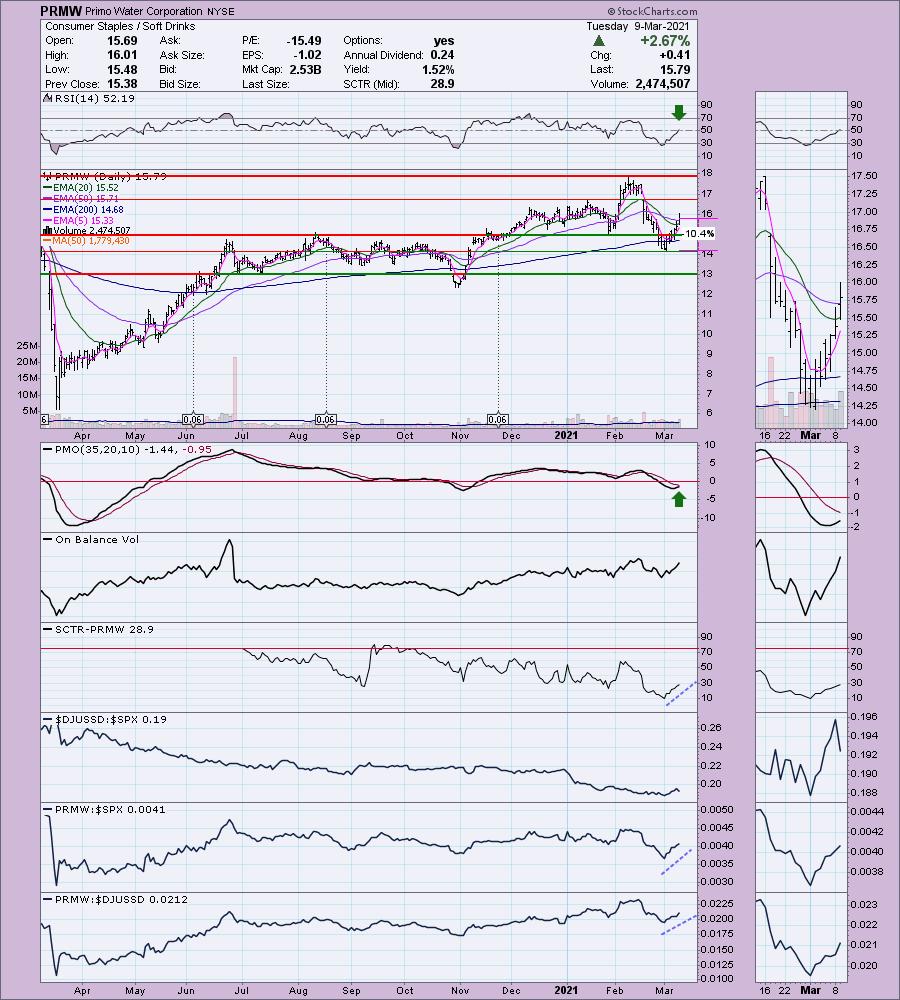

Primo Water Corporation (PRMW)

EARNINGS: 5/6/2021 (BMO)

Primo Water Corp. engages in the manufacture, process, and distribution of beverages. It operates through the following business segments: Route Based Services; Coffee, Tea, and Extract Solutions; and All Other. The Route Based Services segment includes Aquaterra and Eden businesses. The Coffee, Tea, and Extract Solutions segment relates to the S&D business. The All Other segment manufactures, repacks, and markets carbonated soft drinks in Europe. The All Other segment focuses on Aimia, Decantae, and RCI concentrate businesses, Columbus, Georgia manufacturing facility, and other miscellaneous expenses. The company was founded in 1955 and is headquartered in Tampa, FL.

Below is the chart and commentary from Tuesday (3/9):

"PRMW is up +1.27% in after hours trading. The last two 'diamonds in the rough' are from Consumer Staples. Today price traded above the 20-EMA and finished with a close above the 50-EMA. Both the 5/20-EMAs are rising and should trigger ST and IT Trend Model BUY signals soon with a 5/20-EMA positive crossover (ST Trend Model BUY) and a positive 20/50-EMA crossover (IT Trend Model BUY). The RSI has just reached positive territory and the PMO is rising toward crossover BUY signal. The SCTR is improving. The industry group is performing about as well as the SPY, but we can see that PRMW is outperforming both."

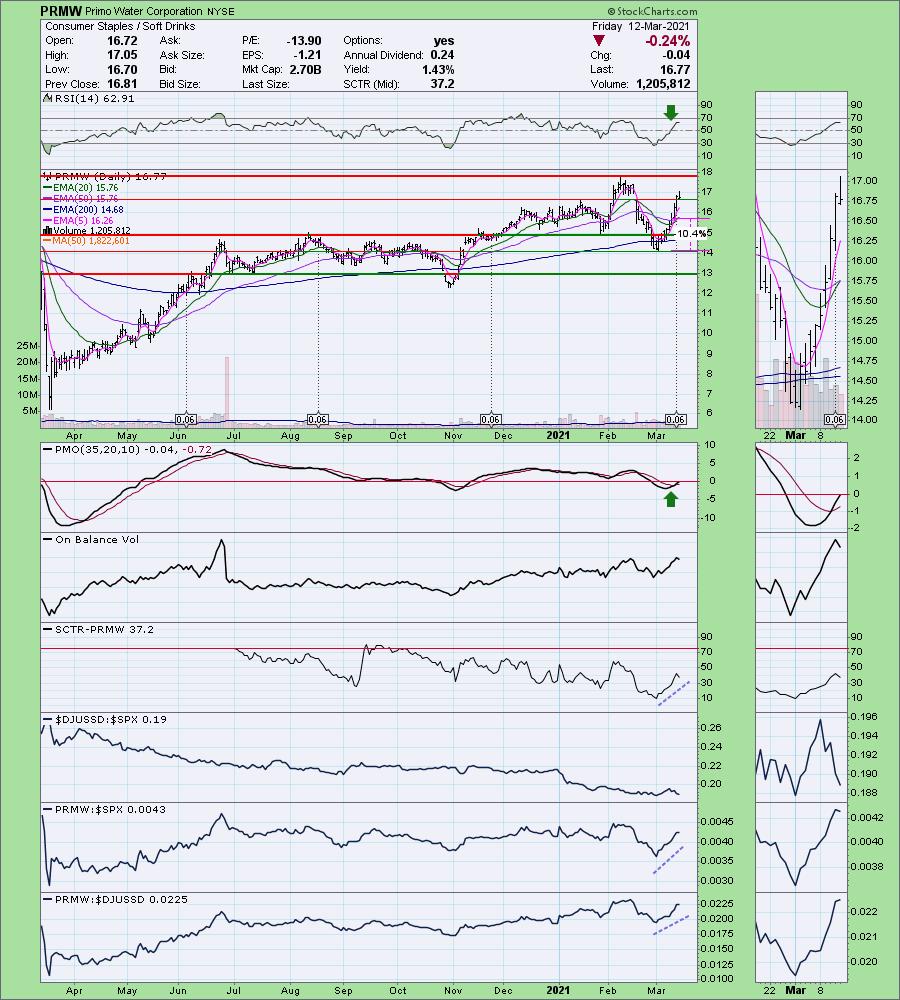

Here is today's chart:

It pulled back slightly today but maintained above support at the January top. The RSI is still positive and the PMO has nearly reached positive territory. Strong overhead resistance is arriving at the February top. It could get stopped at that level, but if the indicators remain positive, look for a breakout to higher highs.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

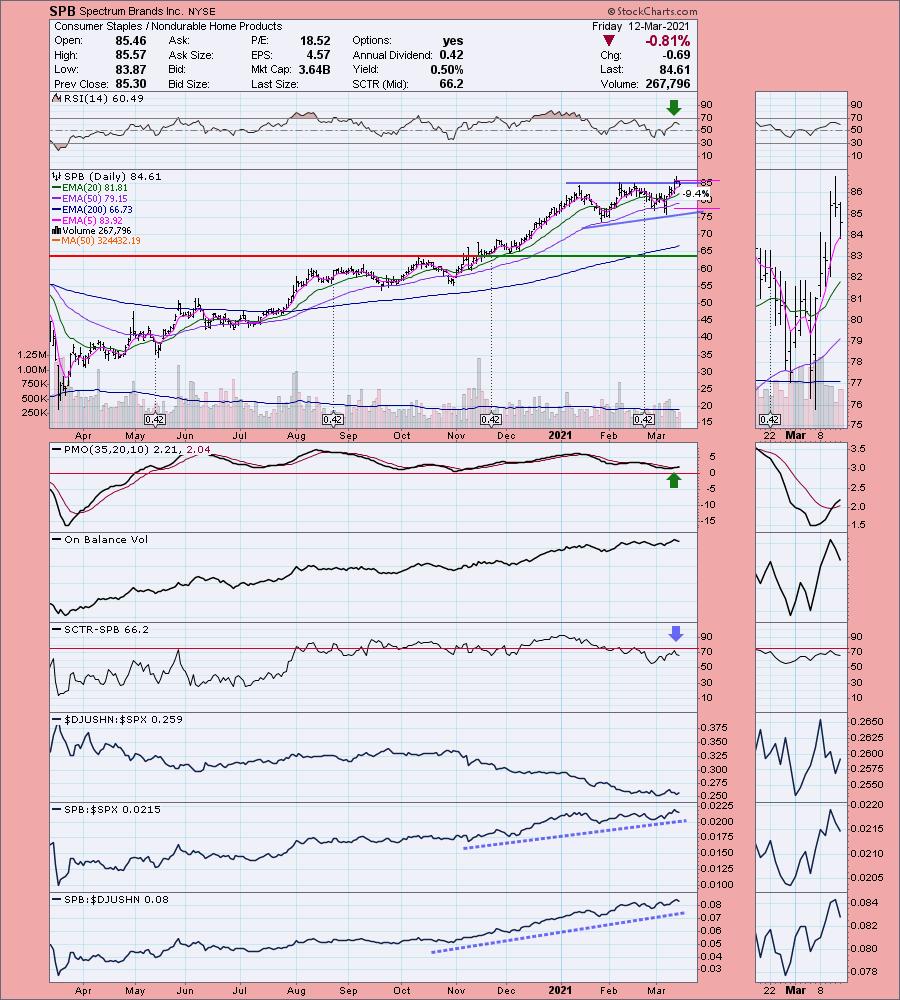

Spectrum Brands Inc. (SPB)

EARNINGS: 4/29/2021 (BMO)

Spectrum Brands Holdings, Inc. is a consumer products and home essentials company. It engages in the manufacture and supply of residential locksets, residential builders hardware, plumbing, shaving and grooming products, personal care products, small household appliances, specialty pet supplies, lawn, garden and home pest control products, and personal insect repellents. The firm operates through the following segments: Hardware and Home Improvement (HHI); Home and Personal Care (HPC); Global Pet Care (GPC); and Home and Garden (H&G). The HHI segment consists of hardware, security and plumbing business. The GPC segment focuses on the pet care business. The H&G segment involves the home and garden and insect control business. The HPC segment includes the small kitchen and personal care appliances business. The company was founded in 1906 and is headquartered in Middleton, WI.

Below is the chart and commentary from Wednesday (3/10):

"SPB is unchanged in after hours trading. I love the recent breakout from the bullish ascending triangle. The RSI is positive and the PMO is nearing a crossover BUY signal. The SCTR is nearing the hot zone. The group has been underperforming, but SPB is having no problem outperforming the benchmark SPX. The stop could be set very deep at support around $75, but I prefer a stop that is smaller than 11%."

Below is today's chart:

The chart still looks pretty good. The breakout didn't hold, but the 5-EMA is still acting as support which suggests internal strength. Despite a big decline, the PMO wasn't really damaged. I gave it a bullish Sparkle Factor, but it certainly isn't as bullish as some of the other "diamonds in the rough" this week.

THIS WEEK's Sector Performance:

Click Here to view Carl's annotated Sector ChartList!

CONCLUSION:

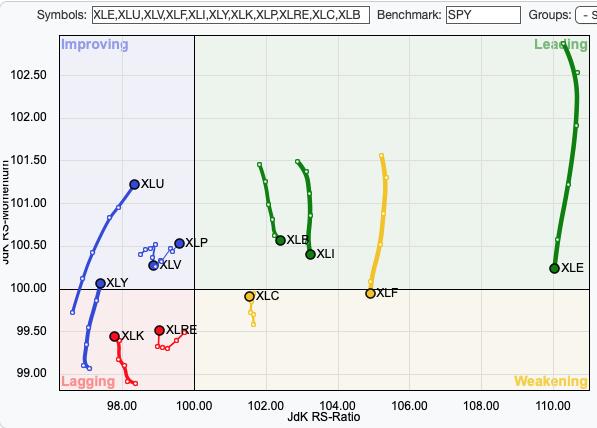

Below is the sector Relative Rotation Graph for the short term or "daily" version. Clearly the sectors that are gaining strength are defensive in nature with the exception of Consumer Discretionary (XLY). As far as XLY goes, keep your eye on the "recovery" stocks within travel, cruise lines, airlines and restaurants & bars.

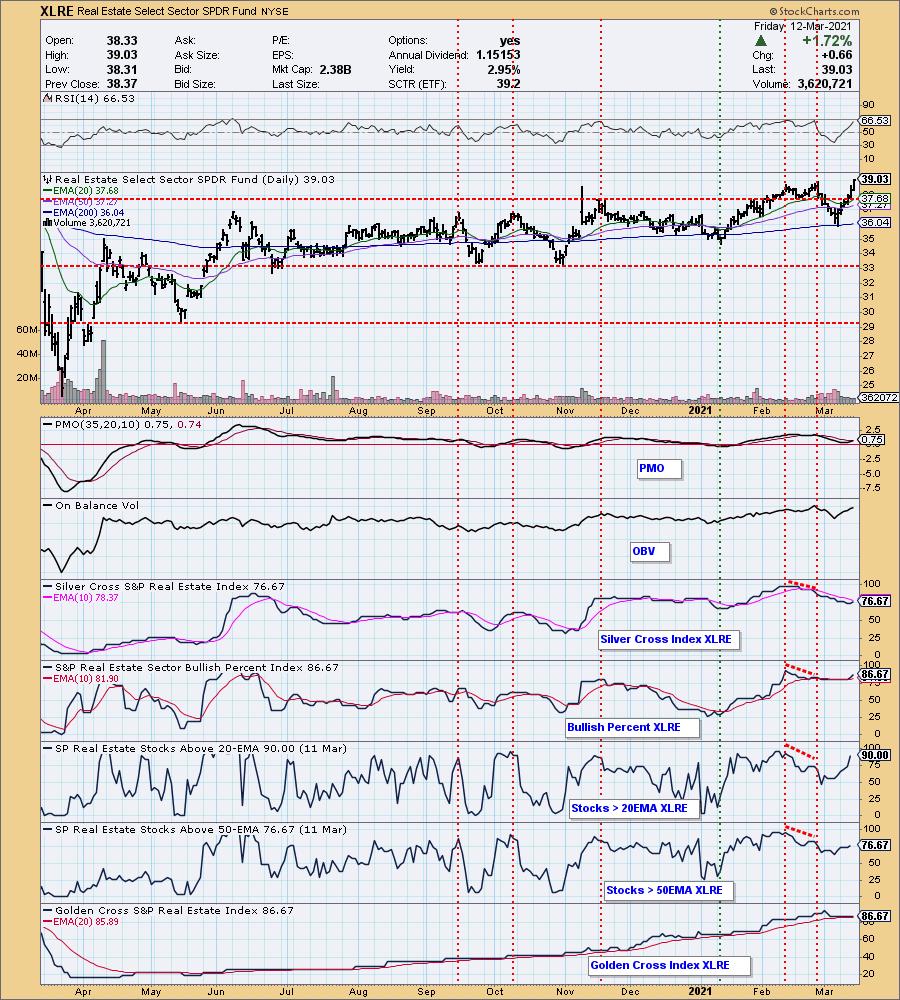

Sector to Watch: Real Estate (XLRE)

While it may not be as impressive on the RRG, the sector chart is showing new momentum and room to run. I discussed Renewable Energy and recovery stocks in XLY so why am I choosing Real Estate? The sector chart looks fantastic right now. A new PMO BUY signal, positive RSI and a beautiful breakout today. Notice that participation is improving greatly. With over 86% of stock having their 50-EMA > 200-EMA, there is a clear bullish bias in this sector.

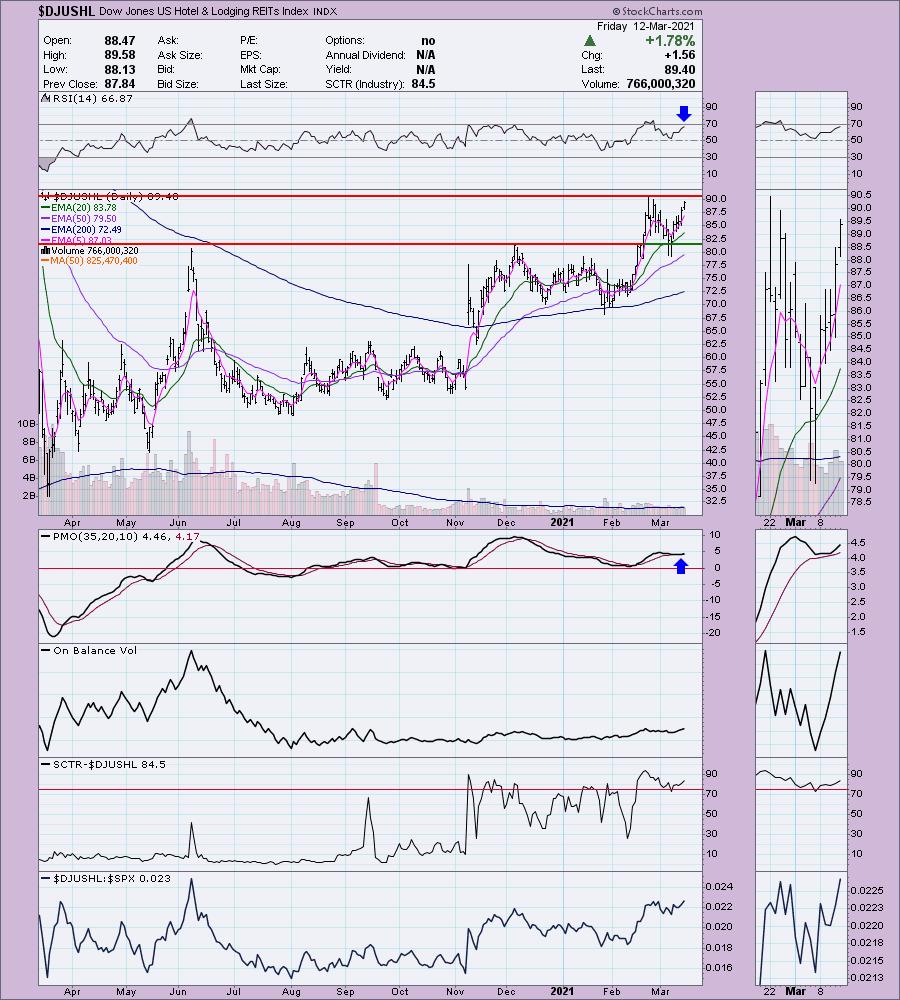

Industry Group to Watch: Hotel & Lodging REITs ($DJUSHL)

This group has the highest SCTR within the Real Estate sector. It hasn't quite broken out, but given the PMO bottom above the signal line and the fact that it is not overbought, I would expect the breakout next week. We're starting to see some outperformance of the SPX. I suppose this piggybacks on the recovery stocks' bullishness.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 75% invested right now and 25% is in 'cash', meaning in money markets and readily available to trade with. This week I added Diamonds: EXC, RAD, BLBD and SPWR. I sold BOIL, but have a $9.60 stop on UNG. I felt overexposed to Nat Gas and pared back the position by selling BOIL.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)