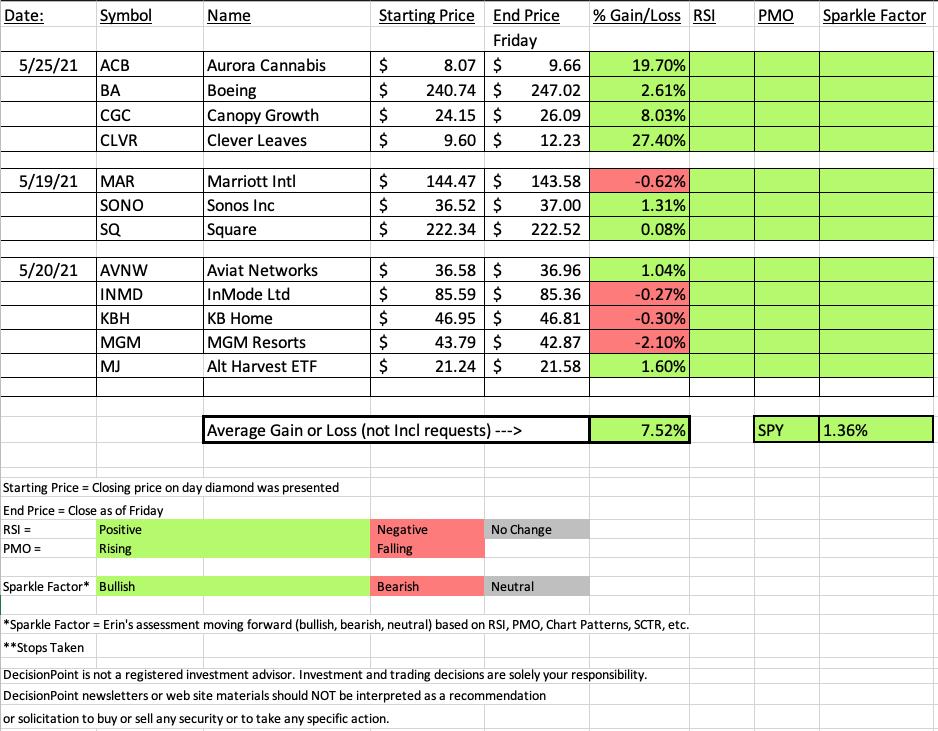

It is clear on our the Diamonds spreadsheet this week that cannabis was a huge winner! ACB was up 19.7%, CGC was up 8% and CLVR was up a whopping 27.4%! It isn't too late to get in this space. I offered up the Alternative Harvest ETF (MJ) yesterday and it was up 1.6% today. There is plenty of upside here, triple digit upside on some of these stocks. I decided to let everyone in on the "secret" during yesterday's StockChartsTV special "The Pitch". I highly recommend you look at the recording with myself, Mary Ellen McGonagle and Danielle Shay, hosted by David Keller, CMT. Here is the link.

Newsweek just dropped an article on the proposed cannabis legislation. If you're unfamiliar with this space, you should read it here.

CLVR is the clear winner this week so we'll take a look at it. The biggest loser was MGM Resorts (MGM), but it was picked only yesterday and was down only 1.48%, offering a good entry.

All of the stocks this week have the green light to proceed. All them have positive RSIs, all of them have rising PMOs and all have a "green" Sparkle Factor.

Register now for next week's Diamond Mine trading room on June 4th HERE.

(Full Disclosure: I own ACB and CLVR)

Diamond Mine Information:

RECORDING LINK:

Topic: DecisionPoint Diamond Mine (5/28/2021) LIVE Trading Room

Start Time : May 28, 2021 09:01 AM

Meeting Recording LINK.

Access Passcode: May-28th

REGISTRATION:

Topic: DecisionPoint Diamond Mine (6/4/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Free DecisionPoint Trading Room on Mondays, Noon ET

*Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!*

=======================================

BELOW is a link to Monday's recording:

Topic: DecisionPoint Trading Room

Start Time : May 24, 2021 09:00 AM

Meeting Recording LINK.

Access Passcode: may24-2021

For best results, copy and paste the access code to avoid typos.

Darling:

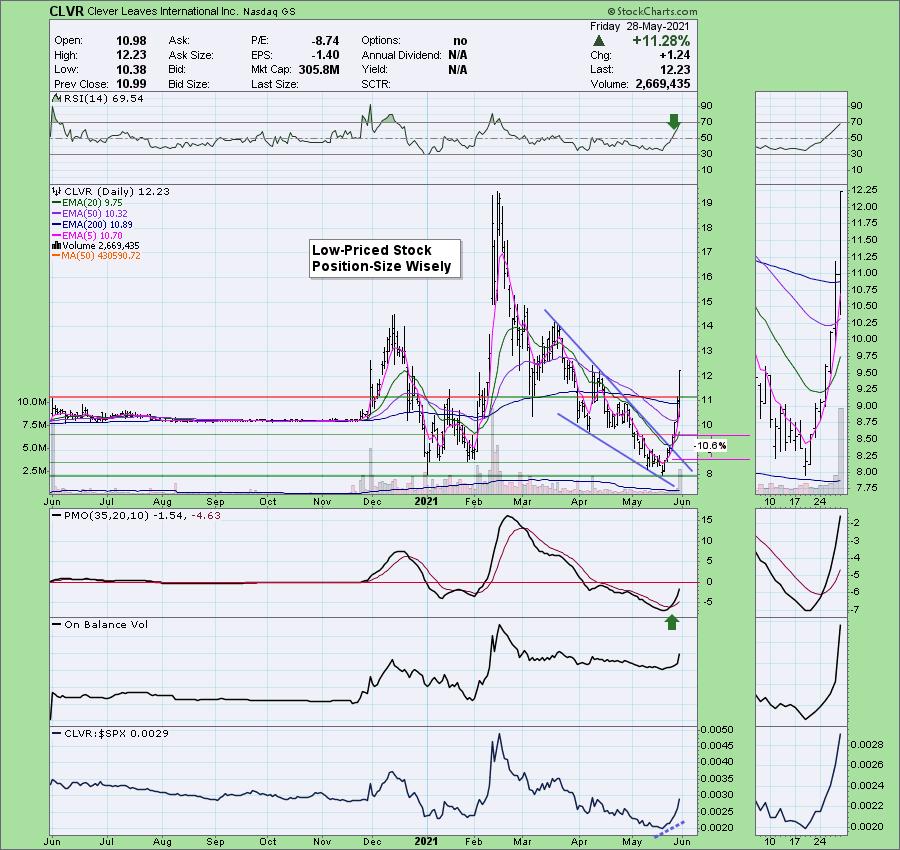

Clever Leaves International Inc. (CLVR)

EARNINGS: 8/12/2021 (AMC)

Clever Leaves Holdings, Inc. operates as a holding company. It produces pharmaceutical-grade cannabinoids. The company was founded on July 23, 2020 and is headquartered in New York, NY.

Below is the commentary and chart from Tuesday:

"I'm not happy to report that CLVR is down -3.12% in after hours trading. However, even with that drop, it remains above the 20-EMA. It did hit overhead resistance so it isn't completely surprising to see it pulling back. There are plenty of positives on the chart. The RSI just reached positive territory. There is a large bullish falling wedge that resolved upward as expected today. The PMO just triggered a crossover BUY signal. We did see very strong volume coming in on this recent rally out of the May low. It is performing better than the SPX right now. The stop is very deep, another reason to position size carefully. If I could bring the stop down further I would, but I don't do stops that are much higher than 10%. This is already a stretch."

Here is today's chart:

Who knew this one was going to go this crazy? It had a great set-up but this was a bit unexpected, especially given it was down this morning! The RSI is nearing overbought territory, but given this unbelievable move today, of course it is. I believe there is still great upside potential on these stocks, this one may need a pullback. It is currently down -1.88% in after hours trading, so if you're not in, you could find a decent entry on a pullback. The new stop should likely be set at $11 or so.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

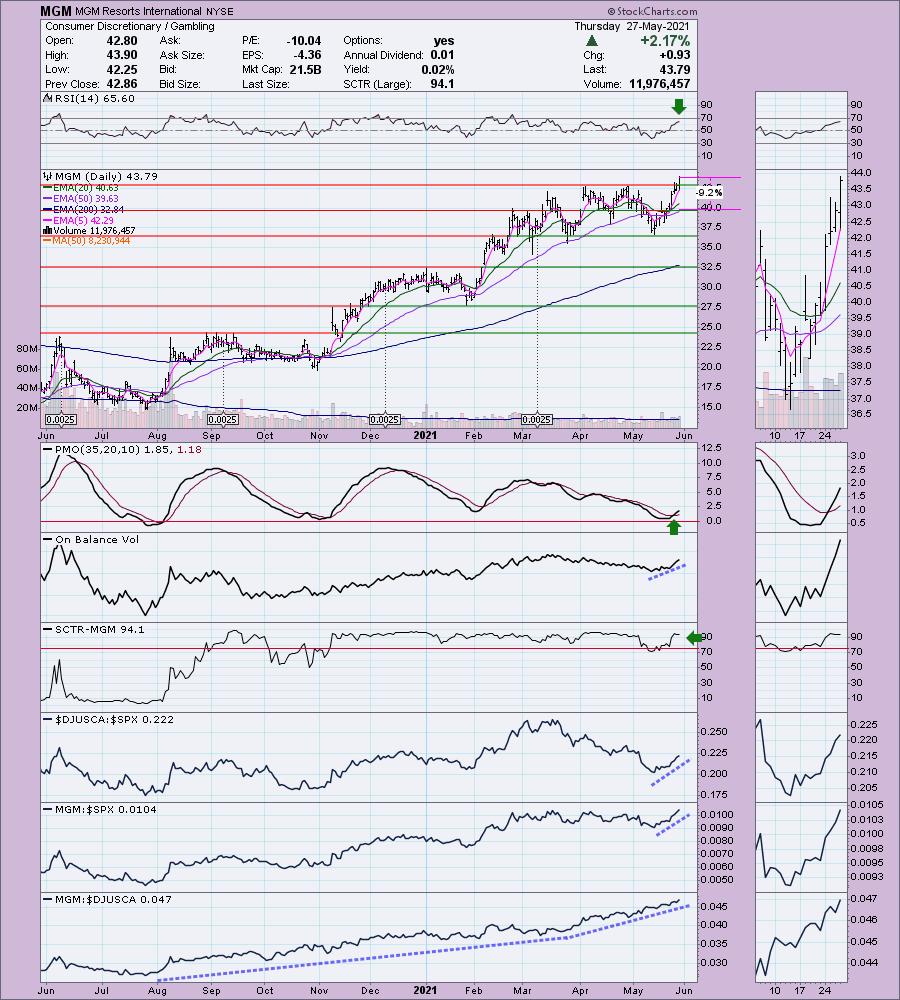

MGM Resorts International (MGM)

EARNINGS: 7/29/2021 (AMC)

MGM Resorts International is a holding company, which engages in the ownership and operations of casino resorts. The firm's casino resorts offer gaming, hotel, convention, dining, entertainment, retail, and other resort amenities. It operates through the following business segments: Las Vegas Strip Resorts, Regional Operations and MGM China. The Las Vegas Strip Resorts segment consists of the following casino resorts: Bellagio, MGM Grand Las Vegas, Mandalay Bay, The Mirage, Luxor, New York-New, Excalibur, Park MGM, and Circus Las Vegas. The Regional Operations segment consists of the following casino resorts: MGM Grand Detroit in Detroit, Michigan; Beau Rivage in Biloxi, Mississippi; Gold Strike Tunica in Tunica, Mississippi; Borgata in Atlantic City, New Jersey; MGM National Harbor in Prince George's County, Maryland; and MGM Springfield in Springfield, Massachusetts. The MGM China segment consists of MGM Macau and MGM Cotai. The company was founded by Kerkor Kerkorian on January 29, 1986 and is headquartered in Las Vegas, NV.

Below is the chart and commentary from yesterday:

"MGM is down -0.11% in after hours trading. I really like today's breakout that is accompanied by a positive and not overbought RSI, and a PMO crossover BUY signal. The OBV is currently confirming the rally. The SCTR is first rate and MGM is clearly one of the stocks you want to own in this industry group given its consistent outperformance within its group. We also see it outperforming the SPX as well. The stop is a bit deep set at the 50-EMA."

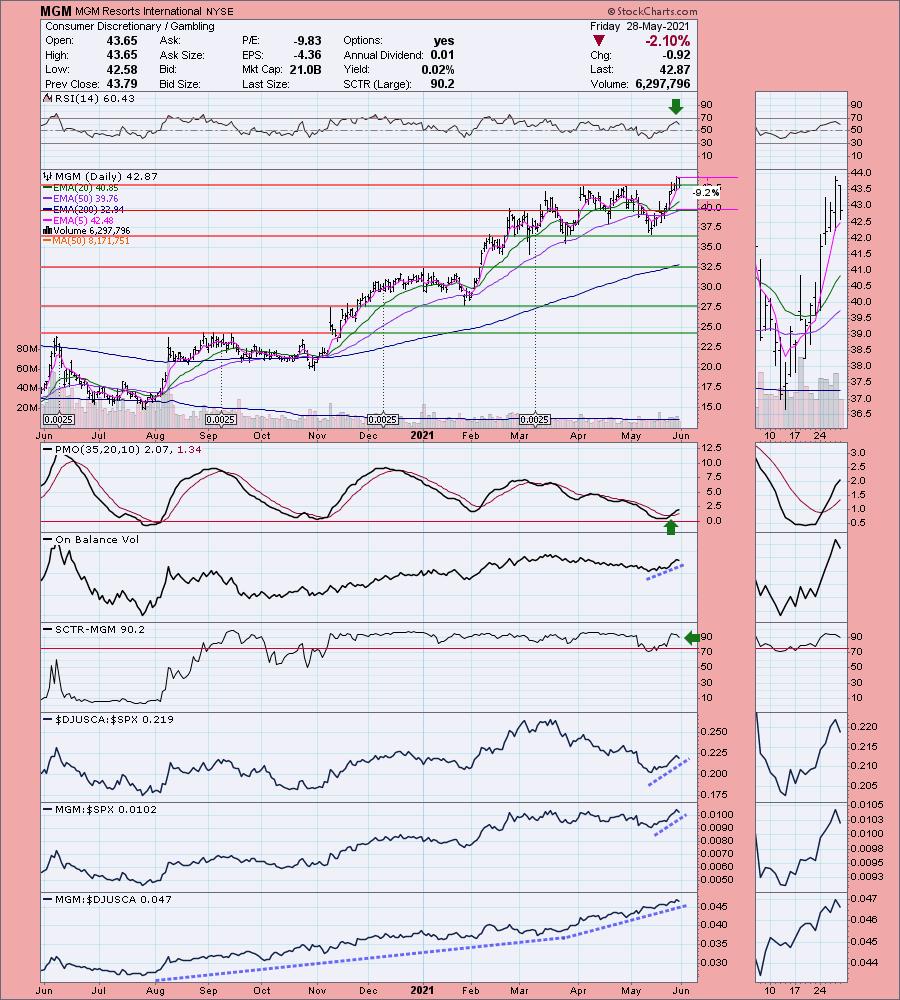

Below is today's chart:

Honestly, for a "dud" this chart still looks healthy to me. The RSI did fall on today's drop and the PMO is decelerating somewhat. However, it held support and did what we like...broke out and then pulled back to the breakout point. There are probably better investments out there, but this doesn't look that bad.

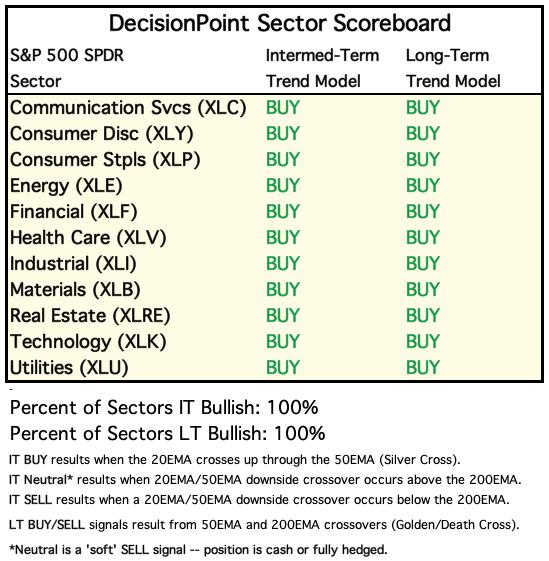

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

CONCLUSION:

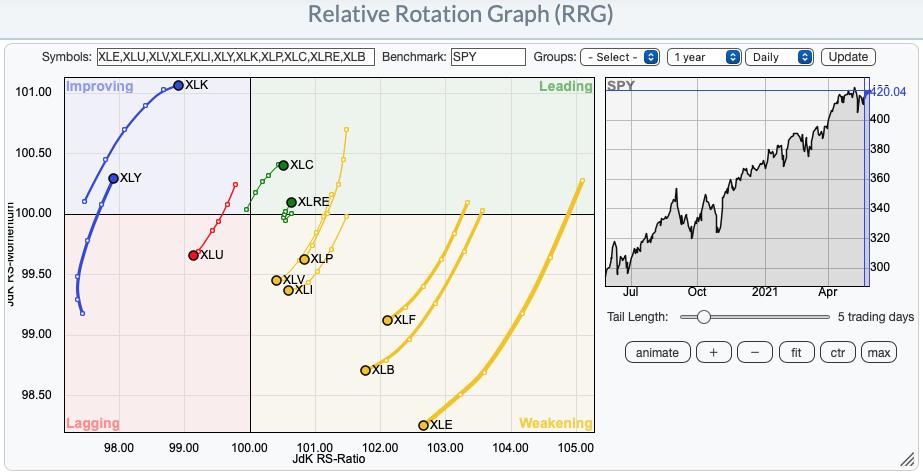

I chuckled when I opened the short-term sector RRG. Those in the Diamond Mine may remember that looking at my sector CandleGlance charts that my top four were: XLC, XLK, XLRE and XLY. Note that the only four sectors moving in the proper direction are those four sectors.

Short-term RRG:

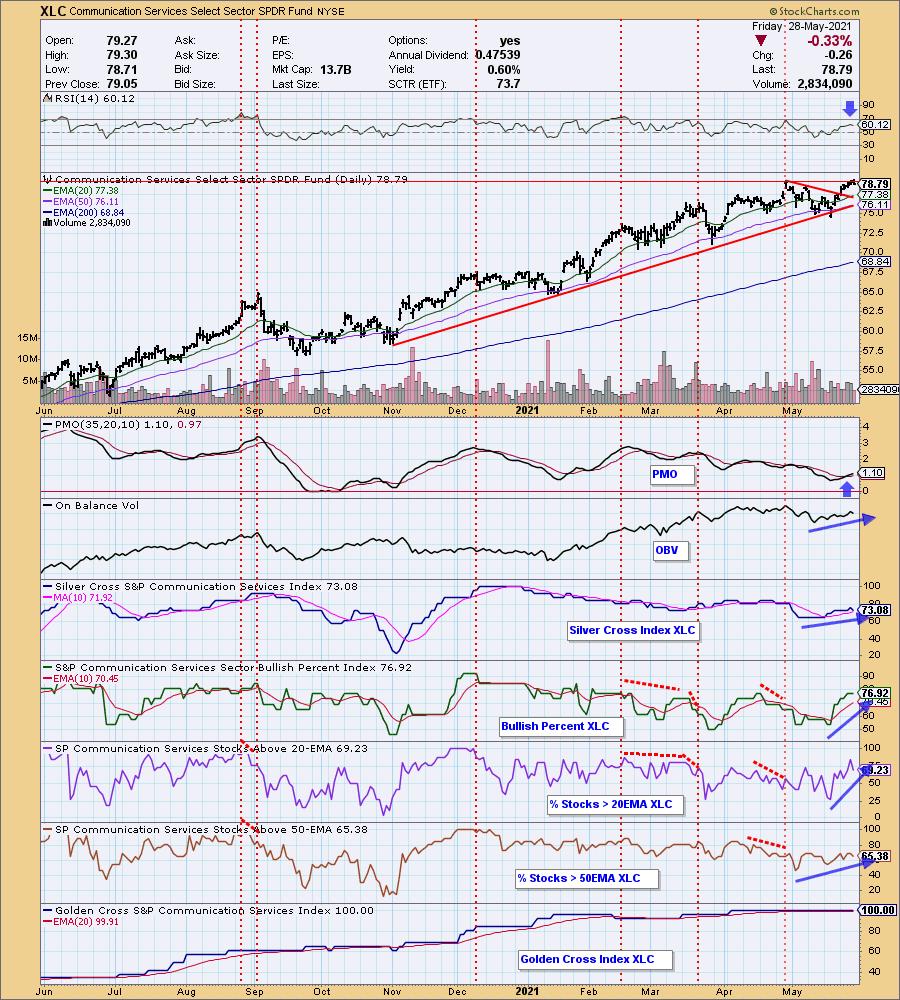

Sector to Watch: Communication Services (XLC)

This sector did close slightly lower and beneath overhead resistance which does bother me a bit. Part of the reason I liked it this morning was that it had broken out to new all-time highs. However, the internals are still strong and rising. None of them are at overbought extremes except the GCI at 100%. I look at that as a strong foundation for this sector to continue higher.

Industry Group to Watch: Media Agencies ($DJUSSC)

After reviewing the industry groups within XLC, I picked this one as "most likely to succeed". The bounce is coming off not only the 200-EMA, but also off support at the January and March lows. Overhead resistance is arriving, so it may have trouble with that next week. Overall, I think this group has potential.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 55% invested right now and 45% is in 'cash', meaning in money markets and readily available to trade with. Diamonds purchased this week: ACB and CLVR. Probably will add MJ next week or add to positions if they pull back.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)