Today I've selected three Reader Requests, as well as a stock that has been in my scan results for three days now (I believe the chart is finally ripe), and a Biotech I like right now. So I have FIVE picks today!

Biotechs are breaking out and taking center stage so I selected a requested Biotech that looks interesting, but also decided to add a Biotech of my own. Mary Ellen McGonagle and I discussed the breakouts in Biotech (as well as IPOs and Short Squeezes!) in today's Chartwise Women show. Yesterday's Biotech, ILMN is still a great choice in this space.

Today's "Diamonds in the Rough" are: CERT, CYBE, HOFT, KMX and NVAX.

Stocks/ETFs to Review (no order): INNV, KARO, ZY, AEE, CVI, CYH, INOV, WTRG, DG, RGEN and MASI.

** UPCOMING VACATION - June 28th to July 9th **

It's that time of year again! Last year it was a road trip to Alabama and back, this year it is a road trip to Utah and back! We plan on dropping in Las Vegas, Zion, Spanish Fork, Bryce Canyon, back to the Grand Canyon, Bull Head City and finally back home. I'll include my travel diary and pictures just like last year for Diamonds readers!

I plan on writing, but trading rooms will be postponed until I return home. Blog articles may be delayed depending on WIFI service and/or our travel for the day. You'll miss two Diamond Mines (I'll make them up in the coming weeks).

Diamond Mine REGISTRATION Information:

Diamond Mine REGISTRATION Information:

When: Jun 11, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (6/11/2021) LIVE Trading Room

Register in advance for this webinar HERE.

After registering, you will receive a confirmation email containing information about joining the webinar, including the password. SAVE IT! Zoom doesn't always send out the reminders.

=======================================================================

Diamond Mine RECORDING Link:

Topic: DecisionPoint Diamond Mine (6/4/2021) LIVE Trading Room

Start Time : Jun 4, 2021 09:00 AM PT

Meeting Recording LINK.

Access Passcode: June-4th

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Free DP Trading Room RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Jun 7, 2021 08:41 AM

Meeting Recording Link.

Access Passcode: June-7th

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Certara Inc. (CERT)

EARNINGS: 8/5/2021 (AMC)

Certara, Inc. engages in the provision of software and technology enables services for drug developers. It offers cell and gene therapy, clinical pharmacology, complex biologics, decision analytics and modeling, drug development and regulatory strategy, and model-based analysis services. The company was founded on June 27, 2017 and is headquartered in Princeton, NJ.

CERT is down -0.59% in after hours trading. This is a rather new Biotech so we don't have as much information as I prefer, but the daily chart is shaping up nicely. The RSI has just hit positive territory. We have a double-bottom pattern that is about to execute. You can see that the Biotechs are really outperforming the SPX right now. CERT isn't performing particularly well, but it looks like it may be ready to wake up and outperform. The stop is set near the lows that form the double-bottom.

Not much to say about the weekly chart. With so little data, I hate to make sweeping judgments on the negative weekly RSI. Volume patterns are still being figured out as well, but the OBV is definitely confirming the declining trend that is currently in place.

CyberOptics Corp. (CYBE)

EARNINGS: 7/22/2021 (AMC)

CyberOptics Corp. engages in designing, developing and manufacturing of precision sensing technology solutions. Its products include Multi-Reflection Suppression Technology, High Precision 3D and 2D Sensors, 3D MRS Sensors and SMT Electronic Assembly Alignment Sensors, Automated Optical Inspection Products, SPI, Semiconductor Wafer and Advanced Packaging Products, General Industrial Metrology Products and Semiconductor Sensors. The company was founded by Steven K. Case in 1984 and is headquartered in Minneapolis, MN.

CYBE is unchanged in after hours trading. I actually like this one better given today's pullback toward the breakout point. This pullback also took the RSI out of overbought territory. The PMO is rising strongly still. Performance looks good. Today's dip in performance is due to the pullback of course. I like that I can set a reasonable stop just below the February high.

The weekly chart is especially bullish. There is a positive RSI and weekly PMO BUY signal. The OBV is confirming the rally out of the December 2020 low. Upside potential looks reasonable as well.

Hooker Furniture Corp. (HOFT)

EARNINGS: 8/27/2021 (BMO)

Hooker Furniture Corp. is a home furnishings marketing and logistics company. It offers worldwide sourcing of residential casegoods and upholstery, as well as domestically-produced custom leather and fabric-upholstered furniture. The company operates its business through three segments: Hooker Branded, Home Meridian, and Domestic Upholstery. Its major casegoods product categories include home entertainment, home office, accent, dining and bedroom furniture under the Hooker Furniture brand, and youth furniture sold under the Opus Designs by Hooker brand. The company designs and markets its furniture, both as stand-alone products and as part of a group of products within multi-piece groups or broader collections offering a unifying style, design theme and finish. Its collections include offerings, such as Abbott Place, Beladora, Harbour Pointe and Sanctuary collections. The company's residential upholstered seating companies, include Bradington-Young LLC, a specialist in upscale motion and stationary leather furniture, and Sam Moore Furniture LLC, a specialist in upscale occasional chairs, settees and sectional seating with an emphasis on cover-to-frame customization. Its customers include independent furniture stores, specialty retailers, department stores, catalog and internet merchants, interior designers and national and regional chains. Hooker Furniture was founded in 1924 and is headquartered in Martinsville, VA.

HOFT is unchanged in after hours trading. I like the price action, but the industry group is suffering which could add gravity to HOFT's price. The breakout was strong and now price is pulling back toward the breakout point. The technicals still look good given the positive RSI and rising PMO. The OBV is a bit of a sticking point. We should've have seen a higher high on the OBV when the original breakout occurred, and we didn't. The stop level is set near the 50-EMA at $37.50.

The weekly chart is mixed. The weekly RSI is very positive, but the PMO is unsteady. Additionally I see a negative divergence with price tops and OBV tops. Upside potential is pretty good at 18%.

Carmax Inc. (KMX)

EARNINGS: 6/25/2021 (BMO)

CarMax, Inc. is a holding company, which engages in the retail of used vehicles and wholesale of vehicle auction operator. It operates through the CarMax Sales Operations and CarMax Auto Finance (CAF) segments. The CarMax Sales Operations segment comprises of all aspects of its auto merchandising and service operations. The CAF segment pertains to its finance operation, which offers vehicle financing services to customers buying retail vehicles. The company was founded by Richard L. Sharp and William Austin Ligon in 1993 and is headquartered in Richmond, VA.

KMX is up +0.59% in after hours trading. This is the one that has been in my scan results for at least three days. It still has some flaws. The RSI is negative and the industry group is suffering. I see a bullish double-bottom pattern in the making. There is a slight positive divergence between near-term OBV bottoms and price bottoms. Typically OBV positive divergences lead to sustained rallies. Performance is improving against the SPX. It is performing a bit better than the rest of its group. The stop can be set tightly just below the August 2020 top.

The weekly RSI is negative, but improving now. The weekly PMO is quite ugly so consider this one a short-term trade. It appears we are bouncing off support at both the 43-week EMA and the 2020 top.

Novavax, Inc. (NVAX)

EARNINGS: 8/9/2021 (AMC)

Novavax, Inc. focuses on the discovery, development and commercialization of vaccines to prevent infectious diseases. It provides vaccines for COVID-19, seasonal flu, respiratory syncytial virus, Ebola, and Middle East respiratory syndrome. The company was founded in 1987 and is headquartered in Gaithersburg, MD.

NVAX is up +0.16% in after hours trading. I covered NVAX as a Reader Request on July 30th 2020. It hit its 9.2% stop when price dropped in August, so the position would be closed at this point. However, I like it today given the improvement in the Biotech space and knowing that this one is a leader based on the 98.9 SCTR. Today price pulled back toward the breakout point. This took the RSI away from overbought territory. The PMO shows no damage and is now rising in positive territory on an oversold crossover BUY signal. Volume is coming in and despite the pullback, the OBV didn't sustain much damage either. The stop is set below the August 2020 top.

The weekly chart is beginning to improve. The weekly RSI has reached positive territory and price has broken through a strong zone of resistance formed by the 2020 top and 2015 tops. The OBV is confirming the rally that began in mid-July of last year. The weekly PMO is in the process of turning back up.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Current Market Outlook:

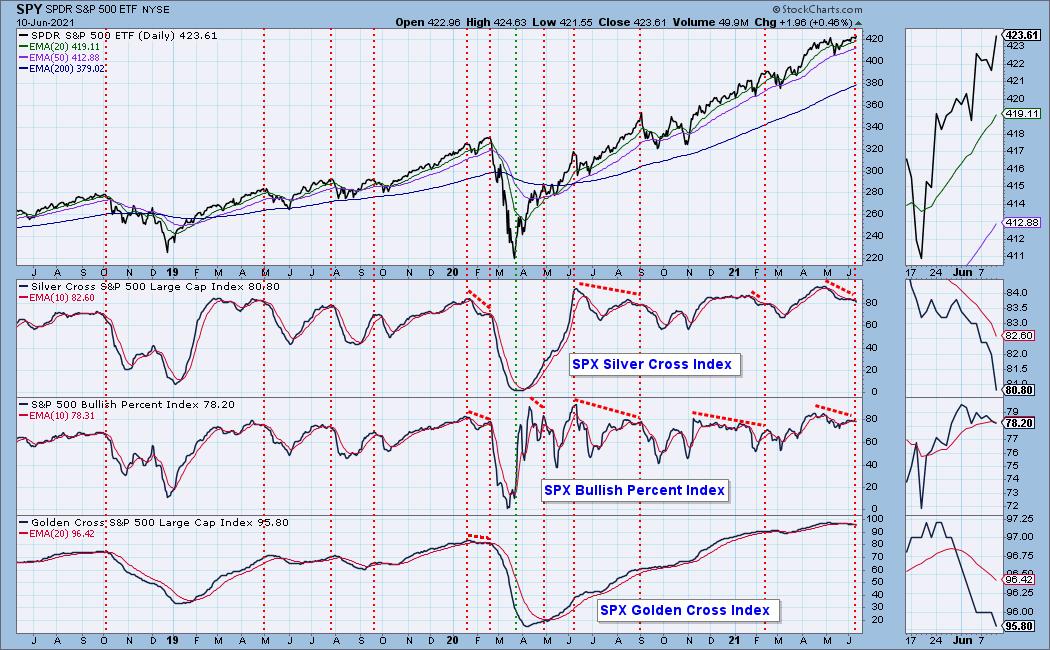

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

The Diamond Index chart looks at the number of scan results from my bullish Diamond PMO Scan and the number of scan results from the inverse Diamond Dog Scan. The Diamond Ratio divides the bullish results by the bearish results.

I only have data going back to October 2019 so I won't make any sweeping conclusions about the Diamond Index chart. I have marked cardinal tops with red dotted vertical lines and cardinal price bottoms with green dotted vertical lines. I believe that when the Diamond Dog results spike, it usually comes at a price bottom, or marks a strong continuation of the rising trend.

Unfortunately, the Diamond PMO Scan result numbers aren't providing much insight. The Diamond Ratio has promise, but again I don't see a clear correlation to the market tops/bottoms right now. I need to study and manipulate the data some more. Keep you posted!

Full Disclosure: I'm about 70% invested and 30% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com