It was so hot at the Grand Canyon today, over 95 degrees with very little breeze. The heat took it out of us so we did an airplane ride and stopped at a few of the best viewpoints. We are exhausted and have decided to go home a day early with a long drive home tomorrow. I've included photos at the end of today's blog.

Yesterday's Diamonds did quite well. I still like the Industrials and contemplated adding another Gold Miner; however, I decided to go with a dividend ETF instead and concentrate on Railroads. The choo-choo's are looking really good. I even had a subscriber email me with one of today's Diamonds in the group. I saw it on a scan and definitely agreed with his assessment. I added one more.

Mega-cap stocks are doing exceedingly well right now and based on the charts, I expect them to continue to outperform for a bit longer. Stocks like AMZN, AAPL, GOOGL, MSFT, among others look very bullish. However, they are getting very overbought for entry right now. If you own some of those FAANG+ stocks, I would continue to hold. When they turn south, that's when I expect the market to turn over as well.

Today's "Diamonds in the Rough" are: CSX, UNP and VIG.

** WORKING VACATION - June 28th to July 9th **

It's that time of year again! Last year it was a road trip to Alabama and back, this year it is a road trip to Utah and back! We hit Las Vegas, Zion, Spanish Fork and Bryce Canyon. We've arrived at the Grand Canyon, and head back home Thursday. I'll include my travel pictures just like last year!

I plan on writing, but trading rooms will be postponed until I return home. Diamond Report publishing will vary depending on travel and activities, but you WILL get your 10 "Diamonds in the Rough" per week.

TENTATIVE SCHEDULE NEXT WEEK:

Three stocks Tuesday (7/6) and Wednesday (7/7). Then reader requests and one of my selections on Thursday (7/8) for a total of ten stocks this week. The Recap will be on Friday as always (7/9).

Diamond Mine Information:

Diamond Mine Information:

RECORDING LINK Wednesday (6/23):

Topic: BONUS DecisionPoint Diamond Mine Wednesday (6/23)

Start Time : Jun 23, 2021 09:01 AM

6/23 Diamond Mine Recording Link.

Access Passcode: June-23rd

REGISTRATION LINK FOR MAKE-UP (Wednesday 7/14):

When: Jul 14, 2021 09:00 AM Pacific Time (US and Canada)

Topic: Make-up DecisionPoint Diamond Mine (7/14/2021) LIVE Trading Room

Register in advance for this MAKE-UP webinar HERE

REGISTRATION FOR FRIDAY (7/16) Diamond Mine:

When: Jul 16, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (7/16/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Jun 21, 2021 09:00 AM

Meeting Recording HERE

Access Passcode: June-21st

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "Diamonds in the Rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

CSX Corp. (CSX)

EARNINGS: 7/21/2021 (AMC)

CSX Corp. engages in the provision of rail-based freight transportation services. Its services include rail service, the transport of intermodal containers and trailers, rail-to-truck transfers and bulk commodity operations. The company was founded in 1827 and is headquartered in Jacksonville, FL

CSX was unchanged in after hours trading. I've covered CSX twice before. First on August 11th 2020, the stop was never hit and so it is up +33.3% since. Second, on February 16th 2021, the stop was never hit so it is up a modest +9.6% since then. It is set up nicely once again. Price broke out of a bullish falling wedge. The RSI is positive and the PMO just triggered a crossover BUY signal. Additionally, there is a ST Trend Model BUY signal that triggered today as the 5-EMA crossed above the 20-EMA. Performance looks like it is improving across the board. I like that you don't have to set a deep stop. 6% puts us at support at the November high.

I noticed that the falling wedge on the daily chart, forms a pennant on a flagpole on the weekly chart. The weekly RSI is positive. Unfortunately, the weekly PMO isn't looking too good, but on a short-term basis, I believe we should see new all-time highs.

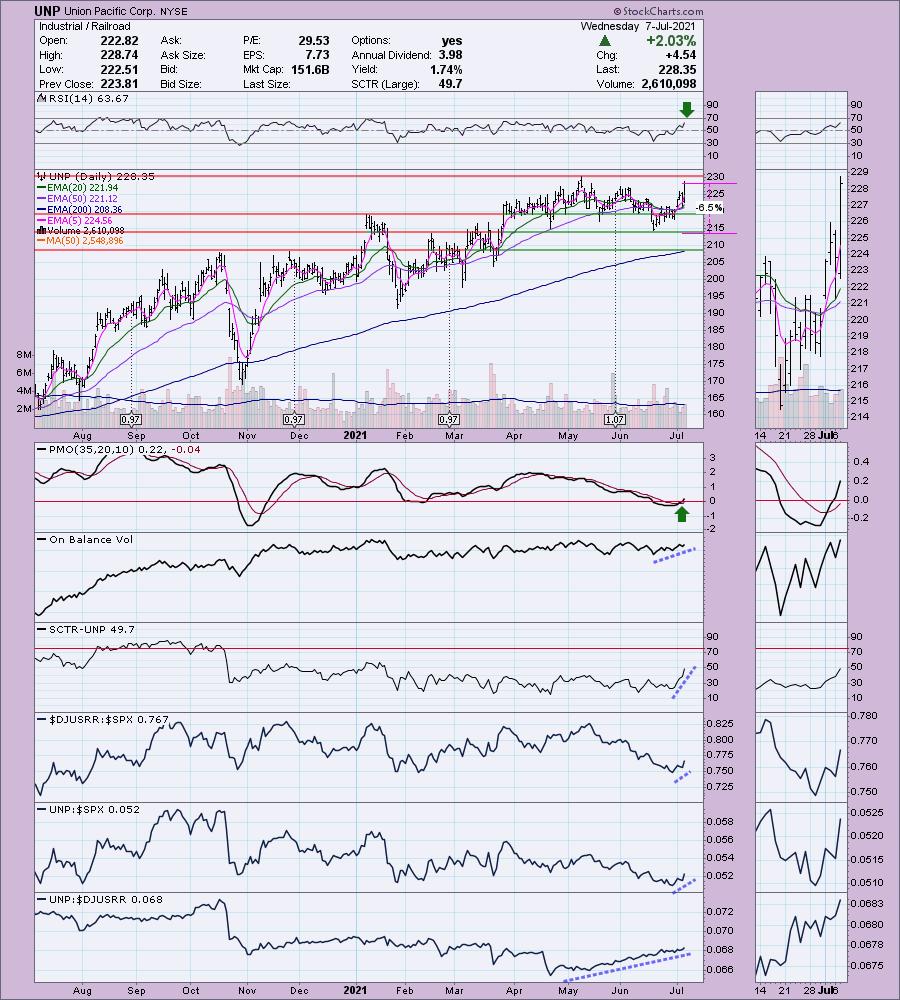

Union Pacific Corp. (UNP)

EARNINGS: 7/22/2021 (BMO)

Union Pacific Corp. engages in the provision of railroad and freight transportation services. Its principal operating company, Union Pacific Railroad Co., operates as a railroad franchise. The Railroad's diversified business mix includes agricultural products, automotive, chemicals, coal, industrial products, and intermodal. The company was founded in 1969 and is headquartered in Omaha, NE.

UNP was down -0.15% in after hours trading. I've covered UNP twice before also. First on September 15th 2020, the 7.5% stop was hit on the market decline in October of 2020. The second time was as a reader request on January 7th 2021, the 7.9% stop was hit on the January market decline, just barely. Certainly it had a great rally today. Price is getting close to overhead resistance, but the RSI is positive and the PMO has just had a crossover BUY signal. Also, all of the EMAs have reconfigured positively with the fastest EMA on top and the slowest on the bottom. This group is beginning to outperform and UNP is one of the strongest in the group based on relative performance. The stop is reasonable at just 6.5%.

The weekly RSI is positive and the weekly PMO is beginning to decelerate and is attempting to turn back up.

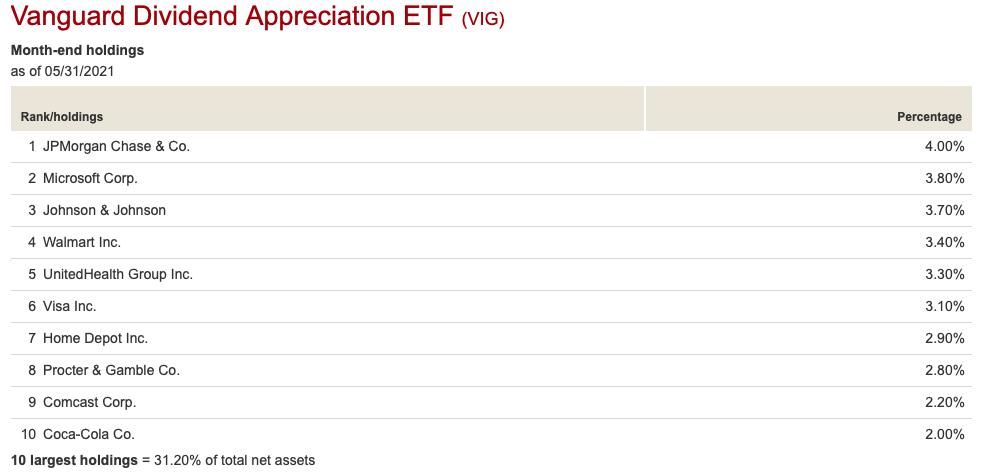

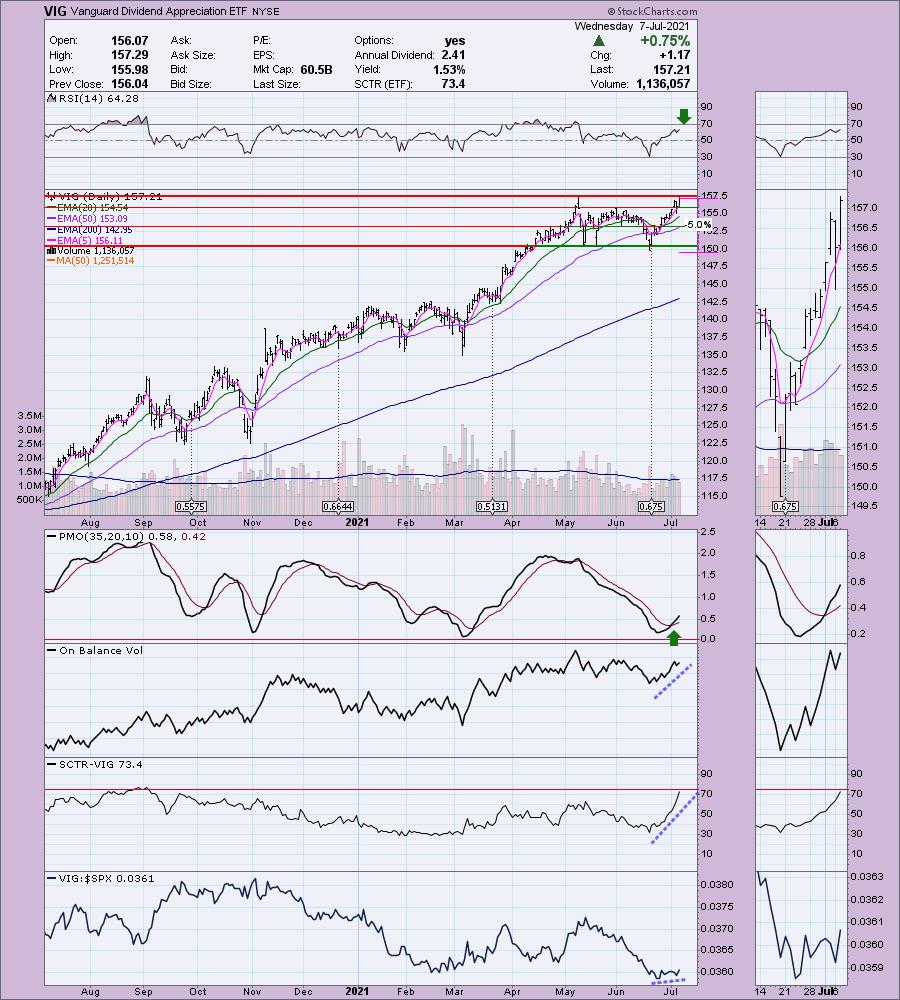

Vanguard Dividend Appreciation ETF (VIG)

EARNINGS: N/A

VIG tracks a market-cap-weighted index of US companies that have increased their annual dividends for 10 or more consecutive years.

VIG was down -0.29% in after hours trading. I liked this ETF not only for its chart, but for its focus on dividend payers. I've listed the top ten holdings above, so you can choose one of the stocks vs this fund. The market is toppy. One area that many investors move into is high yield stocks. This ETF gives you exposure to those stocks. Price is hitting overhead resistance, but given the positive RSI and new PMO crossover BUY signal. You can see by the rise in the SCTR that this ETF is one performing very well against other ETFs. The OBV is confirming the move and the ETF is beginning to outperform the SPX.

VIG is in a nice rising trend channel. The weekly RSI is positive and the weekly PMO is turning up. The OBV is confirming the rising trend.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

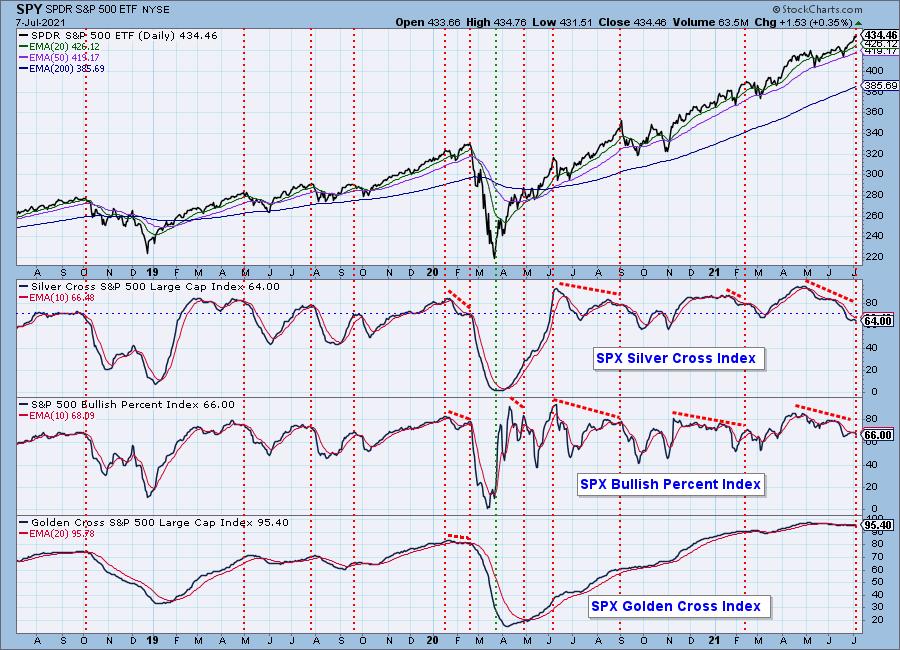

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

First picture is from a lookout at Spanish Fork UT. You can see Lake Utah below the mountains. It was a great 4th of July there (celebrated on the 3rd since the 4th was a Sunday and it is Utah). All of the neighborhoods lit off stadium-quality fireworks:

Microbrew when we arrived at Bryce Canyon:

Bryce Canyon shots continued:

First view of the Grand Canyon at the Watch Tower. Yes, I was a bit nervous but I had my lovely husband to calm me:

Views from the airplane tour:

You can see the airplane wing in the upper left!

Cactus flower along the canyon rim:

From Bright Angel Point:

We all agreed that we didn't need to go out to that lookout!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com