I've made it home! No interesting pictures to share from today. We traveled on two very sparse desert highways to get home so there wasn't much to see. The scenery didn't change much!

I picked out three reader requests that look interesting and then included one of my own. The Real Estate sector is heating up and REITs are breaking out. Investors are looking for high yields for protection against a market downturn. One of today's requests was a REIT and I included one as well.

With investors getting edgy, we have to be very selective if we are going to open our exposure. These selections look fairly good, but a surprise decline will likely take everyone with it so be careful out there.

Today's "Diamonds in the Rough" are: CCI, KMB, SBUX and UDR.

Stocks to Review (no order): SIC, EQIX, and SBAC.

Although I am home a day early, there will still not be a Diamond Mine tomorrow. The next one is Wednesday! Registration details are below.

Diamond Mine Information:

Diamond Mine Information:

RECORDING LINK Wednesday (6/23):

Topic: BONUS DecisionPoint Diamond Mine Wednesday (6/23)

Start Time : Jun 23, 2021 09:01 AM

6/23 Diamond Mine Recording Link.

Access Passcode: June-23rd

REGISTRATION LINK FOR MAKE-UP (Wednesday 7/14):

When: Jul 14, 2021 09:00 AM Pacific Time (US and Canada)

Topic: Make-up DecisionPoint Diamond Mine (7/14/2021) LIVE Trading Room

Register in advance for this MAKE-UP webinar HERE

REGISTRATION FOR FRIDAY (7/16) Diamond Mine:

When: Jul 16, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (7/16/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Jun 21, 2021 09:00 AM

Meeting Recording HERE

Access Passcode: June-21st

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "Diamonds in the Rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

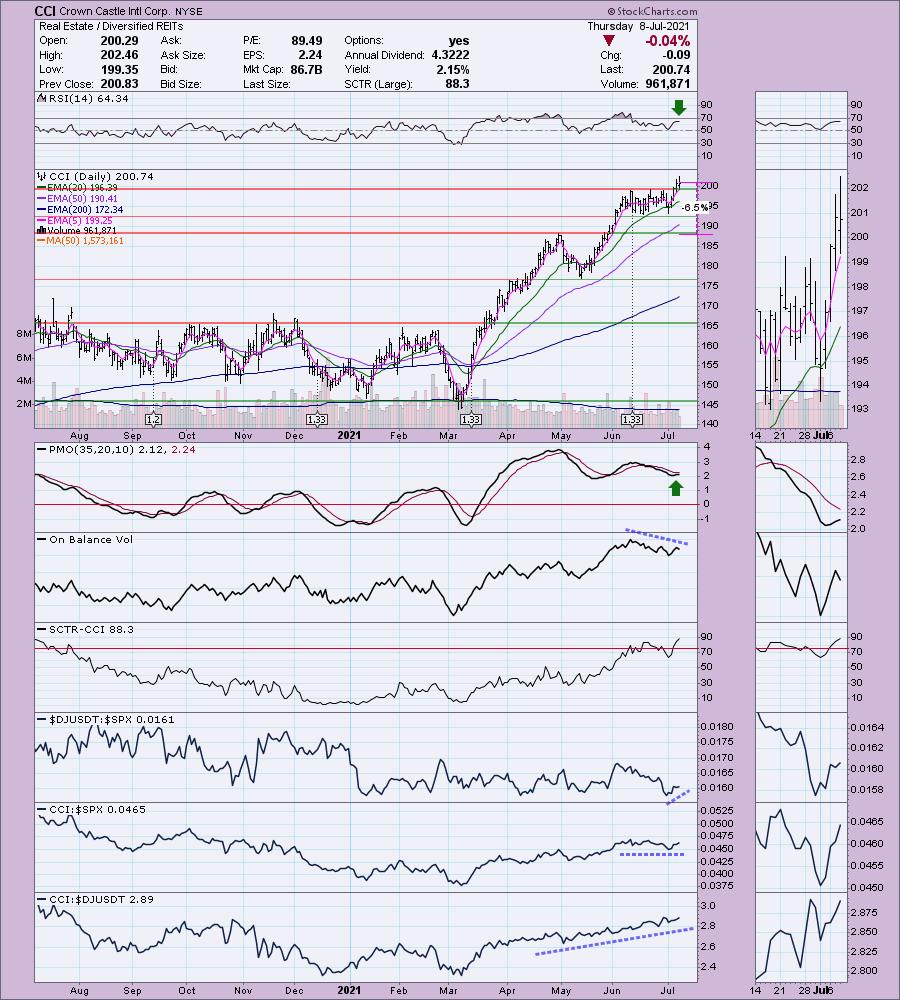

Crown Castle Intl Corp. (CCI)

EARNINGS: 7/21/2021 (AMC)

Crown Castle International Corp. is a real estate investment trust company, which engages in the provision of access to wireless infrastructure via long-term contacts. It operates through the following segments: Towers and Fiber. The Towers segment offers access, including space or capacity towers dispersed throughout the United States. The Fiber segment covers access, including space or capacity of fiber primarily supporting small cell networks and fiber solutions. The company was founded by Ted B. Miller Jr. and Edward C. Hutcheson Jr. in 1994 and is headquartered in Houston, TX.

CCI was down -0.11% in after hours trading. I've covered CCI twice before. First as a reader request on April 9th 2020 (it just barely hit its 8.3% stop in May) and second on December 29th 2020 (the stop was nearly hit, but since it wasn't, it is up +30.8%). I like the breakout from the bull flag formation. The RSI is positive and the PMO has just turned up. The group is beginning to outperform and this is the stock that leads. Note that its relative strength against the group has been moving higher since March. It has also outperformed the SPX and is beginning to accelerate that performance. The stop is thin at 6.5%, however you could tighten it to short-term support at $193.

The weekly chart looks good, but the RSI is overbought. I'll forgive that since the PMO is rising strongly and isn't that overbought yet.

Kimberly Clark Corp. (KMB)

EARNINGS: 7/23/2021 (BMO)

Kimberly-Clark Corp. engages in the manufacture and marketing of products made from natural or synthetic fibers. It operates through the following segments: Personal Care, Consumer Tissue, and K-C Professional (KCP). The Personal Care segment offers disposable diapers, training and youth pants, swim pants, baby wipes, feminine and incontinence care products, and other related products. The Consumer Tissue segment produces and sells facial and bathroom tissue, paper towels, napkins, and related products for household use. The K-C Professional segment supplies workplace supporting products such as wipers, tissue, towels, apparel, soaps, and sanitizers. The firm's brands include Depend, Huggies, Kleenex, Kotex, and Scott. The company was founded by John A. Kimberly, Havilah Babcock, Charles B. Clark, and Frank C. Shattuck in 1872 and is headquartered in Irving, TX.

KMB was up +0.07% in after hours trading. I've covered this one numerous times. March 17th 2020: The bear market took out the 7.3% stop fairly quickly. April 2nd 2020: The stop was never hit so that position is up a modest +4.7%. November 11th 2020: The 5.9% stop was taken out during the bear market in March.

As my subscriber noted, KMB is up against overhead resistance right now. However, the chart is very favorable and a Consumer Staple with a high yield is a likely place to rotate if the market goes south. We have a new Silver Cross of the 20/50-EMAs. The OBV is confirming the rally and the RSI is positive and not overbought. The PMO is on a BUY signal and relative performance is decent. The stop is a thin 5.3%.

The weekly RSI just turned positive and the weekly PMO gave us a new crossover BUY signal. Upside potential is over 15%. Pretty good considering the stop is so thin.

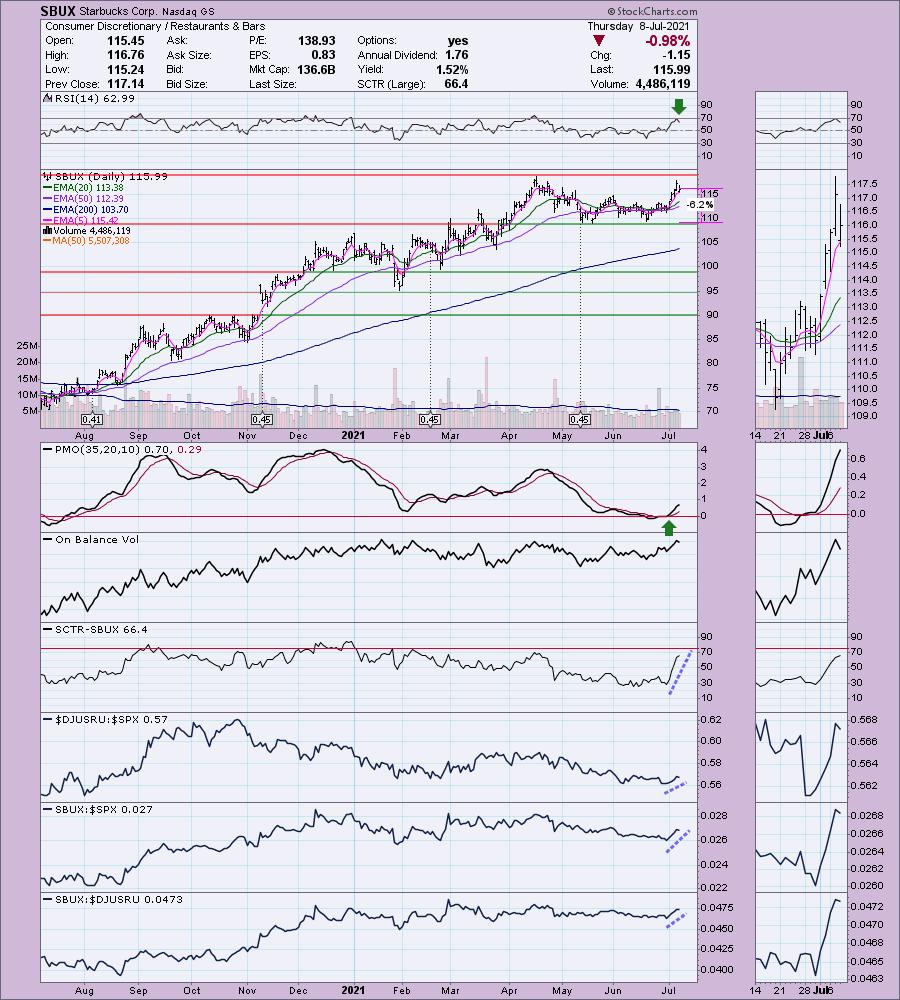

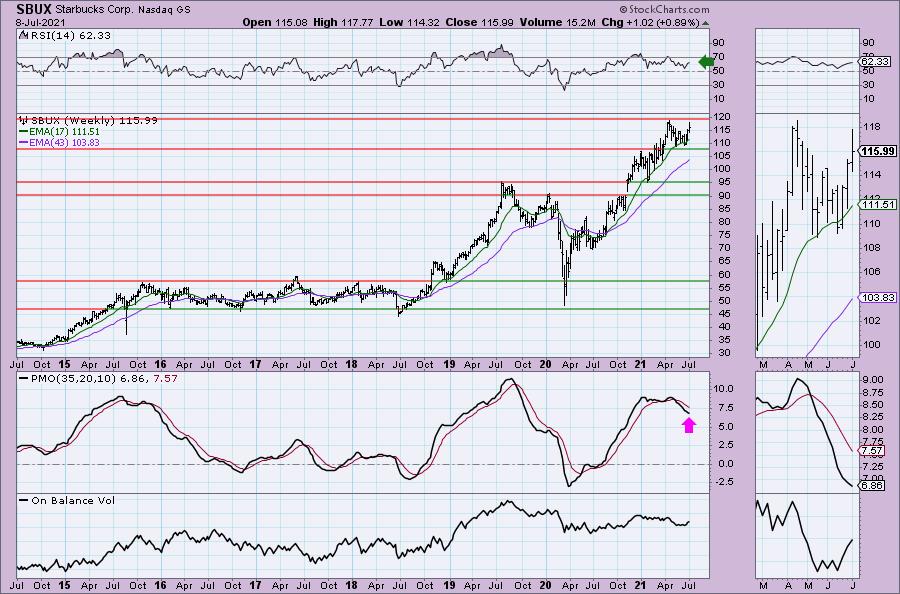

Starbucks Corp. (SBUX)

EARNINGS: 7/27/2021 (AMC)

Starbucks Corp. engages in the production, marketing, and retailing of specialty coffee. It operates through the following segments: Americas; China/Asia Pacific (CAP); Europe, Middle East, and Africa (EMEA); and Channel Development. The Americas, CAP, EMEA segments sells coffee and other beverages, complementary food, packaged coffees, single-serve coffee products, and a focused selection of merchandise through company-oriented stores, and licensed stores. The Channel Development segment include sales of packaged coffee, tea, and ready-to-drink beverages to customers outside of its company-operated and licensed stores. The company brands include Evolution Fresh, Teavana, Tazo Tea and Seattle's Best. Starbucks was founded by Jerry Baldwin and Howard D. Schultz on November 4, 1985 and is headquartered in Seattle, WA.

SBUX was down -0.21% in after hours trading. I've covered SBUX twice before. May 27th 2020: The stop was never hit so the position is up +47.6%. March 2nd 2021: The stop was never hit so it is up a modest +8.2%.

The chart looks favorable, but Consumer Discretionary isn't the best place to be if the market goes south, so be careful. The RSI is positive and no longer overbought. The PMO is on an oversold BUY signal. The SCTR is rising quickly and it is showing an improvement in relative performance overall. The stop is thin at 6.2%.

The weekly RSI is positive, but the weekly PMO is unhealthy. This would be another reason to tread lightly on this one.

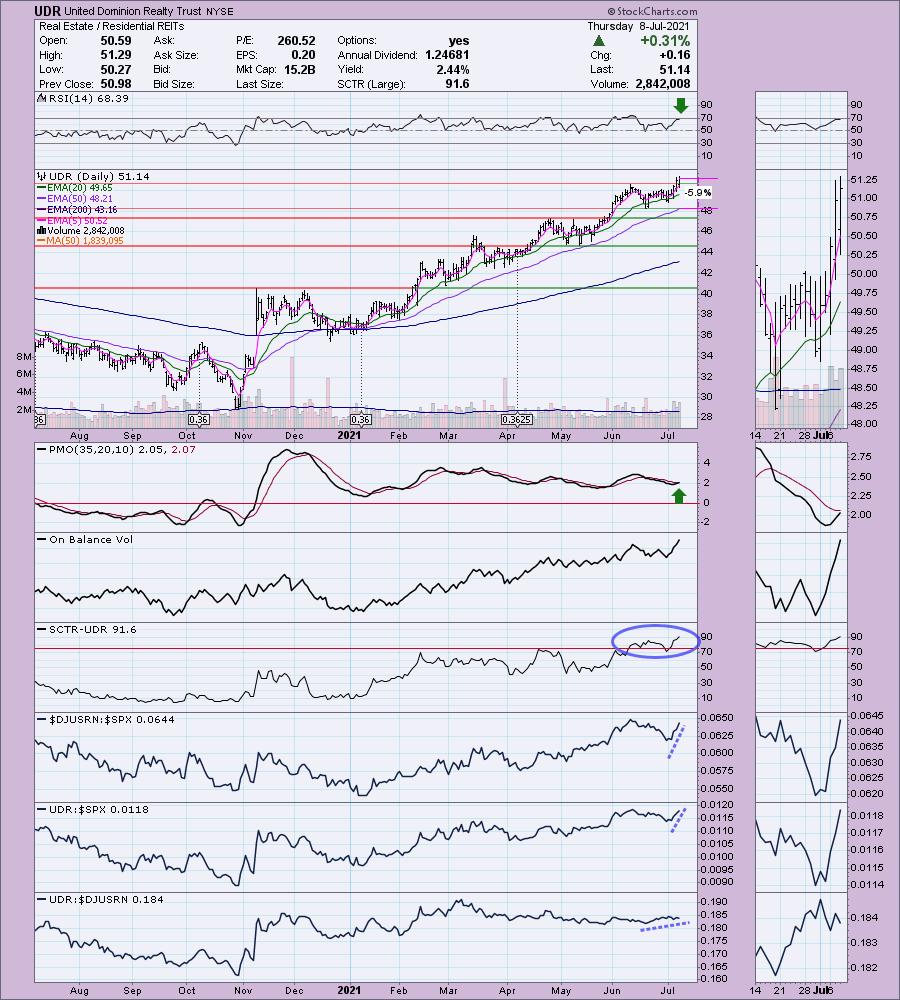

United Dominion Realty Trust (UDR)

EARNINGS: 7/28/2021 (AMC)

UDR, Inc. is a real estate investment trust, which owns, operates, acquires, renovates, develops, redevelops, disposes of, and manages multifamily apartment communities. It engages in the multi-family real estate investment trust business. It operates through the Same-Store Communities and Non-Mature Communities/Other segments. The Same-Store Communities segment pertains to properties that are acquired, developed, and stabilized occupancy. The Non-Mature Communities/Other segment include recently acquired, developed and redeveloped communities and the non-apartment components of mixed use properties. The company was founded in 1972 and is headquartered in Highlands Ranch, CO.

UDR was up +0.12% in after hours trading. I covered it on April 22nd 2021. The stop was never hit so the position is up +10.8%. We have a nice breakout on price. The PMO hasn't quite given us a crossover BUY signal, but it is close. The RSI is positive, albeit getting close to overbought territory. Volume came in on this breakout and the SCTR has been in the "hot zone" most of June and July. Relative performance is excellent. The stop can be set thinly at 5.9%.

There are problems with the weekly chart. The weekly RSI has just entered overbought territory and there is a long-term negative divergence with the OBV. However, the OBV is confirming the current rally and the weekly PMO is rising on a BUY signal.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Current Market Outlook:

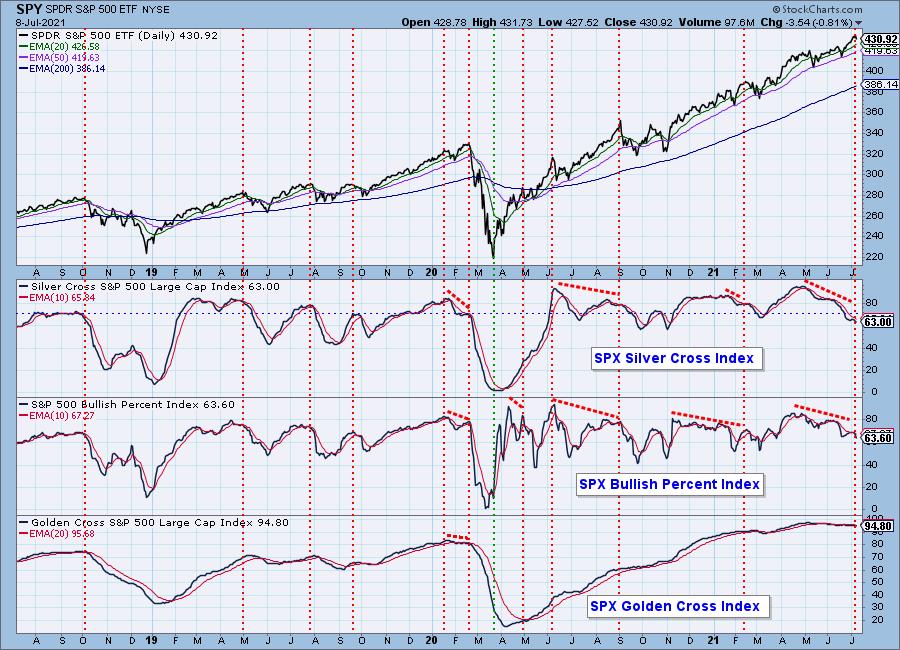

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com