Interesting rotation in the market today. You'll notice on the Sector Summary below that it was the defensive sectors that carried the day. I discussed XLRE yesterday and I have a REIT to add to the others I've presented.

I'm finally seeing a popular industry group waking up. I look at the Gold Miners (GDX) chart everyday in the DP Alert and I've been just chomping at the bit to get involved in the stocks in this group, but participation has been lacking. Today there was definite improvement on the GDX chart. I presented RGLD last week and it is inching higher. Today I found two Gold Miners that are looking especially bullish so it is time to dip our toes in the water.

I'm presenting a Technology stock. I'm neutral on Technology in general given the market's weakness, but the risk-reward on the chart was too good to pass up despite it underperforming its industry group.

Today's "Diamonds in the Rough" are: AGI, DLR, KL and STX.

Stocks to Review (no order): DGEN, EPAM, HIW, CAJ, PNW, BDN, LXP, PDM and WM.

(A reminder, the "Stocks to Review" are stocks that were on my short list for the day.)

Diamond Mine Information:

Diamond Mine Information:

RECORDING LINK Wednesday (6/25):

Topic: DecisionPoint Diamond Mine (6/25) LIVE Trading Room

Start Time : Jun 25, 2021 09:00 AM

Meeting Recording for 6/25 is HERE.

Access Passcode: June-25th

RECORDING LINK "Bonus" Diamond Mine Wednesday (7/14):

Topic: Make-up DecisionPoint Diamond Mine (7/14/2021) LIVE Trading Room

Start Time : Jul 14, 2021 08:59 AM

Meeting Recording LINK for 7/14 is HERE.

Access Passcode: July-14th

REGISTRATION FOR FRIDAY (7/16) Diamond Mine:

When: Jul 16, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (7/16/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Jul 12, 2021 09:00 AM

Meeting Recording for DP Trading Room is HERE.

Access Passcode: W72^WzSb

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "Diamonds in the Rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Alamos Gold Inc. (AGI)

EARNINGS: 7/28/2021 (AMC)

Alamos Gold, Inc. engages in the exploration, development, mining and extraction of precious metals. It operates through the following segments: Young-Davidson, Mulatos, Island Gold, Elchanate, Kirazli and Corporate and Other. The company was founded on February 21, 2003 and is headquartered in Toronto, Canada.

AGI is unchanged in after hours trading. Like GDX, AGI bottomed on fairly strong support and it has now overcome resistance at the 20-EMA and nearly the 50-EMA. You could make a case for a short-term double-bottom, but the most important aspects to this chart are the newly positive RSI and PMO crossover BUY signal. We also are nearing a ST Trend Model 5/20-EMA positive crossover BUY signal. The SCTR has been quick to improve. Notice that industry group is performing about as well as the SPX, but AGI is beginning to outperform the SPX and is already outperforming its industry group. One thing I'm not thrilled with on the Gold Miners I chose is the deep stop levels. You could certainly tighten them up, but the best support level is at the late June low.

The weekly chart is beginning to shape up with the RSI nearly positive and the PMO decelerating. The 17-week EMA just crossed below the 43-week EMA, but if price gets above those EMAs the crossover will disappear quickly.

Digital Realty Trust, Inc. (DLR)

EARNINGS: 7/29/2021 (AMC)

Digital Realty Trust, Inc. operates as a real estate investment trust, which engages in the provision of data center, colocation and interconnection solutions. It serves the following industries: artificial intelligence (AI), networks, cloud, digital media, mobile, financial services, healthcare, and gaming. The company was founded on March 9, 2004 and is headquartered in Austin, TX.

DLR is unchanged in after hours trading. I covered DLR in the March 19th 2020 DP Diamonds Report. The position was up 13% at one point, but the volatile trading that occurred later in March triggered the 9.4% stop. The set up is pretty good on it right now. There is a double-bottom that executed when price broke out above the confirmation line. It did hit the upside target, but retraced most of the breakout yesterday. Today it recaptured yesterday's losses quickly. The RSI is positive and the PMO just triggered a crossover BUY signal. The SCTR is improving and relative performance is improving against the SPX and the already outperforming industry group.

The weekly chart really confirmed my bullishness on the daily chart. The RSI is positive and not overbought and we have a very bullish PMO bottom above the signal line. Additionally, the PMO is not overbought. This looks pretty good on a short- and intermediate-term basis.

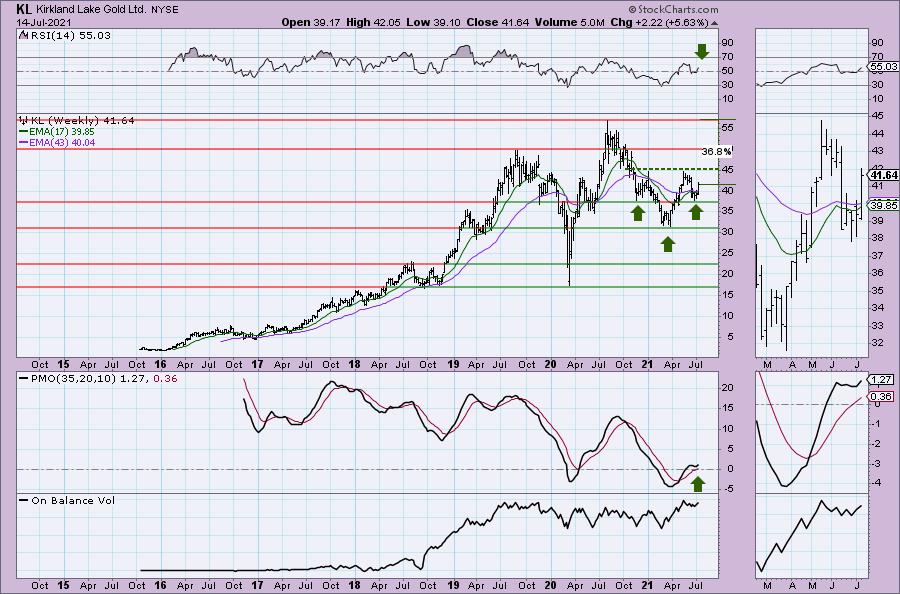

Kirkland Lake Gold Ltd. (KL)

EARNINGS: 7/29/2021 (BMO)

Kirkland Lake Gold Ltd. engages in the mining, development, and exploration of gold properties. The firms projects include Holt Mine, Macassa Mine, and Detour Lake MIne. The company was founded on June 29, 1983 and is headquartered in Toronto, Canada.

KL is unchanged in after hours trading. This stock is one of the strongest stocks within the Gold Mining industry group simply based on its relative performance against the group. Now that the group is performing in line with the SPX, finding relative strength within the group is key. Price broke out yesterday and is continuing its climb. This has given us a positive RSI and new PMO crossover BUY signal. The SCTR is improving quickly. As I noted with AGI, the stop level is deeper than I like, but you need to see the distance between price today and support. You do not have to set it there.

The weekly chart is very bullish. I don't usually see this in our "Diamonds in the Rough" because most are starting to reverse a downtrend. The weekly RSI is positive and there is a PMO bottom above the signal line. The weekly PMO is also not overbought. There is a nearly textbook reverse head and shoulders. If it executes, the minimum upside target would put price at all-time highs and possibly beyond.

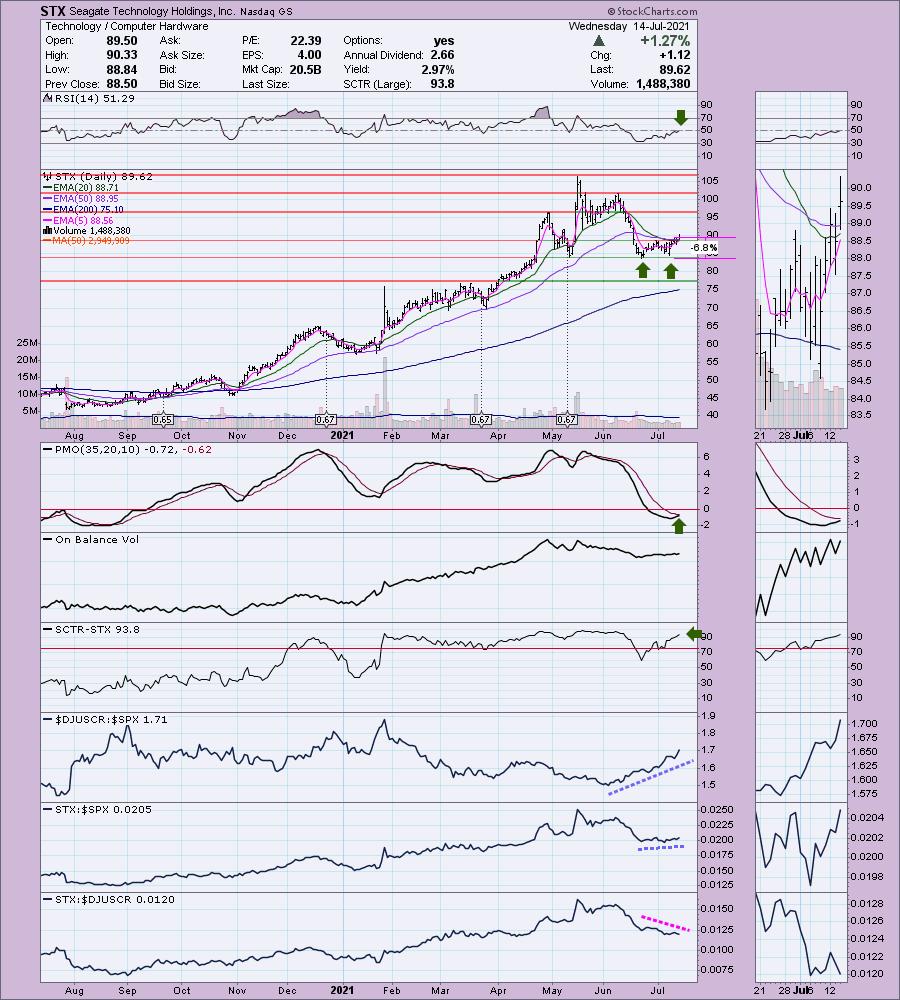

Seagate Technology Holdings, Inc. (STX)

EARNINGS: 7/21/2021 (BMO)

Seagate Technology Holdings Plc operates as holding company that is engaged in the development, production, and distribution of data storage products and electronic data storage solutions. Its products include hard disk drives, solid state hybrid drives, solid state drives, peripheral component interconnect express cards, serial advanced technology attachment controllers, storage subsystems and computing solutions. The firm offers its products under the Backup Plus and Expansion product lines, and Maxtor and LaCie brands. The company is headquartered in Dublin, Ireland.

STX is up +1.54% in after hours trading so we may be onto something here. The risk-reward sold me on this chart in addition to the normal bullish aspects. The RSI just turned positive and the PMO is nearing a crossover BUY signal. There is a double-bottom on price. Price also just broke above key moving averages. The 5-EMA is nearing a positive crossover the 20-EMA which would give us ST Trend Model BUY signal. You can set a conservative 7% stop or less, with upside potential to the all-time highs (19%+ away).

The weekly chart isn't as bullish as the daily chart or some of the other stocks I've presented given the overbought weekly PMO SELL signal. However, the weekly RSI is positive and the bounce off this price level looks very interesting.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

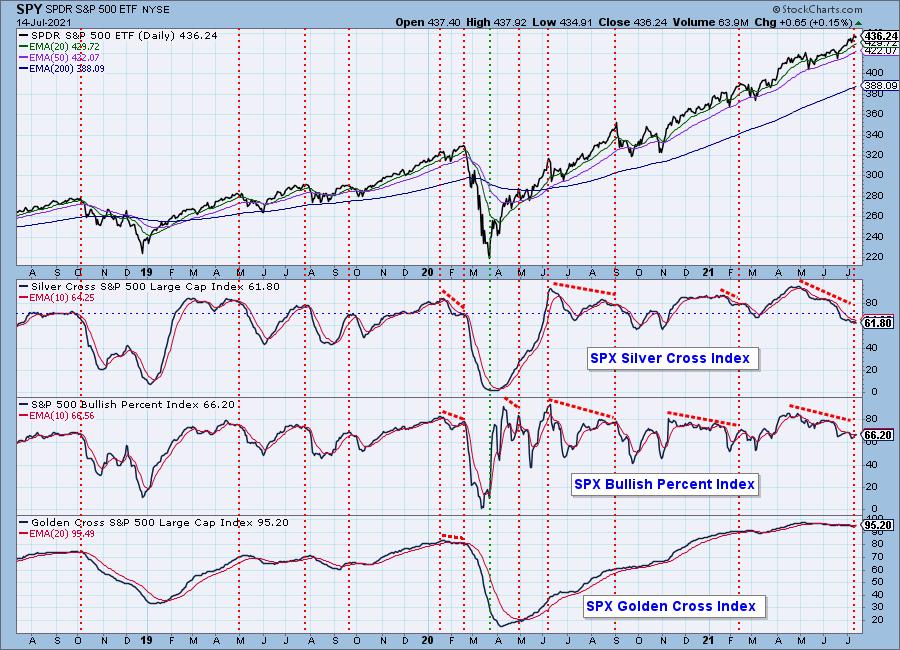

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com