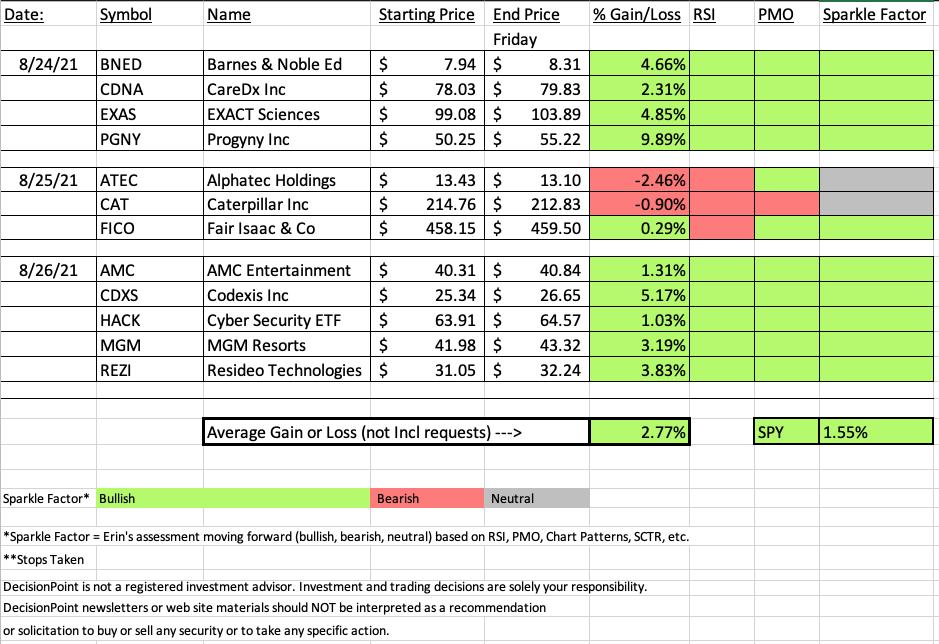

First, I want to apologize for canceling this morning's Diamond Mine Trading Room. This week I won't be able to give you a "make-up" trading room, but I'll try to get one in the week after next. It's unfortunate because this week's "Diamonds in the Rough" really started to sparkle with all but two having green "Sparkle Factors". Diamonds in the Rough beat the SPY this week as well by +1.22%.

I've struggled with vertigo on and off for many years. I have medication but it makes me very sleepy. I have special exercises to do that move my head slowly in a motion that generally will fix it over time, but last night it only made it worse. I was hoping to be 'cured' this morning, but no such luck. I'm sure I'll be able to get those exercises to do their job over the weekend. Here's hoping. Writing works just fine because I don't have to move my head from side to side as I do in a trading room. I appreciate the well wishes that arrived in my inbox from those who did attempt to login live this morning. Thank you for that.

I'm leaving last week's Diamond Mine recording up.

Cybersecurity is the new hot ticket right now as well as meme stocks which are starting to wake up again on high short interest stocks.

This week saw leadership from Natural Gas (UNG), Oil Service (XES), Uranium (URA), Gaming (BJK) and Rare Earth Metals (REMX). I would look very closely at REMX as an intermediate-term investment given the implications of a Taliban run Afghanistan. China is already poised to take advantage of the upheaval which would give them an even bigger share of what they already have. It pulled back slightly this week and that may be the best we'll get for an entry. Keep an eye on it as I'll likely talk about it on Monday's DecisionPoint Show.

The "Darling" this week was Progyny (PGNY), a Health Care Provider I presented on Tuesday. I expected this group to do well this week and there certainly were some winners here. PGNY was up +9.89% since Tuesday.

The "Dud" this week was Alphatec Holdings (ATEC), a Medical Equipment stock, which was down -2.46% since I picked it on Wednesday night. While it doesn't have a green Sparkle Factor, it still looks interesting moving forward so I listed it a Sparkle Factor as Neutral.

Register now for next Friday's Diamond Mine trading room below or right HERE.

RECORDING LINK Friday (8/20):

Topic: DecisionPoint Diamond Mine (8/20/2021) LIVE Trading Room

Start Time : Aug 20, 2021 08:58 AM

Meeting Recording LINK.

Access Passcode: August/20th

REGISTRATION FOR FRIDAY 8/27 Diamond Mine:

When: Sep 3, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (09/03/2021) LIVE Trading Room

Register in advance for this webinar HERE.

After registering, you will receive a confirmation email containing information about joining the webinar.

RECORDING LINK for DP Free Trading Room:

Topic: DecisionPoint Trading Room

Start Time : Aug 23, 2021 09:01 AM

Meeting Recording Link HERE.

Access Passcode: August#23

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Progyny Inc. (PGNY)

EARNINGS: 11/4/2021 (AMC)

Progyny, Inc. is a fertility benefits management company. It provides fertility solutions to employers, managing IUI, in vitro fertilization (IVF), egg freezing, and other fertility treatments. The company operates through one segment: fertility and pharmacy benefits solutions. It also delivers treatment services and access to the firm's network of fertility specialist. The company was founded on April 3, 2008 and is headquartered in New York, NY.

Below is the commentary and chart from Tuesday 8/24:

"PGNY is up +0.90% in after hours trading. Price is now trying to close the gap from earlier this month that was associated with earnings. Price is accelerating higher and closed well above the 20-EMA. The PMO is nearing a crossover BUY signal and the RSI is about to enter positive territory. PGNY is showing outperformance. Watch for a pullback to about the 20-EMA as that could be an interesting entry. The stop is set below the May low."

Here is today's chart:

The gap was closed on today's strong rally. I like that the RSI is not overbought. Knowing that this is also a bullish "V" bottom pattern, there is an expectation that price will likely test resistance at $62.50 or even $65.00. Volume continues to pour in.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Alphatec Holdings Inc. (ATEC)

EARNINGS: 11/4/2021 (AMC)

Alphatec Holdings, Inc. engages in the design, development, and marketing of spinal fusion technology products and solutions for the treatment of spinal disorders. It offers intra-operative information and neuromonitoring technologies, access systems, interbody implants, fixation systems, and various biologics offerings. The company was founded on March 4, 2005 and is headquartered in Carlsbad, CA.

Below is the commentary and chart from Wednesday 8/25:

"ATEC is up +1.41% in after hours trading even after a day that it was up +2.68%. This "V" bottom price pattern is very bullish. When price retraces back up one third of the decline into the "V", the expected result is a rally past the top of the left side of the "V". In this case it would mean a breakout above resistance at $15.50. The RSI is not positive yet, but it is on its way. The PMO has turned up in oversold territory and is likely to give us a crossover BUY signal very soon. Price closed above the 20-EMA forming a bullish "doji" candlestick. Volume is coming in and relative performance measures are all positive. I would've liked to have set the stop below the "V", but that is too deep for me so I opted to line it up at that early August low."

Below is today's chart:

I still like this "dud", but there is risk right now. It appears that price is setting up a nice reverse head and shoulders pattern. We won't know until we get a good rally. The risk is a test of support that is below our stop level of 7.2%. The PMO is still favorable and the RSI is rising again in an attempt to reach positive territory. Definitely watch list material.

THIS WEEK's Sector Performance:

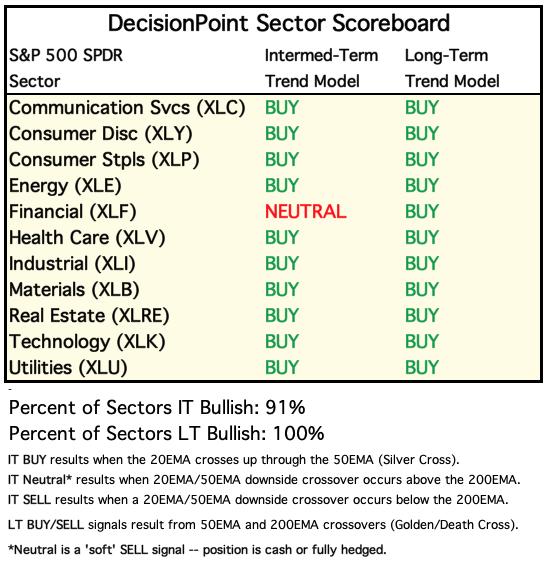

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

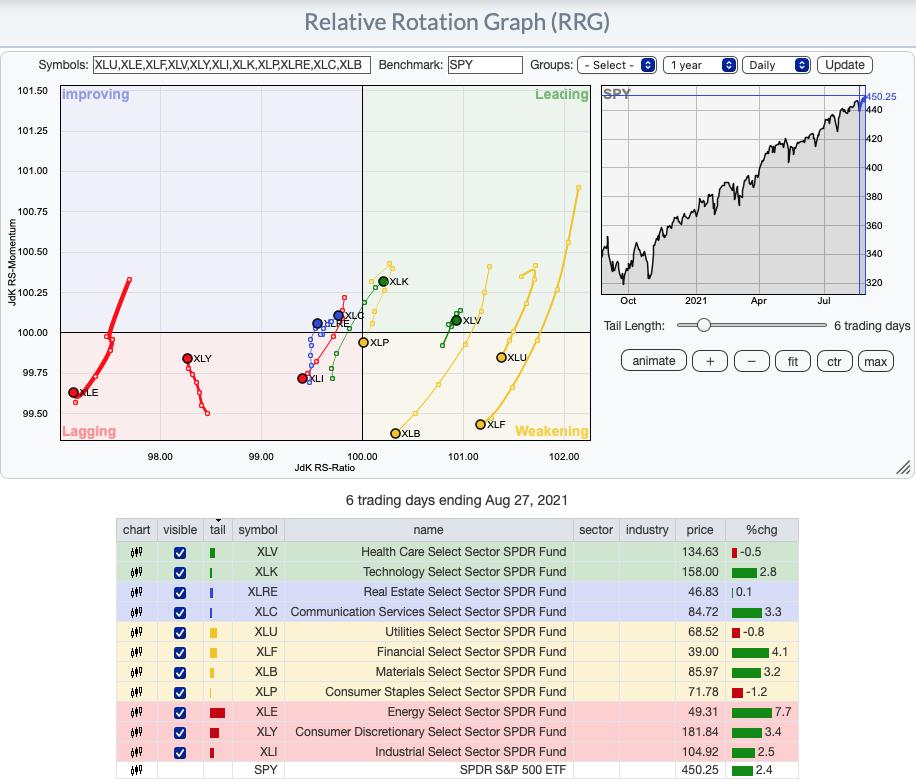

Short-term RRG: Big shakeup on the daily RRG this week. While Healthcare remains in the "Leading" category it has changed its heading to the bearish southwest. Sectors that led most recently, XLP, XLB, XLU and XLF plunged into "Weakening" this week. Strong relative performers right now are XLK, XLC and XLRE.

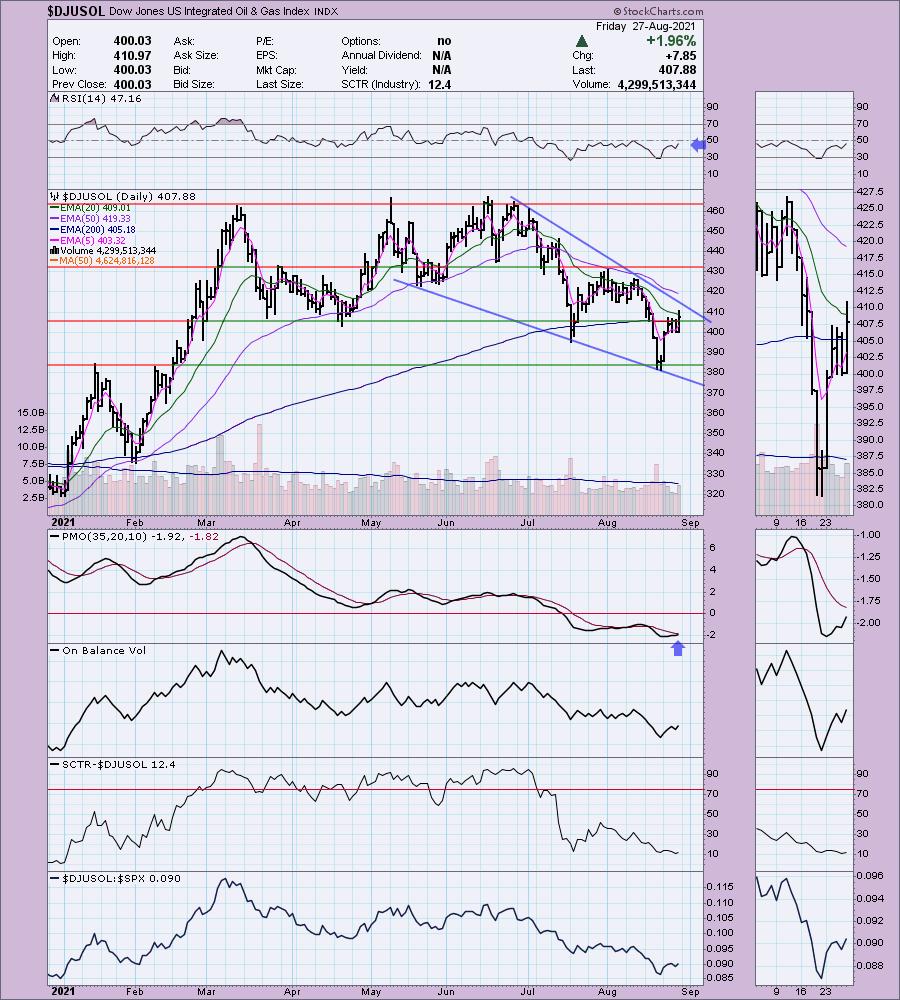

Sector to Watch: Energy (XLE)

I'm going out on a limb with this pick, but the chart looks quite bullish. The risk here is the 50-EMA holding up as overhead resistance. The rest of the chart is telling me that it won't be a problem. First today's action executed a bullish falling wedge pattern. The RSI just hit positive territory and the PMO just had an oversold crossover BUY signal. Notice the increase in participation and the rising SCI and BPI. I like this sector right now.

Industry Group to Watch: Health Care Providers ($DJUSHP)

Going out on a second limb. This is one of the under-performers of the sector based on the SCTR, but the chart is looking up. There is a large bullish falling wedge. Price bounced off sturdy support at the January top. Today it moved strongly above the 200-EMA. While the RSI is still negative, it is rising. The PMO is working on an oversold crossover BUY signal. In all honesty, all of the industry groups within XLE look good. I'm expecting big things from this sector next week.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting! Next Diamonds Report is Tuesday 8/31.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 50% invested right now and 50% is in 'cash', meaning in money markets and readily available to trade with.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com