The Energy sector continued to outperform this week and looks very good going into next week. However, I opted to go with a different sector as the "sector to watch" as it is showing new momentum. I do still like the Energy sector moving forward into next week, but participation is on the overbought side right now.

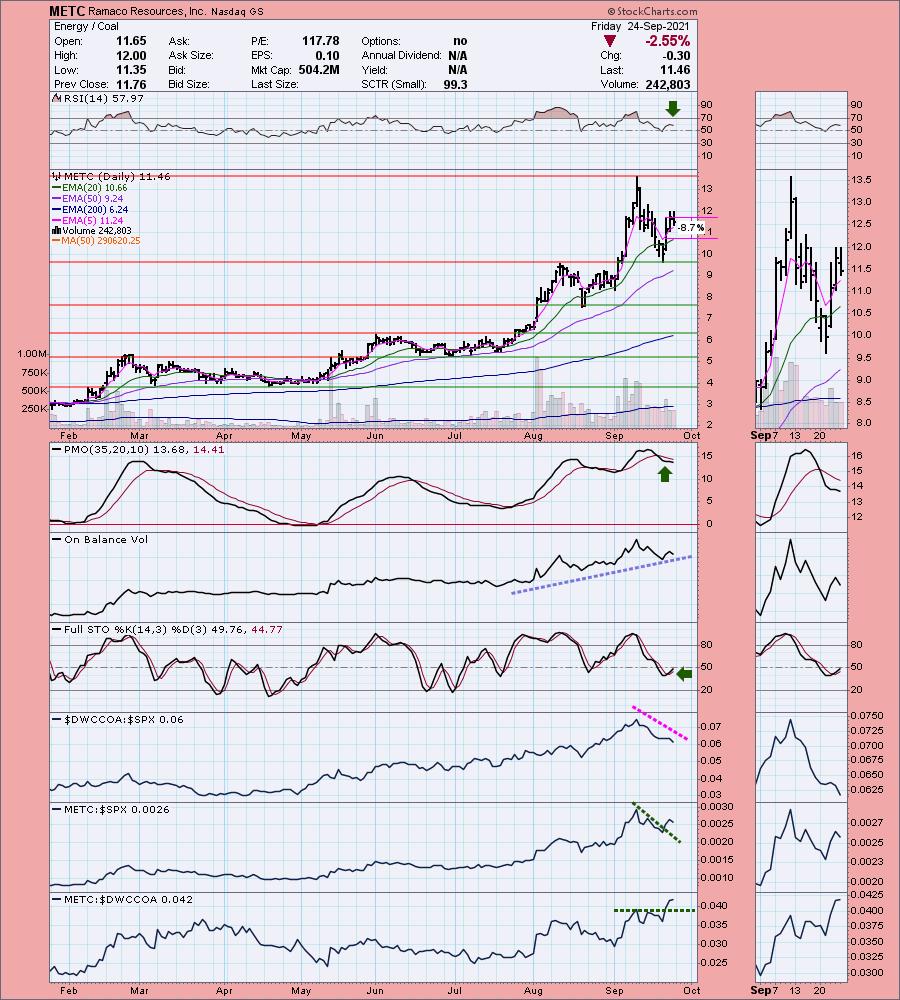

"Diamonds in the Rough" on average outperformed the SPY by 0.50% with the "Darling" (IRWD) gaining +6.16% even though it was in an industry group, Pharma, that lost relative strength this week. The close runner-up was Asbury Automotive (ABG) which was up +5.56% since Tuesday.

The "Dud" wasn't that terrible. It was the coal stock that I added, METC. I think coal is on the rebound, but the indicators went somewhat south. It only had one day of trading so the -2.55% loss since yesterday didn't help. I would still keep coal and this stock on your watchlist. Coal pulled back and it should begin rising again.

You'll note on the spreadsheet that I have four "neutral" Sparkle Factors. Remember a "neutral" means I don't have high hopes for it to continue higher, but I also don't see it breaking down in a major way. Overall you have to make the decision on those charts as to whether they are watchlist material.

Register now for next Friday's Diamond Mine trading room below or right HERE.

RECORDING LINK Friday (9/24):

Topic: DecisionPoint Diamond Mine (9/24/2021) LIVE Trading Room

Start Time : Sep 24, 2021 09:00 AM

Meeting Recording LINK.

Access Passcode: Sept-24th

REGISTRATION FOR FRIDAY 10/1 Diamond Mine:

When: Oct 1, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (10/1/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (9/20) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Sep 20, 2021 09:00 AM

Meeting Recording LINK.

Access Passcode: Sept-20th

For best results, copy and paste the access code to avoid typos.

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

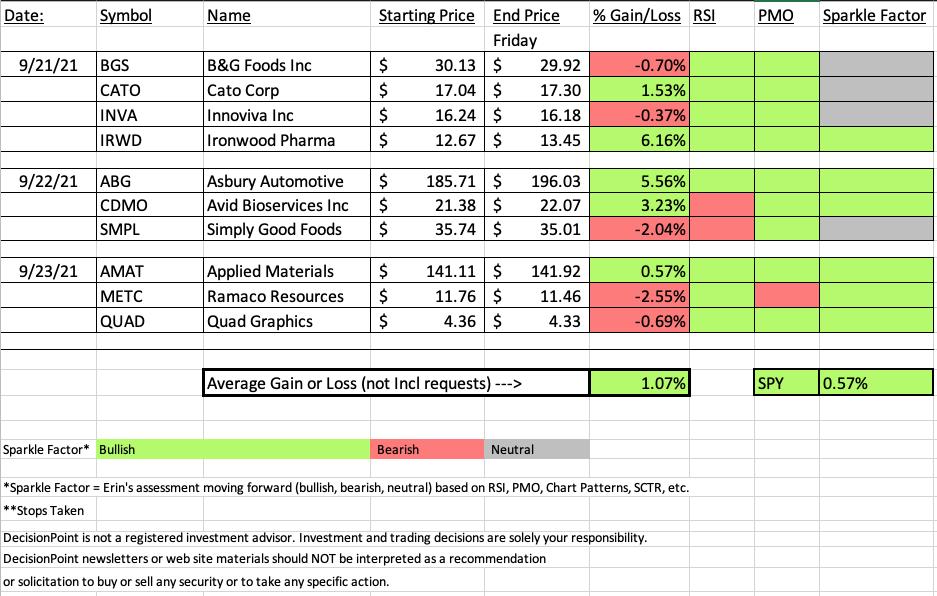

Ironwood Pharmaceuticals Inc. (IRWD)

EARNINGS: 11/4/2021 (BMO)

Ironwood Pharmaceuticals, Inc. is a healthcare company, which focuses on the development and commercialization of Gastrointestinal (GI) product opportunities in areas of significant unmet need, leveraging demonstrated expertise and capabilities in GI diseases. Its products include linaclotide, a guanylate cyclase type-C agonists which treats patients irritable bowel syndrome with constipation and chronic constipation. The company was founded by Peter M. Hecht, Eric F. Summers, G. Todd Milne, Brian M. Cali, Joseph C. Cook Jr., and Gina Bornino Miller on January 5, 1998 and is headquartered in Boston, MA.

Below is the commentary and chart from Tuesday 9/21:

"IRWD is up +0.32% in after hours trading. I covered IRWD on June 22nd, 2020 and on July 9th, 2020. I didn't list stops on these. I liked it on 6/22/20, but wrote that I no longer liked it on 7/9/20. Looking at the weekly chart, the positions were not successful.

I like today's breakout and the cup shaped bottom. The PMO is just turning up and the RSI is just now getting positive. Stochastics look great as they thrust upward. Relative strength is strong. We also have a bounce off the 200-EMA. Price has just peaked above resistance at the May top. I'd set the stop at or just below the 200-EMA."

Here is today's chart:

I still love this chart. We caught the rally at the right time. It hit overhead resistance today and closed above it. The RSI isn't overbought yet and the PMO triggered a crossover BUY signal. Stochastics are still rising and aren't really overbought right now. I would probably look for a slight pullback toward the EMAs as an entry point.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

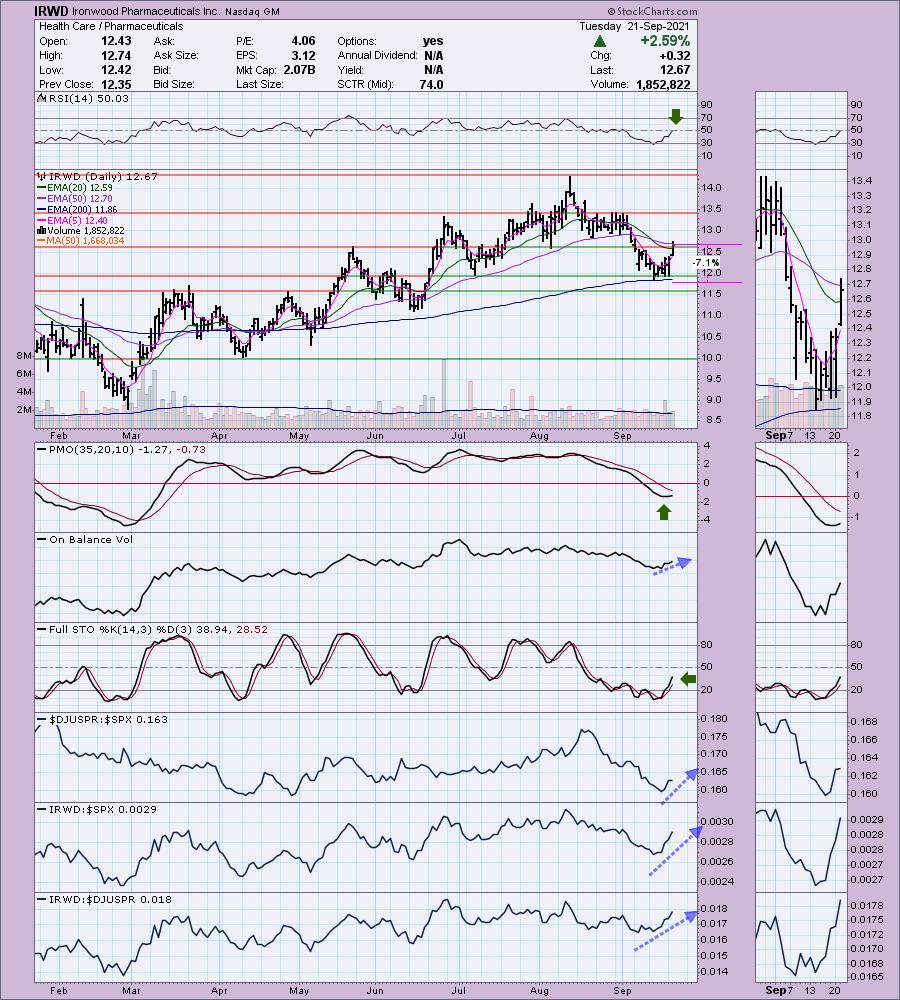

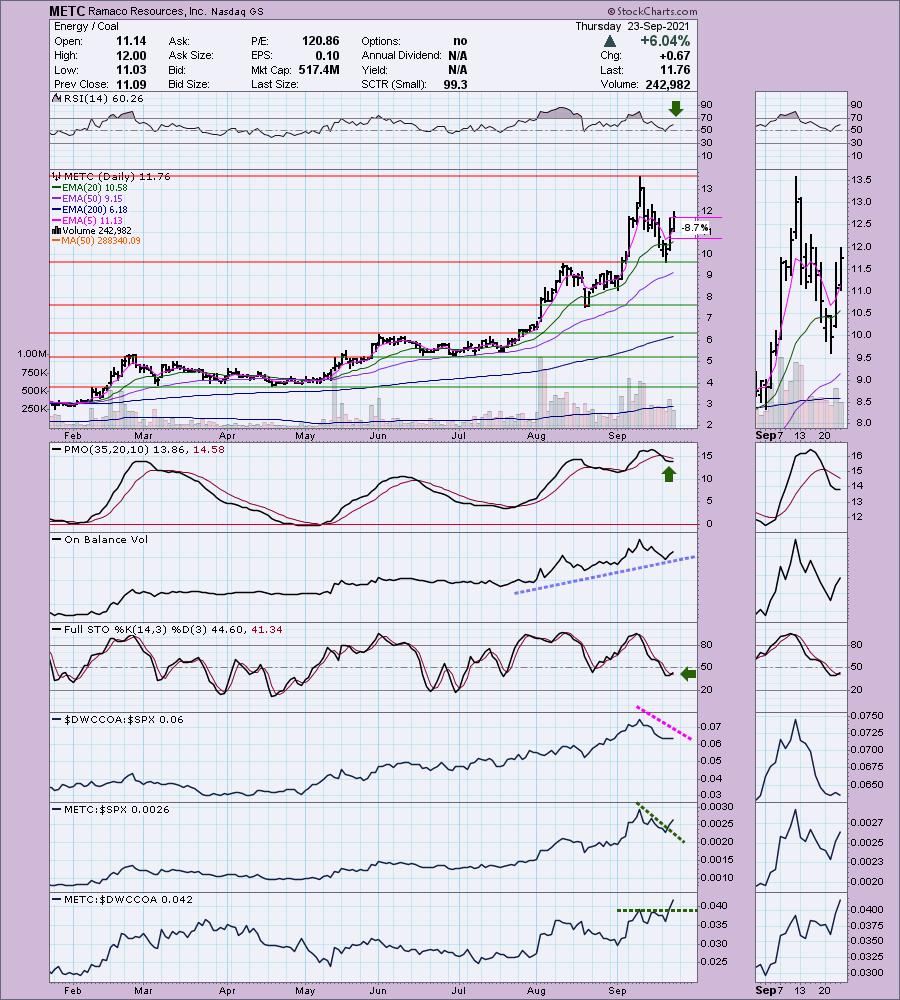

Ramaco Resources, Inc. (METC)

EARNINGS: 11/2/2021 (AMC)

Ramaco Resources, Inc. engages in the operation and development of coal mining properties. The firm deals with metallurgical coal in central and southern West Virginia, southwestern Virginia and southwestern Pennsylvania. Its portfolio consists of Elk Creek, Berwind, RAM Mine, and Knox Creek. The company was founded by Randall W. Atkins in August 2015 and is headquartered in Lexington, KY.

Below is the commentary and chart from yesterday (9/23):

"METC is unchanged in after hours trading. Apparently when I mentioned it yesterday as part of the short list, I definitely should've made it a pick given today's more than 6% rally. Coal pulled back strongly, but is recovering just as strongly. Of the coal charts that subscribers sent, I liked METC because the PMO has turned up, unlike the others. However, I think the other coal stocks are interesting. All them are showing new Stochastics positive crossovers. This stock is low-priced so be sure to position size wisely. The group has been underperforming, but it is now beginning to perform with the SPX given the flat relative strength line. METC is beginning to outperform as it has broken declining trends in relative strength. The OBV is confirming the price rise. The stop is difficult to set given today's huge upside move. I have it set at the 20-EMA."

Below is today's chart:

Coal does appear ready to resume its strong uptrend after a deep decline. When I presented this chart yesterday it wasn't completely "ripe". The RSI still looks healthy, but the PMO has resumed its decline in earnest. Stochastics look good though which is why I would likely watch list this chart. We do need to see more volume on the next rally. As you can see the industry group itself is still struggling relative to the SPX. It's just not quite ripe. However, I still gave it a green Sparkle Factor as I think it still has promise going into next week.

THIS WEEK's Sector Performance:

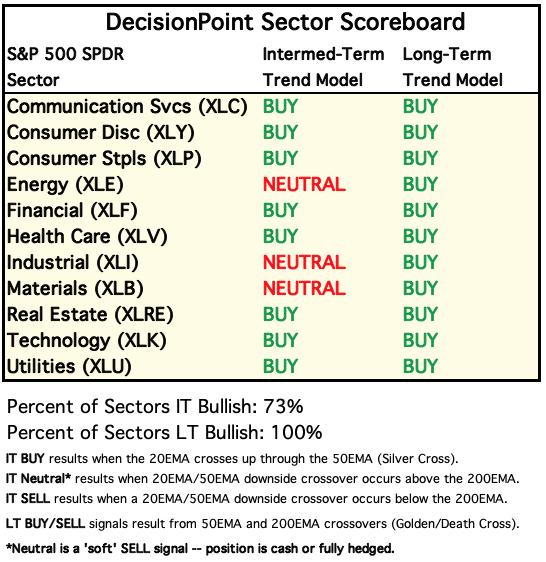

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

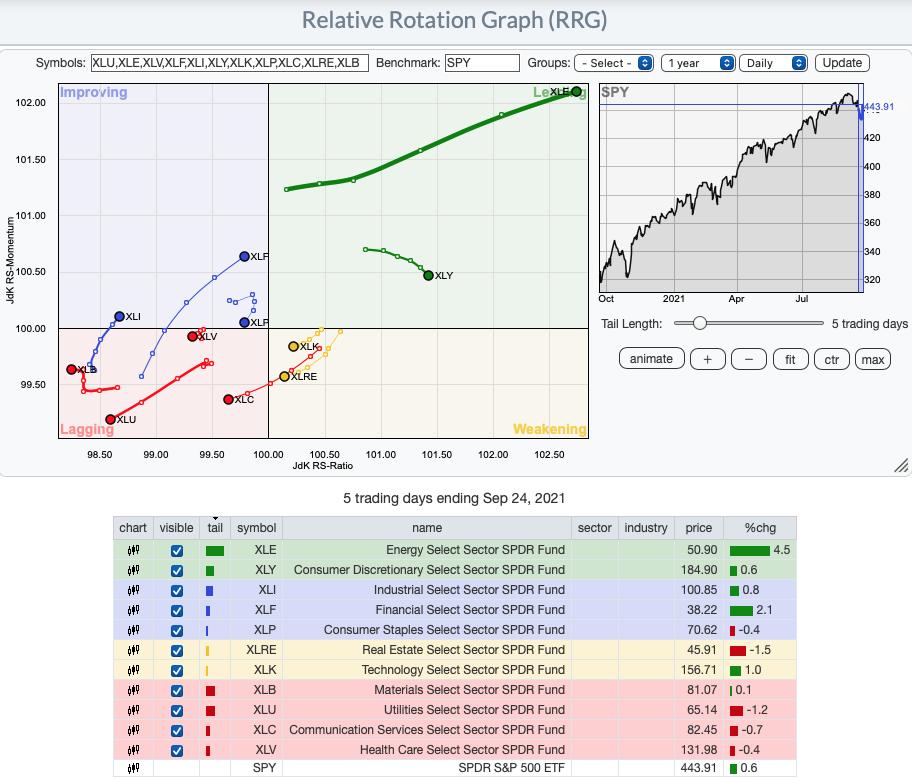

Short-term RRG: As far as the short-term RRG, XLK is losing strength. XLY just entered "Leading" and looks healthy on the chart. XLRE and XLC are in Leading, but they are beginning to rotate back toward Weakening.

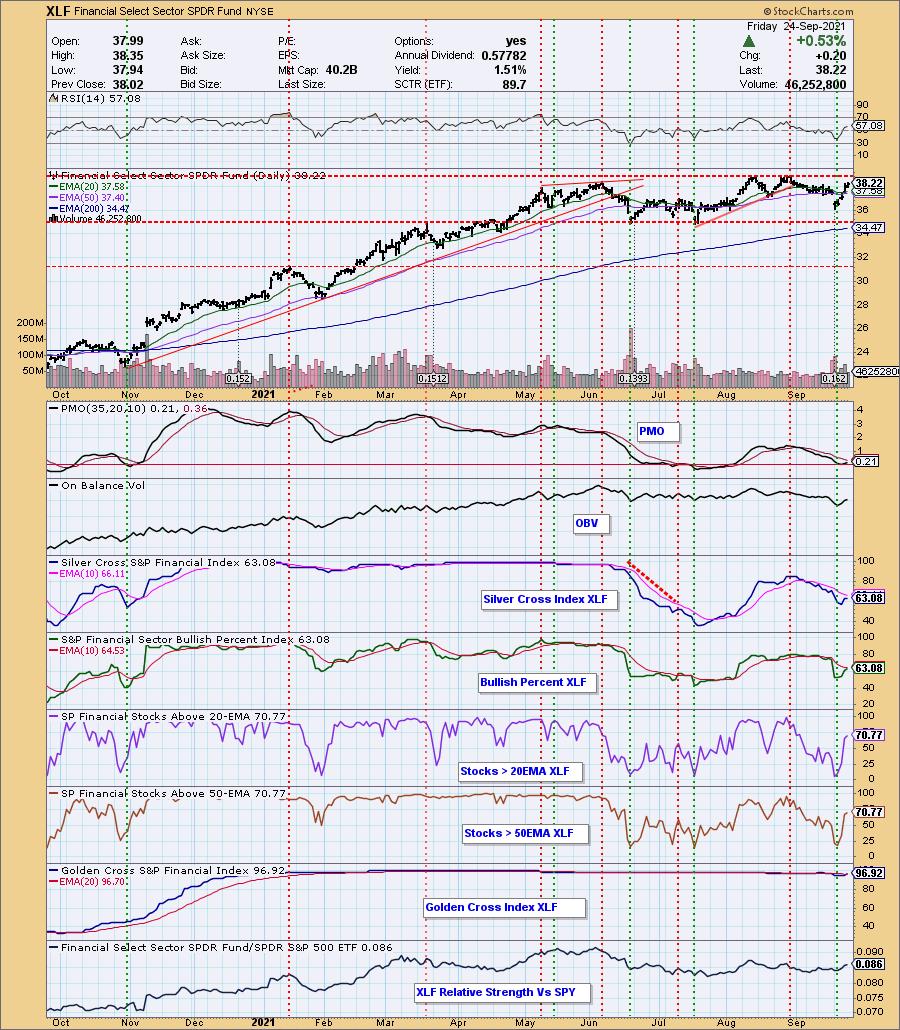

Sector to Watch: Financials (XLF)

I was torn today in the Diamond Mine as far as which sector to pick as the "one to watch". It was a tie between XLE and XLF. XLE is getting overbought as far as participation. I think it will go higher and I believe overbought conditions will simply persist. However, we have an up and comer in XLF. It had a fabulous week after the nasty gap down on Monday. We have new momentum as the PMO is just now turning up. The RSI is positive and definitely not overbought. The SCI turned up this week. It was flat today, but notice the increase in participation of stocks above their 20/50-EMAs. There is now a slight bullish bias given participation percentages are higher than the SCI. It looks good going into next week.

Industry Group to Watch: Investment Services ($DJUSSB)

I discussed in today's Diamond Mine that I had seen a few stocks in this industry group appear early this week. Given the double-top and break below support, I wasn't ready to present any of them. Of course, they were on fire after Monday's decline. The RSI is positive and the PMO just bottomed on the zero line. Stochastics are strong and relative strength is breaking out. Should be interesting to see how it behaves next week.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting! Next Diamonds Report is Tuesday 9/28.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 70% invested right now and 30% is in 'cash', meaning in money markets and readily available to trade with.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com