Happy Veteran's Day! I would like to applaud and thank all those who have served or are serving our country. My family has a rich tradition of service that I'm very proud to be a part of as an eight-year veteran of the US Air Force. Carl also served in the USAF as a pilot for 20 years. One of my favorite positions was when I worked in acquisition for the Strategic Defense Initiative (SDI Programs or "Star Wars") at Los Angeles AFB. I put a picture of my father and I at the bottom of the blog. Other members of my family that have served include three uncles, a great uncle, 2 grandfathers and my husband who served 22 years in the Navy. This is your day... or I suppose "our" day.

Reader requests were heavy on Financials and I like that emphasis. It appears yields are going to rebound and typically that is good for Financial stocks, particularly banks. I have two banks and one in consumer finance. The other two have very strong charts that you will want to see.

Looking forward to seeing you in tomorrow's Diamond Mine trading room. If you can't make it, feel free to send me symbol requests via email and you can watch the recording to see your stocks reviewed. Here is the link to register. It is also below per usual.

Today's "Diamonds in the Rough": ALLY, AXP, CARG, DGX and GWB.

RECORDING LINK Friday (11/5):

Topic: DecisionPoint Diamond Mine (11/5/2021) LIVE Trading Room

Start Time: Nov 5, 2021 09:01 AM

Meeting Recording Link HERE.

Access Passcode: November#5

REGISTRATION FOR FRIDAY 11/12 Diamond Mine:

When: Nov 12, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (11/12/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (11/8) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Nov 8, 2021 08:57 AM

Meeting Recording Link HERE.

Access Passcode: November%8

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "Diamonds in the Rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Ally Financial Inc. (ALLY)

EARNINGS: 1/21/2022 (BMO)

Ally Financial, Inc. is a holding company, which provides digital financial services to consumers, businesses, automotive dealers, and corporate clients. It operates through the following segments: Automotive Finance Operations, Insurance Operations, Mortgage Finance Operations, and Corporate Finance Operations. The Automotive Finance Operations segment offers retail installment sales contracts, loans and leases, offering term loans to dealers, financing dealer floor plans and other lines of credit to dealers, warehouse lines to companies, fleet financing, providing financing to companies and municipalities for the purchase or lease of vehicles and equipment, and vehicle re-marketing services. The Insurance Operations segment focuses on finance protection and insurance products sold primarily through the automotive dealer channel, and commercial insurance products sold directly to dealers. The Mortgage Finance Operations segment consists of the management of a held-for-investment consumer mortgage finance loan portfolio, which includes bulk purchases of jumbo and LMI mortgage loans originated by third parties. The Corporate Finance Operations segment provides senior secured leveraged cash flow and asset-based loans to mostly United States based middle market companies focuses on businesses owned by private equity sponsors with loans typically used for leveraged buyouts, mergers and acquisitions, debt refinancing, restructurings, and working capital. The company was founded in 1919 and is headquartered in Detroit, MI.

Predefined Scans Triggered: Elder Bar Turned Green and Bullish MACD Crossovers.

ALLY is up +0.02% in after hours trading. Out of the gate my one dislike about this chart is that it slipped over 15% after reporting earnings in October. I prefer stocks that have had strong earnings. However, ALLY is rising from the ashes after a healthy bounce off the 200-EMA and support at the July low. It's beginning to break above resistance and closed above the 20-EMA for the first time since its earnings slide. The RSI is getting ready to enter positive territory. The PMO is nearing an oversold crossover BUY signal. Stochastics are rising strongly and relative strength is improving. The stop can be thinned, but I've set it below the July bottom.

The weekly PMO is trying to turn back up and the weekly RSI has reentered positive territory. There is a large bull flag. If it can recapture new all-time highs that would be about a 12% gain, but if it breaks out further, upside potential is huge based on the flag.

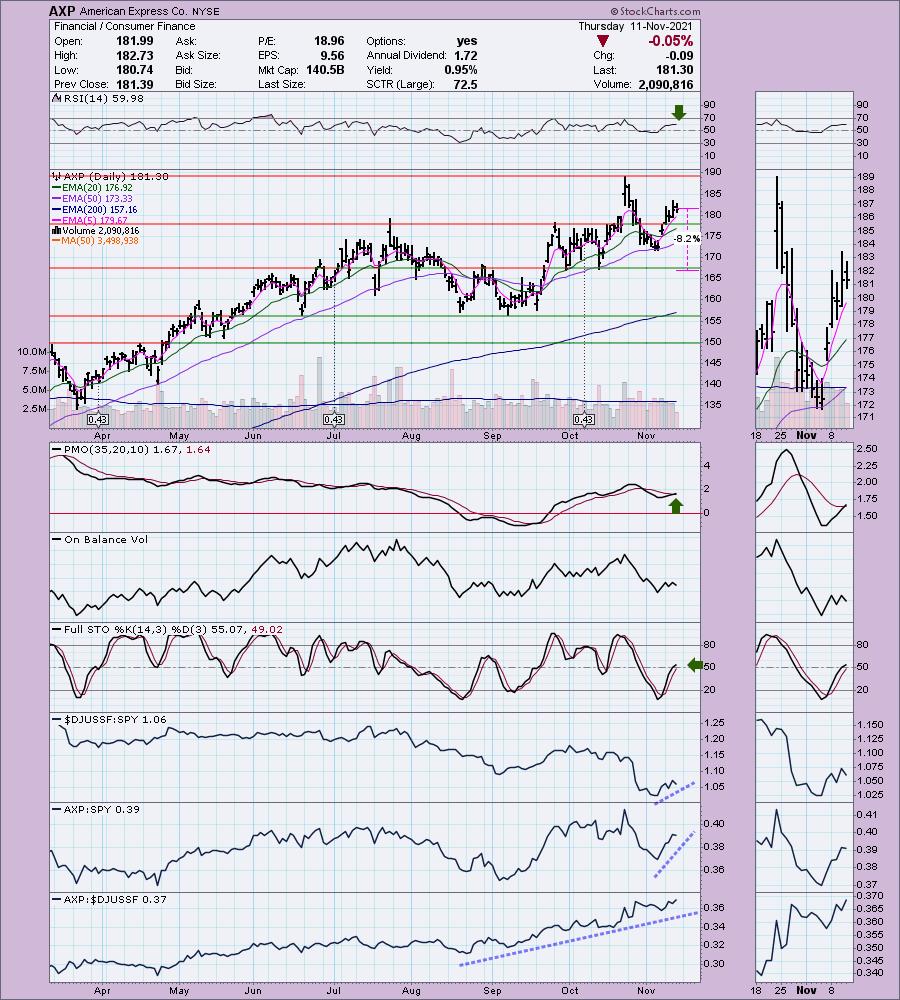

American Express Co. (AXP)

EARNINGS: 1/25/2022 (BMO)

American Express Co. engages in the provision of charge and credit card products and travel-related services. It operates through the following segments: Global Consumer Services Group, Global Commercial Services, Global Merchant and Network Services, and Corporate and Other. The Global Consumer Services Group segment issues a wide range of proprietary consumer cards globally. The Global Commercial Services segment provides proprietary corporate and small business cards, payment and expense management services, and commercial financing products. The Global Merchant and Network Services segment operates a global payments network that processes and settles card transactions, acquires merchants, and provides multi-channel marketing programs and capabilities, services, and data analytics. The Corporate and Other segment covers corporate functions and certain other businesses and operations. The company was founded by Henry Wells, William G. Fargo, and John Warren Butterfield on March 28, 1850 and is headquartered in New York, NY.

Predefined Scans Triggered: None.

AXP is up +0.11% in after hours trading. I've covered AXP twice before this year on February 18th 2021 and April 28th 2021. Neither has been stopped out so the gains are +41.1% and +18.9% respectively. The chart is firming up for another entry. The RSI is hovering in positive territory and the PMO triggered a crossover BUY signal today. Stochastics are rising in positive territory and relative strength proves that AXP is a leader in the Consumer Finance industry group as well as a strong relative performer against the SPY. The stop is set below the October lows.

The weekly RSI is positive and the weekly PMO is bottoming. Price has broken above the July top. It is very close to new all-time highs so I would set an minimum upside target around $212.12 which would be a gain of 17%.

CarGurus, Inc. (CARG)

EARNINGS: 2/10/2022 (AMC)

Cargurus, Inc. engages in the provision of online auto shopping. The firm offers proprietary technology, search algorithms and data analytics to analyze new and used car listings. It operates through the following segments: United States and International. The United States segment derives revenues from marketplace subscriptions, advertising services and other revenues from customers within the United States. The International segment includes the revenues from marketplace subscriptions, advertising services and other revenues from customers outside of the United States. The company was founded by Langley Steinert on November 10, 2005 and is headquartered in Cambridge, MA.

Predefined Scans Triggered: Moved Above Upper Keltner Channel, New 52-week Highs, P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

CARG is unchanged in after hours trading. While this stock is on the overbought side based on the RSI and overbought PMO, it still looks poised to move higher. Volume is coming in strong. While the group is performing about as well as the market, CARG is has been outperforming the group and the SPY since August! Stochastics are turning back up and the OBV has been confirming this rally since August as well. The stop is set below the October tops.

The weekly RSI has just entered overbought territory, but given this breakout from overhead resistance and the strongly rising weekly PMO, I expect this one to keep on climbing. Upside potential should it reach its all-time high is 44%.

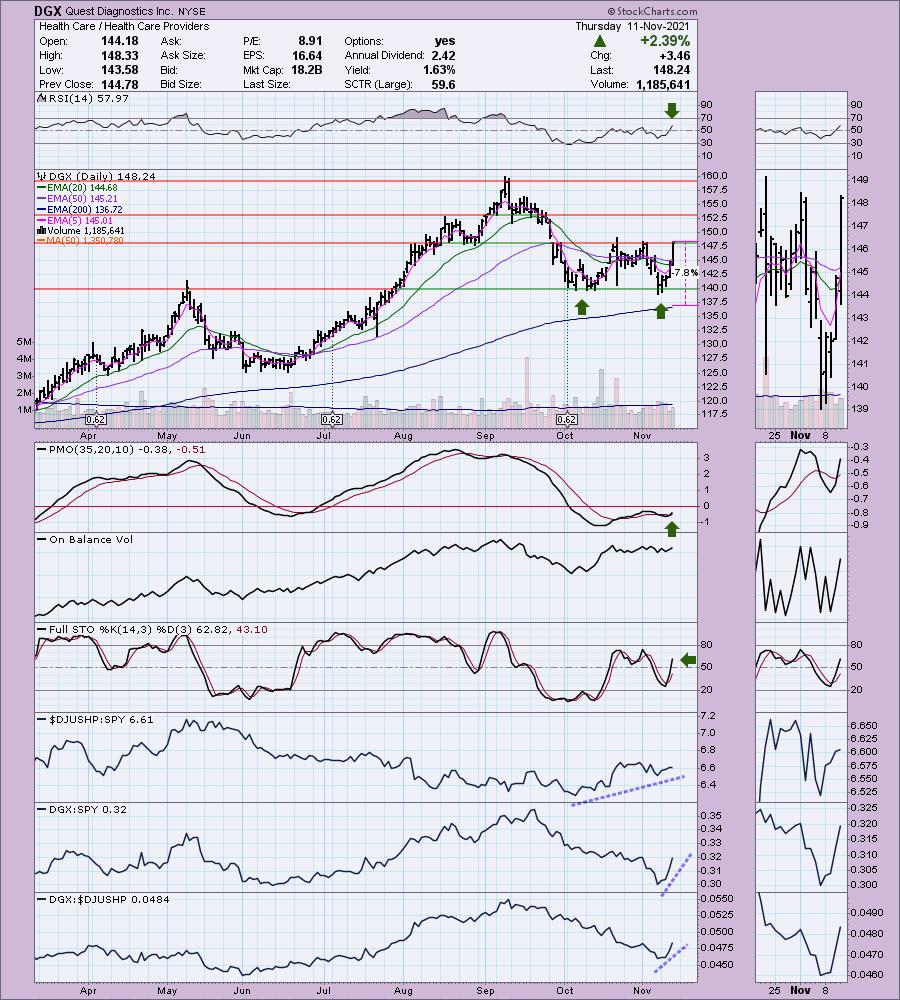

Quest Diagnostics Inc. (DGX)

EARNINGS: 2/3/2022 (BMO)

Quest Diagnostics, Inc. engages in the provision of diagnostic testing, information and services. It operates through the Diagnostic Information Services (DIS) and All Other segments. The DIS segment offers diagnostic information services to patients, clinicians, hospitals, health plans, and employers. The All Other segment consists of risk assessment services, healthcare information technology, diagnostic products, and clinical trials testing businesses. The company was founded in 1967 and is headquartered in Secaucus, NJ.

Predefined Scans Triggered: Bullish MACD Crossovers, Parabolic SAR Buy Signals, Entered Ichimoku Cloud and Ichimoku Cloud Turned Red.

DGX is unchanged in after hours trading. I've covered DGX three times before, February 27th 2020, September 15th 2020 and January 5th 2021. The 2/27/20 position was stopped out in the bear market sell-off. The 9/15/20 position is still open and currently up +30.5%. The 1/5/21 was nearly stopped out in the February 2021 decline given it was a thin 6%, so it is up +21.8% currently.

I love the pullback to support at the May top and the consolidation that created a bullish double-bottom formation. A breakout from that formation implies a minimum upside target right at overhead resistance at the September high. The RSI just entered positive territory and the PMO triggered a crossover BUY signal today. Stochastics are rising strongly. While it hasn't always performed well against the group, it is beginning to and given the group is a strong relative performer, that is very bullish for DGX. The stop is set at the 200-EMA.

The weekly PMO is beginning to turn back up and the weekly RSI has stayed in positive territory for months. All-time highs are only 8.7% away, so my upside target would be around $173.45 for a 17% gain.

Great Western Bancorp Inc. (GWB)

EARNINGS: 1/27/2022 (AMC)

Great Western Bancorp, Inc. operates as a bank holding company. The firm engages in the provision of relationship-based business and agri-business banking services. It also offers deposit and loan products to its retail customers through several channels, including its branch network, online banking system, mobile banking applications and customer care centers. The company was founded in 1935 and is headquartered in Sioux Falls, SD.

Predefined Scans Triggered: Elder Bar Turned Green and P&F Double Top Breakout.

GWB is unchanged in after hours trading. We have a large double-bottom pattern that executed back in early October with the breakout. Price subsequently pulled back to the breakout point and reversed bullishly. It is now making its way to the minimum upside target of the pattern at $38. The RSI is positive and not overbought. The PMO has just accelerated higher and Stochastics are turning back up in positive territory. It's a strong relative performer against the group and the SPY. The stop is set below the 50-EMA at the late October intraday low. You could certainly lengthen it down toward the confirmation line of the double-bottom pattern.

I love the large bullish cup with handle pattern on the weekly chart. This rally has confirmed the pattern and suggests price will move well-above all-time highs which are about 16% away. The weekly RSI is positive and the weekly PMO is zeroing in on a crossover BUY signal.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

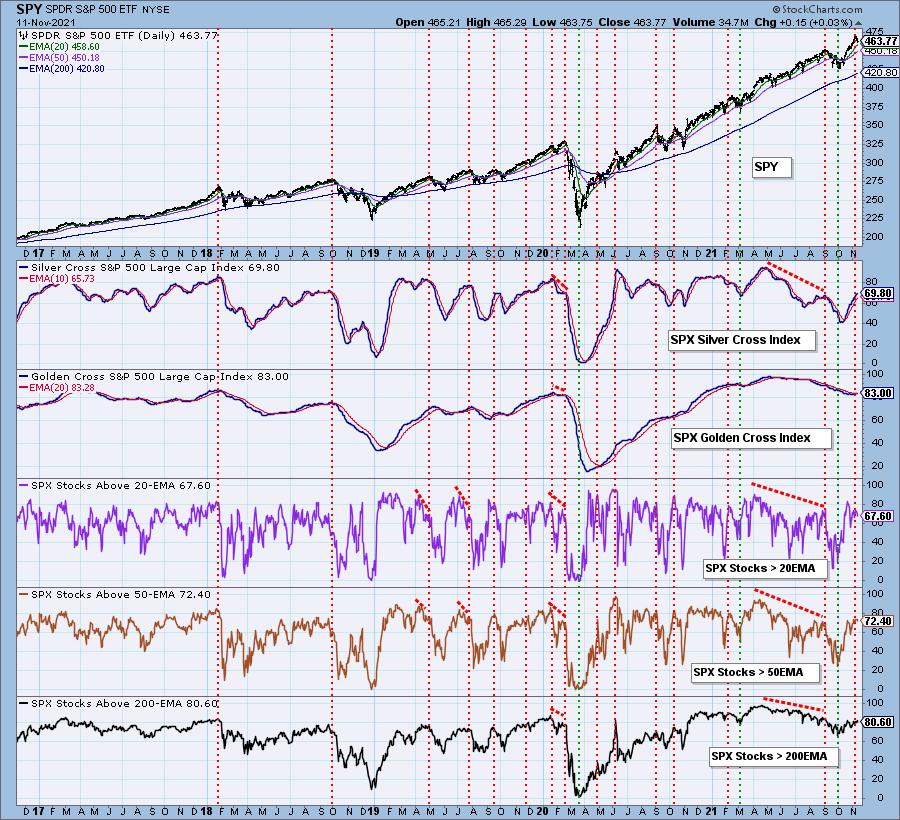

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 70% invested and 30% is in 'cash', meaning in money markets and readily available to trade with. I am considering a purchase of DGX and GWB depending on the 5-minute charts tomorrow and/or Monday.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com