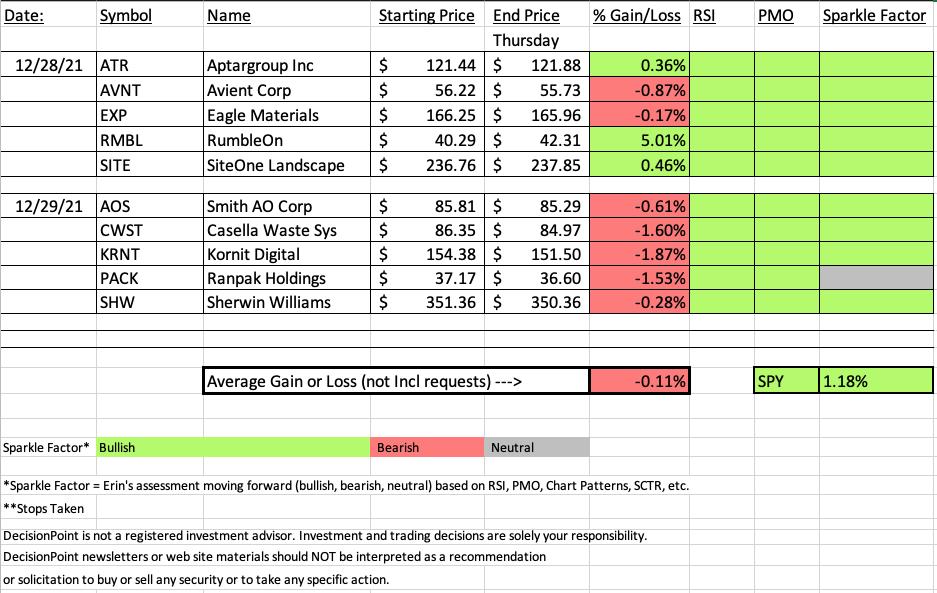

Yesterday's picks all finished down today, but all of them look good moving into next week with the exception of one that is neutral moving forward. Tuesday's picks finished mostly higher. They all look good moving into next week.

PACK is the chart that I'm not as bullish on even though it wasn't down as far as some of the other stocks. The price pattern and indicators are good except for Stochastics which topped before reaching 80. I didn't include PACK today as our actual "Dud" since Kornit Digital (KRNT) was down -1.87% while PACK was down -1.53%.

This week's "Darling" is RumbleOn (RMBL) which finished the week up over 5%.

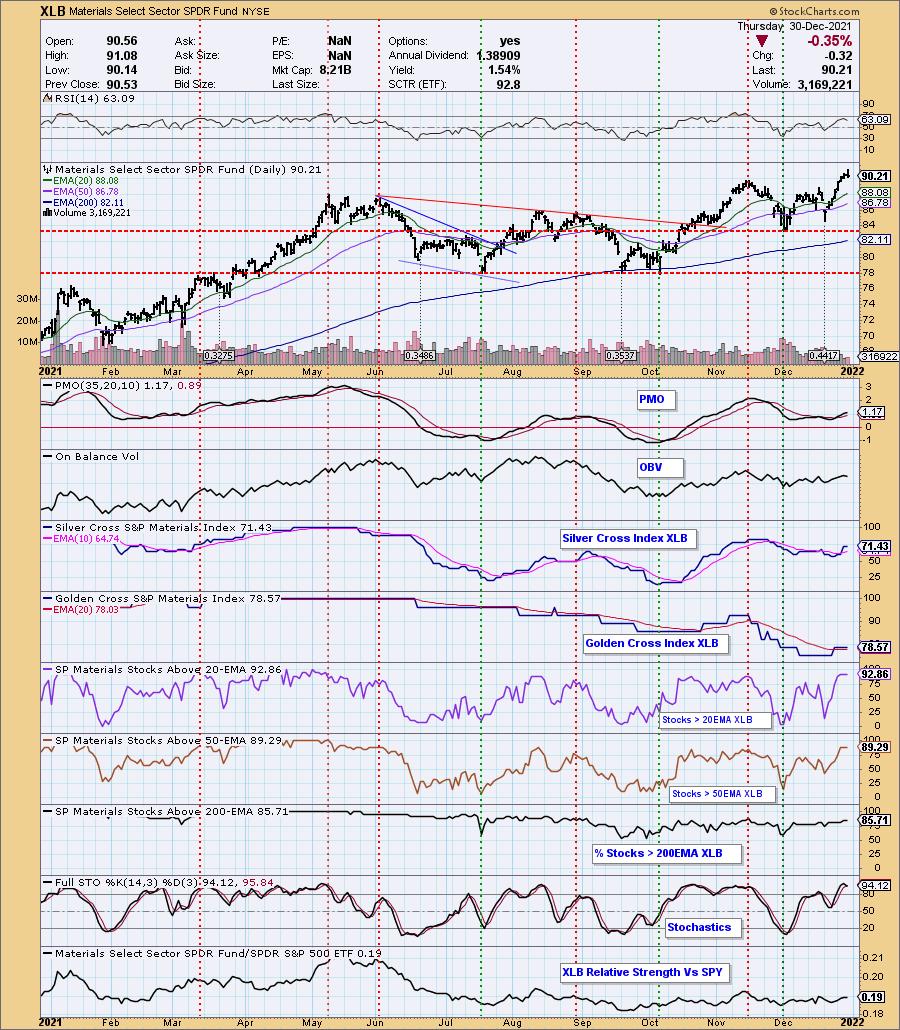

After reviewing participation and momentum, it came down to four sectors that all were very similarly set up with short-term bullish biases: XLC, XLY, XLI and XLB. I decided to go with Materials (XLB) mainly because I liked its price breakout to new all-time highs combined with bullish biases in all timeframes. It also fits with my industry group selection.

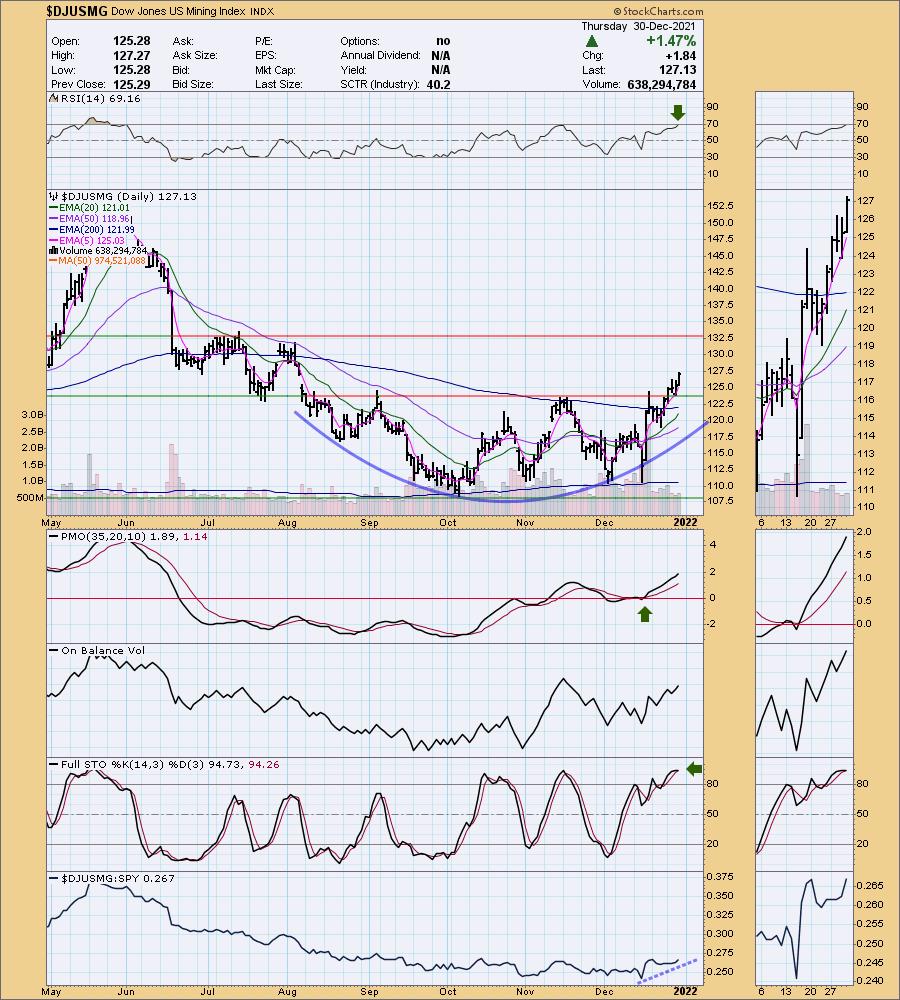

While in the Diamond Mine this morning, I decided that the "Mining" industry group is where it is at. There are certainly more groups within Materials that look positive, but I liked the shape of the chart. You'll find it below.

Next week we move back into our normal schedule for DP Diamonds. Tue/Wed will be my stock picks and Thursday will include reader requests. Friday is the Diamond Mine and Recap. Don't forget to register for next week's Diamond Mine below.

Best wishes for a happy and healthy new year! The next Diamonds report will be on Tuesday of next week.

RECORDING LINK Thursday (12/30):

Topic: DecisionPoint Diamond Mine THURSDAY (12/30/2021) LIVE Trading Room

Start Time: Dec 30, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: Diamond#30

REGISTRATION FOR 1/7 Diamond Mine:

When: Jan 7, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (1/7/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (12/27) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Dec 27, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: Holiday@2

For best results, copy and paste the access code to avoid typos.

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

RumbleOn, Inc. (RMBL)

EARNINGS: 3/14/2022 (BMO)

RumbleOn, Inc. engages in the provision of motor vehicle dealer and e-commerce platform. It operates through the following segments: Powersports; Automotive; and Vehicle Logistics and Transportation. The Powersports segment distributes pre-owned motorcycles and powersports vehicles. The Automotive segment focuses on the distribution of pre-owned cars and trucks. The Vehicle Logistics and Transportation segment offers nationwide automotive transportation services between dealerships and auctions. The company was founded by Matthew A. Lane, Marshall Chesrown, and Steven Richard Berrard on October 24, 2013 and is headquartered in Irving, TX.

Predefined Scans Triggered: Moved Below Ichimoku Cloud.

Below are the commentary and chart from Tuesday (12/28):

"RMBL is unchanged in after hours trading. What caught my eye on this one was the strong OBV positive divergence. The PMO triggered a crossover BUY signal today. Stochastics are rising strongly in positive territory above net neutral (50). It is showing great relative strength right now. The stop level is just below the 200-day EMA."

Here is today's chart:

This pick looked a little suspect yesterday but it turned it on today with a 5%+ gain. This has brought price up to strong overhead resistance at $43. The indicators are looking even more bullish than when I picked this on Tuesday. I would expect to see a small pullback after today's big move and then a breakout above resistance.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Kornit Digital Ltd (KRNT)

EARNINGS: 2/15/2022 (BMO)

Kornit Digital Ltd. engages in the development, manufacture, and marketing of industrial and commercial printing solutions for the garment, apparel and textile industries. It offers printing solutions for apparel, polyester, sportswear, beachwear, accessories, paradigm shirt, textiles, curtains, cushions and couches. The company was founded by Ofer Ben-Zur on January 16, 2002 and is headquartered in Rosh HaAyin, Israel.

Predefined Scans Triggered: Moved Below Ichimoku Cloud and P&F Low Pole.

Below are the chart and commentary from Wednesday (12/29):

"KRNT is unchanged in after hours trading. There is a bullish "V" bottom price pattern that as retraced about half of the prior decline. The pattern is confirmed when it retraces 1/3 of the prior decline so the expectation is higher prices. The RSI is positive and the PMO just triggered a crossover BUY signal. Stochastics are rising and positive. Relative strength studies are very positive for both the group and KRNT. The stop is set below the November bottom."

Below is today's chart:

KRNT didn't have a good day, but it wasn't that bad either. Price still closed above the 50-day EMA and the indicators look healthy except for the declining RSI. However, the RSI is still positive. I think this one will be fine moving into next week.

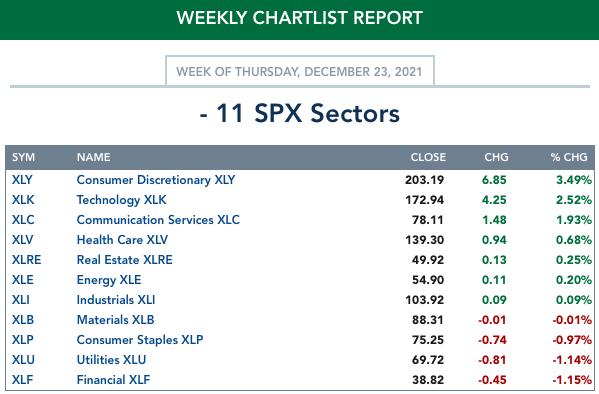

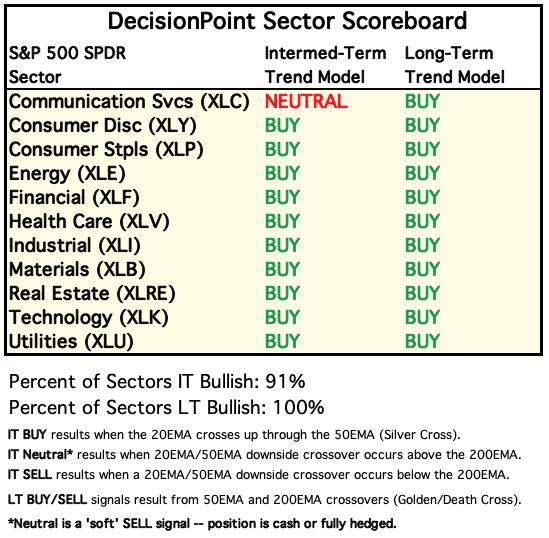

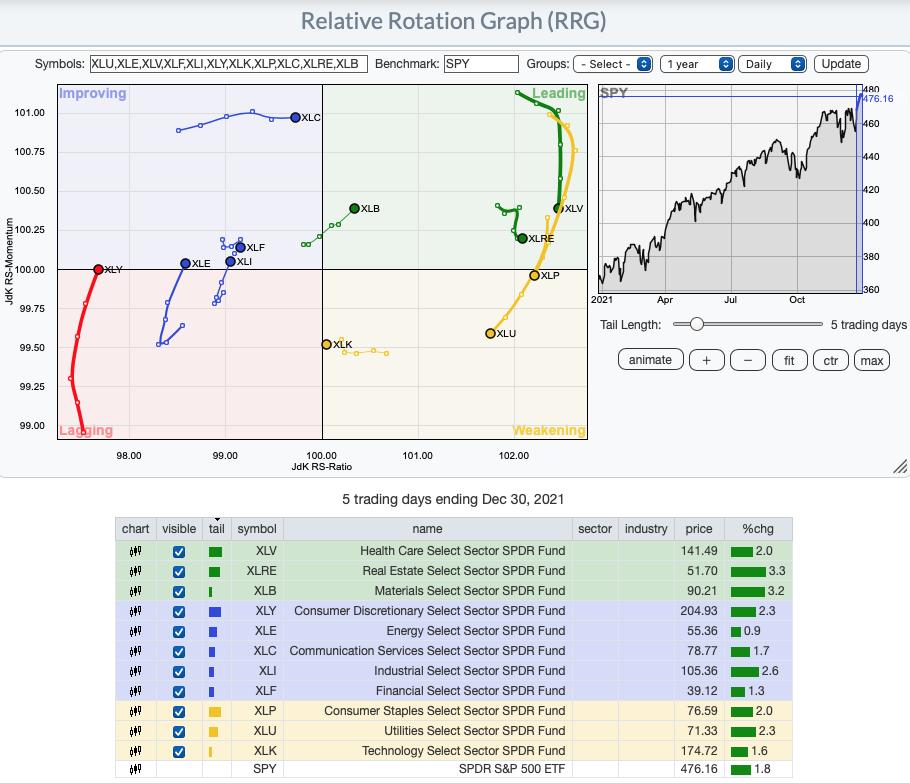

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Hereto view Carl's annotated Sector ChartList!

Short-term (Daily) RRG: We have only three sectors that are "Leading" with XLV and XLRE shifting toward a southward heading toward Weakening. Materials is the newcomer to Leading and looks great moving into next week. XLK is nearing Lagging as it travels in the bearish southwest direction. XLF is unsure as to where it wants to go. XLY is about to enter Improving. XLI and XLE have made it into Improving. XLC which was our "sector to watch" last week in DP Diamonds Recap. It is still looking bullish on its chart and this week's Diamonds "Darling" was from this sector.

Intermediate-Term (Weekly) RRG: In the longer term, XLC is still Lagging, but it is at least not traveling in the bearish southwest direction. XLK is still reflecting leadership in the longer term with XLRE finding its way into Leading and traveling in the bullish northeast direction. XLY is also in Leading, but has a bearish heading now. XLE firmly in Weakening and traveling in the bearish southwest direction. Similarly, XLF looks the most bearish as it moves further into Lagging. XLI has a bearish southwest heading, but is still in the Improving category. All other sectors look bullish as they move in the bullish northeast direction, headed toward Leading.

Sector to Watch: Materials (XLB)

It really was a difficult decision to pick this week's sector. Last week's, XLC, still looks very good and I was surprised by how bullish XLY looked. I hesitated to pick XLY simply because I'm not feeling that bullish going into January and this is considered an aggressive sector, additionally the SCI was in a declining trend.

XLB broke to new all-time highs this week and while it didn't close at an all-time high today, it did set a new intraday high. Participation readings of %stocks > 20/50-day EMAs are higher than the SCI and while overbought, we know that those conditions can be sustained if price keeps moving higher. I really liked that XLB has a long-term bullish bias as participation of stocks > 200-day EMA is higher than the already bullish GCI.

Industry Group to Watch: Miners ($DJUSMG)

Last week's industry group to watch was Gold Miners. I still like Gold Miners but thought I'd go with Mining after seeing the rounded price bottom and breakout above strong overhead resistance. The PMO is on a crossover BUY signal and isn't overbought. Stochastics are rising and are above 80.

I've included the Gold Miners chart below so you can that participation is improving again causing the SCI to rise after a positive crossover its signal line. The bias in all timeframes is bullish given participation percentages are above the SCI and GCI.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a very Merry Christmas! The next Diamonds Report is Tuesday 12/21.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 10% exposed to the market. I will evaluate indicators next week to determine if expanding exposure makes sense.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com