I have four primary scans that I use to find "Diamonds in the Rough". All four of those scans returned very few results and of the results, I didn't like much if any. Consequently, I decided given my bearish stance on the market right now to use a scan I rarely run--"High Yield - Defensive Sectors". This scan produces stocks that have high dividend yields primarily in Energy/Real Estate/Consumer Staples, but I also included Materials today which is why Southern Copper (SCCO) is on the list. This scan produced today. I did put a few Financials in the "Stocks to Review" that I found from my other scans. It is time to move toward value vs. growth or limit your overall exposure.

Two of yesterday's "Diamonds in the Rough" turned out to be coal as they hit their stops on very deep declines today. It is proof that even when all the indicators are lined up, there are no guarantees. These stocks did at least open much lower so unless you decided to put in an overnight order on one of them (something I definitely don't recommend right now), you likely wouldn't have entered them. TTEK never saw a conservative "buy point" on the 5-minute candlestick chart and VRTV saw one conservative "buy point" in the afternoon, but given it was already down so much, I know I wouldn't have taken it.

What stocks are you looking at right now? What are your favorite value plays? Tomorrow is Reader Request Day so email them to me before 4:00p ET tomorrow.

Today's "Diamonds in the Rough": BGS, ET, PBFX and SCCO.

"Stocks to Review": BCSF, KMF, RC, GS, NHI, NYCB, OKE, PSXP and SHLX.

RECORDING LINK Thursday (12/30):

Topic: DecisionPoint Diamond Mine THURSDAY (12/30/2021) LIVE Trading Room

Start Time: Dec 30, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: Diamond#30

REGISTRATION FOR 1/7 Diamond Mine:

When: Jan 7, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (1/7/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (12/27) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Dec 27, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: Holiday@2

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Predefined Scan Results are taken from the StockCharts.com Scan List.

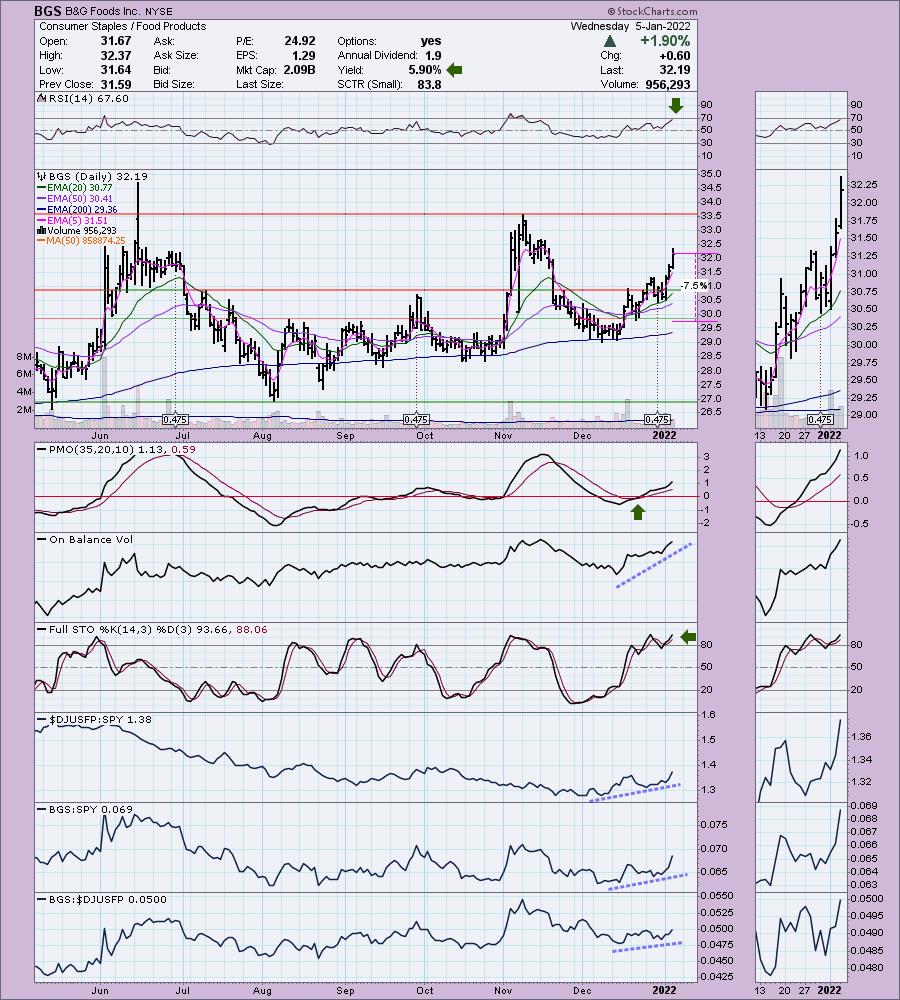

B&G Foods Inc. (BGS)

EARNINGS: 3/1/2022 (AMC)

B&G Foods, Inc.is a holding company, which engages in the manufacture, sale, and distribution of shelf-stable frozen food, and household products in the U.S., Canada, and Puerto Rico. Its products include frozen and canned vegetables, hot cereals, fruit spreads, canned meats and beans, bagel chips, spices, seasonings, hot sauces, and wine vinegar. Its brands include Back to Nature, Bear Creek, Cream of Wheat, Green Giant, Mrs. Dash, and Ortega. The company was founded in 1889 and is headquartered in Parsippany, NJ.

Predefined Scans Triggered: Moved Above Upper Keltner Channel and Moved Above Upper Bollinger Band.

BGS is down -0.12% in after hours trading. I've covered BGS two times previously on April 21st 2021 and September 21st 2021. The first position is still open as the stop was never hit, but it is up only +5.6% currently. The second position is also still open and is up +6.8%. Price has formed a nice base and recently bounced off support at the 20-day EMA. The RSI is positive and rising. The PMO has been on a BUY signal for a few weeks, but it is not overbought. The OBV is confirming the current rally and Stochastics are oscillating above 80 suggesting internal strength. Relative strength studies are bullish. The stop is set below support at the August/September tops.

We have a pennant sitting on a flag pole that formed after the bear market low. These are continuation patterns which tells us to expect price to breakout. The weekly RSI is positive and the weekly PMO just triggered a crossover BUY signal. Upside potential is listed above 40% at the all-time high.

Energy Transfer LP (ET)

EARNINGS: 2/16/2022 (AMC)

Energy Transfer LP provides natural gas pipeline transportation and transmission services. It operates through the following segments: Intrastate Transportation and Storage, Interstate Transportation and Storage, Midstream, NGL and Refined Products Transportation and Services, Crude Oil Transportation and Services, Investment in Sunoco LP, Investment in USAC, and All Other. The Intrastate Transportation and Storage segment owns and operates natural gas transportation pipelines. The Interstate Transportation and Storage segment includes transportation pipelines, storage facilities and gathering systems and deliver the natural gas to industrial end-users and other pipelines. The Midstream segment consists of natural gas gathering, compression, treating, processing, storage, and transportation. The NGL and Refined Products Transportation segment engages in the operations transport, store and execute acquisition and marketing activities utilizing a complementary network of pipelines, storage and blending facilities, and strategic off-take locations that provide access to multiple NGL markets. The Crude Oil Transportation and Services segment provides transportation, terminalling, acquisition, and marketing services to crude oil markets. The Investment in Sunoco LP engages in the distribution of motor fuels to independent dealers, distributors, and other commercial customers and the distribution of motor fuels to end-user customers at retail sites. The Investment in USAC segment provides compression services to its customers in connection with infrastructure applications including both allowing for the processing and transportation of natural gas through the domestic pipeline system and enhancing crude oil production through artificial lift processes. Energy Transfer was founded in 1996 and is headquartered in Dallas, TX.

Predefined Scans Triggered: P&F Double Bottom Breakout.

ET is unchanged in after hours trading. I like today's pullback to the 200-EMA after yesterday's strong break above it. This 1%+ decline didn't damage the indicators and this level should provide an excellent entry. The RSI is positive, the PMO is rising on a crossover BUY signal and Stochastics are above 80 and still rising. The group is showing new relative strength and ET is performing well against the SPY and the group. The stop is set below support at the last price lows. You could deepen it to below the $8 support level if you aren't risk averse. You can also tighten the stop to just under the 20-day EMA if you are risk averse.

We have another pennant on a flag pole. In this case, the pennant is a bullish falling wedge. The weekly RSI is rising and nearing positive territory. The weekly PMO has turned back up. If we get the breakout, I would look for an upside target of 28%, but if that level is overcome, you can raise the target to the 2018 high.

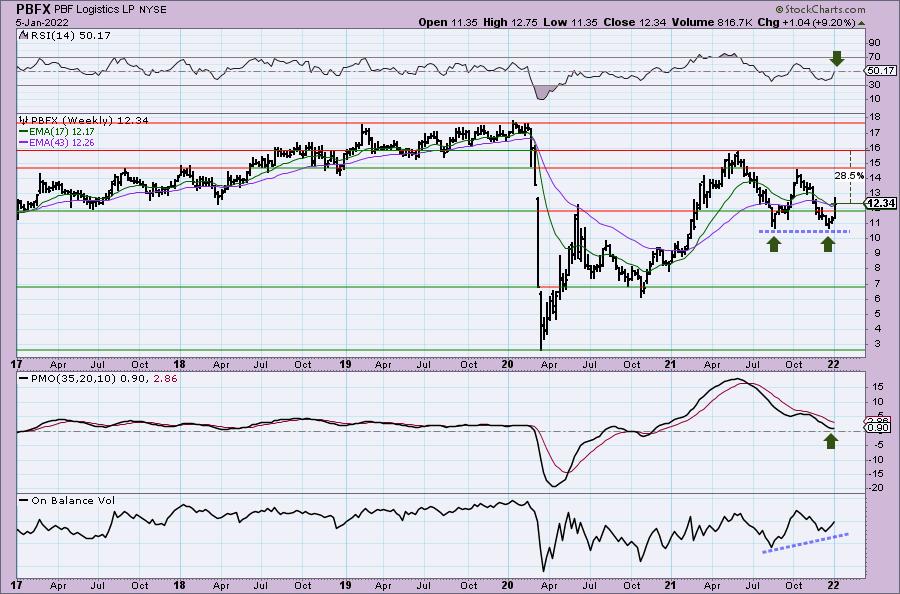

PBF Logistics LP (PBFX)

EARNINGS: 2/10/2022 (BMO)

PBF Logistics LP owns, leases, operates, develops and acquires crude oil and refined petroleum products terminals, pipelines, storage facilities, and similar logistics assets. It operates through two operating segments: Transportation and Terminaling Segment, and Storage Segment. The Storage segment consists of 30 tanks for storing crude oil, refined products and intermediates. The firm's initial assets consist of a light crude oil rail unloading terminal at the Delaware city refinery that also services the Paulsboro refinery and a crude oil truck unloading terminal at the Toledo refinery that are integral components of the crude oil delivery operations at all three of PBF Energy, Inc.'s refineries. The company was founded on February 25, 2013 and is headquartered in Parsippany, NJ.

Predefined Scans Triggered: Filled Black Candles and Moved Above Upper Keltner Channel.

PBFX is unchanged in after hours trading. Monday saw a breakout above the 20-day EMA, yesterday saw a breakout above the 50-day EMA and today, it saw a breakout above the 200-day EMA. It did pull back after the initial pop on the open, but did maintain above the 200-day EMA. The RSI is positive and the PMO is rising strongly on an oversold crossover BUY signal. Volume is coming in on this advance. Stochastics are positive and rising above 80. Relative strength studies are excellent. The stop is set around the September low and below the early December lows.

We have a unconventional double-bottom on the weekly chart. Unconventional in that these are reversal patterns and usually set up after a longer-term decline. I'm still calling this a double-bottom only because the confirmation line (resistance drawn from middle of "W") is below the 2021 top. The weekly RSI just moved into positive territory and the weekly PMO is turning back up above the zero line. If price can reach resistance at the 2021 high, that would be an over 28% gain.

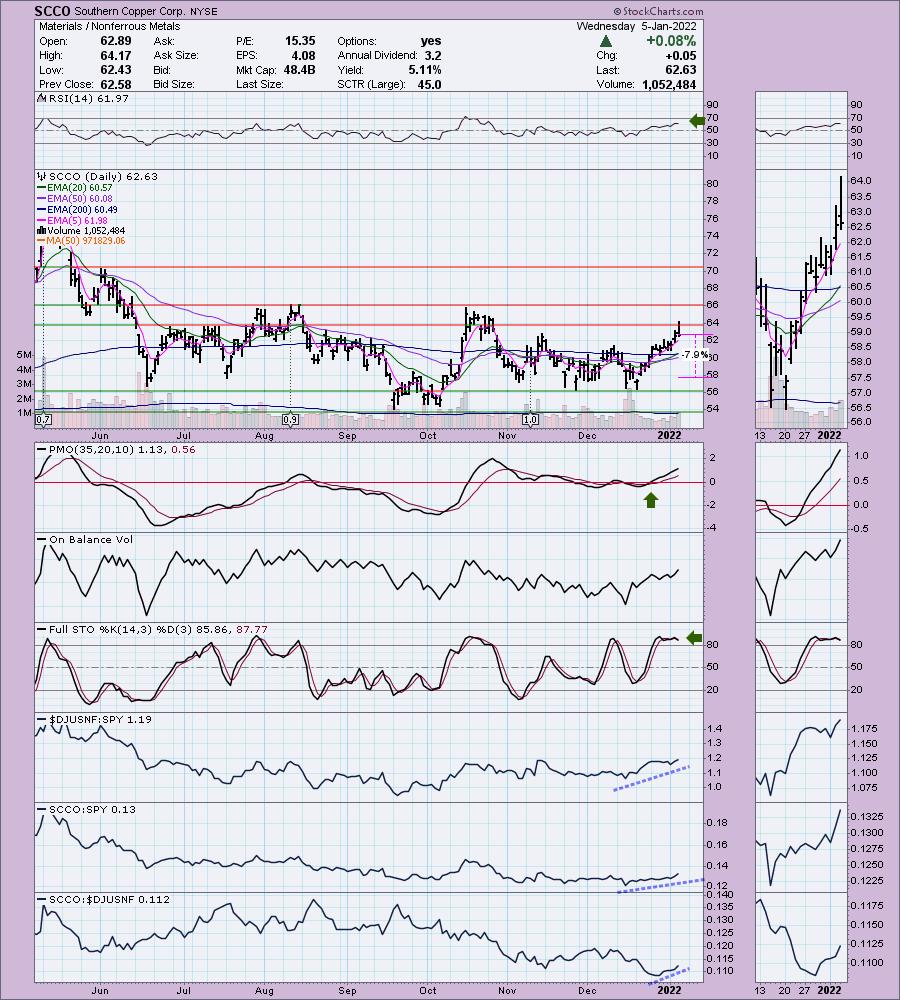

Southern Copper Corp. (SCCO)

EARNINGS: 1/25/2022 (AMC)

Southern Copper Corp. engages in the development, production, and exploration of copper, molybdenum, zinc, and silver. It operates through the following segments: Peruvian Operations; Mexican Open-Pit Operations; and Mexican Underground Mining Operations. The Peruvian Operations segment focuses on the Toquepala and Cuajone mine complexes and the smelting and refining plants, industrial railroad, and port facilities that service both mines. The Mexican Open-Pit Operations segment comprises La Caridad and Buenavista mine complexes, the smelting, and refining plants and support facilities, which service both mines. The Mexican Underground Mining Operations segment involves in the operation of five underground mines, a coal mine, and several industrial processing facilities. The company was founded on December 12, 1952 and is headquartered in Phoenix, AZ.

Predefined Scans Triggered: Filled Black Candles, P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

SCCO is down -1.01% in after hours trading. I've covered SCCO twice before on October 21st 2020 (position is still open and up +25.5%) and May 11th 2021 (position was stopped out). Currently SCCO is nearing the top of its trading range between $56 and $66. This means there is strong overhead resistance to deal with, but I like the indicators and the Materials sector. The RSI is positive and the PMO is rising on a BUY signal. Stochastics are oscillating above 80 (although they have turned down). Relative strength is improving for the group and SCCO is outperforming both the group and SPY. The stop is set just below $58 at my typical 8% level, but you can tighten it to just under the 50-day EMA.

The weekly chart looks very good as the weekly RSI has just entered positive territory and the weekly PMO is nearing a crossover BUY signal. If price can recapture all-time highs that would be a 28%+ gain.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 10% invested and 90% is in 'cash', meaning in money markets and readily available to trade with. Contemplating adding exposure to the Energy sector, particularly Pipelines. I'll keep you posted.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Happy Charting!

- Erin

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com