I ran my scans and yet again, there were no results of worth. Consequently, I didn't see a "theme" today. I'm very appreciative that readers sent in some interesting requests. I apologize that I could not cover them all so if yours wasn't selected, bring them to tomorrow's Diamond Mine trading room and I'll review them for you.

I pared back my exposure to 25% today and will likely book a profit or two and shrink my exposure further tomorrow. The market is exceedingly weak right now. Investors seems to finally be waking to the problems of inflation and rising yields. I don't think any sector will be untouched, not even Energy. So consider today's picks as watch list material. I can't in good conscience pretend that these stocks or any stocks will perform well in the coming week or two.

Don't forget to sign up for tomorrow's Diamond Mine trading room! It should be very interesting given the market's volatility right now.

Today's "Diamonds in the Rough": AUY, BIP, SLB, TIMB and TRQ.

RECORDING LINK (1/14/2022):

Topic: DecisionPoint Diamond Mine (1/14/2022) LIVE Trading Room

Start Time: Jan 14, 2022 09:00 AM

Meeting Recording Link.

Access Passcode: Diamond@14

REGISTRATION FOR 1/21 Diamond Mine:

When: Jan 21, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (1/21/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (1/18) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Jan 18, 2022 09:00 AM

Meeting Recording Link.

Access Passcode: January@18

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from the StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Yamana Gold Inc. (AUY)

EARNINGS: 2/17/2022 (AMC)

Yamana Gold, Inc. engages in the production of gold, silver and copper. It operates through the following segments: El Peñón, Canadian Malartic, Jacobina, Minera Florida, Cerro Moro, Other Mines, and Corporate and Other. The company was founded by Peter Marrone on July 30, 2003 and is headquartered in Toronto, Canada.

Predefined Scans Triggered: P&F Double Bottom Breakout.

AUY is unchanged in after hours trading. I covered AUY back on December 17th 2020. The position was stopped out fairly quickly. I still like Gold Miners. This one looks good, but remember to position size appropriately as it is low-priced. Currently price is struggling against the August/October tops. The indicators are looking very healthy despite today's drop. The RSI is positive and the PMO is also positive. Both are not overbought. Stochastics are slightly iffy as they have flattened and haven't quite moved above 80. Relative strength of the group and AUY are strong in all regards.

We can see that AUY is essentially stuck in a trading range. The weekly RSI is now positive and the PMO is rising off a recent BUY signal. If it can get out of the range and overcome resistance, I've set an upside target at the mid-2020 top and the May/June tops.

Brookfield Infrastructure Partners L.P. (BIP)

EARNINGS: 2/2/2022 (BMO)

Brookfield Infrastructure Partners LP is an infrastructure company, which engages in the management of diversified portfolio of infrastructure assets that will generate sustainable and growing distributions over the long-term for unit holders. It operates through the following segments: Utilities, Transport, Energy, Data Infrastructure, and Corporate. The Utilities segment include regulation of business which earn a return on asset base. The Transport segment consists transportation for freight, bulk commodities, and passenger. The Energy segment comprises systems that gives energy transmission, gathering, processing, and storage services. The Data Infrastructure segment involves in the critical infrastructure and services to global communication companies. The company was founded in July 1905 and is headquartered in Hamilton, Bermuda.

Predefined Scans Triggered: Parabolic SAR Buy Signals and Shooting Star.

BIP is down -1.47% in after hours trading. I hesitated to include this one because as the predefined scans tell us, we have a bearish "shooting star" candlestick. It failed to overcome overhead resistance at the November top and pulled back today. I'm forgiving the candlestick mainly because many charts have them based on today's unusual price action (pop in the AM and then steady decline). I like Utilities in general based on that sector's high yields and defensive nature. But as I mentioned in the opening, all sectors are going to feel the pinch if the market breaks down further. This is why I am trying to put in thin stop levels for protection. The RSI is positive and the PMO just moved into a whipsaw BUY signal after price rebounded off the 50-day EMA. Stochastics are in negative territory, but are rising nicely. Relative strength is strong across the board, we just need to consider that the group and BIP are at relative highs or past. That can sometimes precede a decline. The stop is thin at -4.5%.

The weekly chart shows a steady rising trend. The weekly RSI is positive and the weekly PMO is triggering a crossover BUY signal and the OBV is rising with price, confirming the rally. Since it is at all-time highs, I would set an upside target around 14% at $68.84.

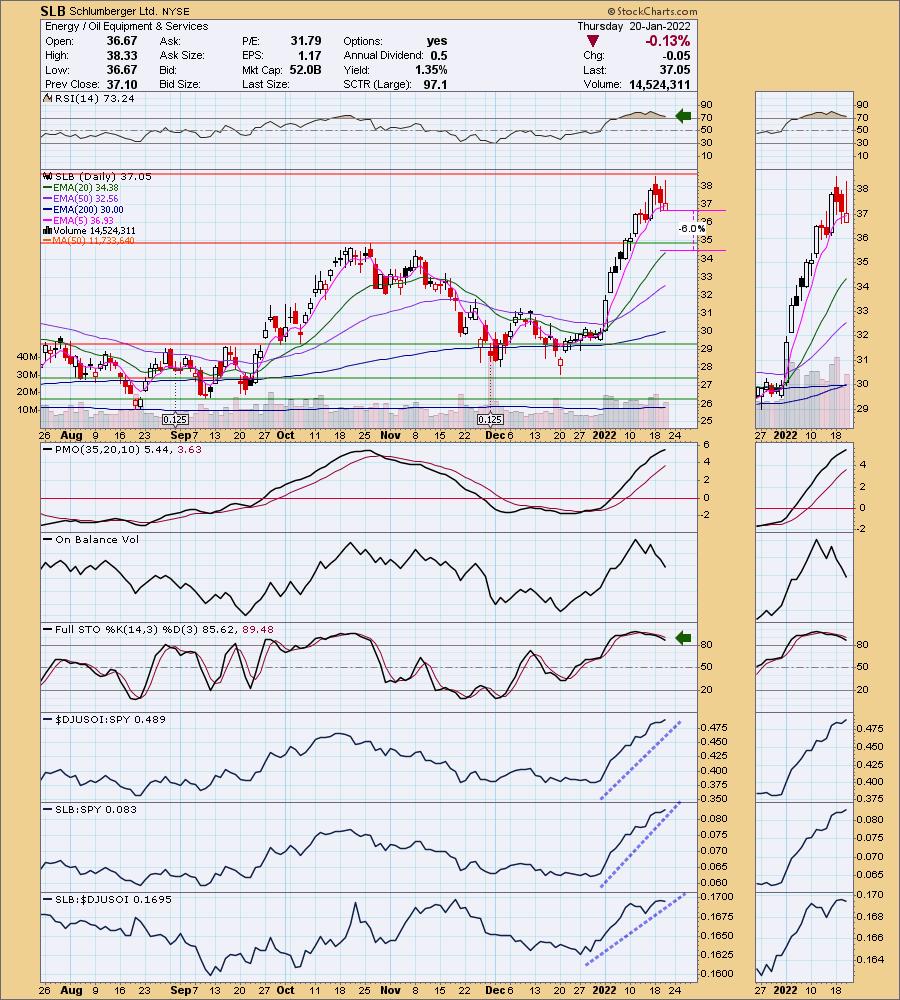

Schlumberger Ltd. (SLB)

EARNINGS: 1/21/2022 (BMO) ** REPORTS TOMORROW **

Schlumberger NV engages in the provision of technology for reservoir characterization, drilling, production and processing to the oil and gas industry. It operates through the following business segments: Digital and Integration; Reservoir Performance; Well Construction; and Production Systems. The Digital and Integration segment combines the company's software and seismic businesses with its integrated offering of asset performance solutions. The Reservoir Performance segment consists of reservoir-centric technologies and services that are critical to optimizing reservoir productivity and performance. The Well Construction segment includes the full portfolio of products and services to optimize well placement and performance, maximize drilling efficiency, and improve wellbore assurance. The Production Systems segment develops technologies and provides expertise that enhances production and recovery from subsurface reservoirs to the surface, into pipelines, and to refineries. The company was founded by Conrad Schlumberger and Marcel Schlumberger in 1926 and is headquartered in Houston, TX.

Predefined Scans Triggered: Hollow Red Candles, P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

SLB is down -0.30% in after hours trading. I didn't realize they were reporting earnings tomorrow or I might not have included it. It appears ready to pull back to the October top before it resumes its rally since the RSI is overbought. The PMO is still rising, but it is overbought. Stochastics are still positive above 80, but may be arcing back down. Relative strength certainly shows merit, but I'd keep my stop very thin or wait for an entry closer to that October top.

This area of overhead resistance is very long-term as it is now testing the 2019 highs. If it can overcome, the next area of strong resistance is about 40% away. The weekly RSI is positive and not overbought, and the weekly PMO looks very bullish given its new crossover BUY signal.

TIM S.A (TIMB)

EARNINGS: 2/9/2022 (AMC)

TIM SA (Brazil) engages in providing mobile telephony, internet, and media telecommunication services. It offers modem, tablet, cell phone, and ultra fixed broadband. The company was founded on March 9, 1998 and is headquartered in Rio de Janeiro, Brazil.

Predefined Scans Triggered: None.

TIMB is down -1.19% in after hours trading. I covered TIMB on May 19th 2021. The position has stopped out since. I thought this one was interesting. Price confirmed the double-bottom pattern with yesterday breakout, but price closed back beneath the confirmation line. Still, the RSI is positive and the PMO is on an oversold BUY signal just below the zero line. It nearly had a "golden cross" of the 50/200-day EMAs today which would have given us a LT Trend Model BUY signal. It already had a "silver cross" of the 20/50-day EMAs. Stochastics and relative strength are bullish. I'd set my stop below the key moving averages.

The weekly chart shows us that price has drifted out of a bearish ascending triangle pattern. I prefer a breakout from a pattern versus a "drift", but it can still be considered positive as a bullish breakout from a bearish pattern is always bullish. The weekly RSI just hit positive territory again and the weekly PMO has bottomed above its signal line which is also bullish. Upside target is set at the late 2020 high.

Turquoise Hill Resources Ltd. (TRQ)

EARNINGS: 3/8/2022 (AMC)

Turquoise Hill Resources Ltd. engages in the exploration and development of mineral properties. It focuses on Oyu Tolgoi Copper-Gold Mine. The company was founded by Robert Martin Friedland on January 25, 1994 and is headquartered in Montreal, Canada.

Predefined Scans Triggered: None.

TRQ is up +0.76% in after hours trading. I'll admit that this is my own pick. I kept coming back to it and decided I'd horn in and write it up. I covered TRQ back on June 1st 2021. It was stopped out fairly quickly. I like the chart again so hopefully it will end better this time. Price is breaking out, or trying to. The RSI is positive and the PMO has turned back up and is headed for a crossover BUY signal. I will admit that the PMO is overbought right now, but Stochastics are positive and relative strength studies are bullish. The stop is set below the September high.

Price broke out from a long-term bullish falling wedge and has now triggered a weekly PMO crossover BUY signal. The weekly RSI is also positive. I don't see any reason why we won't see a test of the 2021 high except of course, that the market is very very weak.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 25% invested and 75% is in 'cash', meaning in money markets and readily available to trade with.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Happy Charting!

- Erin

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com