I only had a handful of stocks that I "liked" today, but I felt all had merit and could be presented. It occurred to me that one way to 'break the tie' is to look at my selections on an RRG. It worked!

In order to protect the identity of these stocks, I will put the RRG below the Diamond Mine information. That way the RRG will not be the thumbnail for today's article. We don't want non-subscribers having the opportunity to see which I picked today. It is not fair to you as Diamonds subscribers.

As far as themes, Banks still are coming up. I did notice that Industrials had good representation as well.

Today's "Diamonds in the Rough": APOG, FDP, OMI and RTL.

Stocks to Review (No order): BY, HMST, NFG and GBCI.

RECORDING LINK (2/11/2022):

Topic: DecisionPoint Diamond Mine (2/11/2022) LIVE Trading Room

Start Time: Feb 11, 2022 09:00 AM

Meeting Recording Link.

Access Passcode: Diamond@11

REGISTRATION FOR Friday 2/18 Diamond Mine:

When: Feb 18, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (2/18/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Topic: DecisionPoint Trading Room

Start Time: Feb 14, 2022 09:00 AM

Meeting Recording Link.

Access Passcode: Valentine#14

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from the StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

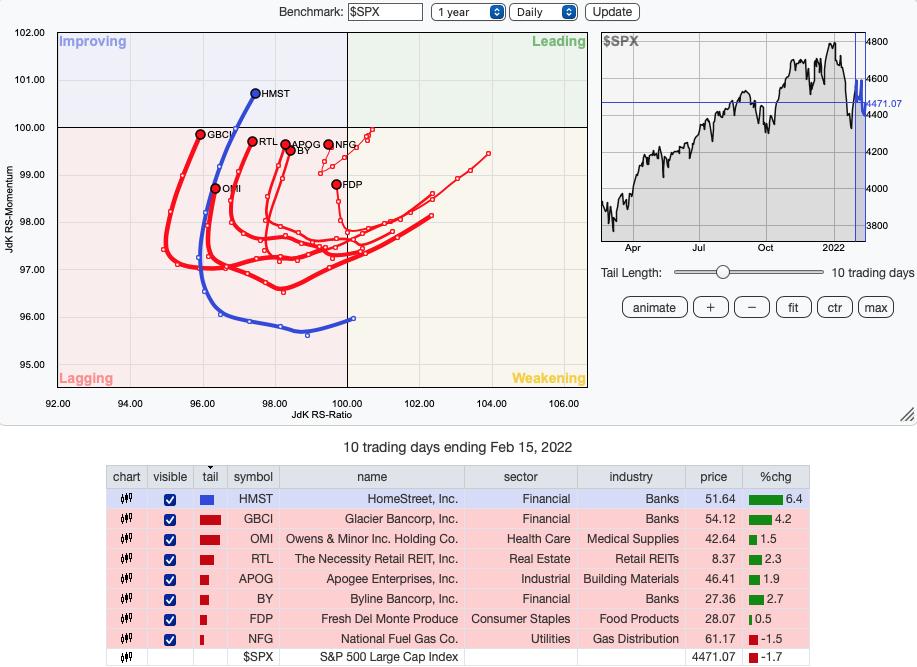

DAILY RRG: They all look pretty much the same on the short-term RRG. It shows you how the scans do hone in on specific criteria that lead us to stocks moving in a bullish northeast heading. When we look at this RRG, HMST looks the strongest given it is the only one in "Improving".

WEEKLY RRG: It is a different story on the weekly RRG. HMST now looks like one of the weakest. The four I came up with based on this RRG were FDP which is moving quickly in the bullish northeast direction. RTL and OMI are well within Leading and are pushing further east. APOG was the other I chose. It remains in Leading and has switched to a bullish northeast heading within Leading.

It will be very interesting to see how these "Diamonds in the Rough" do this week. It may become a part of my routine.

Apogee Enterprises, Inc. (APOG)

EARNINGS: 4/7/2022 (BMO)

Apogee Enterprises, Inc. engages in the design and development of architectural products and services. It also provides architectural glass, aluminum framing systems and installation services for buildings, as well as value-added glazing products for custom picture framing. The company operates through the following segments: Architectural Framing Systems, Architectural Glass, Architectural Services, and Large-Scale Optical Technologies. The Architectural Framing Systems segment designs, engineers, fabricates and finishes aluminum window, curtainwall, storefront and entrance systems comprising the exterior of buildings. The Architectural Glass segment fabricates coated, glass used in custom window and wall systems. The Architectural Services segment integrates technical services, project management, and field installation services to design, engineer, fabricate, and install building glass and curtainwall systems. The Large-Scale Optical Technologies (LSO) segment manufactures value-added coated glass and acrylic products for custom framing, museum, and technical glass markets. The company was founded in 1949 and is headquartered in Minneapolis, MN.

Predefined Scans Triggered: Bullish MACD Crossovers and Moved Above Ichimoku Cloud.

APOG is unchanged in after hours trading. Price just broke out of a congested trading range between $43 and $46. We got an IT Trend Model "Silver Cross" BUY signal as the 20-day EMA just crossed above the 50-EMA. We should see a ST Trend Model BUY signal tomorrow when the 5-day EMA crosses above the 20-day EMA. The RSI just hit positive territory above net neutral (50). The PMO is turning up and should not only hit positive territory above the zero line, but should also have a crossover BUY signal as well. Stochastics are rising and are in positive territory now too. The group hasn't been flourishing, but APOG has been an outperformer against the group and the SPY. The stop can be set below the prior trading range.

The weekly RSI has been positive for some time. The PMO is turning back up. We do have strong overhead resistance arriving at the 2018 tops. If that is overcome, I've set the upside target at the next long-term resistance area at $55 (a look at the monthly chart will show you what I'm looking at).

Fresh Del Monte Produce (FDP)

EARNINGS: 2/23/2022 (BMO)

Fresh Del Monte Produce, Inc. engages in production and distribution of fresh fruit and vegetables products. It operates through the following segments: Bananas and Fresh and Value-added products segments. The Bananas segment produces banana. The Fresh and Value-added products segment includes sales of pineapples, melons, non-tropical fruit (including grapes, apples, citrus, blueberries, strawberries, pears, peaches, plums, nectarines, cherries and kiwis), other fruit and vegetables, avocados, fresh-cut fruit and vegetables, prepared fruit and vegetables, juices, other beverages, prepared meals and snacks. The company was founded in 1886 and is headquartered in Coral Gables, FL.

Predefined Scans Triggered: Bullish MACD Crossovers, Elder Bar Turned Green and P&F Low Pole.

FDP is unchanged in after hours trading. I covered FDP on September 9th 2020 (stop was hit when price dropped below its prior trading range). With the market jumpy, Consumer Staples should get some love. Price is trading within a short-term bullish ascending triangle. The RSI is positive and rising. The PMO has turned up and should trigger a crossover BUY signal soon. Stochastics are now moving vertically and should reach 80 soon. The 5-day EMA is in the process of crossing above the 20-day EMA which would produce a ST Trend Model BUY signal. The group is flourishing. FDP performs in line with the group and that has served it well against the SPY. I do note that we could be seeing outperformance against the group soon. The stop can be set much more tightly. I have it set at the bottom of the December trading range.

The weekly RSI is negative, but it is rising and nearing positive territory above 50. The weekly PMO has turned up. If it can reach overhead resistance at the 2019/2020/2021 highs, it would be a 29%+ gain. I don't think we'll see it break above that level given the strength of that resistance line.

Owens & Minor Inc. Holding Co. (OMI)

EARNINGS: 2/23/2022 (BMO)

Owens & Minor, Inc. engages in the provision of healthcare solutions. It operates through the Global Solutions and Global Products segments. The Global Solutions segment consists of the United States distribution, outsourced logistics, and value-added services businesses. The Global Products segment manufactures and sources medical surgical products through production and kitting operations. The company was founded by Otho O. Owens and G. Gilmer Minor in 1882 and is headquartered in Mechanicsville, VA.

Predefined Scans Triggered: Bullish MACD Crossovers, Elder Bar Turned Green and P&F Low Pole.

OMI is down -0.09% in after hours trading. I covered OMI not that long ago on December 21st 2021 (stop was hit on the January slide..barely). I like the bounce off the 200-day EMA and the December low and near August/September tops. Price broke above the 20/50-EMAs. This should trigger a "Silver Cross" BUY signal as the 20/50-day EMAs have a positive crossover. The RSI just hit positive territory. The PMO has turned up. Stochastics are rising in positive territory. Over time, OMI has been a good relative performer. The group hasn't reached relative strength highs, so I believe it has a great chance of rallying back to the January high. The stop is set below closing lows from earlier this month.

The weekly chart looks pretty good as price holds support. The PMO is turning back up and the weekly RSI is positive and rising. Upside potential is over 16% (at least double the stop is my rule of thumb or at resistance).

The Necessity Retail REIT, Inc. (RTL)

EARNINGS: 2/23/2022 (AMC)

American Finance Trust, Inc. is a real estate investment trust, which engages in the acquiring and managing a portfolio of primarily service-oriented and traditional retail and distribution related commercial real estate properties. It operates through income-producing properties segment, which consists of activities related to investing in real estate. The company was founded on January 22, 2013 and is headquartered in New York, NY.

Predefined Scans Triggered: Bullish MACD Crossovers and Entered Ichimoku Cloud.

RTL is down -1.19% in after hours trading. If it drops in tomorrow's trading as far as it is now, it will lose the breakout which is what I liked best coming off a rounded price bottom. Maybe it is due to it being a member of a struggling industry group. Based on relative performance, it has really been outperforming both the group and the SPY. This is a strong area of overhead resistance that it pushed past, especially when you consider it had to vault the 5/20/50-day EMAs. The RSI just hit positive territory and the PMO is turning back up in oversold territory just below the zero line. Stochastics are rising and should reach above 80 soon. The stop can at least be set tightly at just over 5.5%.

RTL has been in a trading range for the past year. It is now in the middle of it, rebounding off the key moving averages. The weekly RSI has turned back up. The weekly PMO is technically on a crossover SELL signal, but it appears it could whipsaw back to a buy signal. The upside target is set at the top of the range.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

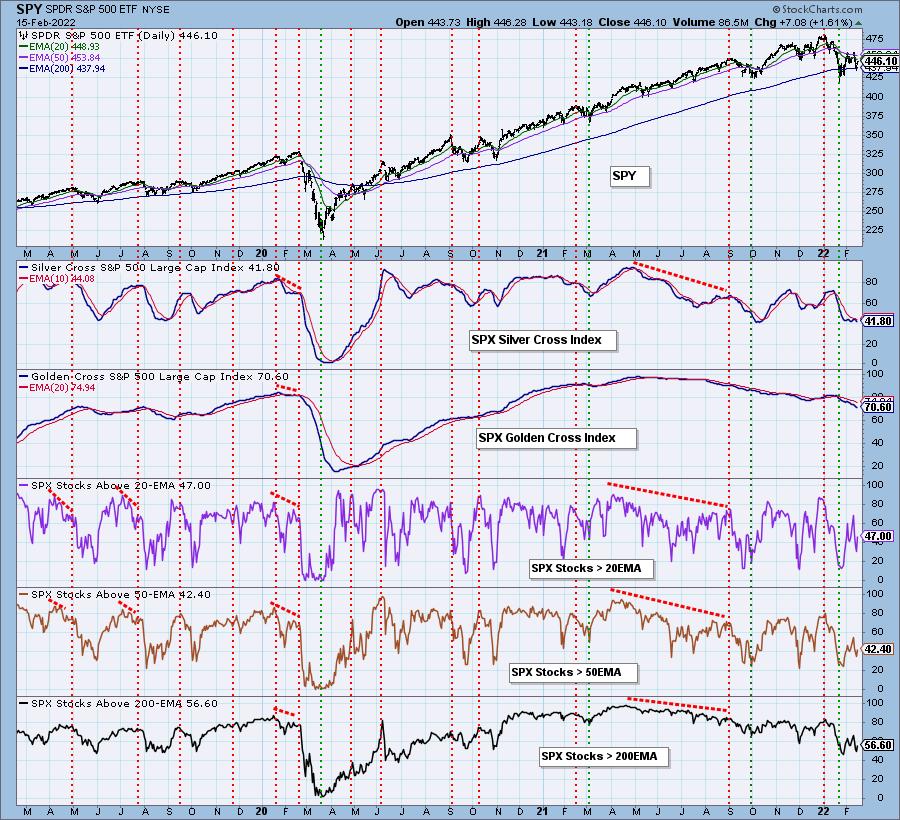

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 10% invested and 90% is in 'cash', meaning in money markets and readily available to trade with.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Good Luck and Good Trading!

- Erin

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com