As I was perusing the CandleGlance charts to tease out five "Diamonds in the Rough", I noticed a trend. Most of the charts that I kept selecting were Banks. Ultimately I ended up with four "Diamonds in the Rough" that were Banks. The outlier is a Natural Resources ETF (FTRI).

I'm running around with my head cut off to prepare to leave for Europe tomorrow so comments will be somewhat brief. A reminder that there will be no more Diamonds reports this week and no Diamond Mine. I'm taking next week off from doing anything Diamonds related so I will be adding a free week to the end of your subscriptions when I return on 4/1. I will post my diary and pictures when I return for those interested.

Today's "Diamonds in the Rough": ALLY, EWBC, FTRI, PACW and WFC.

*** Working VACATION March 23 to April 1 ***

I will be taking a trip to the Netherlands and Belgium to see the tulips! As always, I will post pictures and give you a brief diary of my adventures for those interested. Here is how publishing will be affected.

Schedule:

DP Alert - The DPA will be published each market day as usual, but comments will be abbreviated. You will get the latest charts, but if there are no significant changes, comments will be carried over.

DP Diamonds - Week of March 21st: Five picks on 3/21 and five picks on 3/22 - No Diamond Mine or Recap // Week of March 28th: No Diamonds Reports or Diamond Mine (You will be compensated with an additional week added to the end of your subscription)

RECORDING LINK (3/18/2022):

Topic: DecisionPoint Diamond Mine (3/18/2022) LIVE Trading Room

Start Time: Mar 18, 2022 09:00 AM

MeetingRecording Link.

Access Passcode: March$18

REGISTRATION FOR Friday 4/8 Diamond Mine:

When: Apr 8, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (4/8/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (3/21) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Mar 21, 2022 08:58 AM

Meeting Recording Link.

Access Passcode: March@21

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Ally Financial Inc. (ALLY)

EARNINGS: 4/14/2022 (BMO)

Ally Financial, Inc. is a holding company, which provides digital financial services to consumers, businesses, automotive dealers, and corporate clients. It operates through the following segments: Automotive Finance Operations, Insurance Operations, Mortgage Finance Operations, and Corporate Finance Operations. The Automotive Finance Operations segment offers retail installment sales contracts, loans and leases, offering term loans to dealers, financing dealer floorplans and other lines of credit to dealers, warehouse lines to companies, fleet financing, providing financing to companies and municipalities for the purchase or lease of vehicles and equipment, and vehicle remarketing services. The Insurance Operations segment focuses on finance protection and insurance products sold primarily through the automotive dealer channel, and commercial insurance products sold directly to dealers. The Mortgage Finance Operations segment consists of the management of a held-for-investment consumer mortgage finance loan portfolio, which includes bulk purchases of jumbo and LMI mortgage loans originated by third parties. The Corporate Finance Operations segment provides senior secured leveraged cash flow and asset-based loans to mostly United States based middle market companies focused on businesses owned by private equity sponsors with loans typically used for leveraged buyouts, mergers and acquisitions, debt refinancing, restructurings, and working capital. The company was founded in 1919 and is headquartered in Detroit, MI.

Predefined Scans Triggered: Elder Bar Turned Green, Ichimoku Cloud Turned Green and P&F Double Top Breakout.

ALLY is up +0.13% in after hours trading. I covered ALLY on November 11th 2021, the stop was hit so the position is closed. What impressed me about this chart was the breakout above the 20-day EMA combined with overcoming resistance at the December/January lows. The PMO just triggered a crossover BUY signal and the RSI just hit positive territory above net neutral (50). This tells us that the stock is in the upper half of its two week trading range. Stochastics are rising and are above 50. Relative strength is pretty good. The stop is set midway into the prior trading range between this month's low and now support at the December/January lows.

The weekly chart shows how important it was for price to recapture this level. Unfortunately it hasn't risen high enough to move the RSI positive, but the PMO does seem to be decelerating slightly. Upside potential is over 23% if it recaptures its all-time highs.

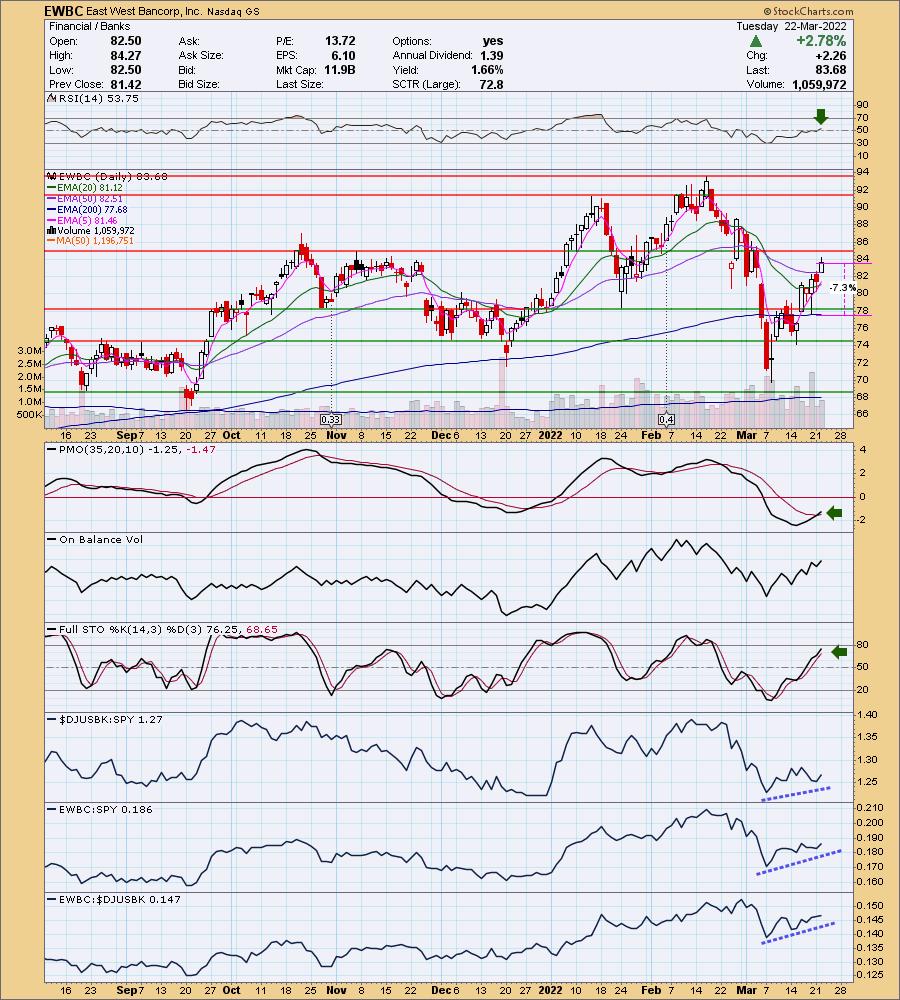

East West Bancorp, Inc. (EWBC)

EARNINGS: 4/21/2022 (BMO)

East West Bancorp, Inc. is a bank holding company, which engages in the provision of financial services. It operates through the following business segments: Consumer and Business Banking, Commercial Banking, and Other. The Consumer and Business Banking segment provides financial service products and services to consumer and commercial customers through the company's branch network in the U.S. The Commercial Banking segment primarily focuses on commercial loans and deposits. The Other segment includes treasury activities of the company and elimination of inter-segment amounts. The company was founded on August 26, 1998, and is headquartered in Pasadena, CA.

Predefined Scans Triggered: Entered Ichimoku Cloud and P&F Double Top Breakout.

EWBC is up +3.18% in after hours trading. This might be the most favorable of all the bank stocks I'm presenting with the exception of nearing overhead resistance. The RSI is positive and the PMO just triggered a crossover BUY signal. Stochastics are rising and should get above 80 shortly. Relative performance is excellent. The stop is set below the 200-day EMA and support at the January low.

The weekly chart looks pretty good. The weekly RSI is positive and the weekly PMO is turning up. If it reaches its all-time highs that would be an over 13% gain.

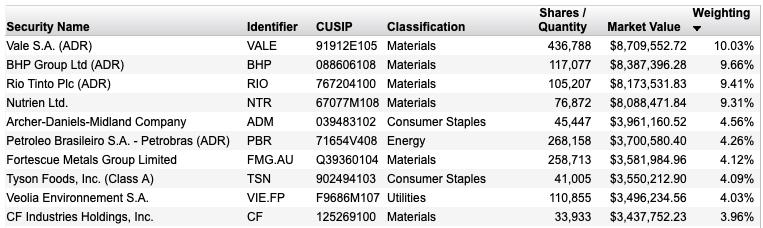

First Trust Indxx Global Natural Resources Income ETF (FTRI)

EARNINGS: N/A

FTRI tracks an index of natural resource stocks selected by dividend yield and weighted by market cap.

Predefined Scans Triggered: New 52-week Highs, Filled Black Candles and P&F Double Top Breakout.

FTRI isn't trading after hours, not sure if that is always the case, but I have no data. I must say that when I saw the top ten holdings of this ETF I was impressed. It's a great basket of stocks that most of us are familiar with. The one detractor on the chart for me is the filled black candlestick which implies we will see price pull back tomorrow. The RSI is positive and the PMO is about to generate a crossover BUY signal. I like the OBV rising so strongly during this rally. In fact, you can see that volume is picking up over the past two days. Relative performance against the SPY is excellent. The stop is set below support at the January top and 50-day EMA.

The weekly RSI is positive and only slightly overbought. I like that the weekly PMO is not only rising, but has been on a crossover BUY signal this year. You can see the increase in volume. Given it is at all-time highs, consider an upside target of about 16% at $18.91.

PacWest Bancorp (PACW)

EARNINGS: 4/19/2022 (AMC)

PacWest Bancorp is a bank holding company, which specializes in financial and banking solutions. It offers commercial banking services including real estate, construction, commercial loans, comprehensive deposit, and treasury management services to small and middle-market businesses through the Pacific Western Bank. The company was founded on October 22, 1999, and is headquartered in Beverly Hills, CA.

Predefined Scans Triggered: Elder Bar Turned Green, P&F Low Pole, Entered Ichimoku Cloud and Rising Three Methods.

PACW is unchanged in after hours trading. This is another great chart. The PMO closed above the 50-day EMA and 20-day EMA. The RSI is now positive and the PMO triggered a crossover BUY signal today. (Looks like the same combination I use on a 5-minute candlestick to time my entries!). Stochastics are rising in positive territory and relative strength studies show outperformance. The stop is set below support at the August 2021 high and November 2021 low.

The weekly chart is mixed. While the weekly RSI just hit positive territory, the weekly PMO is still in decline. Since it is near all-time highs, consider an upside target of 16% at around $53.88.

Wells Fargo & Co. (WFC)

EARNINGS: 4/14/2022 (BMO)

Wells Fargo & Co. is a diversified, community-based financial services company. It is engaged in the provision of banking, insurance, investments, mortgage products and services, consumer and commercial finance. It firm operates through the following segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth & Investment Management. The Consumer Banking and Lending offers Consumer and Small Business Banking, Home Lending, Credit Card, Auto, Personal Lending. The Commercial Banking offers banking and credit products across multiple industry sectors and municipalities, secured lending and lease products, and treasury management. The Corporate and Investment Banking offers corporate banking, investment banking, treasury management, commercial real estate lending and servicing, equity and fixed income solutions, as well as sales, trading, and research capabilities. The Wealth & Investment Management provides personalized wealth management, brokerage, financial planning, lending, private banking, trust and fiduciary products and services to affluent, high-net worth and ultra-high-net worth clients. The company was founded by Henry Wells and William G. Fargo on March 18, 1852 and is headquartered in San Francisco, CA.

Predefined Scans Triggered: P&F Low Pole and Entered Ichimoku Cloud.

WFC is up +0.02% in after hours trading. I really like this chart with the exception of the volume pattern. Yes, the OBV bottoms are rising, but the reading is well-below prior highs. The RSI moved into positive territory today. The PMO had a crossover BUY signal and Stochastics just hopped above 80. Relative strength is rising for the group and the stock. The stop is set below the December highs.

The weekly chart is improving on this recent rally. The weekly RSI is back above 50 and the PMO is about to turn back up. Price is near all-time highs, but if it reaches them it will be a nearly 14% gain.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

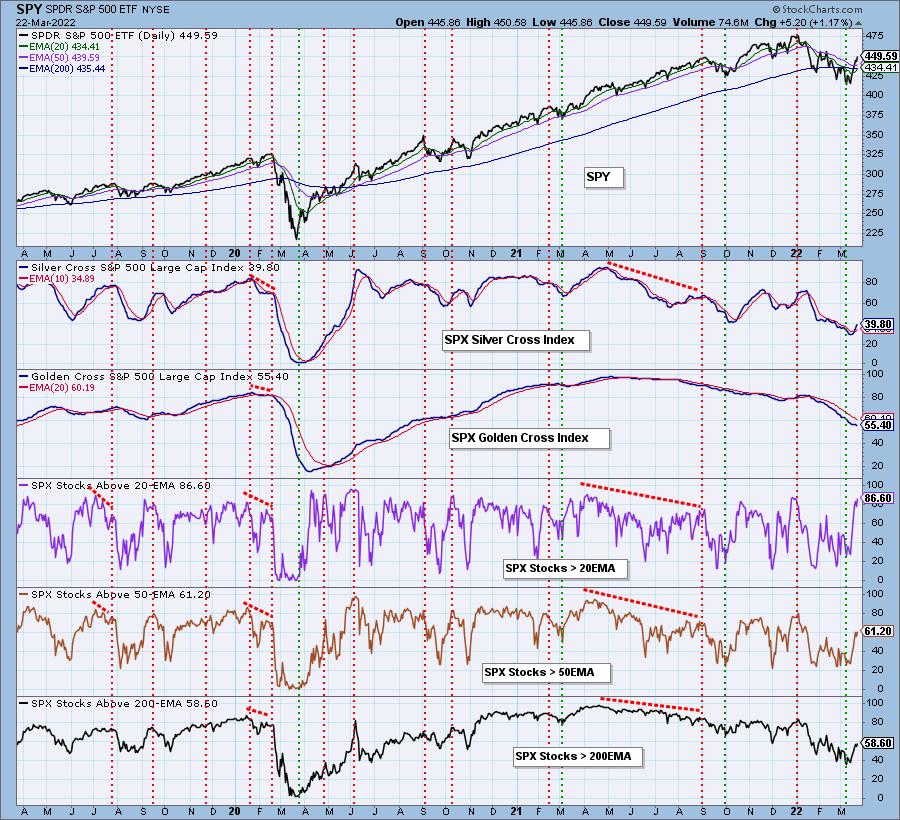

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 15% invested and 85% is in 'cash', meaning in money markets and readily available to trade with. It's a terrible time to go on vacation and prepare for it given the recent rally, but I have to stick to my analysis process.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Good Luck and Good Trading!

- Erin

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com