With the recent rally I expected to see more choices for "Diamonds in the Rough". I was wrong. The Diamond PMO Scan returned two results, only one was worth presenting. My PMO+ Crossover Scan returned one result that I didn't like. Momentum Sleepers Scan returned zero results. I had to resort to my very 'loose' scan that usually returns too many results. I needed that scan today, it returned 39 results. Typically that scan will produce well over a 100 results.

That said, I did find three stocks to present today that look pretty good. Seeing this significant decrease in results does tell me that I should keep my exposure at 15%.

Thank you to all for your patience while I was on vacation. I will be adding the extra week to your subscriptions later today. My mother-in-law has taken a turn for the worse and I'm the only one equipped right now to handle getting her the right care, keeping track of appointments and much more of course. Publishing will still occur but it may mean reports arriving later than usual like today. Rest assured you will always have your DP Diamonds reports and DP Alert reports before market open the next day.

Today's "Diamonds in the Rough": DG, MIRM and SNY.

RECORDING LINK (3/18/2022):

Topic: DecisionPoint Diamond Mine (3/18/2022) LIVE Trading Room

Start Time: Mar 18, 2022 09:00 AM

MeetingRecording Link.

Access Passcode: March$18

REGISTRATION FOR Friday 4/8 Diamond Mine:

When: Apr 8, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (4/8/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (4/4) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Apr 4, 2022 08:59 AM

Meeting Recording Link.

Access Passcode: April#4th

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Dollar General Corp. (DG)

EARNINGS: 5/26/2022 (BMO)

Dollar General Corp. engages in the operation of merchandise stores. Its offerings include food, snacks, health and beauty aids, cleaning supplies, basic apparel, housewares, and seasonal items. It sells brands including Clorox, Energizer, Procter & Gamble, Hanes, Coca-Cola, Mars, Unilever, Nestle, Kimberly-Clark, Kellogg's, General Mills, and PepsiCo. The company was founded by J. L. Turner and Hurley Calister Turner Sr. in 1939 and is headquartered in Goodlettsville, TN.

Predefined Scans Triggered: Elder Bar Turned Green and Parabolic SAR Buy Signals.

DG is up +0.32% in after hours trading. I've covered DG twice before on April 8th 2020 and November 16th 2021. Both positions are closed. This chart is shaping up nicely but I do want to see a breakout here or the position isn't viable. There is a small bullish ascending triangle in the short term that implies an upside breakout. The RSI is positive and the PMO is now accelerating higher above its signal line. The PMO is getting overbought, but given it was near -3.0 at its recent low, the top of the range is +3.0. Stochastics are not above 80 but are oscillating just below. I've set the stop below key moving averages and at horizontal support.

The weekly chart is positive given the RSI is above net neutral (50) and the weekly PMO is on a fairly new BUY signal. It is near all-time highs so consider an upside target of 14% around $261.47.

Mirum Pharmaceuticals Inc. (MIRM)

EARNINGS: 5/5/2022 (AMC)

Mirum Pharmaceuticals, Inc. is a biopharmaceutical company. The firm focuses on the development and commercialization of a late-stage pipeline of novel therapies for debilitating liver diseases. Its products include Maralixibat and Volixibat. The company was founded by Niall O'Donnel, Michael Grey and Christopher Peetz in May 2018 and is headquartered in Foster City, CA.

Predefined Scans Triggered: New 52-week Highs and Stocks in a New Uptrend (Aroon).

MIRM is unchanged in after hours trading. We had an "almost" breakout today. Price popped above overhead resistance but was pulled lower and closed beneath. The chart suggests it will breakout given the positive RSI and nearing PMO crossover BUY signal. Stochastics are rising strongly and should get above 80 soon. Relative performance is fairly good and it is improving. The stop is set below the 20-day EMA.

MIRM has been in a wide trading range and it is headed back to the top. The weekly RSI is positive and the weekly PMO is on a crossover BUY signal and rising. Upside target is about 13%, but if it does breakout, it could certainly move higher.

Sanofi SA (SNY)

EARNINGS: 4/28/2022 (BMO)

Sanofi engages in the research, production, and distribution of pharmaceutical products. It operates through the following business segments: Pharmaceuticals, Consumer Healthcare, and Vaccines. The Pharmaceuticals segment comprises the commercial operations of the following global franchises: specialty care, diabetes and cardiovascular, established prescription products and generics, and research, development, and production activities. The Consumer Healthcare segment includes the commercial operations for its Consumer Healthcare products. The Vaccines segment consists commercial operations of Sanofi Pasteur. The company was founded in 1973 and is headquartered in Paris, France.

Predefined Scans Triggered: Stocks in a New Uptrend (Aroon).

SNY is unchanged in after hours trading. I covered SNY on February 25th 2020 so it should be no surprise that the position closed quickly. The chart is favorable and I like that the stop can be set tightly. In fact you could tighten it up even more by setting it just below the 200-day EMA. The RSI is positive and the PMO is beginning to move higher after being flat for almost a month. Stochastics are almost above 80 and are rising nicely. Relative strength is definitely improving in the short term.

It is near the top of its trading range, so if it doesn't breakout here, I wouldn't hold onto it very long as it is likely going to head back to test the bottom of the range. The weekly PMO looks excellent given it has bottomed above the signal line and is rising on a BUY signal. The weekly RSI is positive. Since it is at all-time highs, consider a 14% upside target at about $60.31.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

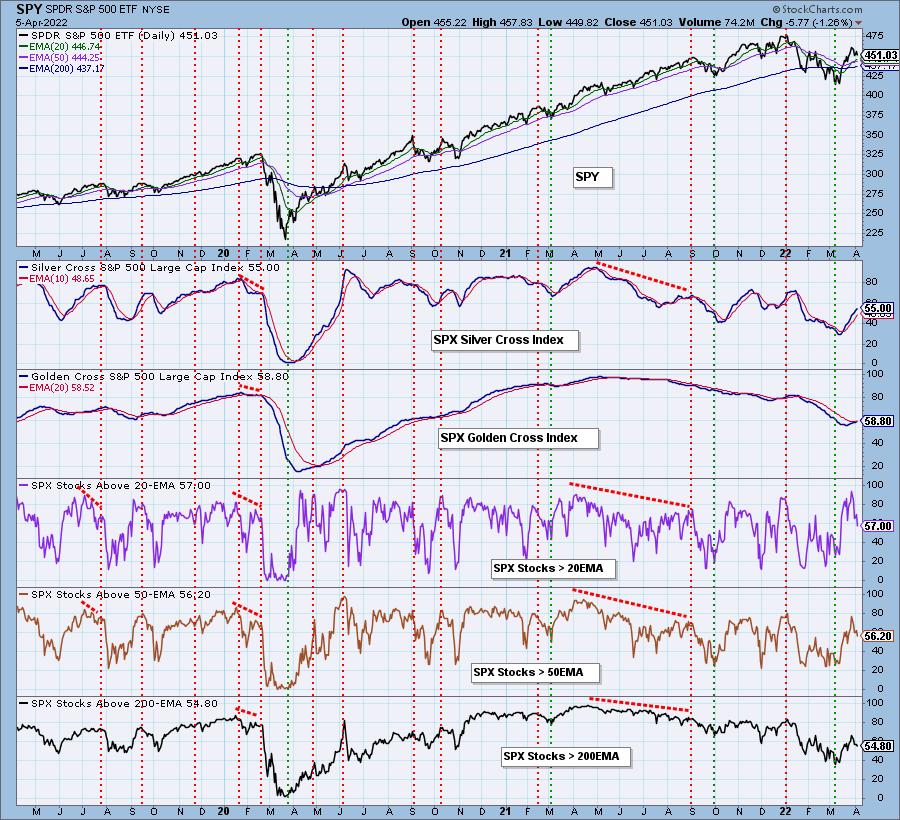

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 15% invested and 85% is in 'cash', meaning in money markets and readily available to trade with. I'm not comfortable with adding positions, particularly since the pickings are so slim.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Good Luck and Good Trading!

- Erin

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com