Great day in the market, especially on holiday trading. Typically you see rather tame volatility. We did see very low volume so we should keep today's rally in perspective.

We have Thursday off for Thanksgiving so I'm doing five picks today and five picks (reader requests included! Send them in!) tomorrow. The Recap will be published on Friday as normal with a Diamond Mine still being held on Friday morning. An upcoming schedule adjustment is that there will be no Diamond Mine on Friday, December 1st. I'm returning to Vegas for the PAC-12 Championship game to watch my beloved USC Trojans play the Oregon Ducks. The game is actually on Friday so the Recap will be published on Saturday night along with the DP Weekly/Monthly Wrap. I'll remind you again when we get closer.

I saw a distinct theme today with Food Products. I only chose one to cover, Kellogg (K), but Hershey (HSY), Lamb Wesson (LW) and Smuckers (SJM) also look good. I was really struggling with which to pick so I suggest you review those charts today. Maybe you'll see something that makes one of the others more desirable to you.

Good Luck & Good Trading!

Erin

Today's "Diamonds in the Rough": CEIX, ICFI, K, NWN and TMUS.

Runner-ups: LW, SJM, STNG, HSY, UGI, HLIT, SYM, ISEE and APLE.

TODAY'S RECORDING LINK (11/18/2022):

Topic: DecisionPoint Diamond Mine (11/18/2022) LIVE Trading Room

Start Time: Nov 18, 2022 09:00 AM

Passcode: Nov#18th

NEXT DIAMOND MINE Trading Room on November 25th 2022:

When: Nov 25, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (11/25/2022) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Here is the last recording:

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

CONSOL Energy Inc. (CEIX)

EARNINGS: 02/07/2023 (BMO)

CONSOL Energy Inc. engages in the production of bituminous coal. It focuses on the extraction and preparation of coal in the Appalachian basin. The firm operates through the following segments: PAMC and CONSOL Marine Terminal. The PAMC segment includes mining, preparation and marketing of thermal coal. The CONSOL Marine Terminal segment provides coal export terminal services. The company was founded in 1864 and is headquartered in Canonsburg, PA.

Predefined Scans Triggered: New CCI Buy Signals, Bullish MACD Crossovers, Parabolic SAR Buy Signals, P&F Double Top Breakout and P&F Triple Top Breakout.

CEIX is unchanged in after hours trading. At first I hesitated on this one given price is right in the middle of an intermediate-term trading range. However, seeing this industry group waking up last week and how it saw great improvement today, I wanted to include it. It was a scan result today. Price broke out strongly above resistance at key moving averages and the July high. There is a positive OBV divergence with price lows. The RSI just moved into positive territory and the PMO has given us a crossover BUY signal. Stochastics are rising again and the new PMO BUY signal is confirming them. Relative strength is pretty good, although the group only just began to perform again. The stop is set around 7.4% or $60.63.

There is still a declining trend showing overall and the weekly PMO hasn't quite confirmed on an intermediate-term investment. The SCTR is excellent at 89.8% meaning it has internal strength as far as trend and condition in all three timeframes.

ICF International Inc. (ICFI)

EARNINGS: 02/23/2023 (AMC)

ICF International, Inc. engages in the provision of technology-based solutions and services to government and commercial clients. It serves the Energy, Environment, and Infrastructure, Health, Education, and Social Programs, Safety and Security, and Consumer and Financial markets. The company was founded in 1969 and is headquartered in Fairfax, VA.

Predefined Scans Triggered: Moved Above Ichimoku Cloud.

ICFI is unchanged in after hours trading. I like today's pop above both the 20/50-day EMAs. It still has to overcome more resistance, but the indicators suggest it will. The RSI just moved into positive territory and the PMO has a nice scoop bottom just below the zero line. Stochastics are rising and just hit positive territory. Relative strength is very good across the board. The stop is set at around 7.7% or $102.45.

The weekly RSI is positive and the weekly PMO has turned up above the signal line which is especially bullish. The SCTR could use a little help but it isn't terrible. I actually like to see SCTRs between 60 and 80 when looking at new momentum trades. Since all-time highs are near, consider an upside target around 15% or $127.65.

Kellogg Co. (K)

EARNINGS: 02/09/2023 (BMO)

Kellogg Co. engages in the manufacturing, marketing, and distribution of ready-to-eat cereal and convenience foods. The firm markets cookies, crackers, crisps, and other convenience foods, under brands such as Kellogg's, Cheez-It, Pringles, and Austin to supermarkets in the U.S. It operates through the following geographical segments: North America, Europe, Latin America, and AMEA(Asia Middle East Africa). The company was founded by Will Keith Kellogg in 1906 and is headquartered in Battle Creek, MI.

Predefined Scans Triggered: Bullish MACD Crossovers.

K is up +0.36% in after hours trading. I like the double-bottom pattern as it suggests, at a minimum, that price will challenge the October high. The RSI is positive and the PMO is rising toward an oversold crossover BUY signal. There is a great looking OBV positive divergence going into this rally. Relative strength is great for the group and for K against the SPY. While K is only performing inline with the group, the group is doing so well that is just fine. The stop is set thinly below support around 5.9% or $67.78.

The weekly chart is mostly favorable. The weekly RSI is positive and the weekly PMO is bottoming. The SCTR isn't great, so this one may not be a great intermediate-term play. Since all-time highs are nearby, consider an upside target of about 15% or $82.83.

Northwest Natural Gas (NWN)

EARNINGS: 02/23/2023 (BMO)

Northwest Natural Holding Co. engages in the local distribution of gas and water through its subsidiaries. It supplies natural gas to residential, commercial, and industrial customers in Oregon and southwest Washington. The company founded in 1859 and is headquartered in Portland, OR.

Predefined Scans Triggered: Moved Above Upper Keltner Channel and P&F Double Top Breakout.

NWN is up +4.54% in after hours trading, so we may be onto something regarding Gas Distribution; notice the relative strength line for the group. I do know that UNG (Nat Gas) is rising again in volatile fashion (as it usually does) and that could be contributing to the rally in this area so keep an eye on the UNG chart as well. The RSI is positive and not overbought. There is a new IT Trend Model "Silver Cross" BUY signal as the 20-day EMA crossed above the 50-day EMA earlier in November. Stochastics are rising strongly. While NWN hasn't recently been outperforming the group, so far its strength against the group is at least trending higher. It is performing well against the SPY. The stop is set below support around 6.3% or $46.60.

The weekly chart is very good. The weekly RSI is now in positive territory and the weekly PMO is nearing a crossover BUY signal. The SCTR is okay at 65.6%. It is rising. Upside potential is over 25%.

T-Mobile US, Inc. (TMUS)

EARNINGS: 02/02/2023 (AMC)

T-Mobile US, Inc. engages in the provision of wireless communications services under the T-Mobile and MetroPCS brands. It offers postpaid and prepaid wireless voice, messaging and data services, and wholesale wireless services. The company was founded in 1994 and is headquartered in Bellevue, WA.

Predefined Scans Triggered: Moved Above Upper Bollinger Band.

TMUS is up +0.32% in after hours trading. It has now broken the declining trend that began this month. The RSI is positive and not overbought. The PMO has whipsawed back into a BUY signal and Stochastics are rising. Relative strength for the group is now positive and TMUS is performing well against the SPY for that reason. It seems to be a good relative performer within the group. The stop is set at 6% around $142.50.

TMUS is about to make new all-time highs. The weekly RSI is positive and the weekly PMO is on a crossover BUY signal. The weekly PMO is not overbought. The SCTR is in the "hot zone" above 70. Consider an upside target of about 15% or $174.34.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

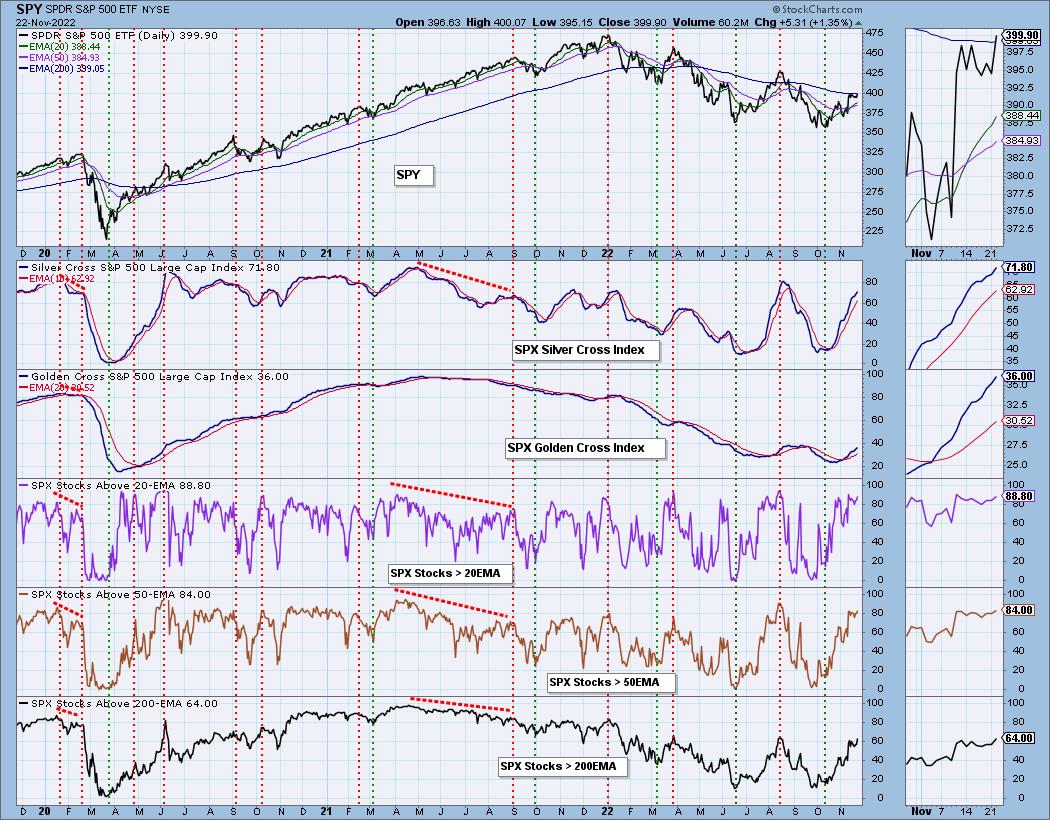

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 35% exposed.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com