With the market doing well, I expected to sit down and have to review hundreds of charts. Instead, I had maybe 40. That sounds like a lot, but when I dove into the charts themselves, I wasn't impressed. Part of the problem is that many stocks have already run up 10% or even 20% before the charts revealed themselves in today's scans.

One goal in Diamonds Reports is to find you new momentum. That's become a bit difficult with the market showing positive momentum since last month's price bottom. However, I did find three stocks of interest. I do have two others on the runner-up list that you can look at too.

If you have some stocks or ETFs on your mind, be sure and send them to me by Thursday morning for possible inclusion in the Thursday Reader Request report.

As reminder, you'll always find the Diamond Mine trading room links underneath the Diamonds logo below. I've had a few people asking. If you don't get your confirmation of registration email, you can always re-register and the link will be sent shortly thereafter.

Good Luck & Good Trading!

Erin

Today's "Diamonds in the Rough": OKE, REGN and VTYX.

Runner-ups: MRTN and NVCR.

RECORDING LINK (10/28/2022):

Topic: DecisionPoint Diamond Mine (10/28/2022) LIVE Trading Room

Recording Link HERE

Passcode: Oct-28th

REGISTRATION LINK (11/4/2022):

When: Nov 4, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (11/4/2022) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Here is the last recording:

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Oneok, Inc. (OKE)

EARNINGS: 11/1/2022 (AMC) ** REPORTED TODAY **

ONEOK, Inc. engages in gathering, processing, fractionating, transporting, storing and marketing of natural gas. It operates through the following segments: Natural Gas Gathering and Processing, Natural Gas Liquids and Natural Gas Pipelines. The Natural Gas Gathering and Processing segment offers midstream services to producers in North Dakota, Montana, Wyoming, Kansas and Oklahoma. The Natural Gas Liquids segment owns and operates facilities that gather, fractionate, treat and distribute NGLs and store NGL products, in Oklahoma, Kansas, Texas, New Mexico and the Rocky Mountain region, which includes the Williston, Powder River and DJ Basins, where it provides midstream services to producers of NGLs and deliver those products to the two market centers, one in the Mid-Continent in Conway, Kansas and the other in the Gulf Coast in Mont Belvieu, Texas. The Natural Gas Pipelines segment provides transportation and storage services to end users. The company was founded in 1906 and is headquartered in Tulsa, OK.

Predefined Scans Triggered: P&F Double Top Breakout.

OKE is up +0.03% in after hours trading after reporting earnings after the bell. They beat estimates. Today saw a tiny breakout above $60. There are multiple layers of overhead resistance ahead, but the chart is quite favorable. The RSI is in positive territory above net neutral (50). The PMO just hit positive territory and is rising/not overbought. Stochastics are comfortably above 80 and moving sideways, indicating internal strength. OKE is outperforming the SPY and its industry group. The group itself has been steadily outperforming the SPY. I've set the stop below support around 6.8% or $55.97.

The weekly chart is improving. There is a large double-bottom forming. It will be confirmed if it can overcome resistance at around $65. The weekly RSI is positive and rising. The weekly PMO has turned up and is going in for a crossover BUY signal. The SCTR isn't in the "hot zone" above 70 and isn't in the basement. Upside potential should it reach overhead resistance at all-time highs is about 19.5%.

Regeneron Pharmaceuticals, Inc. (REGN)

EARNINGS: 11/3/2022 (BMO)

Regeneron Pharmaceuticals, Inc. is a biotechnology company, which engages in the discovery, invention, development, manufacture, and commercialization of medicines. Its product portfolio includes the following brands: EYLEA, Dupixent, Praluent, Kevzara, Libtayo, ARCALYST, and ZALTRAP. The firm accelerates the traditional drug development process through its proprietary VelociSuite technologies such as VelocImmune, which uses unique genetically-humanized mice to produce optimized fully-human antibodies and bispecific antibodies. The company was founded by Alferd G. Gilman, Leonard S. Schleifer, and Eric M. Shooter on January 8, 1988, and is headquartered in Tarrytown, NY.

Predefined Scans Triggered: New 52-week Highs and P&F Double Top Breakout.

REGN is unchanged in after hours trading. While it may not appear to be a breakout, if we use closing prices this is a strong breakout. The RSI is positive and has been since the beginning of September. The PMO is rising, but does look a little bit suspect. Stochastics are above 80 and still rising. Relative strength has been either inline or better than the SPY for REGN and the group. REGN is beginning to outperform both the group and the SPY. The stop is a bit deep at 8.2% around $697.59. You could tighten it up to line up with the 50-day EMA.

REGN just broke out to new all-time highs. The weekly RSI is positive and not overbought. The weekly PMO is on a crossover BUY signal and isn't really overbought when you compare it to its highs in 2020. The SCTR is in the hot zone and suggests that REGN is in the 11% of all stocks based on trend and condition in all three timeframes. Given we are at all-time highs, consider an upside target of 15% around $873.90.

Ventyx Biosciences Inc. (VTYX)

EARNINGS: 11/3/2022 (AMC) ** REPORTS THIS WEEK **

Ventyx Biosciences, Inc. is a clinical-stage biopharmaceutical company, which focuses on developing novel small molecule therapeutics for the treatment of autoimmune diseases. Its clinical stage pipeline includes VTX958, a Phase 1 allosteric TYK2 inhibitor for the treatment of a broad range of autoimmune diseases, VTX002, a Phase 2-ready S1P1 receptor modulator for the treatment of ulcerative colitis, and VTX2735, a Phase 1-ready peripheral inhibitor of the NLRP3 inflammasome, which is a mediator of multiple inflammatory conditions. The company was founded on November 21, 2018 and is headquartered in Encinitas, CA.

Predefined Scans Triggered: Moved Above Ichimoku Cloud and P&F Low Pole.

VTYX is down -1.93% in after hours trading. I note that I covered this one on July 6th this year. That turned out to be an excellent call if I do say so myself! Price did fail after gapping up, but it is now holding gap support at August high. The RSI is positive and the PMO is turning back up in oversold territory above the zero line. It's typically a great performer against the group and it is beginning to really outperform the SPY. Stochastics are rising vertically and are now above 80 signifying internal strength. I'd like for it to have broken overhead resistance, but it probably needs a bit of a pullback. Setting the stop was challenging given the strong rally it's already in. I set it at my max comfort level of 8% around $30.95.

Not much to say about the weekly chart as this is a relatively new issue. We do know the RSI is positive, rising and not overbought and there is that breakout above gap resistance. Upside potential is over 23% if it can sustain the current rally.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

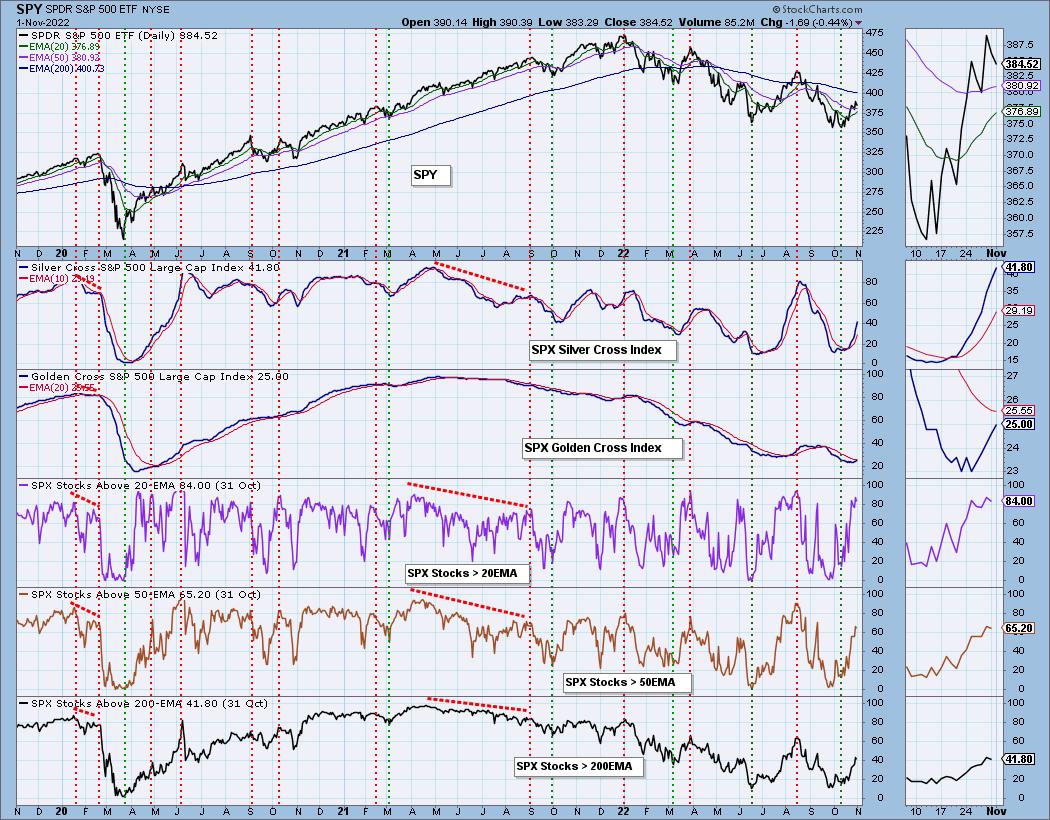

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 50% exposed.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com